Are you feeling overwhelmed by the looming deadline for estate tax payments? You're not alone; many individuals find navigating these financial responsibilities daunting. That's why it's crucial to stay informed and proactive to avoid any penalties or complications. So, let's dive into the details of what you need to know to stay on track with your estate tax obligationsâkeep reading!

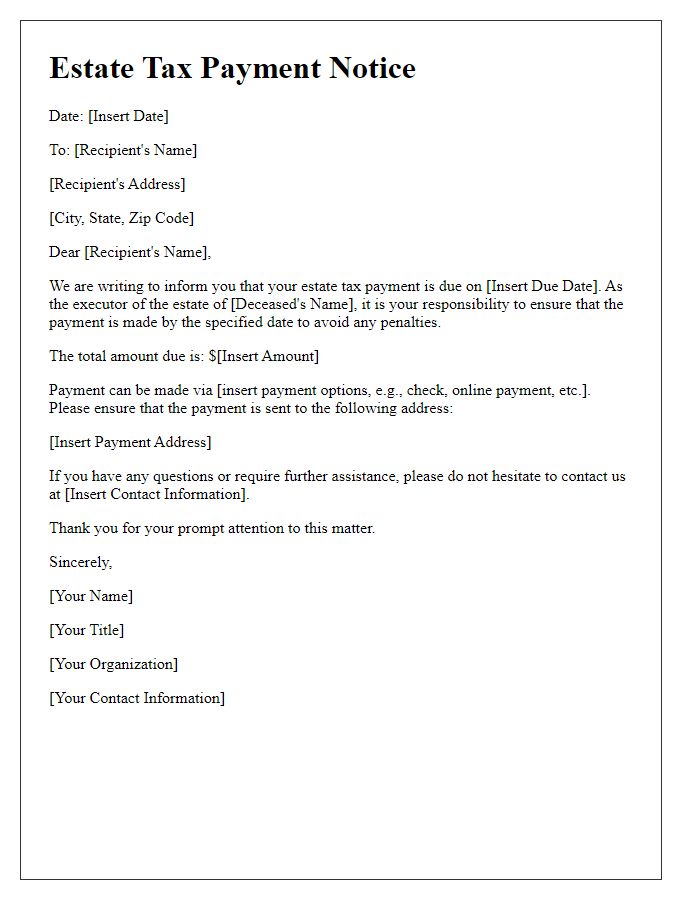

Recipient's details

Estate tax deadlines loom for beneficiaries's estates, often based in jurisdictions such as California, requiring payments within nine months of the decedent's passing. Key recipients might include individual heirs or estates of deceased individuals, necessitating their attention to the Internal Revenue Service (IRS) guidelines. Payments can range significantly, depending on the estate value, with federal estate tax rates reaching up to 40% for estates valued over $12.06 million (as of 2022). Timely remittance ensures avoidance of penalties, which may include interest accrual at rates of 3% or more per annum. Adhering to this schedule protects beneficiaries from potential legal complications associated with overdue payments.

