Hey there! If you're looking to update your taxpayer identification number (TIN), you're in the right place. Keeping your TIN up to date is crucial for smooth tax processing and to ensure you receive your rightful benefits without any hiccups. In this article, we'll walk you through the easy steps to make this update happen. So, let's dive in and get you set up!

Taxpayer Identification Number (TIN) accuracy

Ensuring accurate Taxpayer Identification Numbers (TIN) is crucial for compliance with the Internal Revenue Service (IRS) regulations in the United States. A TIN, used primarily for tax administration purposes, can be a Social Security Number (SSN) or Employer Identification Number (EIN). Incorrect TINs can lead to significant issues, such as delayed tax refunds, penalties, and complications during audits. Moreover, updating TIN information promptly is vital to maintain accurate records and avoid discrepancies with tax filings. Failure to update may result in the IRS labeling accounts as "incorrect" or "invalid," causing disruptions in business operations and financial oversight. Keeping your TIN information current helps ensure smooth transactions and adherence to federal tax requirements.

Personal information verification

Taxpayer identification number updates require meticulous personal information verification to ensure compliance with government regulations. Official documents such as Social Security cards or Taxpayer Identification Numbers must be submitted for accuracy confirmation. Address changes should be validated with recent utility bills or bank statements, displaying the new address clearly. Individuals may also be required to provide proof of identity through government-issued identification, like a driver's license or passport. The process typically occurs through the Internal Revenue Service (IRS) for the United States, with guidelines established under IRS Form W-9 for individuals and IRS Form SS-4 for entities, ensuring correct filing procedures are met. Failure to update this information accurately can lead to delays in processing tax returns or potential fines.

Deadline for submission

Taxpayer identification number (TIN) update is critical for accurate reporting to the Internal Revenue Service (IRS). The deadline for submission of TIN updates typically falls on January 31st of each year, coinciding with the issuance of tax documents such as W-2 forms and 1099s. Businesses, including sole proprietorships and partnerships, are obligated to report any changes to their TINs to ensure compliance with federal tax regulations. Failure to submit updates by the deadline may result in penalties, delayed tax refunds, or issues with the IRS. It is advisable to check IRS guidelines for specific compliance requirements tailored to various taxpayer scenarios, including individuals, corporations, and exempt organizations.

Contact information for assistance

Updating a taxpayer identification number (TIN) requires attention to detail and compliance with tax regulations. The Internal Revenue Service (IRS) provides guidance for taxpayers needing assistance with this process, emphasizing contact through their official channels. Taxpayers must verify personal information such as social security number (SSN) or employer identification number (EIN) before submission. For specific inquiries, the IRS helpline (1-800-829-1040) remains available for personal tax issues, while businesses may reach out to 1-800-829-4933. For additional resources, the IRS website offers extensive information on changing TINs, including downloadable forms and FAQs to streamline the update process.

Security and confidentiality assurances

Security and confidentiality of taxpayer identification numbers (TIN) are critical in maintaining personal information privacy. Organizations, such as the Internal Revenue Service (IRS) in the United States, implement robust encryption protocols and secure access measures to protect sensitive data during the update process. Multi-factor authentication (MFA) enhances security by requiring additional verification steps, ensuring authorized access only. Data breaches have increased by 37% in recent years, highlighting the importance of stringent safeguards around TINs. Compliance with regulations such as the Federal Information Security Management Act (FISMA) mandates organizations to uphold high-security standards, protecting against unauthorized disclosure or tampering of personal taxpayer information. Regular audits and monitoring systems are vital in detecting and mitigating potential threats, thus preserving the confidentiality and integrity of taxpayer identification numbers.

