Are you feeling overwhelmed by the complexities of filing your freelance taxes? You're not alone! Many freelancers find themselves navigating a maze of deductions and forms, making the tax season a stressful time. In this article, we'll break down the key elements you need to know and offer tips to simplify the processâso stick around to learn how to make tax season a breeze!

Clear Subject Line

Freelancers often face unique tax considerations, particularly regarding income tax obligations related to self-employment. The U.S. federal tax code mandates self-employed individuals to report all income, including earnings from side gigs and contract work. Tax brackets may vary based on reported income levels, and applicable deductions such as home office expenses and business-related mileage can significantly reduce taxable income. Additionally, freelancers must account for self-employment taxes, which encompass Social Security and Medicare contributions. It's crucial to keep detailed records of transactions and receipts throughout the year to streamline the tax preparation process and ensure compliance with IRS regulations. Seeking professional consultation tailored to the freelancer's specific financial situation, including potential quarterly estimated tax payments, is often beneficial for maximizing deductions and minimizing liabilities.

Professional Greeting

Freelancers face unique challenges when navigating income tax regulations, especially in the United States. Many rely on professional tax consultants to ensure compliance with the Internal Revenue Service (IRS) guidelines. The IRS provides resources such as Publication 334, which details the tax obligations for sole proprietors and self-employed individuals. Accurate record-keeping of income, including 1099 forms received from clients, is crucial. Deductions for business expenses, such as home office costs, supplies, and travel expenses, can significantly impact taxable income. Regular consultations throughout the year can help freelancers optimize their tax strategies, ultimately leading to savings and reduced risks of audits.

Comprehensive Service Outline

Freelance income tax consultation can provide essential services for independent contractors and self-employed individuals. Services include tax planning, ensuring compliance with Internal Revenue Service regulations, preparing and filing federal and state tax returns, and maximizing deductions. Common deductions for freelancers may encompass home office expenses (such as a portion of rent or mortgage payments), business-related travel, and equipment costs like computers and software. Additionally, consultations can discuss estimated tax payments, relevant deadlines such as April 15th for annual filings, and record-keeping strategies for documentation purposes. Furthermore, addressing potential audits and providing guidance on how to navigate them can be an important aspect of these consultation services.

Fee Structure and Payment Terms

Freelance income tax consultation services require a clear fee structure to ensure transparency for clients. The consultation fee typically ranges between $100 to $300 per hour, depending on the complexity of the client's tax situation and their annual earnings. For additional services like document preparation or filing, rates may vary, for instance, a flat fee of $200 could be charged for standard federal tax returns completed by the April 15 deadline. Payment terms include a 50% deposit upfront for services exceeding $500, with the remaining balance due upon completion of the consultation process. Payment methods usually include direct bank transfer, credit card payments, or payment apps, ensuring convenience for clients to settle their invoices promptly.

Contact Information and Call to Action

Freelancers often face unique challenges when it comes to income tax preparation, making professional consultation essential for maximizing deductions and ensuring compliance. Personal circumstances can vary widely, thus tailored advice is crucial for understanding tax obligations. Consulting an expert can help freelancers navigate complex regulations specific to their trade, such as the Self-Employment Tax (15.3% on net earnings) and available deductions like home office expenses or business-related travel costs. Engaging a qualified tax consultant with experience in freelance tax matters can lead to significant savings and reduce the likelihood of penalties or audits from tax authorities like the IRS.

Letter Template For Freelance Income Tax Consultation Samples

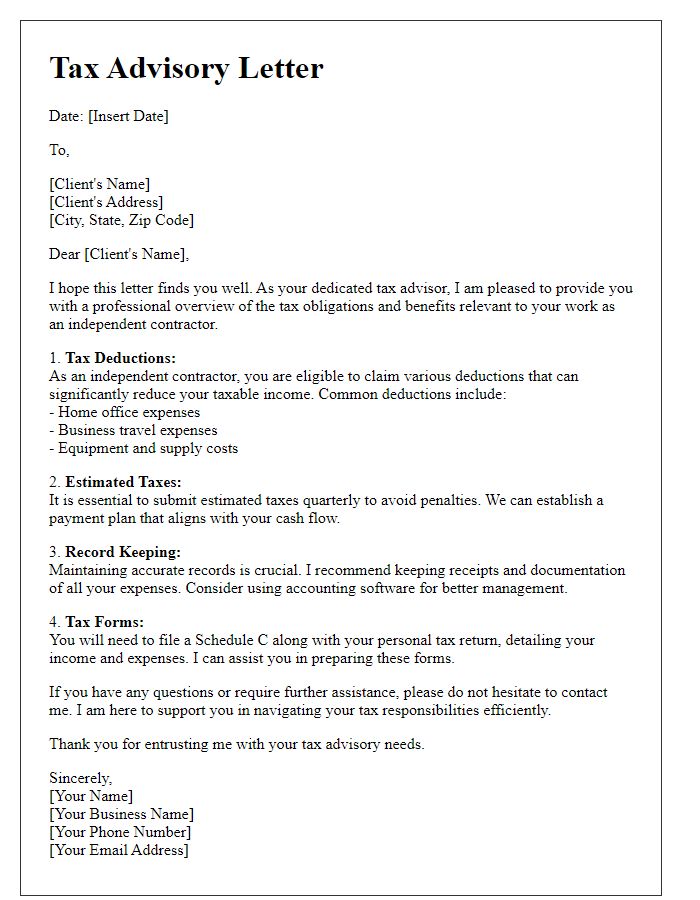

Letter template of professional freelance tax advisory for independent contractors.

