Navigating the complexities of tax return amendments can feel overwhelming, but it doesn't have to be! Whether you're correcting inaccuracies or claiming overlooked deductions, understanding the process is key to ensuring your paperwork is in order. In this article, we'll guide you through a helpful template for crafting a clear and concise letter to explain your amendments effectively. So, let's dive in and make tax season a little less taxingâread on!

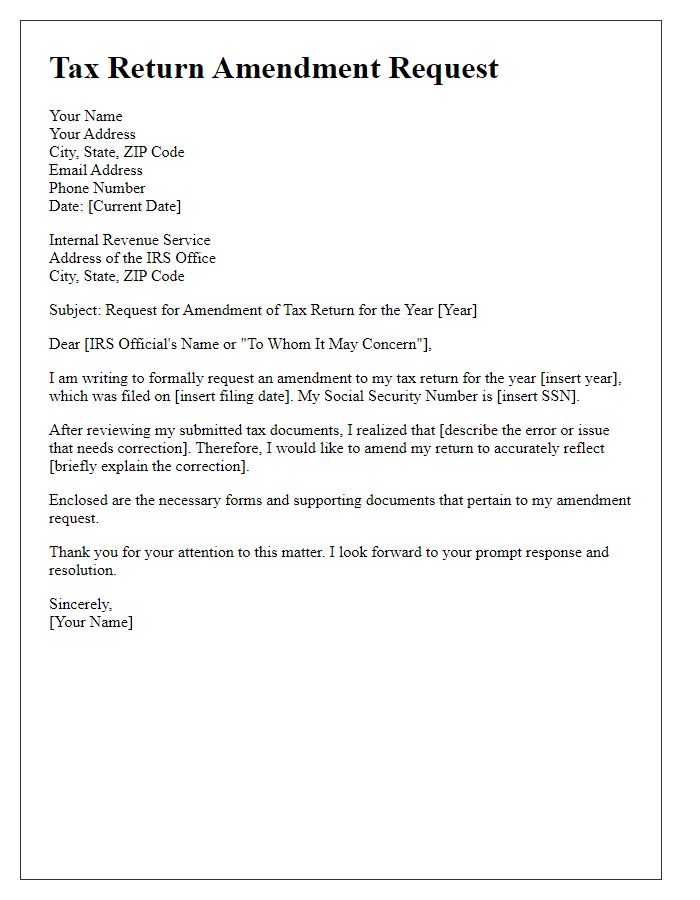

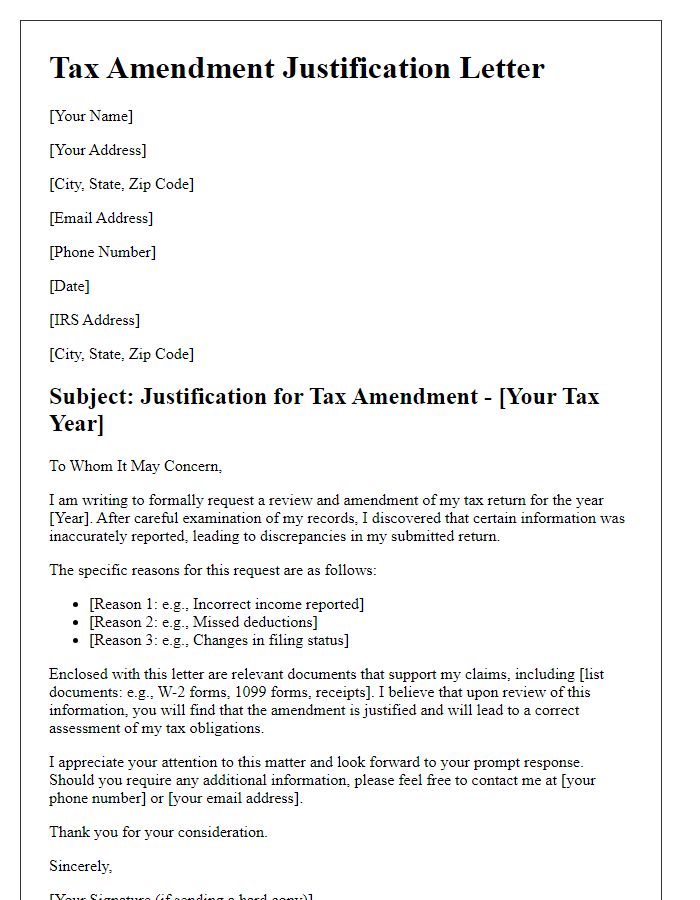

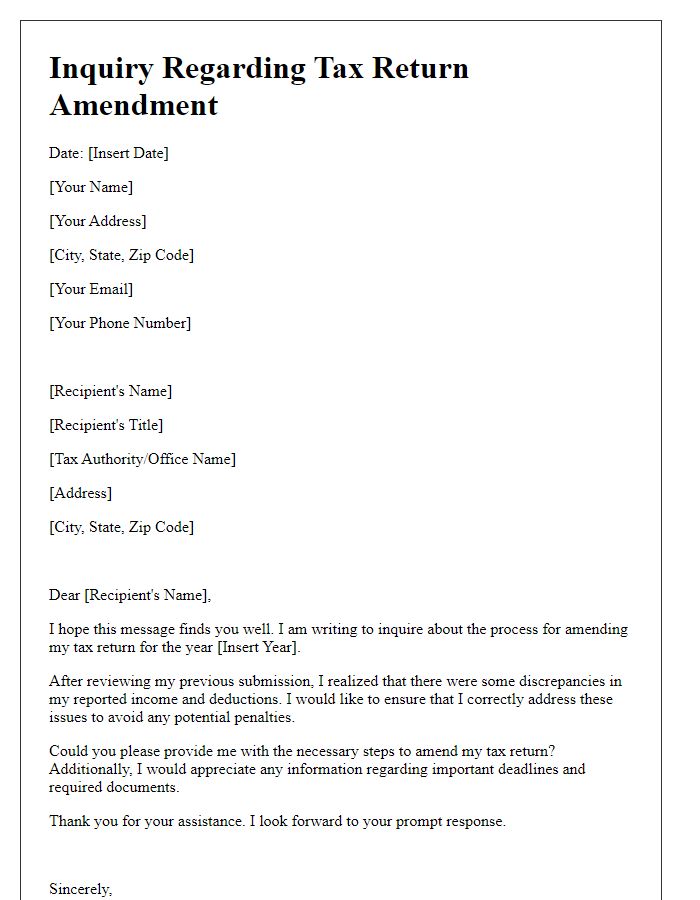

Taxpayer Information

Taxpayer information plays a critical role in the tax return amendment process. Essential details include the Taxpayer Identification Number (TIN), a nine-digit number assigned by the IRS for tracking purposes, ensuring proper identification of individuals or entities. Specific name details, including the full legal names of individuals or business entities (such as LLCs or corporations), are mandatory for accurate record-keeping. Additionally, current mailing addresses, including state and ZIP code (e.g., California 90210), facilitate communication with the IRS regarding any further inquiries or notifications about the amended return. Accurate contact information, such as telephone numbers and emails, is crucial for potential follow-ups or clarifications during the amendment process. Proper documentation overall aids in a smoother resolution of any discrepancies that may arise from the original tax return.

