Are you feeling overwhelmed by your tax obligations and unsure of what to do next? You're not aloneâmany individuals find themselves in a similar situation and seek relief through a partial tax payment arrangement. This flexible solution allows you to settle your tax debt at a comfortable pace while ensuring you stay compliant with tax regulations. If you're curious about how to navigate this process effectively, keep reading for essential tips and steps to get started!

Financial situation explanation

Individuals facing financial hardships often encounter difficulties in managing tax obligations, particularly when faced with unexpected expenses or reduced income. Circumstances such as job loss (unemployment rates reaching 6% in urban areas), medical emergencies (average hospital stay costs averaging $2,500 per day), or substantial debt (credit card interest rates around 16%) can severely impact cash flow. In such situations, taxpayers may seek to establish a partial payment arrangement with authorities, often necessitating a clear explanation of their financial situation to demonstrate genuine inability to pay the full tax owed. Documentation such as recent pay stubs, bank statements, and proof of expenses (monthly rent averaging $1,800 in metropolitan areas) may be required to support the case for a more manageable tax payment solution.

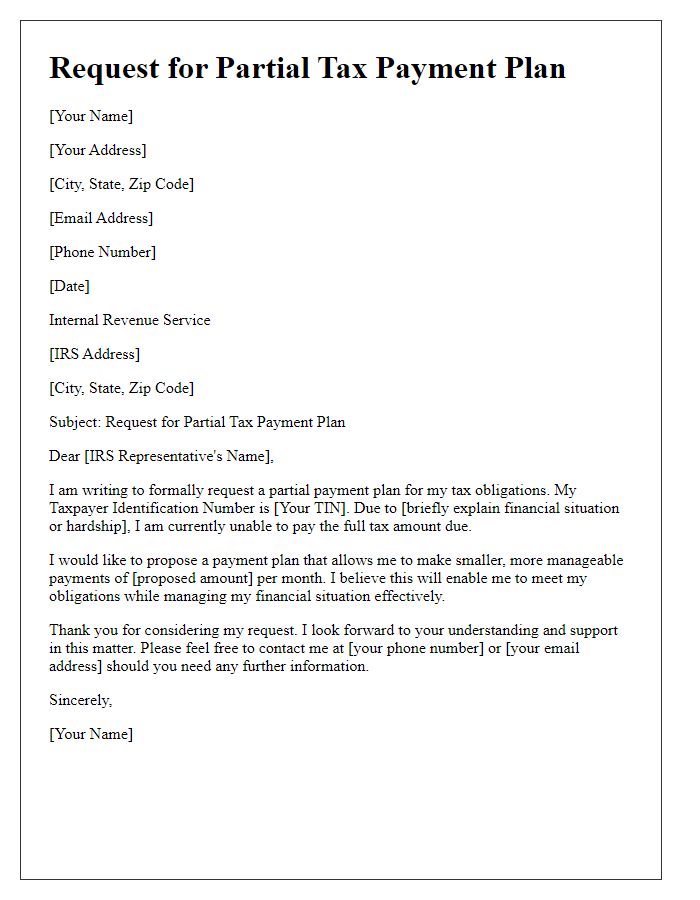

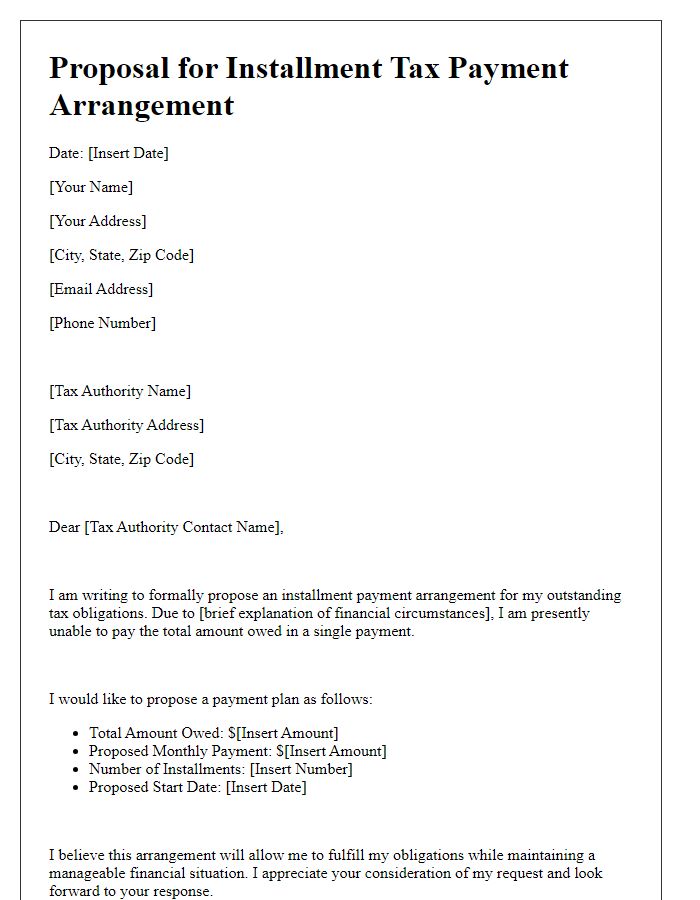

Proposed payment plan

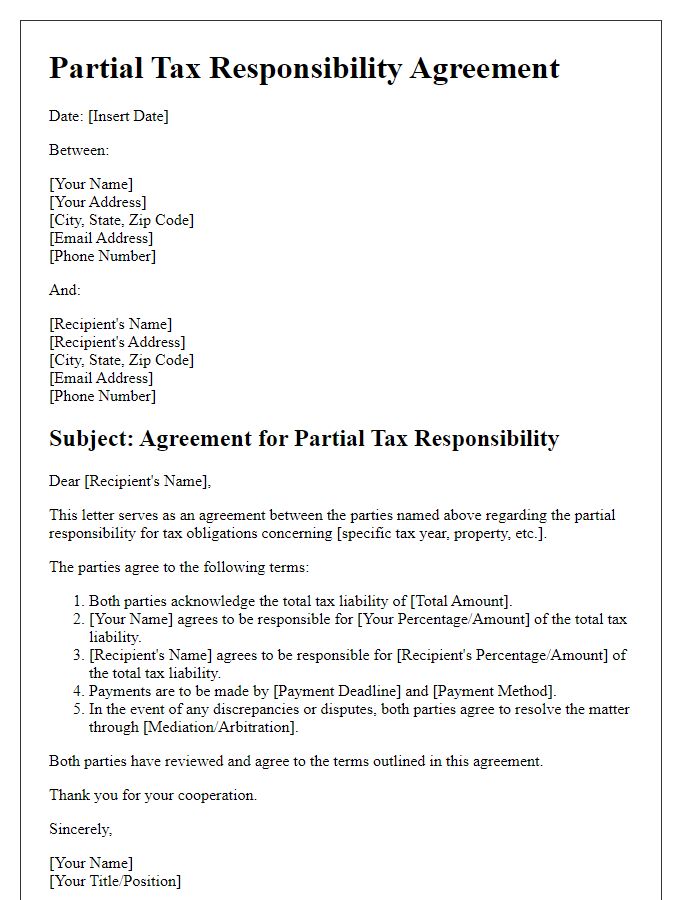

A letter template for a partial tax payment arrangement outlines a structured proposal detailing the plan for repaying outstanding tax liabilities. This formal document specifies the taxpayer's current financial situation, indicating their inability to pay the full amount owed due to economic hardships. Key components include proposed payment amounts, frequency of payments, and the total duration of the arrangement. Clarity in the proposed payment plan fosters transparency and mutual understanding between the taxpayer and tax authority, potentially preventing further legal repercussions. Additionally, including supporting documentation, such as income statements or expense reports, strengthens the request by providing evidence of the taxpayer's financial constraints.

Acknowledgment of tax obligation

