Dealing with a tax fraud investigation can be daunting, but understanding the process can provide some peace of mind. First and foremost, it's essential to know your rights and what to expect from tax authorities. Many individuals find themselves overwhelmed by the complexity of such investigations and the potential repercussions. If you're curious about the steps to take and how to protect yourself during this challenging time, read on for more insights.

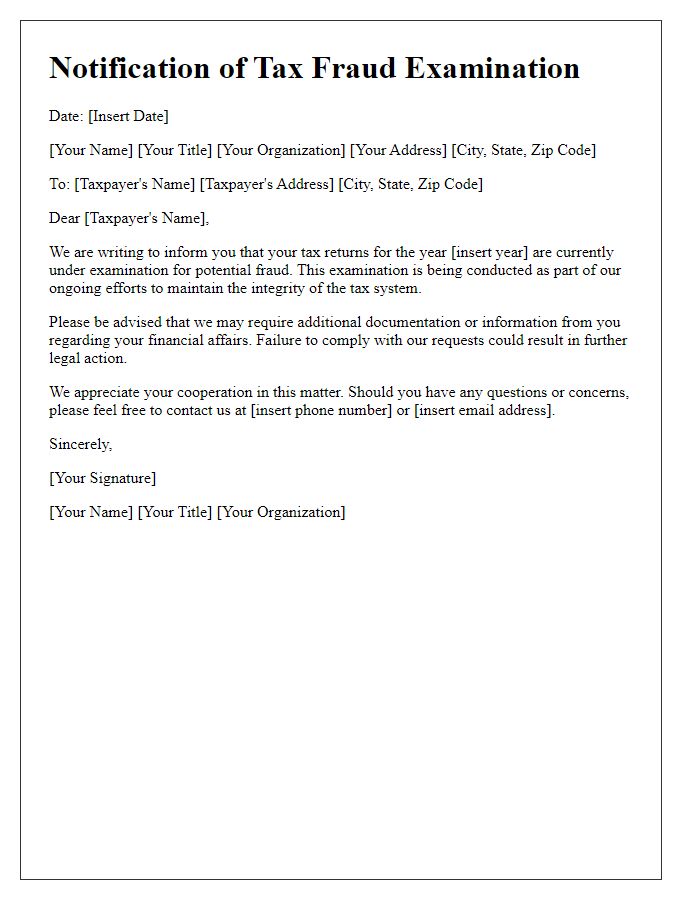

Authority Under Investigation

The authority under investigation for tax fraud schemes often includes the Internal Revenue Service (IRS) in the United States and similar tax authorities worldwide. Investigations typically arise when discrepancies in tax filings, such as unreported income or inflated deductions, attract scrutiny. Cases may involve large sums of money, potentially impacting federal or state revenue. The investigative process could lead to audits, legal actions, and penalties against individuals or organizations suspected of tax evasion. Public records may reveal similar previous cases, indicating patterns of fraudulent activity. Key dates in the investigation timeline, including filing deadlines and meeting dates with tax representatives, can dictate the severity of penalties incurred during these investigations.

