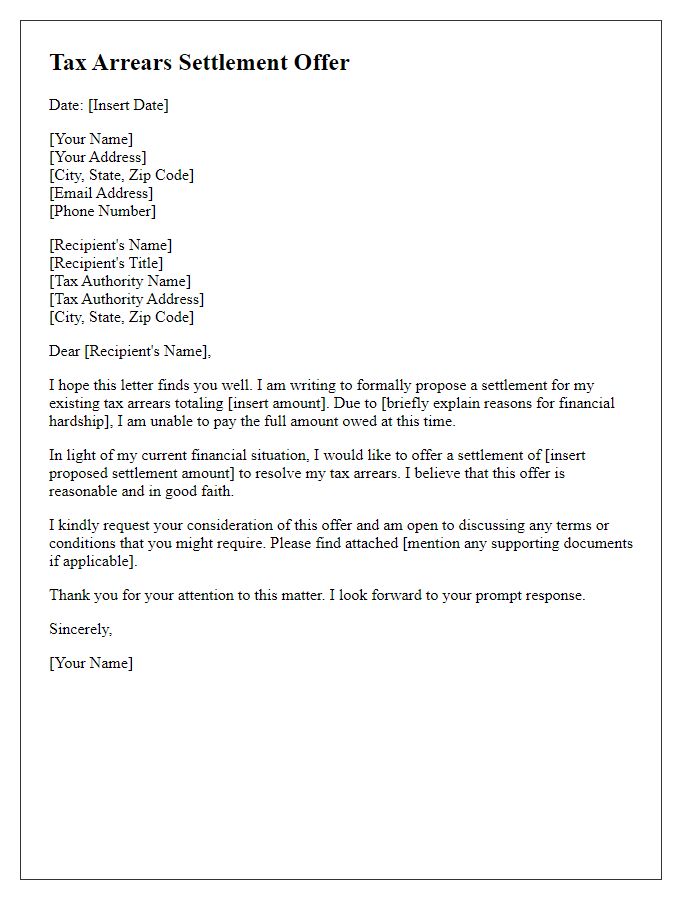

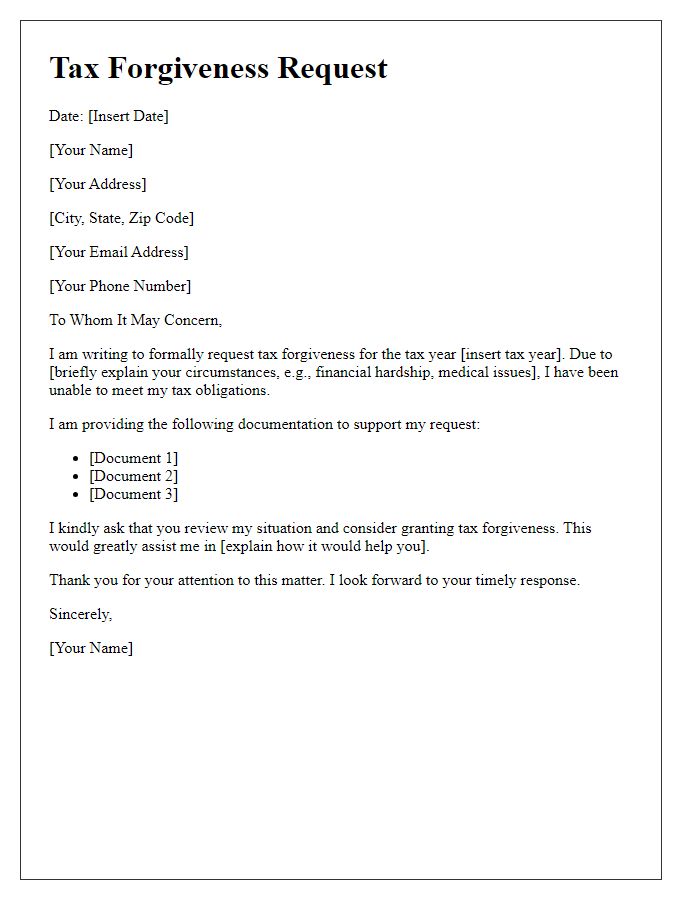

Are you navigating the complex waters of tax debt and feeling overwhelmed? Finding a tax settlement agreement can be your lifeline, providing a way to resolve your tax obligations without the stress of full payment. In this article, we'll explore the essential components of a compelling letter template for an offer of tax settlement that can help you effectively communicate with tax authorities. Stick around to discover tips and insights that could lead you toward financial relief!

