Are you feeling overwhelmed by the process of claiming a dividend withholding tax refund? You're not alone! Many taxpayers find themselves navigating the complexities of tax regulations, but with the right guidance, it can become a straightforward task. In this article, we'll break down the steps to help you successfully file for your refund and reclaim what's rightfully yoursâso stick around to learn more!

Tax identification and investor details

Investors seeking a dividend withholding tax refund must provide comprehensive tax identification details, including their Tax Identification Number (TIN), which uniquely identifies them to the tax authorities. Essential investor information should encompass full name, residential address, and the country of residency, ensuring compliance with local tax regulations. Additionally, investors need to include documentation such as proof of investment, recent dividend statements, and necessary bank details to facilitate smooth processing of the refund. Accurate and detailed submission significantly aids in expediting the refund review procedure by the tax authority.

Dividend payment and withholding details

To obtain a refund for dividend withholding tax, it is essential to understand the intricate details surrounding dividend payments and the withholding process. Dividend payments, often distributed quarterly, fluctuate based on company profits, with common structures including cash dividends and stock dividends. Under tax regulations, a withholding tax rate--typically 30% for foreign investors--applies to these payments, but this can vary based on tax treaties between countries. Key identification, such as the Tax Identification Number (TIN) of both the recipient and the company, is crucial for processing refunds. Additionally, documentation such as Forms 1099 or W-8BEN, showcasing the amount withheld and the dividends received, is required to validate the refund claim. Understanding jurisdiction-specific rules and timelines for submitting refund applications can expedite the resolution of any potential over-withholding of taxes.

Applicable tax treaties or agreements

In many countries, dividend withholding tax can be partially or fully refunded to foreign investors under specific tax treaties or agreements between nations. For instance, the United States has tax treaties with more than 60 countries aimed at reducing or eliminating withholding tax rates on dividends. A common example is the treaty with the United Kingdom, which typically allows for a reduced withholding tax rate of 15% instead of the standard 30%. Investors must provide proper documentation, like a Certificate of Residency, to claim these benefits. Other regions, such as the European Union, have similar agreements facilitating the refund process for dividend withholding tax, sometimes streamlining procedures for eligible investors through harmonized regulations. Understanding the specific provisions in each treaty can significantly impact the overall tax payable on investment income.

Documentation and proof of residency

To obtain a dividend withholding tax refund, essential documentation must be submitted to the relevant tax authorities to establish proof of residency. Tax residency status often references a specific country, such as the United States or Germany, which may require forms like a W-8BEN or a tax identification number (TIN). Additionally, supporting documents like utility bills or bank statements should reflect the resident's name and current address, underscoring the duration of residency, particularly if it spans multiple tax years. Such comprehensive documentation ensures compliance with international tax treaties, designed to mitigate double taxation on dividends. Submitting a complete application enhances the likelihood of a successful refund process.