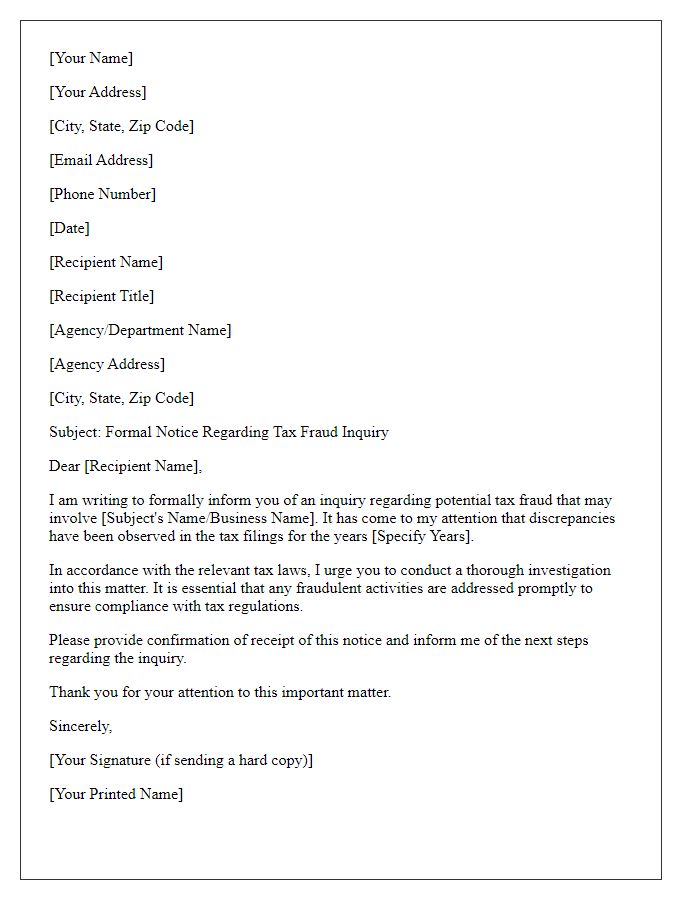

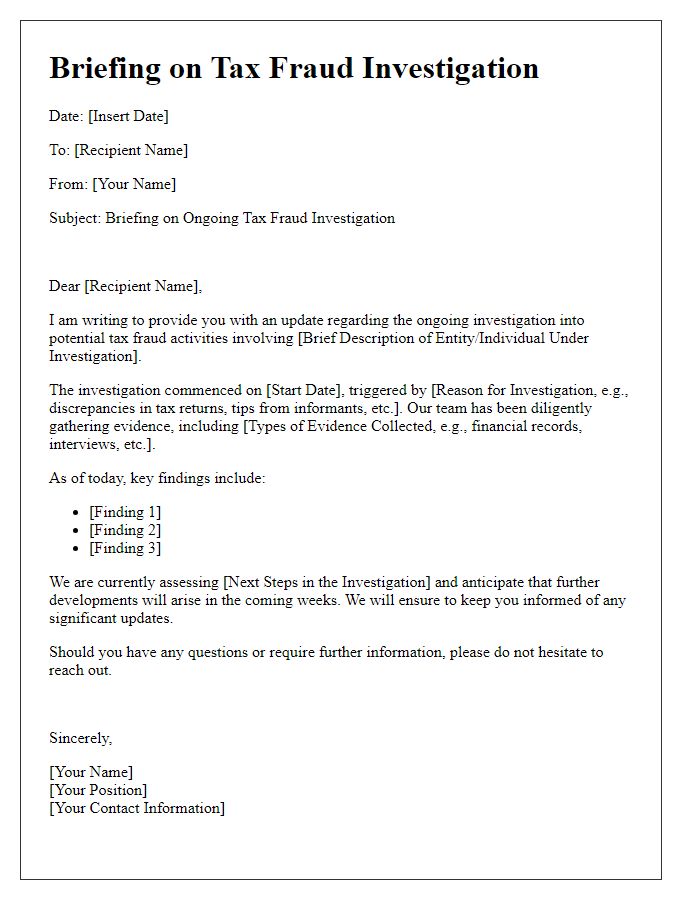

Clear Description of Allegations

A notice of tax fraud investigation may outline specific allegations against a taxpayer, highlighting instances of alleged underreporting of income or misrepresentation of deductions. The Internal Revenue Service (IRS) may assert that certain income sources, such as wages from employment or rental income from properties, were not fully disclosed on tax returns for the years 2020 through 2022. Furthermore, discrepancies in reported deductions, such as exaggerated business expenses or illegitimate charitable contributions, may be identified. The IRS could also reference patterns of behavior, such as repeated amendments to tax returns or inconsistent financial statements provided to financial institutions. This notice typically includes a timeline for response and details about subsequent proceedings, ensuring taxpayers are aware of their rights and the gravity of the allegations.