Acknowledging tax obligations is crucial for maintaining compliance with the Internal Revenue Service (IRS). Tax liabilities, such as income tax or property tax, accumulate based on specific laws and regulations. For example, individuals must settle federal income tax by April 15 annually, while property taxes may vary by county, often due in quarterly installments. Failure to address obligations can lead to penalties, interest, and potential liens on properties. Initiating a partial payment agreement may involve submitting Form 9465 to the IRS, allowing taxpayers to pay overdue amounts in manageable monthly installments, thereby easing financial burden while ensuring adherence to legal responsibilities.

Contact information

In the financial realm, establishing a partial tax payment arrangement requires clear communication and documentation, particularly when dealing with tax authorities such as the Internal Revenue Service (IRS) in the United States. Taxpayers must provide important contact information, including full name, mailing address, and phone number, to facilitate correspondence. Furthermore, taxpayers should include their Social Security Number (SSN) or Employer Identification Number (EIN) linked to their tax account to ensure proper identification. Detailed explanations of the financial situation are essential, outlining reasons for requesting a payment plan, such as unexpected medical expenses or job loss. Clarity regarding the proposed payment amounts and schedule, including how long each payment will span, promotes transparency and assists tax officials in processing the arrangement efficiently.

Assurance of future compliance

Proposing a partial tax payment arrangement can help individuals manage their financial obligations while assuring tax authorities of future compliance. This arrangement involves breaking down the total tax liability into smaller, more manageable payments over a specified period. For instance, taxpayers may offer to pay 25% of their total tax due each month for six months, ensuring they remain current with their financial responsibilities. The assurance of future compliance entails a commitment to adhere to all tax laws and regulations going forward, thus reducing the risk of penalties or tax audits. Establishing clear communication with the tax authority, such as the Internal Revenue Service (IRS) in the United States, provides a foundation for trust and accountability, ultimately resulting in a smoother resolution of the taxpayer's obligations.

Comments