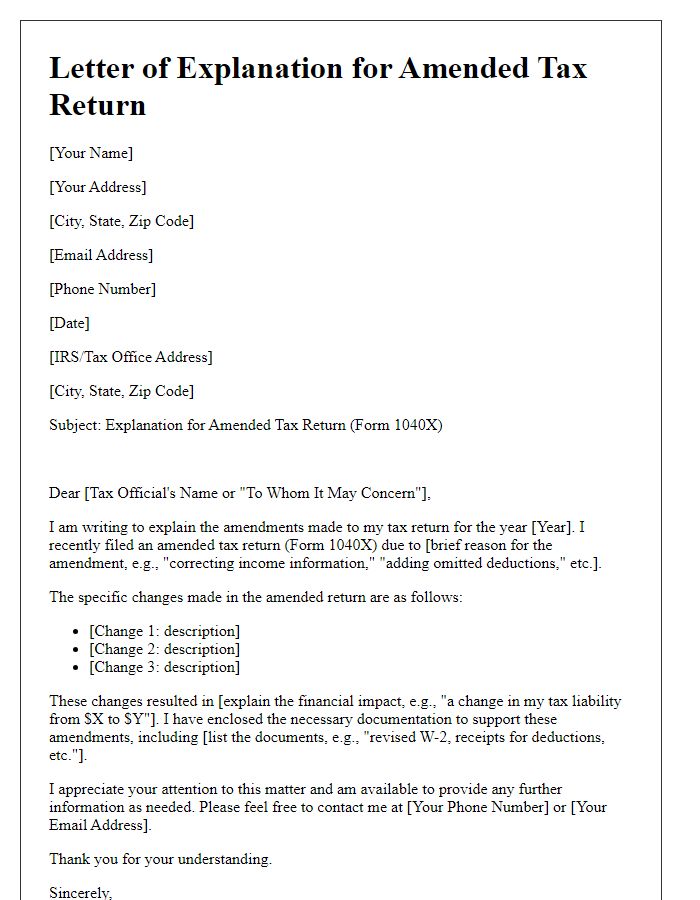

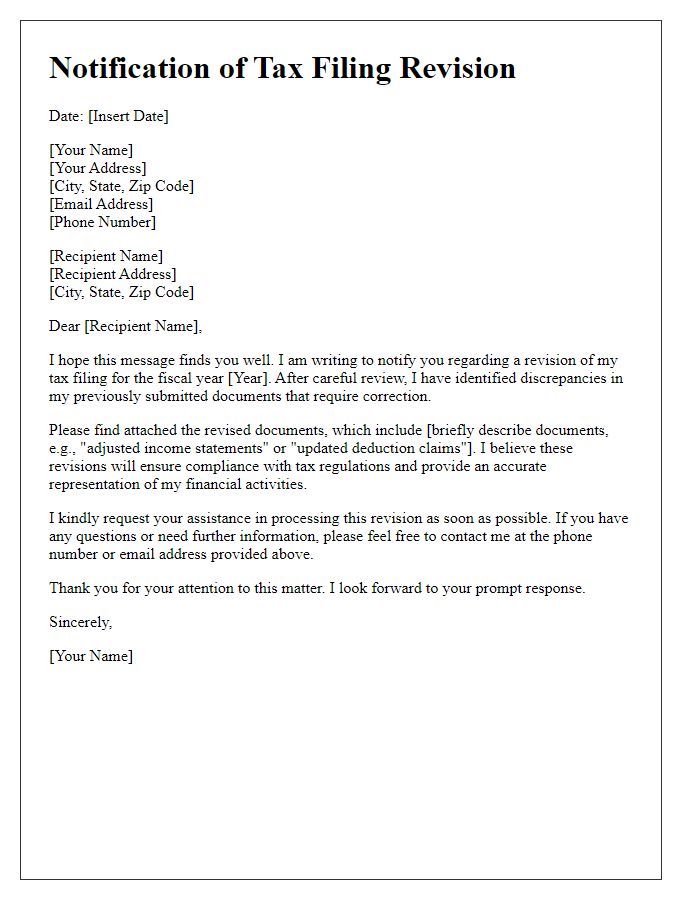

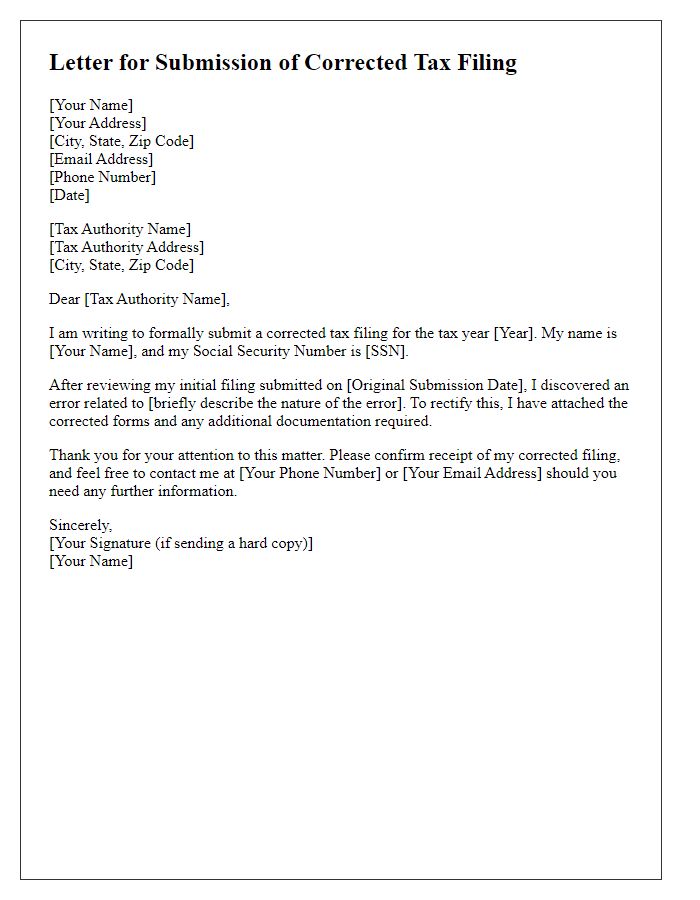

Reason for Amendment

Amending a tax return, such as IRS Form 1040, is often necessary to correct errors or report additional income. Common reasons for amendment include inaccurately reported income (for instance, underreporting W-2 earnings from an employer), overlooked deductions or credits (like missed eligibility for the Earned Income Tax Credit), or state tax discrepancies that need alignment with federal returns. Additionally, changes in filing status, such as a marriage or divorce affecting tax brackets, warrant an amendment to ensure compliance with tax laws. Filing Form 1040-X, the Amended U.S. Individual Income Tax Return, helps rectify these issues and facilitate accurate tax reporting for the IRS.