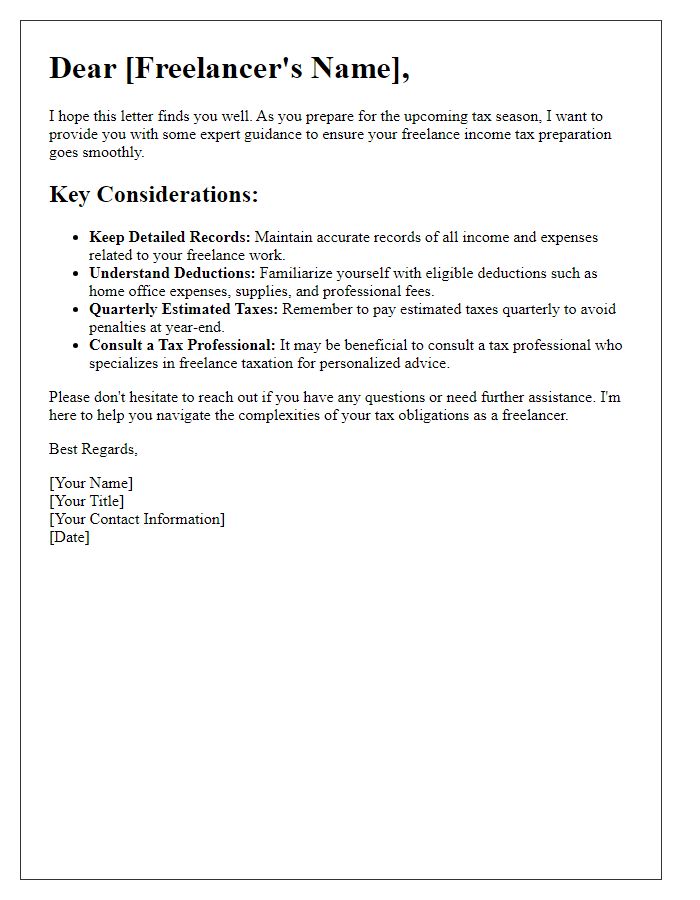

Letter template of expert guidance for freelance income tax preparation.

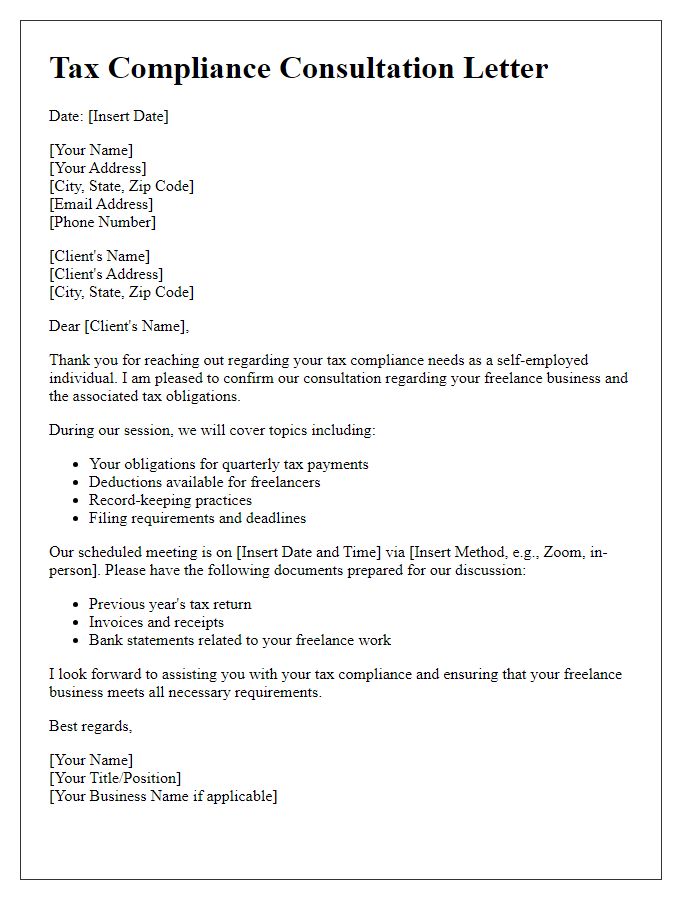

Letter template of freelance tax compliance consultation for self-employed individuals.

Letter template of strategic tax consultation for freelance entrepreneurs.

Letter template of comprehensive tax services for freelance professionals.

Comments