Are you feeling overwhelmed by tax season and unsure about how to handle your tax obligations? Appointing a tax payer representative can streamline the process and provide you with the expert guidance you need. This appointment not only helps you navigate the complexities of tax laws but also ensures that your interests are effectively represented. Curious about how to get started? Read on to find out how to create a letter for your representative appointment!

Representative Identification

Taxpayer representatives, identified through IRS Form 2848, provide crucial assistance during tax matters. This form allows designated individuals, such as attorneys or certified public accountants, to communicate with the IRS on behalf of a taxpayer. The representative must include their credentials and identification number, typically a Social Security Number or an Employer Identification Number. Appointments are essential during audits, appeals, or disputes, particularly when significant tax amounts, such as over $10,000, are at stake. This ensures that taxpayers receive expert guidance, making the complex tax processes manageable and compliant with regulations. Proper identification and documentation are essential for establishing authority and safeguarding taxpayer rights.

Taxpayer Information

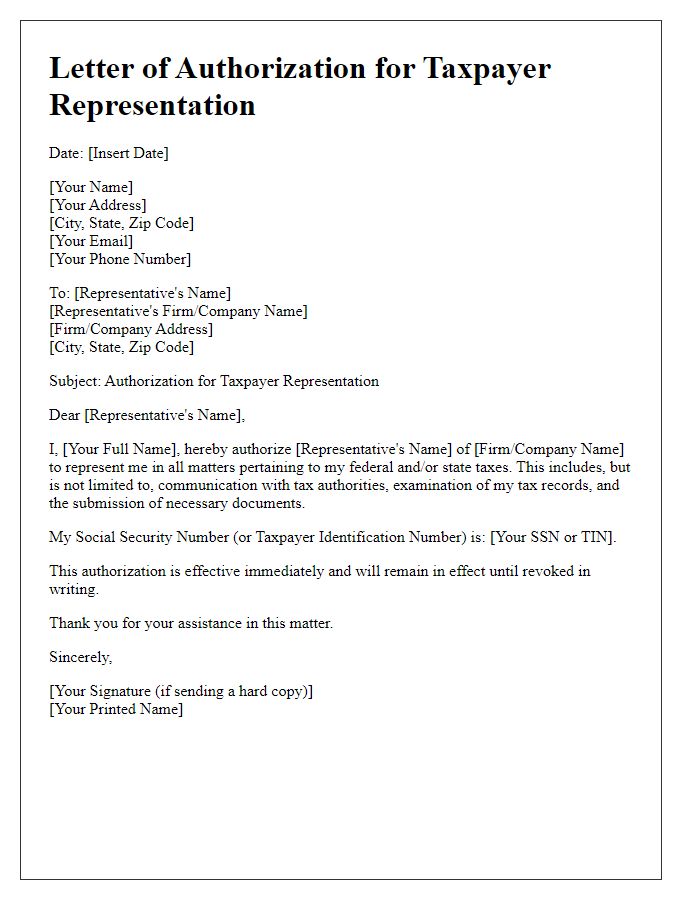

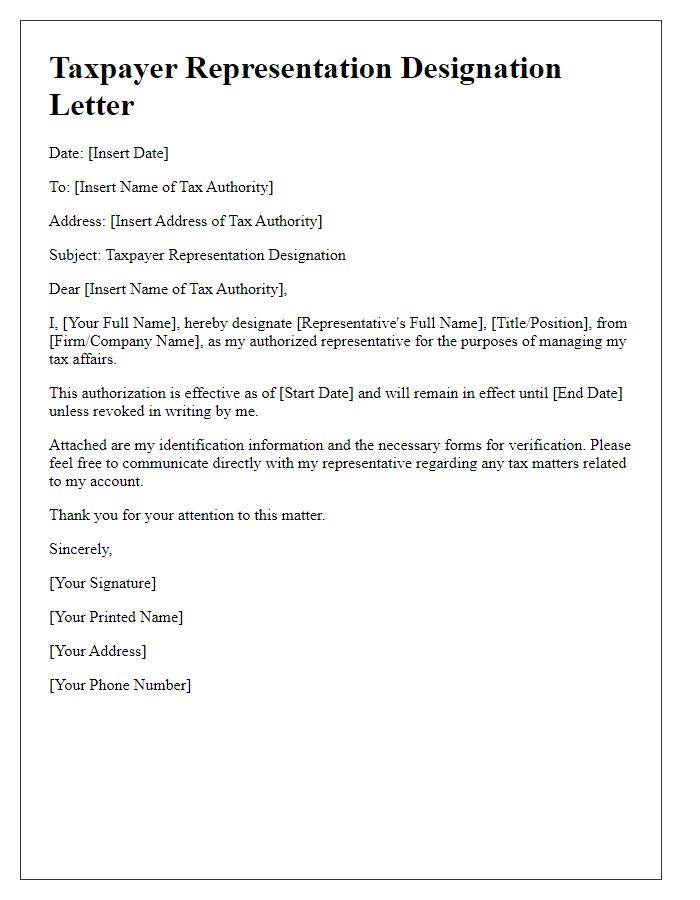

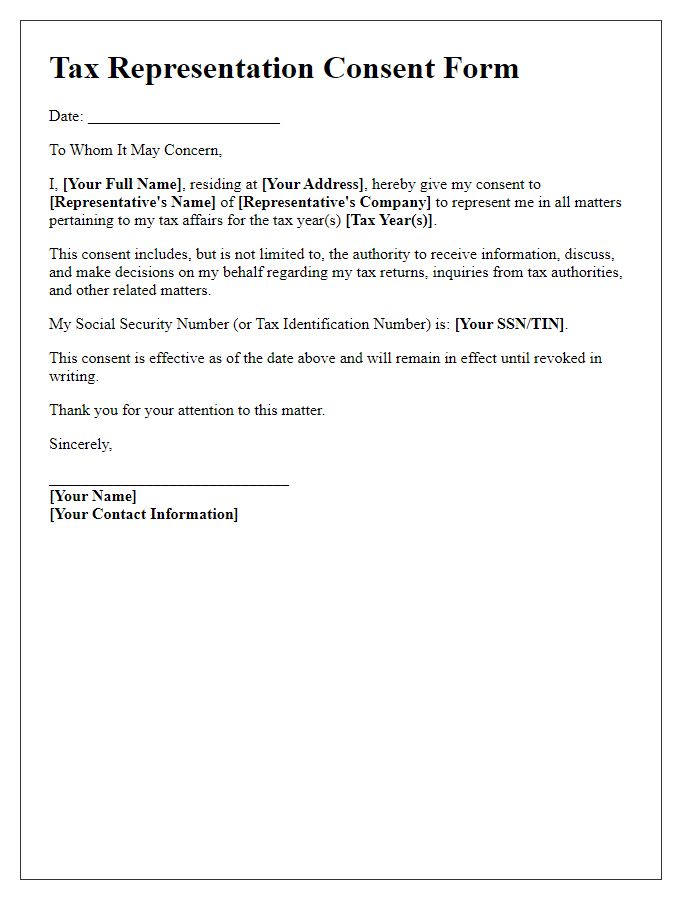

Taxpayer representation involves a designated individual or entity, such as a tax advisor or attorney, authorized to handle tax matters on behalf of the taxpayer. This appointment typically includes critical taxpayer information including full name, Social Security Number (SSN) or Taxpayer Identification Number (TIN), and contact details. The representative must also provide their credentials, such as firm name, address, and identification number, to verify their qualifications. This appointment form often requires the taxpayer's signature, indicating consent for the representative to access sensitive tax information from the Internal Revenue Service (IRS) and perform necessary actions regarding filings, disputes, or inquiries. Effective appointments ensure smooth communication between the taxpayer and tax authorities, streamlining the tax process.

