Are you navigating the complex world of tax shelter investments? Understanding how to effectively verify these investments can feel overwhelming, but it doesn't have to be. In this article, we'll break down the essential steps to ensure your tax shelter investments are legitimate and compliant with current regulations. Keep reading to discover actionable tips and a handy template that can simplify your verification process!

Legal Compliance and Regulatory References

Tax shelter investments, including limited partnerships and offshore accounts, require careful scrutiny to ensure compliance with regulations set by the Internal Revenue Service (IRS) and the Securities and Exchange Commission (SEC). Documentation including Form 1065 for partnerships and Schedule K-1 for individual partners must be thoroughly analyzed. Each investment must align with IRS guidelines stated in Internal Revenue Code Section 469 concerning passive activity losses and credits. Due diligence on the investment structure is essential to prevent potential penalties, which can escalate to fines exceeding $10,000 or criminal liabilities. Regulatory references from the Financial Industry Regulatory Authority (FINRA) should also guide the verification process to confirm that all broker-dealers involved adhere to necessary standards and practices, maintaining transparency and legality in all financial transactions.

Detailed Description of Investment Structure

Tax shelters often involve intricate structures designed to minimize tax liabilities while maximizing returns. One common investment structure is the limited partnership (LP), where a general partner (GP) manages the investment and limited partners (LPs) contribute capital without participating in day-to-day decisions. This type of structure allows for pass-through taxation, meaning profits and losses directly affect the partners' individual tax returns, which can lead to substantial tax benefits. Another prevalent structure utilizes real estate investment trusts (REITs), where qualified investors pool funds to invest in income-generating properties and receive dividends that can be tax-advantaged under certain conditions. Additionally, certain entities may implement Deferred Tax Liability (DTL) strategies, allowing for capital gains treatment on investments held for longer periods, thus deferring taxation until realized. Each investment vehicle's specific framework must comply with the Internal Revenue Code (IRC) regulations to ensure validity and effectiveness in achieving tax-efficient outcomes.

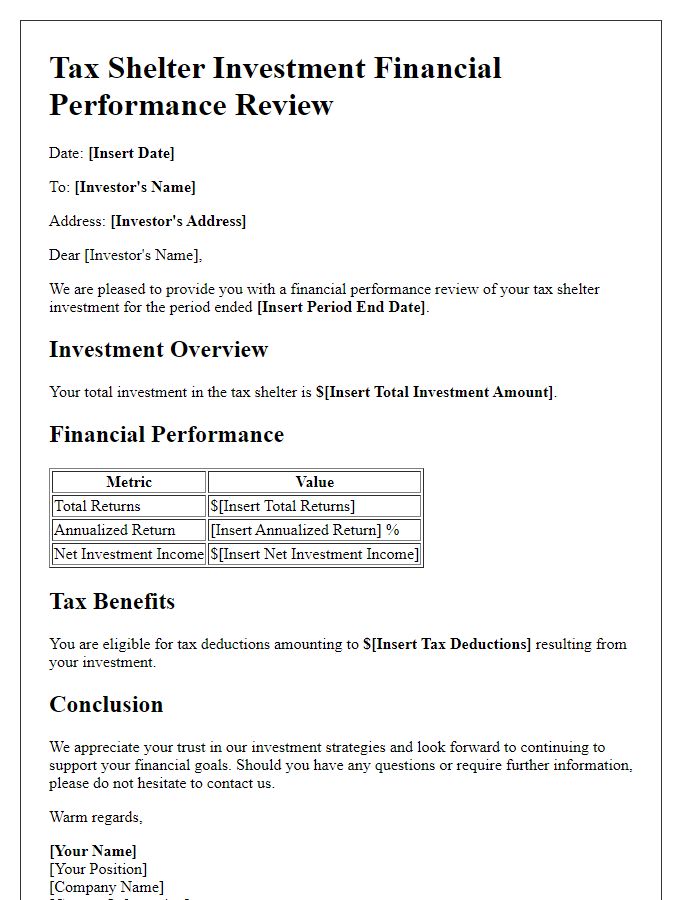

Identification of Tax Benefits and Deductions

Tax shelters offer significant advantages for investors seeking to reduce financial liabilities. Tax benefits include deductions on income tax for contributions made within specific investment vehicles, such as Individual Retirement Accounts (IRAs) or 401(k) plans. Deduction thresholds can vary by state, with limits often reaching thousands of dollars annually. Notable events, such as the Tax Cuts and Jobs Act of 2017, introduced various changes to tax laws, impacting the way taxpayers can leverage these shelters. Investors often benefit from reduced taxable income, contributing to potential refunds or lower overall tax payments. Important entities, like the Internal Revenue Service (IRS), provide guidelines to ensure compliance, highlighting the necessity of accurate documentation for claimed deductions.

Verification of Investor's Financial Interest

Verification of an investor's financial interest in tax shelter investments, such as Limited Partnerships (LPs) or Real Estate Investment Trusts (REITs), is essential for compliance with regulations set forth by the Internal Revenue Service (IRS). This process often involves gathering detailed documentation including financial statements, tax returns, and account statements from previous fiscal years to ensure transparency and validate the authenticity of the investor's claims. Investors must demonstrate adequate capital investment, typically a minimum threshold of $100,000, to showcase commitment to risk-sharing within the venture. Additionally, investor profiles may include high net worth individuals or accredited investors with an income exceeding $200,000 annually or net worth surpassing $1 million, excluding primary residences, to qualify for participation in complex investment structures designed to yield tax benefits.

Disclosures and Risk Acknowledgement

Tax shelter investments often entail specific disclosures and risk acknowledgements crucial for potential investors. These investments, designed to reduce taxable income, may include vehicles such as Limited Partnerships, Real Estate Trusts, or certain types of annuities. Important details include the potential for illiquidity, where funds may be tied up for extended periods, and the risks of investment depreciation, particularly in volatile sectors like real estate or alternative energy markets. Regulatory compliance is essential; investors must understand Internal Revenue Code sections relevant to the investment. Additionally, the entity responsible for tax shelter management, such as a financial advisory firm or a specialized investment company, should be clearly identified along with their credentials. Financial projections must be based on historical data, while accounting for market fluctuations, thereby reinforcing the necessity of professional financial advice prior to committing funds to such ventures.

Comments