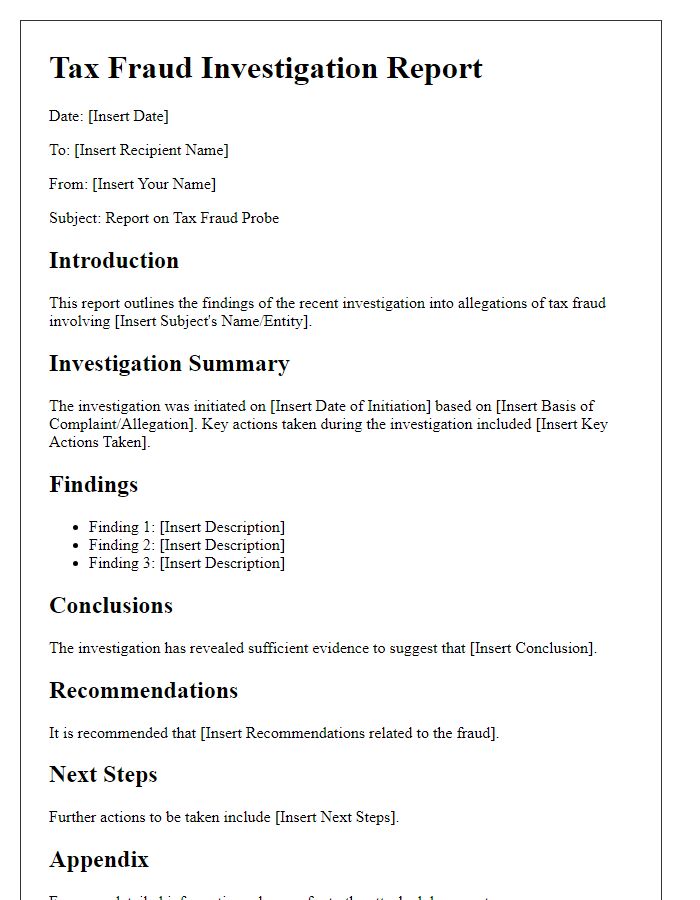

Detailed List of Supporting Evidence

A tax fraud investigation often includes crucial supporting evidence that can impact the outcome of the case. Documentation such as financial records, including bank statements and tax returns, may reveal discrepancies in reported income or deductions. Additional items may include transaction logs, receipts, and invoices that highlight suspicious patterns, such as unusually high expenses compared to industry standards or multi-year financial inconsistencies. Correspondence with tax authorities or internal memos discussing accounting practices may further illustrate intent or knowledge of wrongdoing. Witness statements from employees or contractors could provide context to the evidence collected, strengthening claims of fraudulent intent. Digital evidence, such as emails or file metadata, may also play a vital role in establishing a timeline of suspicious activity. Each of these pieces contributes to a comprehensive view of the alleged tax fraud, essential for legal review and potential prosecution.