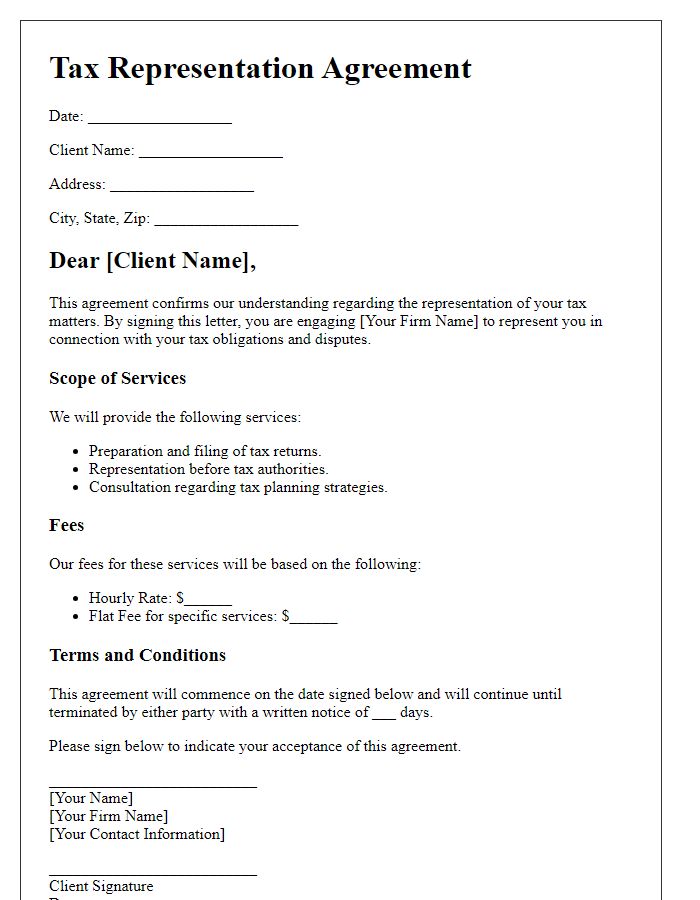

Scope of Representation

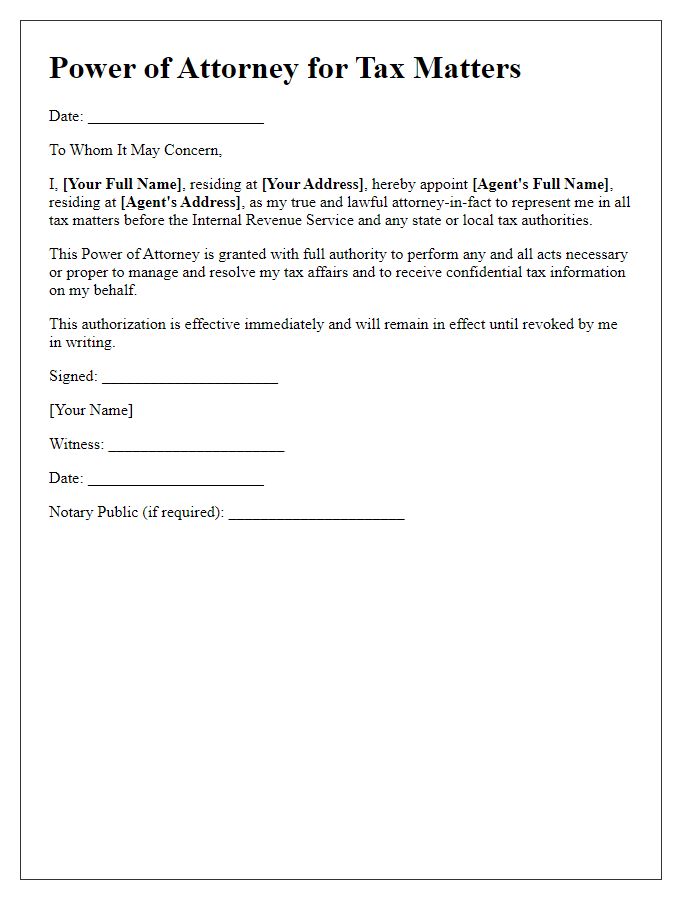

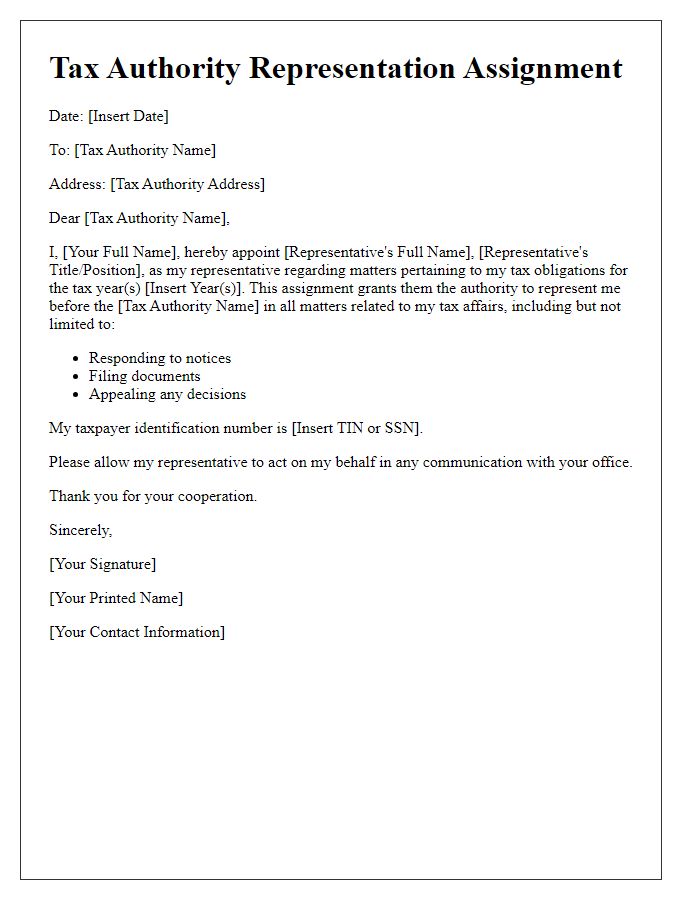

A tax payer representative appointment outlines the specific authority granted to an individual or organization to act on behalf of a taxpayer during dealings with the Internal Revenue Service (IRS) or other tax authorities. This scope of representation may include representation for audits, appeals, or collections. The designated representative, which can be a Certified Public Accountant (CPA), enrolled agent, or tax attorney, is authorized to communicate with tax authorities, access financial records, and negotiate on behalf of the taxpayer. The appointment must be clearly documented through IRS Form 2848, Power of Attorney and Declaration of Representative, ensuring that all parties understand the limits of authority, such as duration of representation and specific tax issues involved. This formal arrangement helps protect the taxpayer's interests and ensures compliance with relevant tax laws and regulations.

Authorization Duration

Taxpayer representatives play a crucial role in assisting individuals and entities during their interactions with tax authorities, such as the Internal Revenue Service (IRS) in the United States. When an individual authorizes a representative to act on their behalf, it is important to clearly define the authorization duration. The duration may specify a particular time frame, such as starting from the date of authorization for one year until a specified end date, or it may be open-ended, allowing the representative to act on behalf of the taxpayer until written notice of termination is provided. Additionally, including details like the taxpayer's identification number, representative's contact information, and any specific tax matters or tax years the authorization covers enhances the clarity of the appointment. This explicit information ensures both parties are aware of the time constraints governing the representative's authority and helps prevent potential disputes or misunderstandings with tax authorities.

Signature and Date

A tax payer representative appointment allows an individual or organization to designate another party to handle tax matters on their behalf. This process often involves the signing of a formal document that outlines the rights and responsibilities of the appointed representative, as well as the specific tax matters they are authorized to address. Key details typically included in this appointment form are the taxpayer's name, address, taxpayer identification number, and a clear statement of authority granted to the representative. The document requires signatures from both parties, along with the date, to indicate mutual agreement and to ensure compliance with tax authority requirements. Properly executed, this appointment streamlines communication between the taxpayer and tax authorities, facilitating effective representation during audits, disputes, or inquiries.