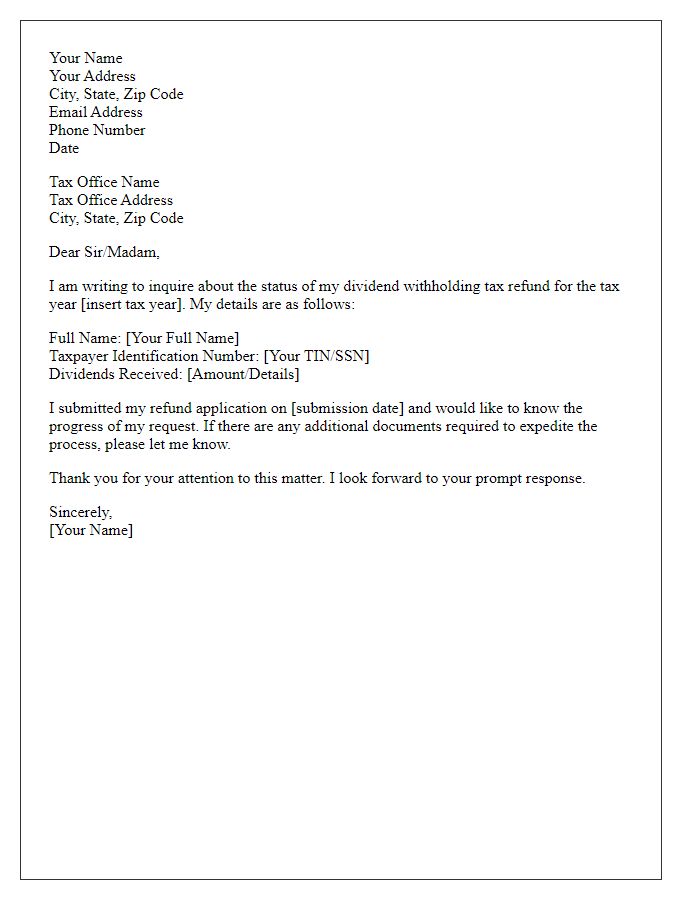

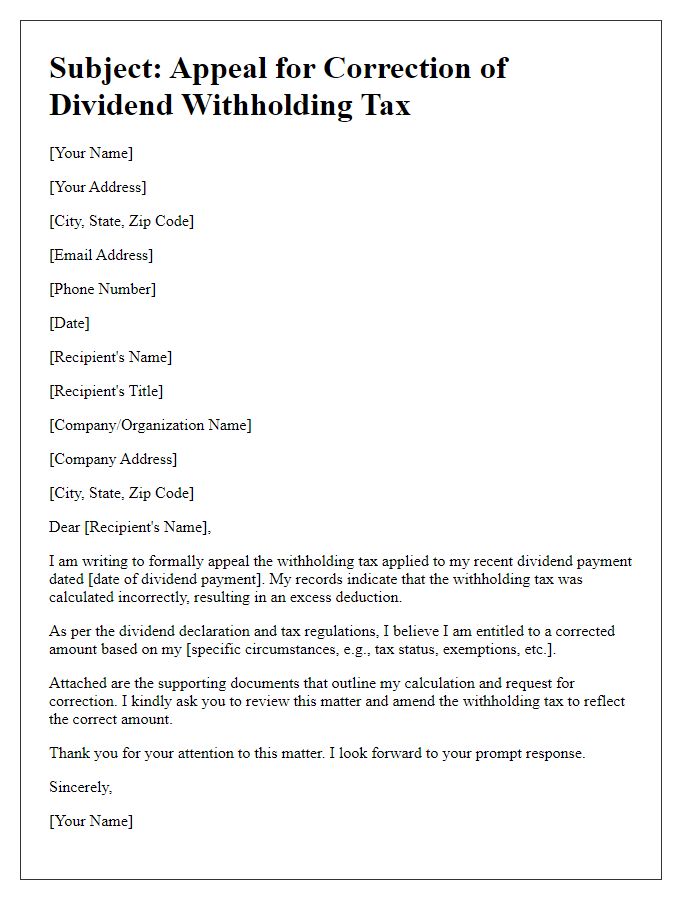

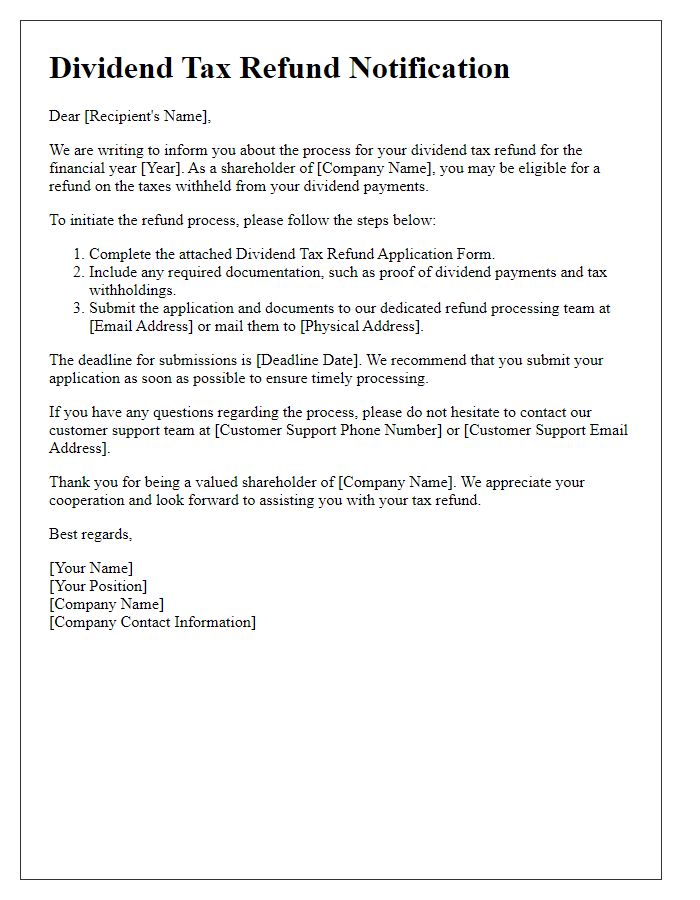

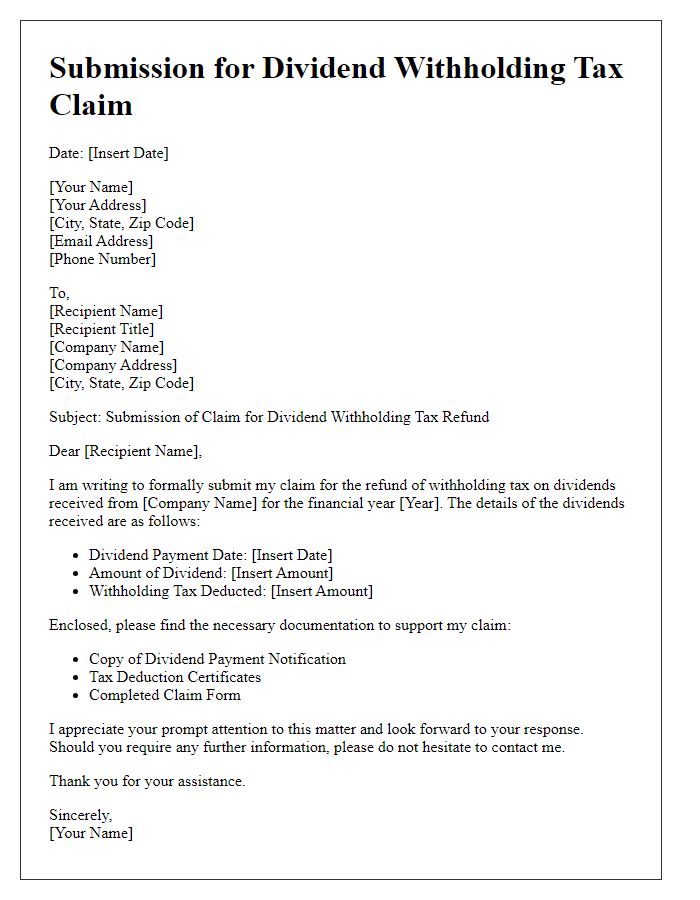

Refund claim instructions and contact information

Dividend withholding tax refunds are essential for investors who have had taxes deducted from their dividend payments, typically at a rate of 30% depending on the country. To initiate a refund claim, gather necessary documents such as the dividend statement, tax withholding certificates, and proof of residency. Contact the tax authorities, such as the Internal Revenue Service (IRS) in the United States or the local tax office relevant to your investment jurisdiction. Provide complete information including your tax identification number (TIN), the amount withheld, and bank details for refund processing. Ensure all paperwork is submitted within the specified timeframe, often within three years from the original tax payment date, to avoid rejection of the claim. for any assistance, consider reaching out through dedicated helplines or email addresses listed on the tax authority's official website.