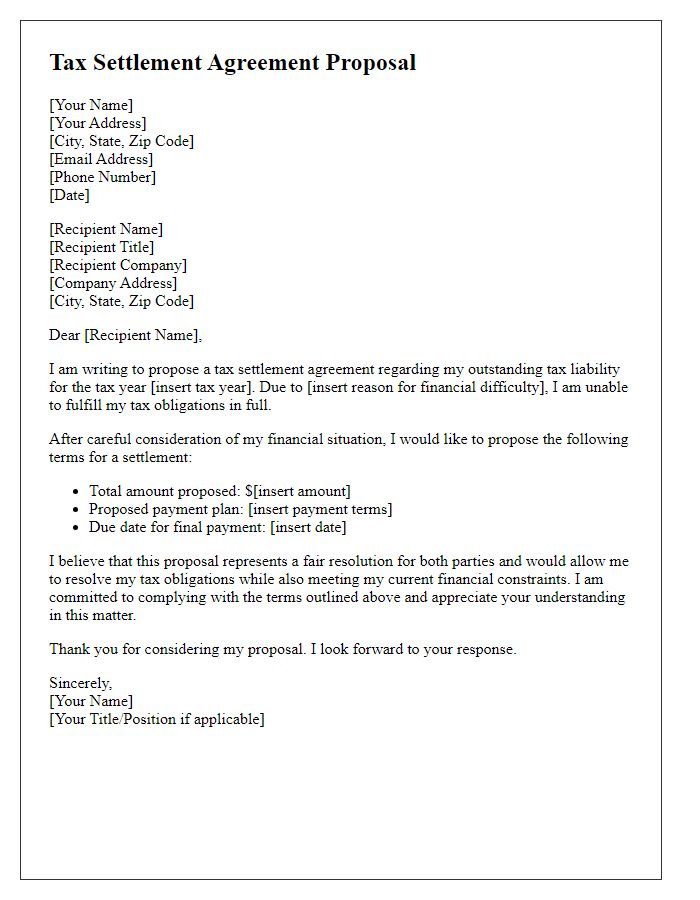

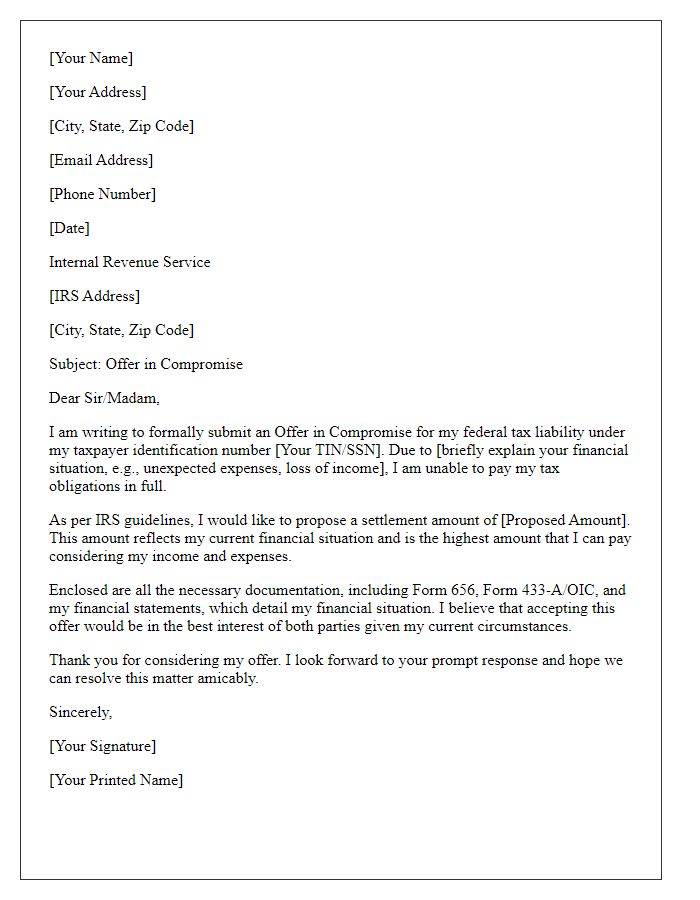

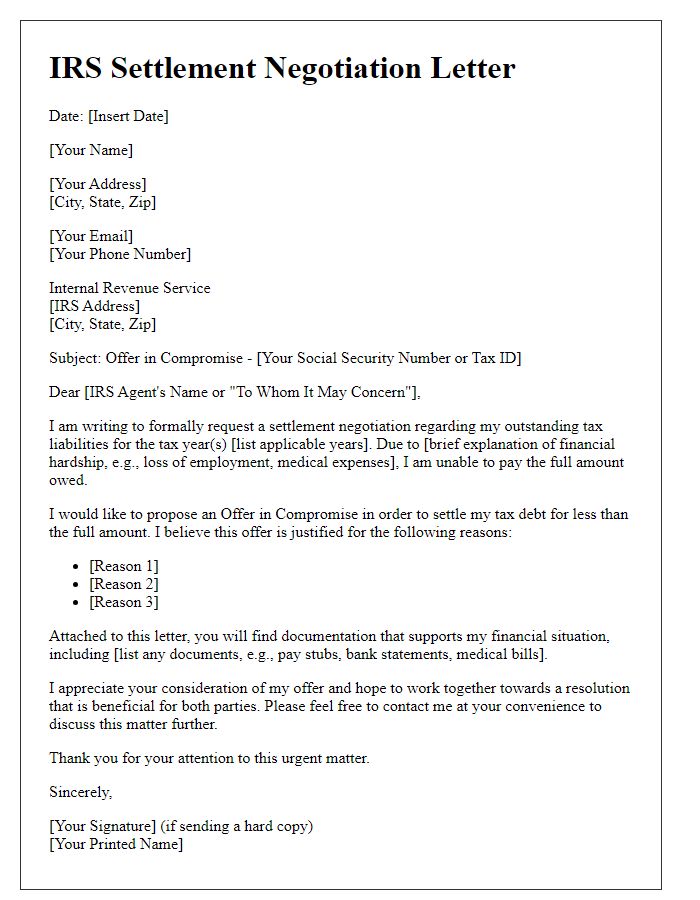

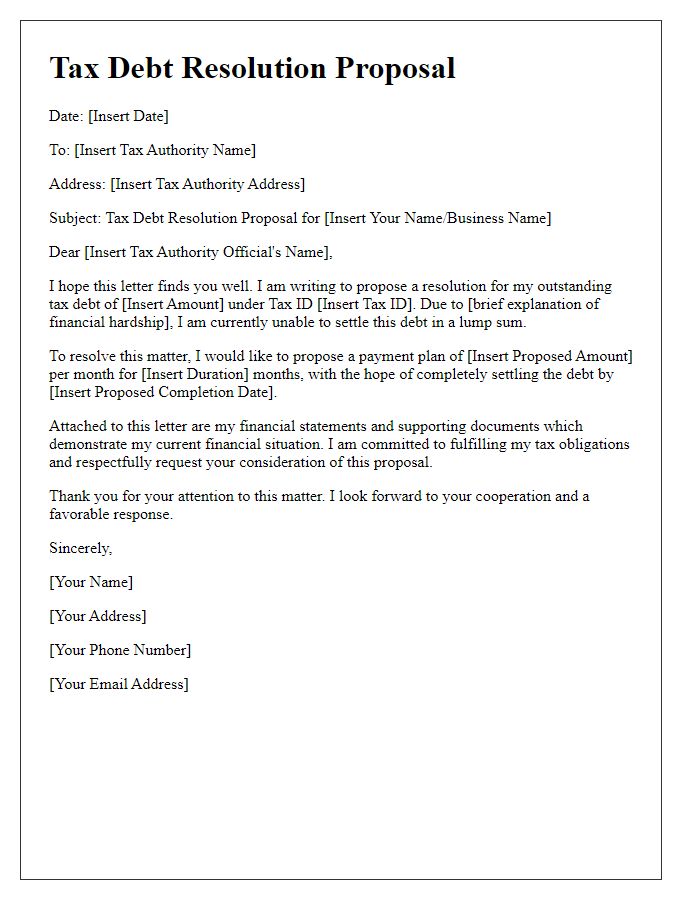

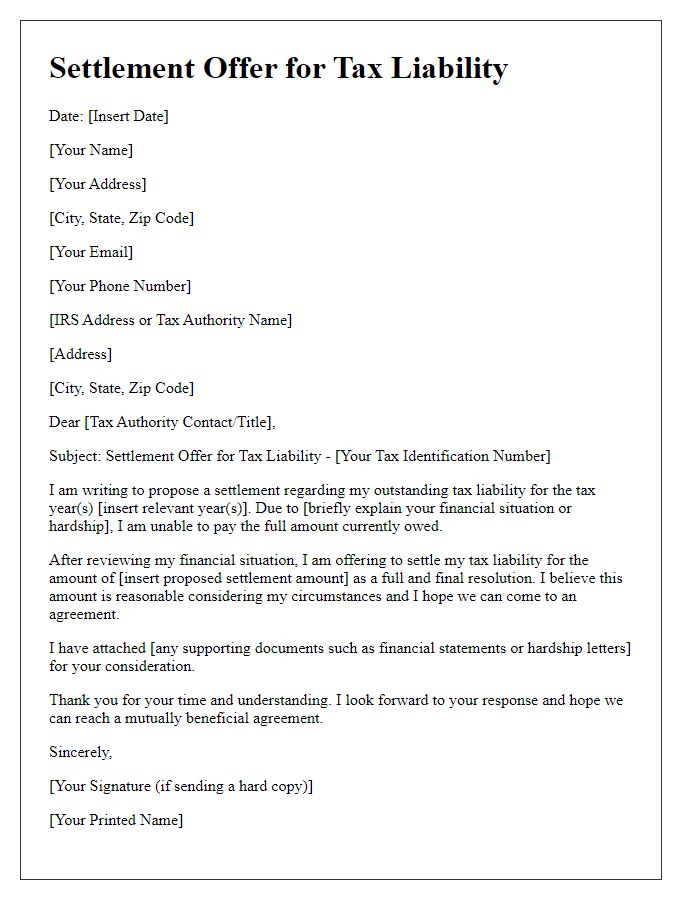

Opening statement and reference details

In addressing tax liabilities, a tax settlement agreement serves as a vital legal framework enabling taxpayers and the Internal Revenue Service (IRS) to negotiate a resolution for outstanding debts. The agreement specifies terms under which the taxpayer can settle their unpaid taxes, often resulting in a reduced amount owed. For example, a taxpayer with a liability of $50,000 may negotiate a settlement of $20,000, provided they meet certain criteria such as demonstrating financial hardship. This process often requires the submission of detailed financial disclosures, ensuring transparency regarding income, expenses, and assets. Timely communication with the IRS and adherence to agreed-upon payment schedules is crucial for maintaining the validity of the settlement.