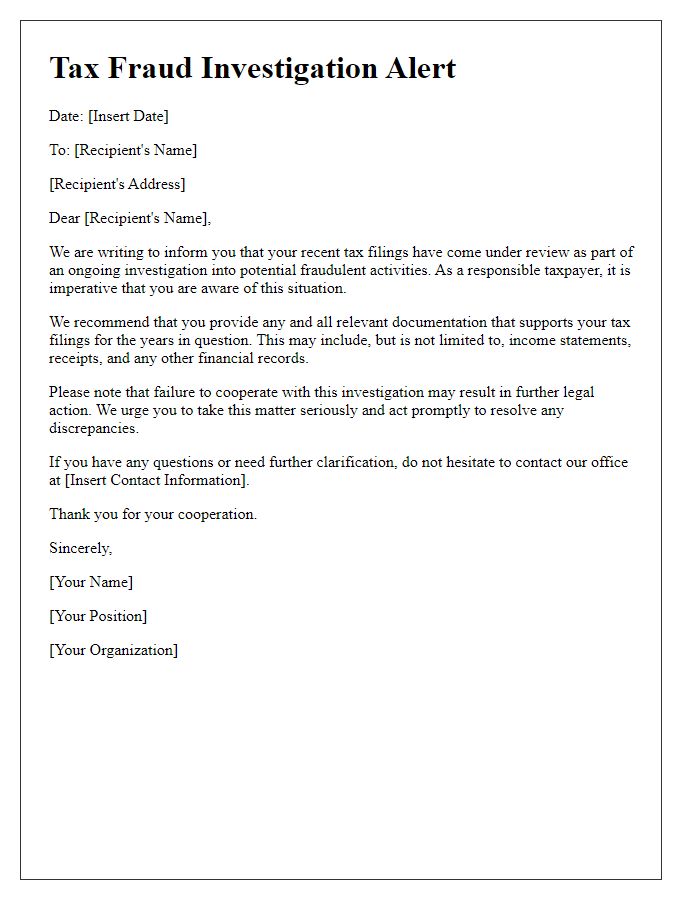

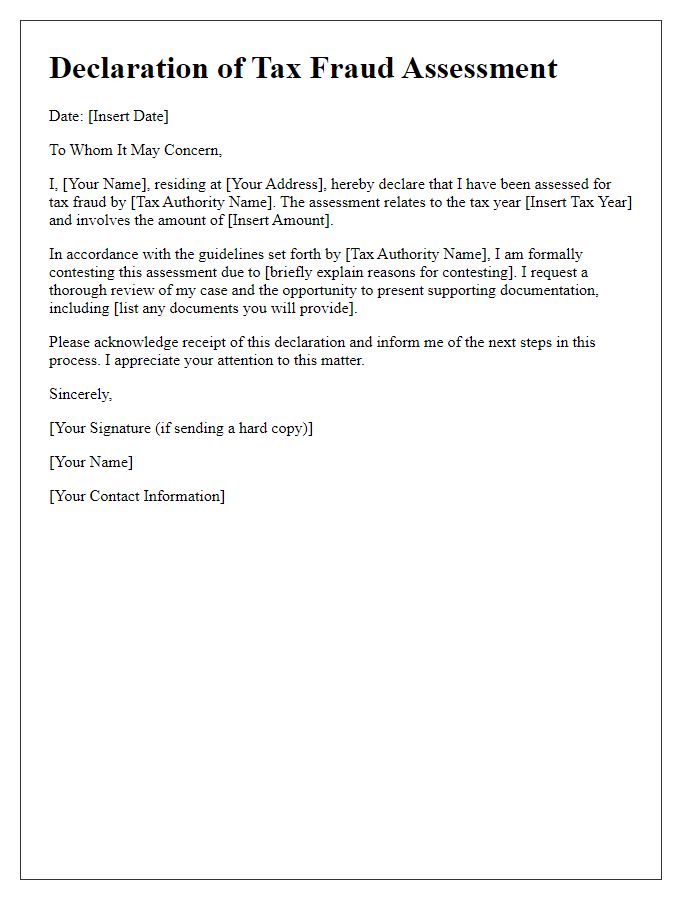

Rights and Obligations

Receiving a notice of tax fraud investigation can be a daunting experience. Individuals targeted by the Internal Revenue Service (IRS) must understand their rights and obligations. The IRS has the authority to investigate claims of tax fraud, which can lead to penalties, including fines and potential imprisonment. Taxpayers are entitled to receive a written notice detailing the allegations against them, and they have the right to request a meeting with an IRS representative to discuss their case. Additionally, individuals should be aware of their obligation to maintain accurate tax records. It is crucial to respond promptly to any correspondence from the IRS to avoid complications. Seeking advice from a tax professional can provide guidance during this stressful process and help navigate the complexities involved in tax fraud investigations.

Point of Contact Information

Notice of tax fraud investigations often requires clear and publicly available point of contact information to ensure effective communication. This typically includes the name of an authorized representative from the tax authority, such as the Internal Revenue Service (IRS) in the United States, responsible for handling the investigation. The contact's phone number, usually including country code and area code, facilitates immediate access to relevant inquiries. The email address ensures documentation is maintained for future reference. Additionally, the physical office address, often the headquarters or local office related to the investigation, is crucial for any formal correspondence. Proper identification, such as employee ID numbers or department names, adds credibility and ensures direct communication with the correct office or personnel.

Comments