Letter Template For Dividend Withholding Tax Refund Samples

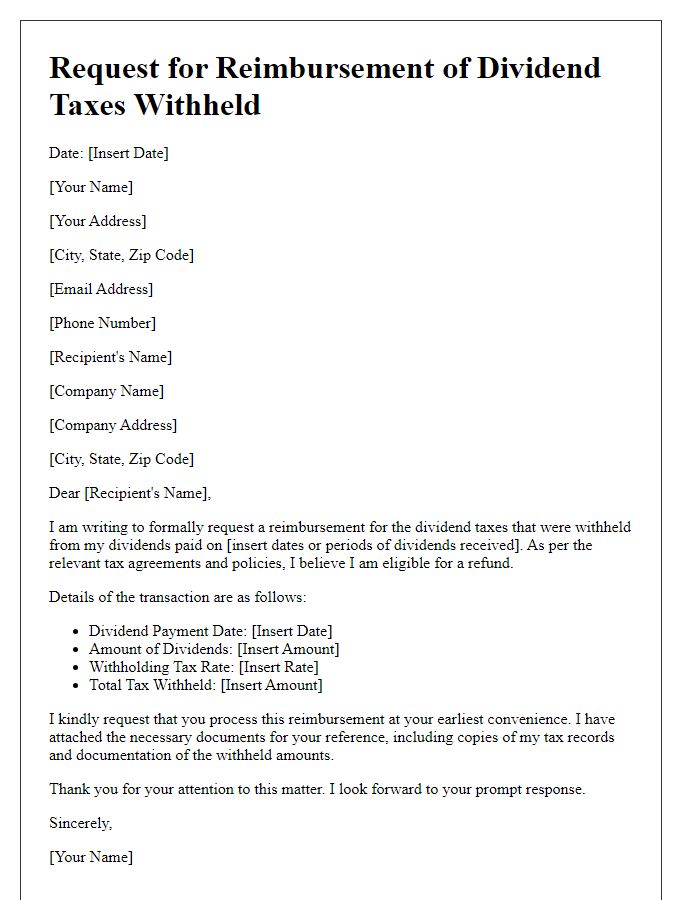

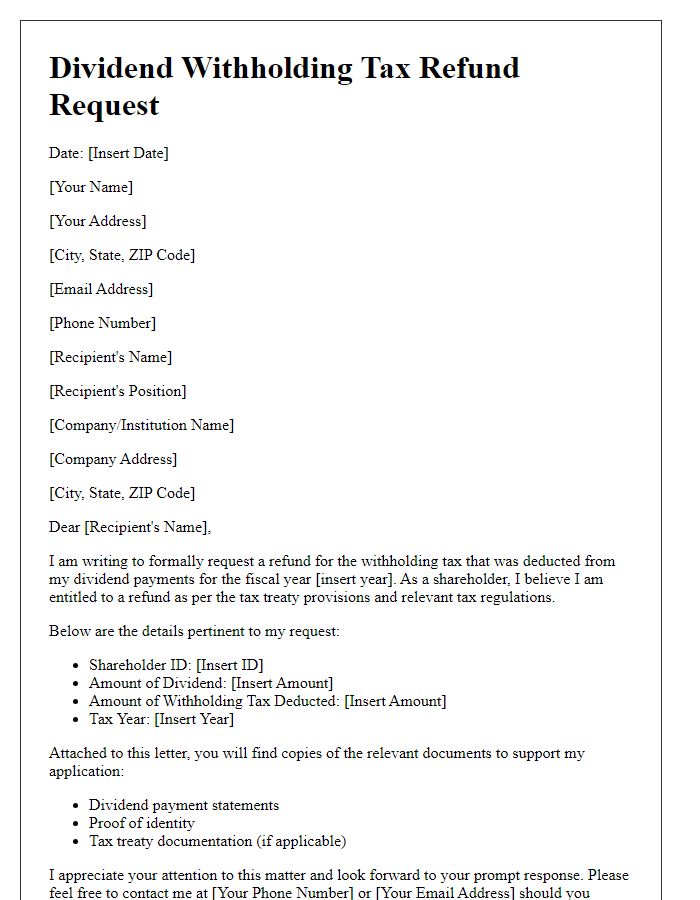

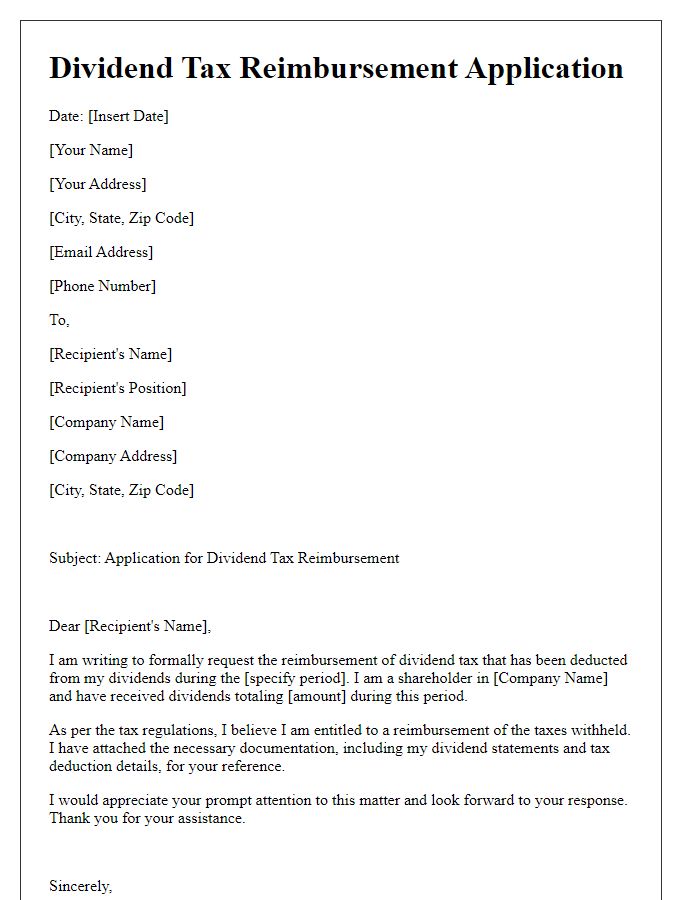

Letter template of formal request for reimbursement of dividend taxes withheld.

Comments