Are you thinking about starting a business in a tax-free zone? Navigating the process can seem daunting, but the potential benefits make it worthwhile. In this article, we'll walk you through the essential steps and provide tips to help you successfully register your business. So, get comfortable, and let's dive into the world of tax-free zone opportunitiesâyou won't want to miss what's next!

Business Name and Description

Choosing a tax-free zone for establishing a business can significantly enhance economic advantages and growth potential. The business name plays a critical role in branding, requiring a unique and memorable identity that resonates with target customers. A well-crafted business description provides essential insights into the product or service offering, operational strategy, and target market. Key factors to highlight include the location--often in special economic regions like Dubai Free Zone or Panama Pacifico--compliance with local regulations, and benefits derived from tax exemptions on various business activities. Additionally, detailing the expected impact on local employment rates and community development can strengthen the registration proposal's viability and support from governmental agencies.

Contact Information

Tax-free zone business registration requires precise contact information to ensure compliance with local regulations and efficient communication. Business name must reflect the legal entity and be unique within the jurisdiction, such as "GreenTech Solutions LLC". The registration form should include a physical business address, preferably within the tax-free zone, like "123 Innovation Drive, Freeport". Accurate phone numbers, including area codes, are essential for direct inquiries, e.g., "+1 (305) 555-0123". Email addresses must be professional and actively monitored, such as "info@greentechsolutions.com". Additionally, identifying managing members with full names, titles, and personal contact details aids in verifying legitimacy. This structured information streamlines the approval process and enhances the organization's credibility within the local economic landscape.

Tax Identification Number (if applicable)

Tax identification numbers (TIN) are essential for businesses operating within tax-free zones, such as those established in countries like UAE or the Bahamas. TINs serve as unique identifiers assigned to businesses for tax purposes, facilitating compliance with local regulations. Businesses need to include their TINs in registration documents to ensure proper processing by tax authorities. In many jurisdictions, obtaining a TIN involves submitting specific documentation, verifying business structure, and providing personal identification of owners. Missing or incorrect TIN information can lead to delays in registration and potential penalties, highlighting the importance of accuracy in these details.

Zone-Specific Compliance Requirements

Tax-free zones, such as those in Dubai's Jebel Ali Free Zone, have specific compliance requirements for businesses aiming for registration. Businesses must submit a completed application form detailing their operations and planned activities. Documentation includes a valid trade license, company incorporation documents, proof of physical address in the zone, and identification for shareholders and directors. Additionally, businesses must meet capital requirements, which typically range from AED 50,000 to AED 1 million depending on the zone. Regular audits are mandated to ensure adherence to local regulations and tax exemptions, crucial for maintaining operational legitimacy and benefits provided by the zone. Furthermore, businesses must comply with sector-specific regulations, especially in industries like manufacturing and technology, to align with the free zone's strategic vision.

Signature and Date

Tax-free zones, often found in regions like the United Arab Emirates or Panama, provide businesses with significant financial incentives, including exemption from certain taxes. These zones encourage investment by offering benefits such as reduced customs duties and streamlined regulatory processes. Proper documentation is vital for registration, encompassing details like business name, type of activity, and ownership structure. The signature and date section confirms an official agreement and verifies the applicant's commitment to comply with the zone's regulations. Attention to these formalities ensures adherence to local laws and facilitates smoother approval.