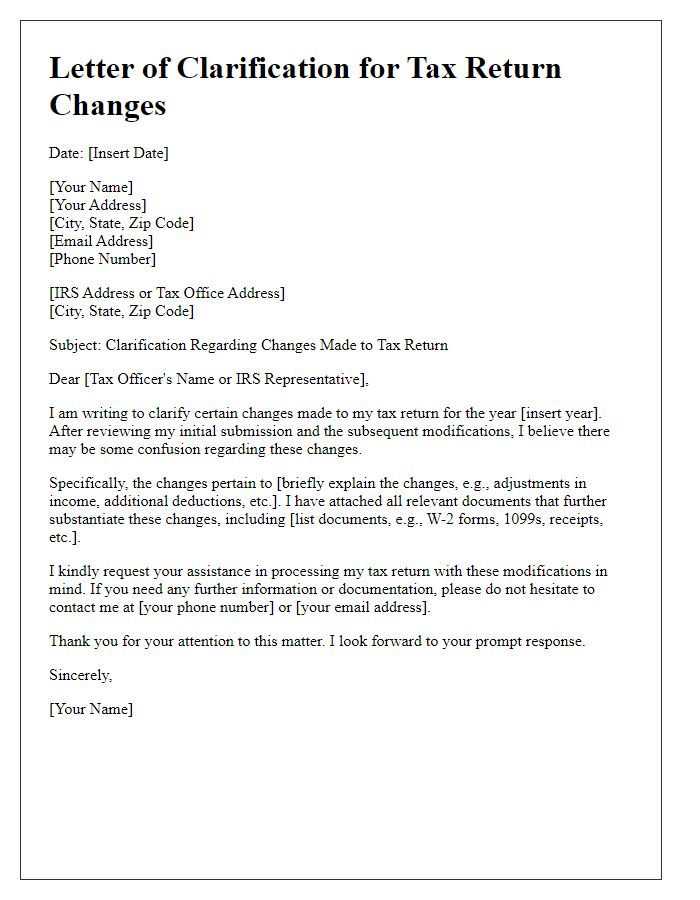

Detailed Explanation of Changes

Amending a tax return involves crucial adjustments that can impact various financial aspects. Form 1040-X, used for amendments, highlights these changes, often resulting from overlooked income, deductions, or credits. For instance, individuals may discover additional income sources, such as freelance earnings of $5,000, which necessitates reporting. Adjustments to deductions, like the overlooked $2,000 medical expense deduction, can alter the final tax obligation significantly. Moreover, taxpayers might find eligibility for credits, such as the Earned Income Tax Credit (EITC) worth up to $6,660 for qualifying low-income families with children. Incorrect filing could have led to underpayment or overpayment, necessitating revision to comply with IRS regulations and avoid potential penalties. Each adjustment must be documented thoroughly to substantiate the accuracy of the amended return.