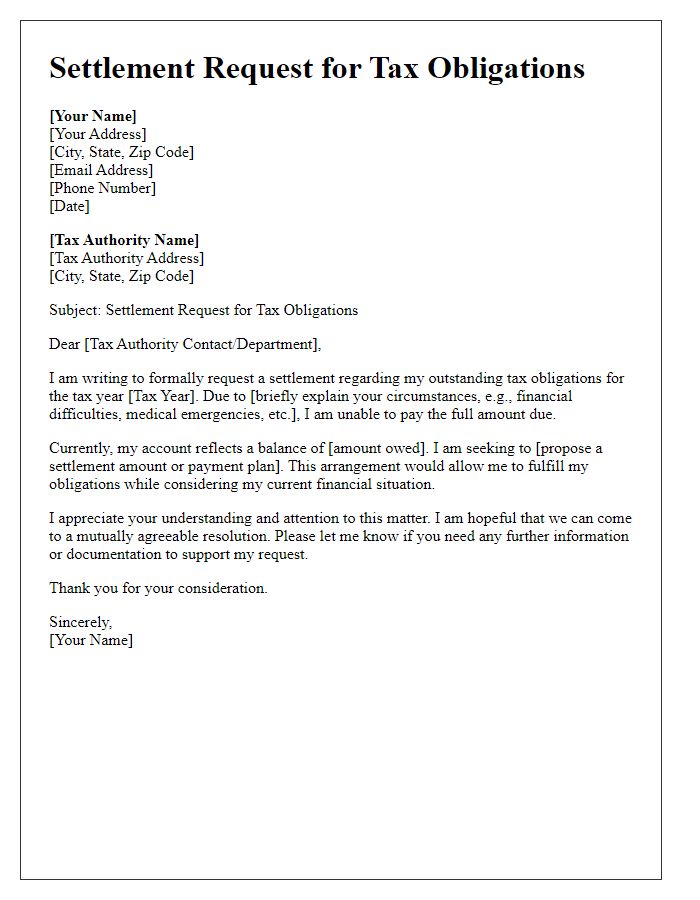

Summary of tax liability and settlement terms

A tax settlement agreement outlines the agreement between a taxpayer and the Internal Revenue Service (IRS) regarding outstanding tax liabilities. Tax liabilities may include federal income taxes, payroll taxes, or business taxes that have accrued over specific tax years. The agreement typically summarizes the total outstanding amount owed, including any penalties and interest, which may accumulate over time. It may also outline specific settlement terms, such as reduced payment amounts, payment plans, or lump-sum settlements that allow taxpayers to resolve their debts more easily. Key components of the agreement often include timelines for payments, details on compliance with future tax obligations, and potential release of liens or levies. Clear communication throughout this process can ensure both parties understand the terms and expectations to reach a fair resolution.