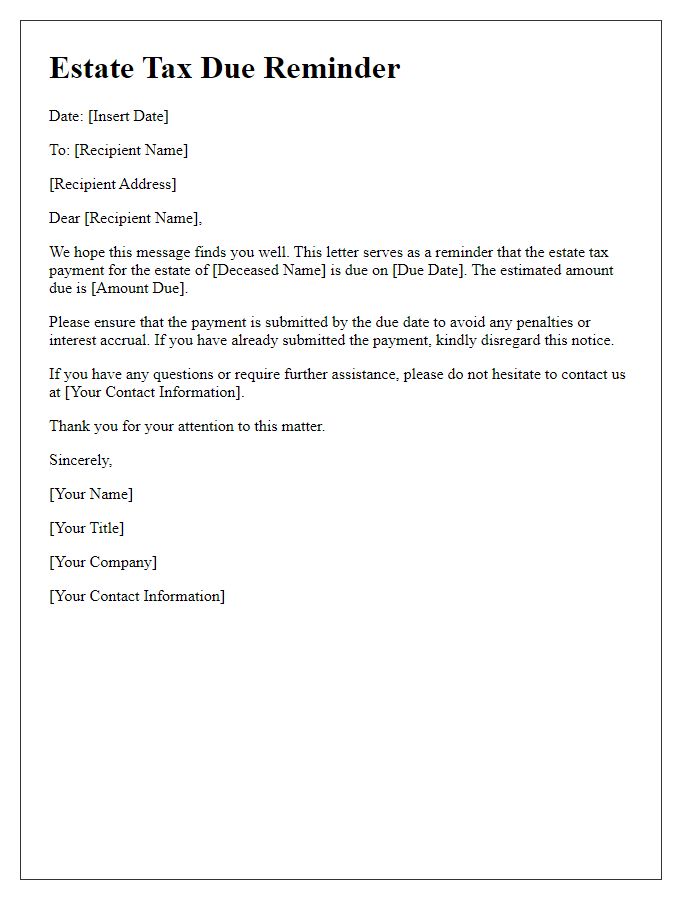

Tax payment due date

Estate tax obligations require timely payments to avoid penalties. The deadline for estate tax payments typically falls nine months after the date of death of the decedent. For estates valued over $12.92 million in the United States, federal estate taxes may apply, with rates ranging from 18% to 40% based on the total taxable value. Missing this deadline can lead to additional interest charges accumulating from the due date. Executors or administrators of the estate must ensure proper documentation, including IRS Form 706, is submitted to the Internal Revenue Service in accordance with regulations.

Outstanding amount

An outstanding estate tax balance can significantly impact financial planning and compliance. Executors may face consequences if the payment is not addressed, including penalties and interest accruing on the unpaid amount. The Internal Revenue Service (IRS) mandates that estate taxes, which apply to estates above $12.92 million for decedents in 2023, must be settled within nine months of the individual's passing. Failure to pay the outstanding amount can lead to complications in the distribution process of the estate in states like California or New York, where the tax implications can further complicate matters. Timely payment ensures that beneficiaries receive their inheritances without delays and potential legal hurdles.