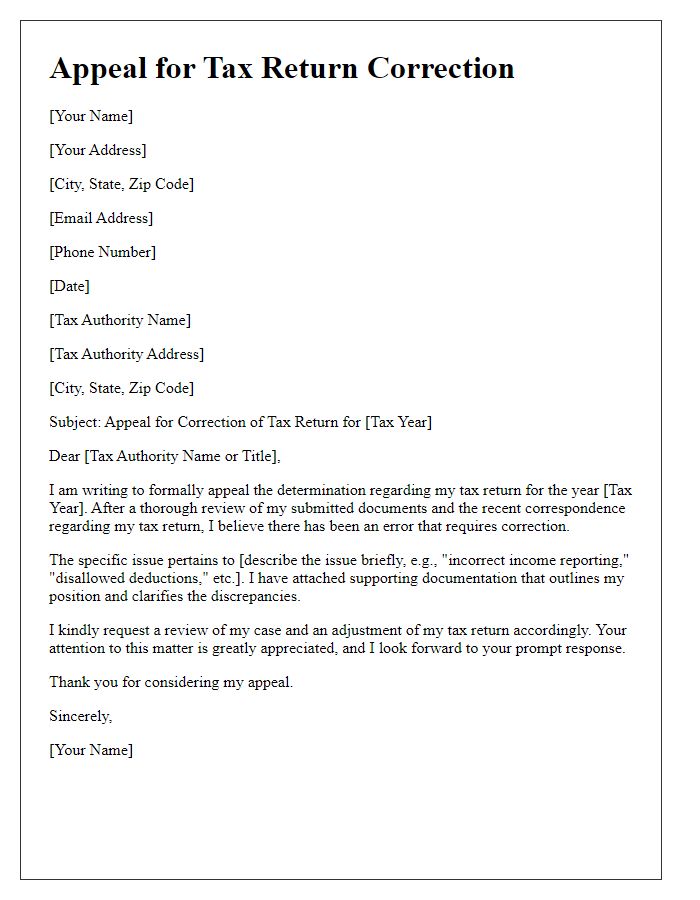

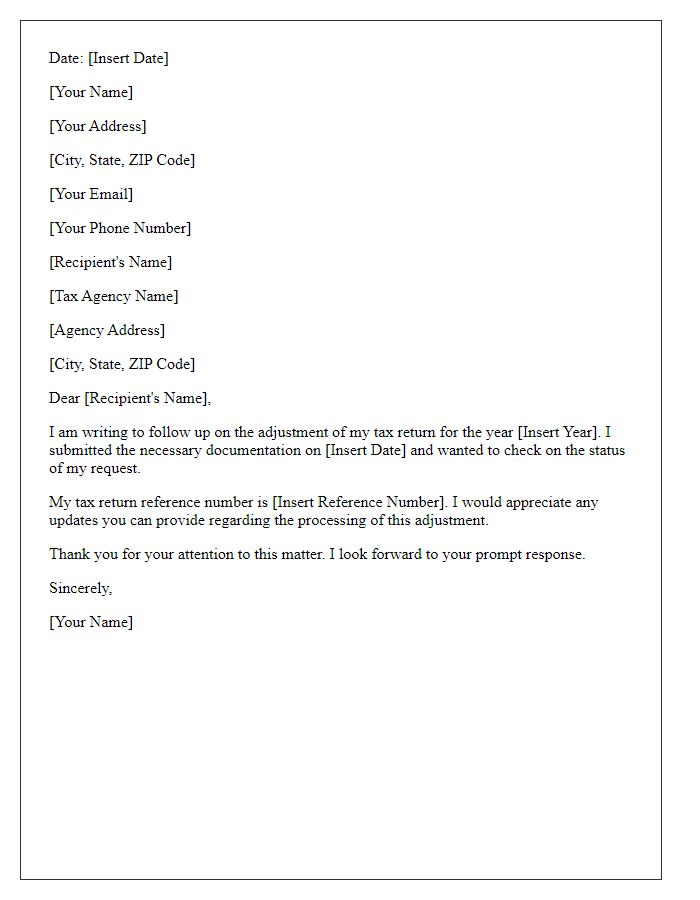

Impact on Previous Tax Return

The process of amending a tax return can significantly impact taxpayers, especially if adjustments are made to income figures or deductions. For instance, a taxpayer in California may discover an error in reporting self-employment income of $25,000, which if uncorrected could lead to penalties and interest on underreported income. If adjustments result in a refund, timely submission (typically within three years of the original filing date) is crucial to reclaim overpaid taxes efficiently. Additionally, amendments can alter a taxpayer's eligibility for certain credits, such as the Earned Income Tax Credit (EITC) valued up to $6,728, emphasizing the importance of accurate filing records.

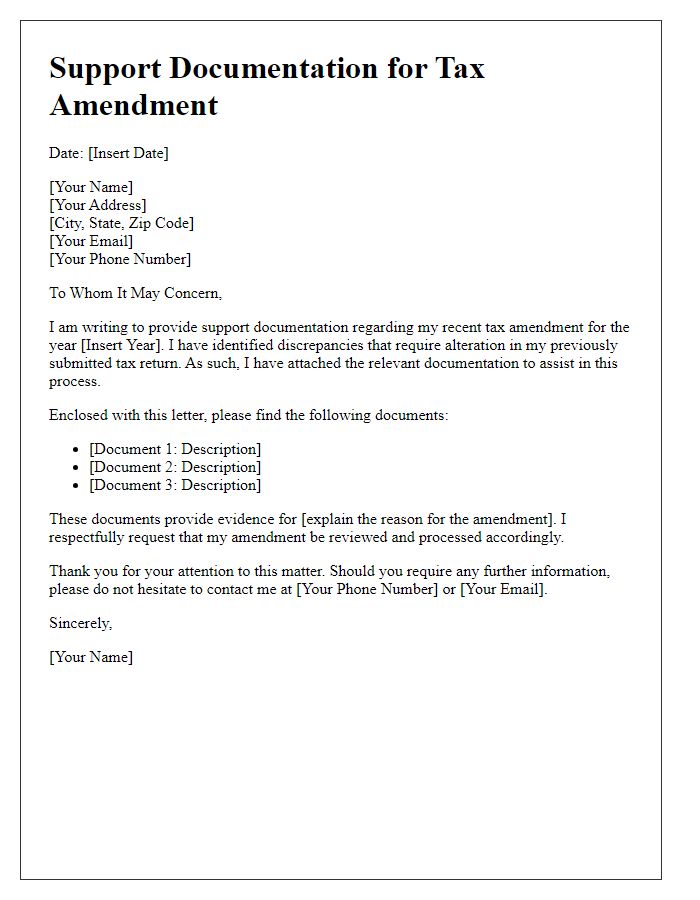

Supporting Documentation

Amending a tax return requires careful attention to supporting documentation, crucial for validating changes made to previously submitted information. Common documents include W-2 forms, critical for reporting income from employers, and 1099 forms, which detail income received as an independent contractor or interest earned from bank accounts. Additionally, receipts for deductible expenses, such as medical bills or home office supplies, provide evidence for itemized deductions taken. Taxpayers should also include any notices received from the Internal Revenue Service (IRS), such as CP2000 notices, which may indicate discrepancies in reported income. Properly organized and complete documentation can expedite the amendment process, ensuring compliance and reducing the risk of audits.

Comments