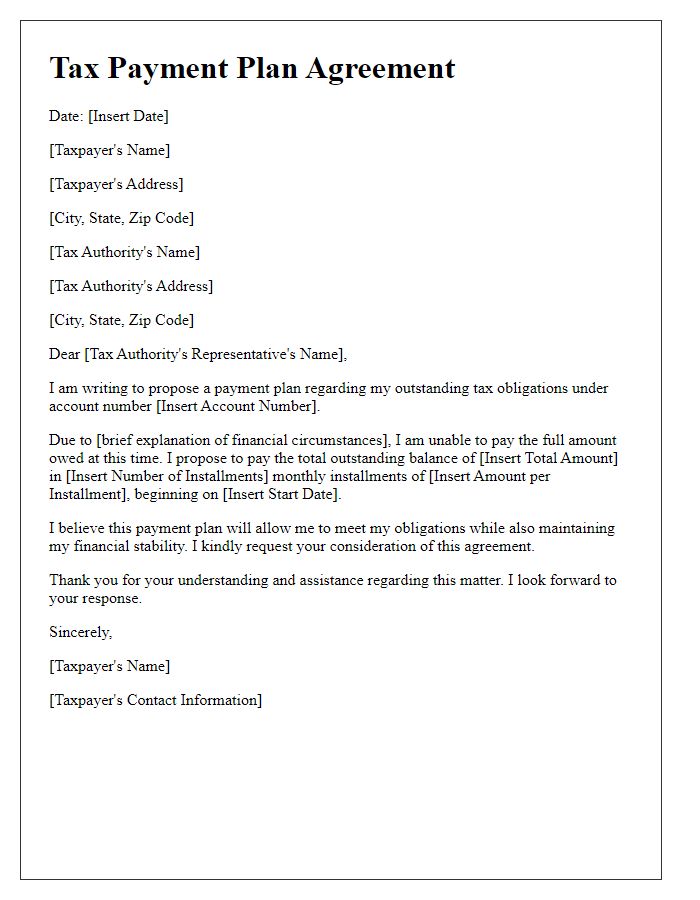

Payment structure and deadlines

A tax settlement agreement outlines a structured payment plan between taxpayers and governmental tax authorities to resolve outstanding tax liabilities. Typically, the payment structure consists of an initial down payment, often ranging from 10% to 25% of the total due amount, followed by a series of monthly payments over a specified period, which can vary from 12 to 60 months. Absolute deadlines for each payment must be clearly stated, including the first payment due date, which should be within 30 days of agreement acceptance. Failure to adhere to these payment schedules may result in penalties, interest accrual, or reinstitution of the original tax liability, complicating the taxpayer's financial obligations further. Enforcing clear communication and consistent documentation of payments is crucial for both parties involved to uphold the agreement conditions.

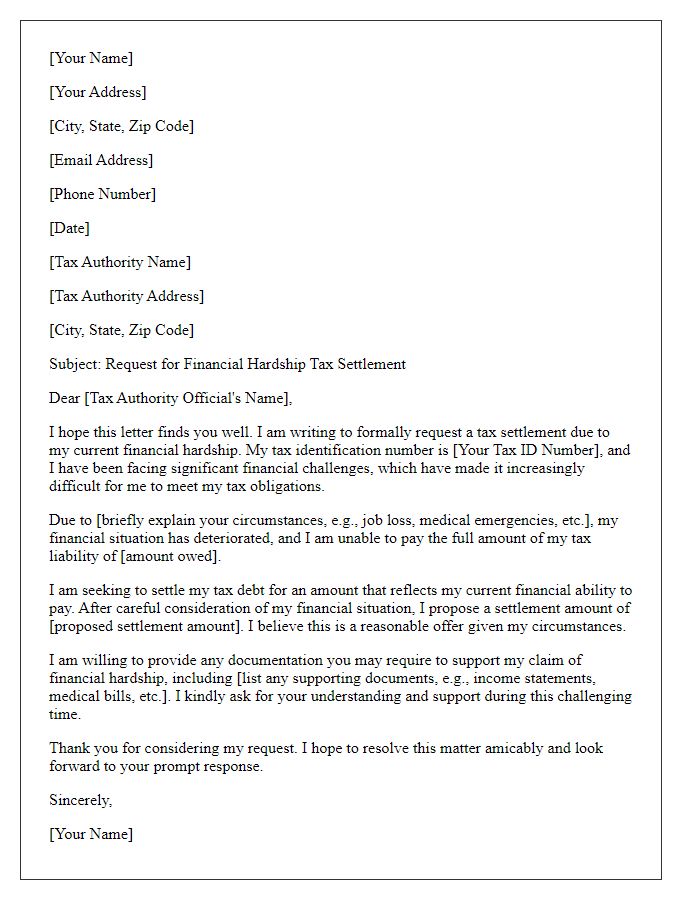

Legal disclosures and obligations

A tax settlement agreement conveys the terms for resolving tax liabilities between taxpayers and governmental entities such as the Internal Revenue Service (IRS) in the United States. Legal disclosures outline the taxpayer's financial situation, including income statements, asset valuations, and outstanding debts to ensure transparency during negotiations. Obligations detailed in the agreement may involve monthly payment plans, compliance with future tax filings, and adherence to specified settlement amounts, which could reflect a reduction of overall tax liabilities. This legal document is crucial for risk management, as the taxpayer must acknowledge potential consequences for non-compliance, including penalties, interest accrual, or further collection actions. The agreement also aims to prevent future disputes, providing a framework for both parties to agree on resolution timelines and expectations.

Contact information for further queries

The Offer of Tax Settlement Agreement is a formal document that facilitates a resolution between a taxpayer and a taxing authority, such as the Internal Revenue Service (IRS) in the United States. This agreement often outlines specific terms regarding the outstanding tax liabilities, including the amount owed, the proposed settlement figure, and the timeline for payment. Providing accurate contact information is crucial for both parties to address concerns; including office phone numbers, email addresses, and physical addresses ensures efficient communication. Taxpayers may also consider listing the name of a dedicated contact person within the agency to streamline correspondence, especially for complex queries related to tax codes and regulations.

Comments