If you're a homeowner or business owner in our community, you may have received recent news concerning adjustments to the luxury tax. This change is designed to better reflect the current economic trends and ensure fair taxation for all property owners. Understanding the implications of this adjustment is crucial, as it could affect your financial planning moving forward. So, let's delve deeper into what these changes entail and how they might impact youâread on to learn more!

Recipient Information

The notification of luxury tax adjustment document outlines changes impacting high-value goods, including luxury automobiles, designer fashion, and upscale residential properties. The tax is typically assessed on items exceeding a specific price threshold, often set at $100,000. This adjustment may arise from state legislation revisions or economic factors influencing tax rates, highlighting significant shifts in financial responsibilities for both consumers and retailers. Affected recipients include high-net-worth individuals and luxury goods retailers, located in affluent areas such as New York City and Los Angeles. Timely receipt of this notification ensures all parties remain compliant with the latest tax requirements and avoid potential penalties.

Subject Line

Luxury tax adjustments can significantly impact high-value purchases, such as luxury vehicles or premium real estate. As of October 2023, recent regulatory changes have increased the luxury tax rate by 2% in states like California and New York, affecting items priced over $1 million. This adjustment aims to enhance tax revenue for public services. Buyers may notice higher costs on invoice statements from retailers, who must comply with updated tax regulations and ensure accurate collection. Timely notification of these changes is crucial for financial planning and budgeting.

Introduction and Purpose

The notification of luxury tax adjustment serves to inform taxpayers regarding changes in luxury tax regulations affecting items categorized as luxury goods. Luxury goods typically include high-value items such as yachts, private jets, luxury cars, and designer clothing, with tax rates varying significantly between jurisdictions, sometimes exceeding 20% in certain cities. The purpose of this adjustment notification is to ensure compliance with the updated legislation, outline the implications for affected taxpayers, and describe procedures for how these changes will be implemented effective from the start of the next fiscal year. Information regarding the assessment process and payment timelines will also be highlighted to facilitate a smooth transition.

Details of Tax Adjustment

Luxury tax adjustments can significantly impact high-value purchases, such as luxury vehicles, yachts, and designer goods. This tax, typically ranging from 5% to 10%, varies based on the item's value exceeding a specific threshold, often set at $50,000 for automobiles, for instance. Applicable in several jurisdictions across the United States, including California and New York, the adjusted tax rates aim to redistribute wealth and fund public services. Consumers may receive notification letters detailing these changes, outlining effective dates, revised valuation methods, and instructions for compliance. Understanding these adjustments is crucial for affluent individuals and businesses to ensure accurate budgeting and avoid penalties.

Contact Information for Queries

Luxury tax adjustments can significantly influence the financial landscape for high-value items, such as luxury cars or premium real estate. The IRS (Internal Revenue Service) may initiate these changes annually, considering market valuations or inflation changes. Affected individuals or businesses should contact local tax authorities or consult with certified tax professionals for clarification and further assistance regarding their specific situations. Key resources may include the IRS website, which offers official updates, or local government offices responsible for taxation. Ensuring compliance with these adjustments is crucial to avoid potential penalties.

Letter Template For Notification Of Luxury Tax Adjustment Samples

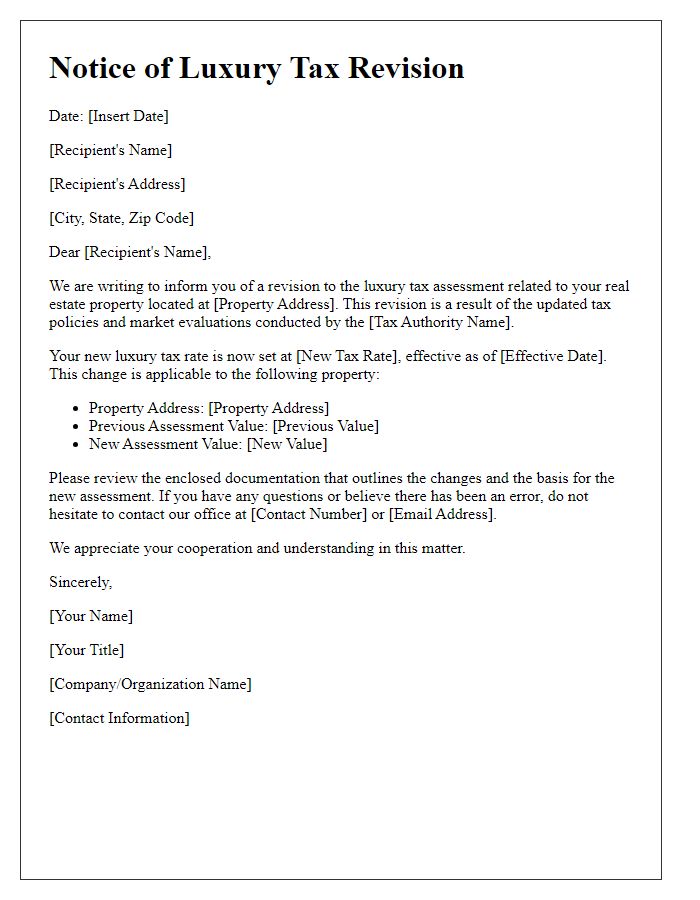

Letter template of Luxury Tax Adjustment Notification for Property Owners

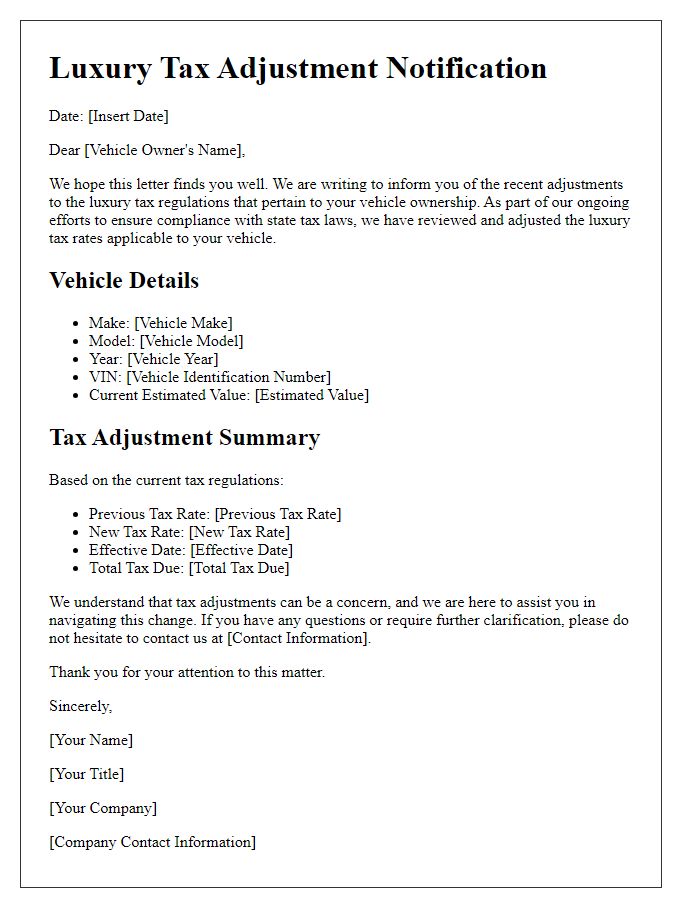

Letter template of Luxury Tax Adjustment for Exclusive Goods and Services

Letter template of Luxury Tax Adjustment Advisory for High-Income Earners

Comments