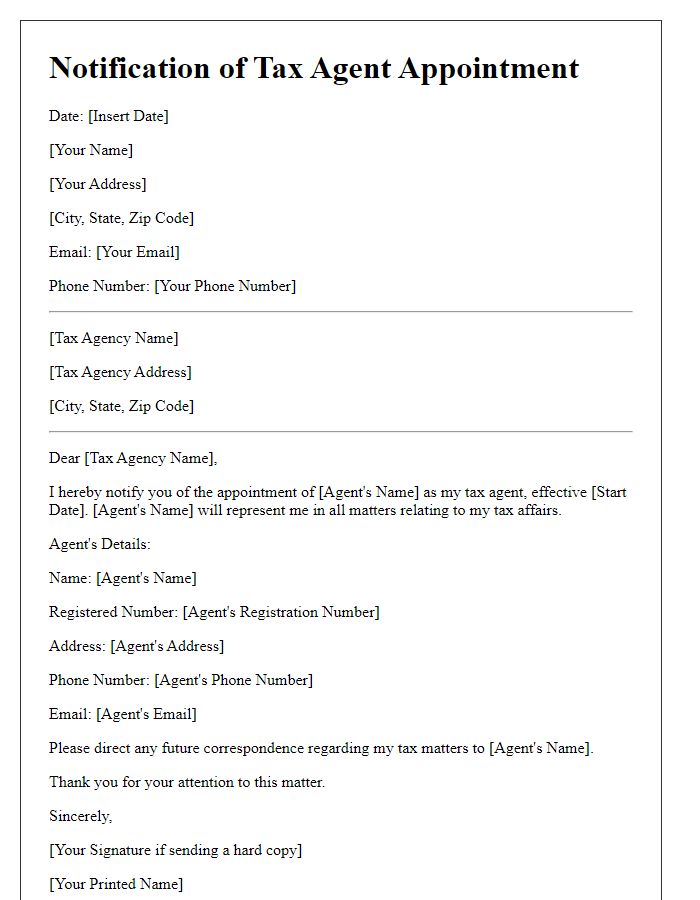

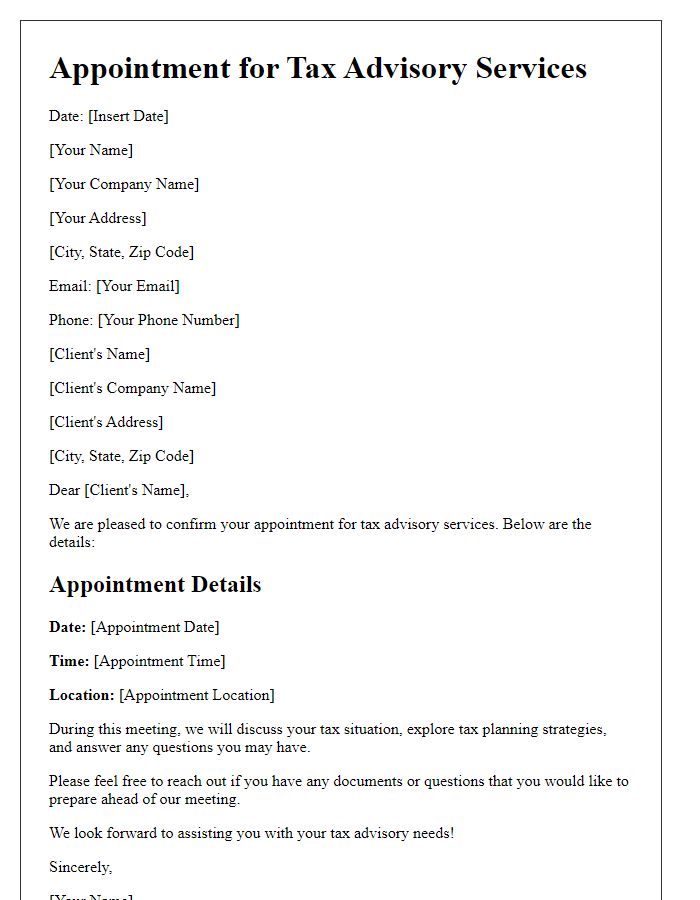

Letter Template For Tax Payer Representative Appointment Samples

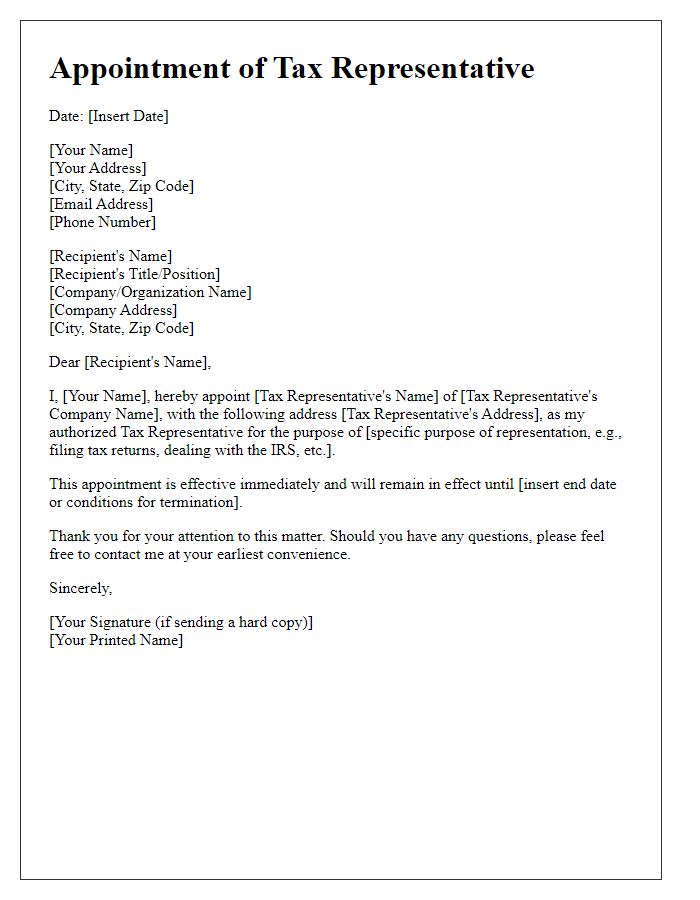

Letter template of Authorization for Taxpayer Representation Appointment

Comments