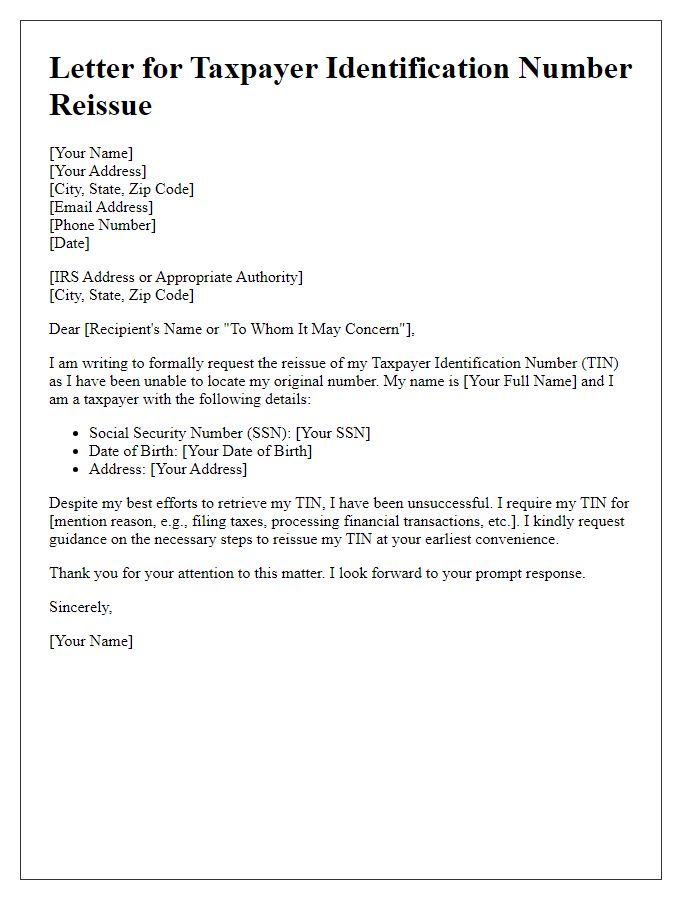

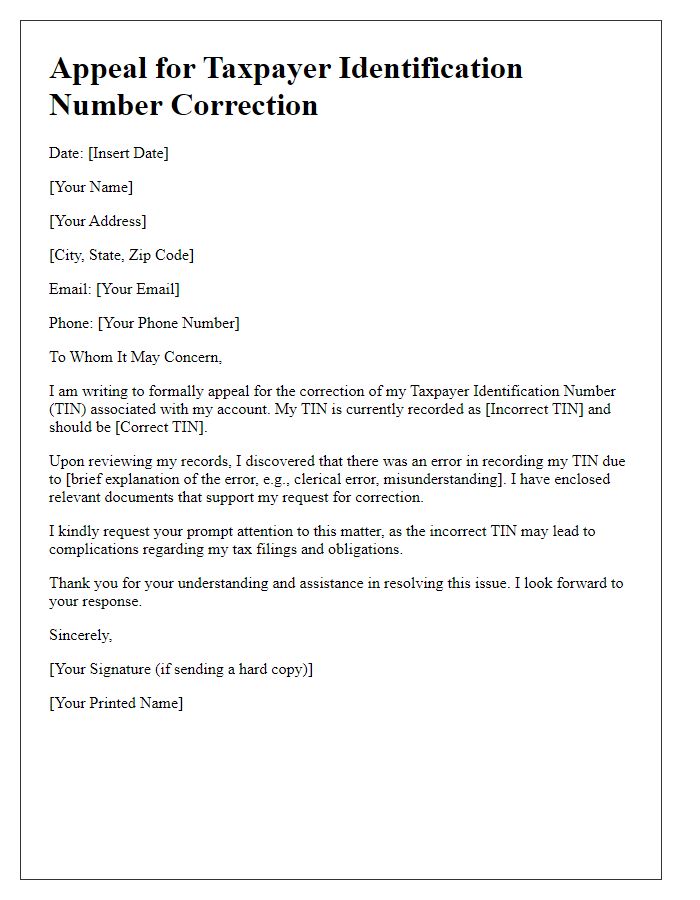

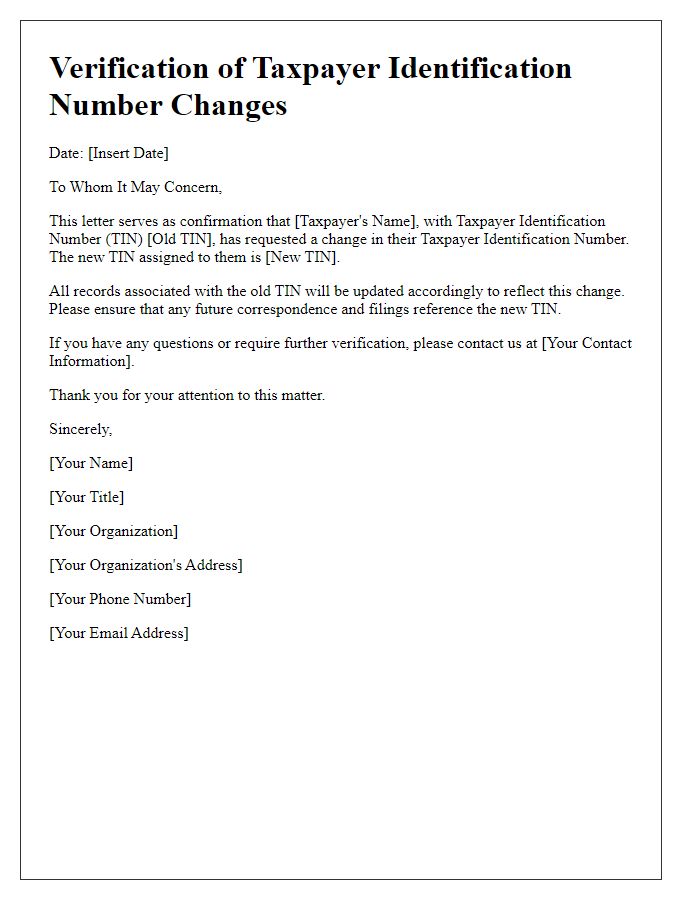

Letter Template For Taxpayer Identification Number Update Samples

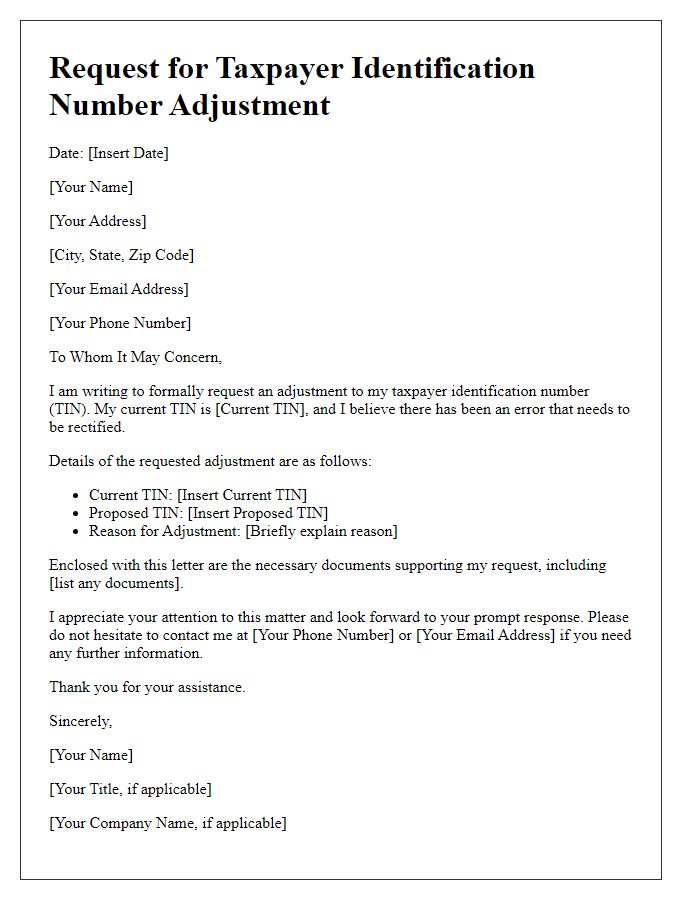

Letter template of request for taxpayer identification number adjustment