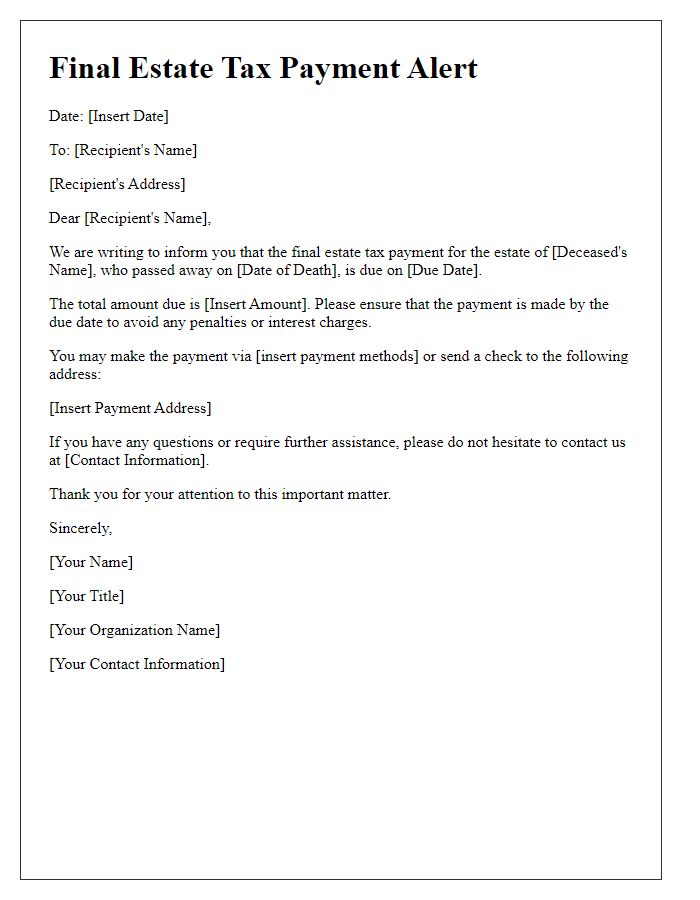

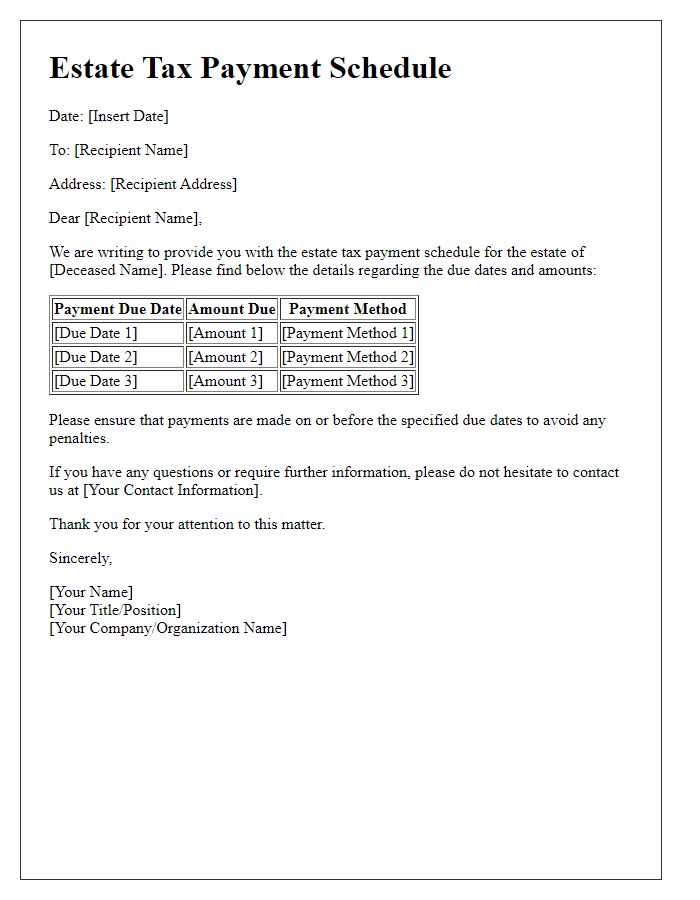

Payment instructions

Estate tax payments require meticulous attention to detail and strict adherence to deadlines. Given the complexities surrounding estate tax laws, timely payment is crucial to avoid penalties. The Internal Revenue Service (IRS) mandates that the federal estate tax return (Form 706) be filed within nine months of the individual's passing, with improper late filings potentially incurring hefty fines. Payment methods are versatile; options include electronic funds transfer (EFTPS), checks or money orders to the U.S. Treasury, or credit card payments through authorized third-party processors. Penalties for late payment may accrue interest on the unpaid tax amount, increasing financial liability significantly. Maintaining accurate records is vital for documentation and subsequent audits.

Contact information for inquiries

Estate tax payment notifications serve as crucial reminders for taxpayers. These alerts inform individuals about their upcoming responsibilities related to federal or state estate taxes, which can significantly impact the settlement of inherited assets. Estate taxes, assessed on the value of an individual's estate upon their death, can have varying rates across jurisdictions, often ranging from 18% to 40%. Inquiries regarding specific payment amounts, due dates, or filing procedures should be directed to the relevant tax authority, typically the Internal Revenue Service (IRS) for federal taxes, or the appropriate state department for state estate taxes. For reference, the IRS can be reached at 1-800-829-1040, where representatives provide assistance from 7 a.m. to 7 p.m. local time, while state agencies maintain their own contact lines. Timely communication ensures compliance and avoidance of potential penalties associated with late payments.

Comments