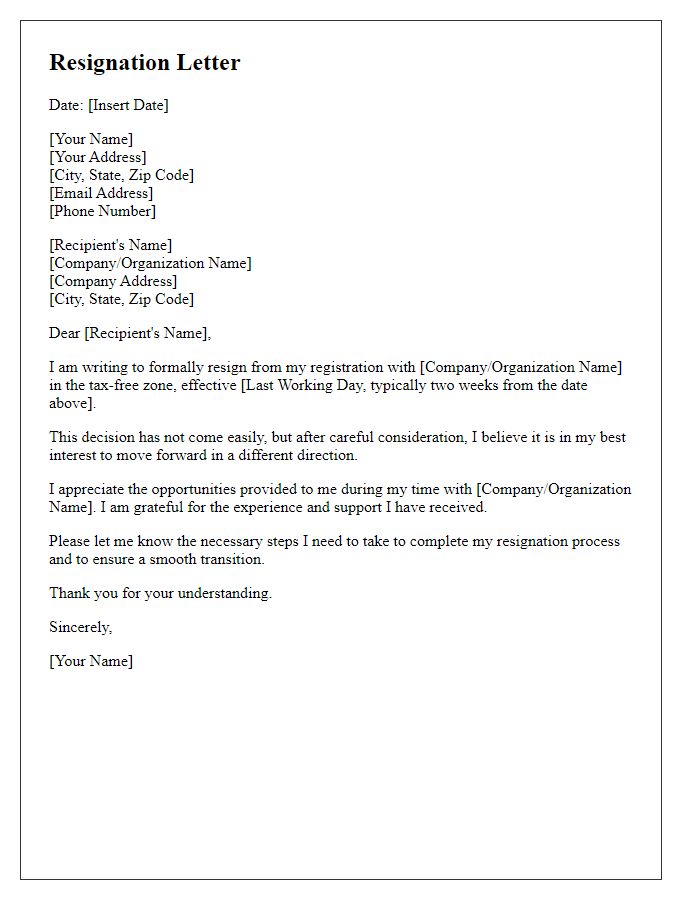

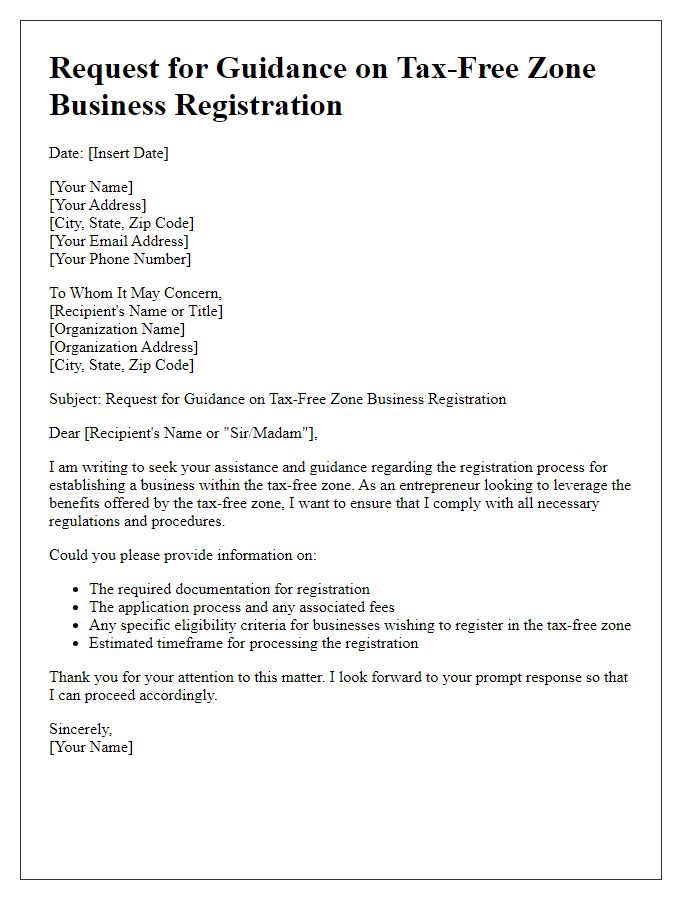

Letter Template For Tax-Free Zone Business Registration Samples

Letter template of inquiry for tax-free zone business registration process

Letter template of appeal for tax-free zone business registration denial

Letter template of confirmation for tax-free zone business registration completion

Letter template of update request for tax-free zone business registration status

Letter template of notification for tax-free zone business registration changes

Letter template of partnership proposal for tax-free zone business registration

Letter template of compliance submission for tax-free zone business registration

Comments