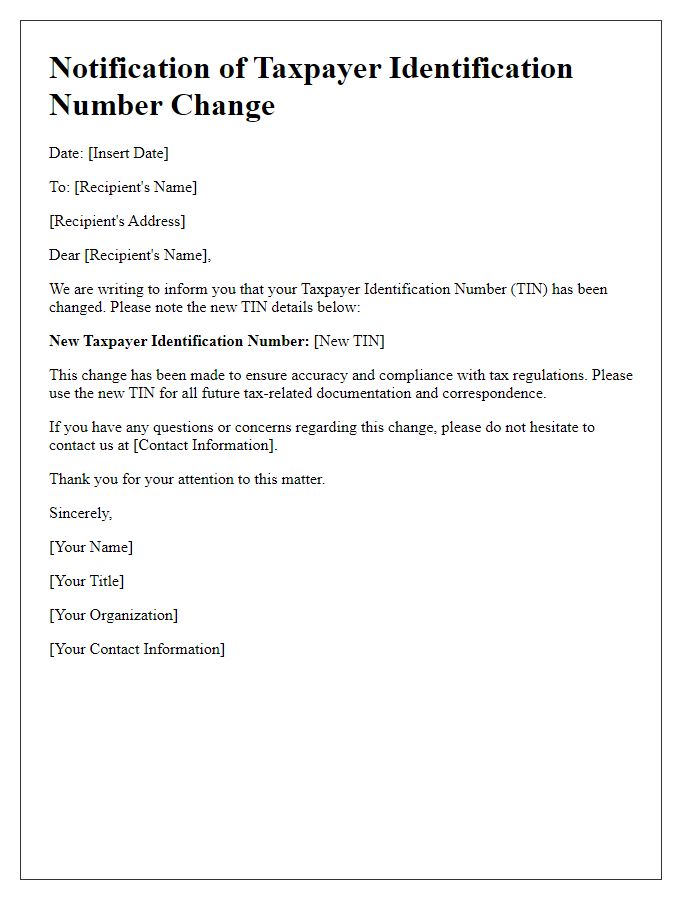

Letter template of notification for taxpayer identification number change

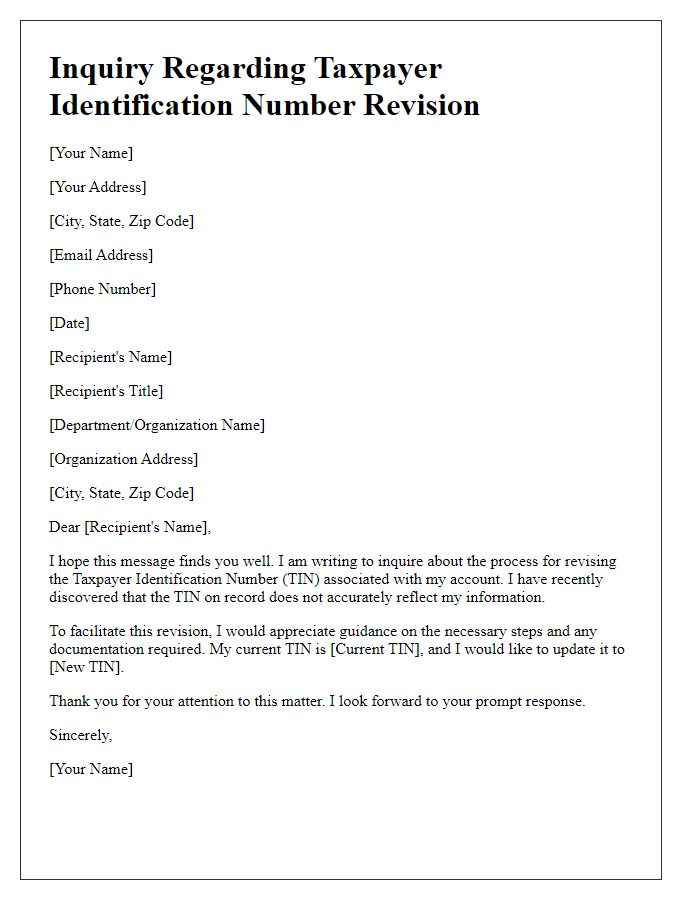

Letter template of inquiry regarding taxpayer identification number revision

Letter template of confirmation for taxpayer identification number update

Letter template of authorization for taxpayer identification number amendment

Letter template of submission for taxpayer identification number modification

Letter template of documentation for taxpayer identification number alteration

Letter template of explanation for taxpayer identification number reissue

Comments