Are you feeling overwhelmed by the complexities of tax payments and considering a tax deferral agreement? You're not alone; many individuals and businesses face similar challenges and seek solutions that can ease their financial burdens. By exploring the potential benefits of a tax deferral agreement, you can gain much-needed flexibility in managing your financial obligations. Join us as we delve deeper into this topic and discover how a tailored proposal could work for you!

Clear Subject Line

Tax deferral agreement proposals can significantly aid individuals and businesses faced with financial constraints by allowing them to postpone tax payments without penalties. The proposed agreement typically outlines specific terms such as the duration of the deferral, usually ranging from 6 to 12 months, and the conditions that must be met to qualify. For instance, eligibility criteria may include a demonstrated financial hardship or unforeseen circumstances such as medical emergencies or natural disasters. Additionally, details about future payment plans are crucial, including monthly payment schedules and any interest rates that may apply post-deferral. Compliance with IRS regulations and local tax authorities is essential to ensure the legitimacy of the agreement, facilitating continued support for taxpayers struggling to meet their obligations.

Formal Salutation

Tax deferral agreements are crucial financial arrangements often entered into by organizations seeking to postpone tax obligations for various reasons, such as cash flow management. These agreements typically outline specific conditions under which taxes can be deferred, including eligible income types, applicable jurisdictions, and regulatory compliance requirements. Organizations, particularly small businesses, may opt for these agreements during fiscal challenges or significant capital investments, allowing them to maintain operational liquidity. Clear articulation of payment plans and timelines is essential in these documents to ensure mutual understanding and adherence to the agreed terms.

Specific Tax Details

A tax deferral agreement proposal often includes essential specifics regarding the taxpayer's financial situation and the tax obligation in question. Detailed amounts detailing the tax owed (for example, $50,000 in federal income tax for the fiscal year 2022) should be clearly stated. The timeline for the deferral (potentially extending up to three years) needs articulation, with emphasis on events like quarterly payment schedules or annual tax filings. Additionally, referencing particular tax codes (like IRS Section 453 for installment sales) adds legal context. Location factors might play a role, such as tax regulations unique to states like California or New York which could influence the agreement's structure. The proposal's intent to alleviate immediate financial burdens while maintaining tax compliance is crucial, ensuring stakeholders understand the implications of delaying the tax payment.

Proposed Payment Plan

Proposed payment plans for tax deferral agreements often involve structured installments tailored to individual financial circumstances. For instance, taxpayers might suggest monthly payments of $500 for a duration of 12 months, allowing for a total deferred amount of $6,000. The Internal Revenue Service (IRS), established in 1862 and headquartered in Washington D.C., typically requires detailed financial disclosures including income statements and expenses to evaluate the applicant's eligibility. Tax deferral scenarios can occur during significant life events such as job loss or medical emergencies, impacting a taxpayer's ability to meet deadlines. Proper documentation, including a signed agreement and proposed schedule, can facilitate successful negotiations with the IRS and provide a pathway to compliance.

Contact Information

In a tax deferral agreement proposal, various data points must be meticulously outlined for proper clarity and context regarding the stakeholders involved. Essential elements include the taxpayer's name, such as John Smith, alongside a detailed mailing address that specifies city and state, for example, 123 Maple Street, Springfield, IL 62701. The proposal must include contact numbers, providing direct lines like (555) 123-4567, and professional email addresses, often formatted as john.smith@email.com. Additionally, the tax authority's name, like the Internal Revenue Service (IRS), along with their detailed contact information, creates a comprehensive overview of communication lines necessary for discussing the tax deferral agreement. Such precision is vital to ensure a smooth process when addressing potential negotiations or clarifications regarding tax obligations.

Letter Template For Tax Deferral Agreement Proposal Samples

Letter template of tax deferral agreement request for individual taxpayers.

Letter template of tax deferral agreement proposal for small businesses.

Letter template of tax deferral agreement application for real estate investors.

Letter template of tax deferral agreement inquiry for non-profit organizations.

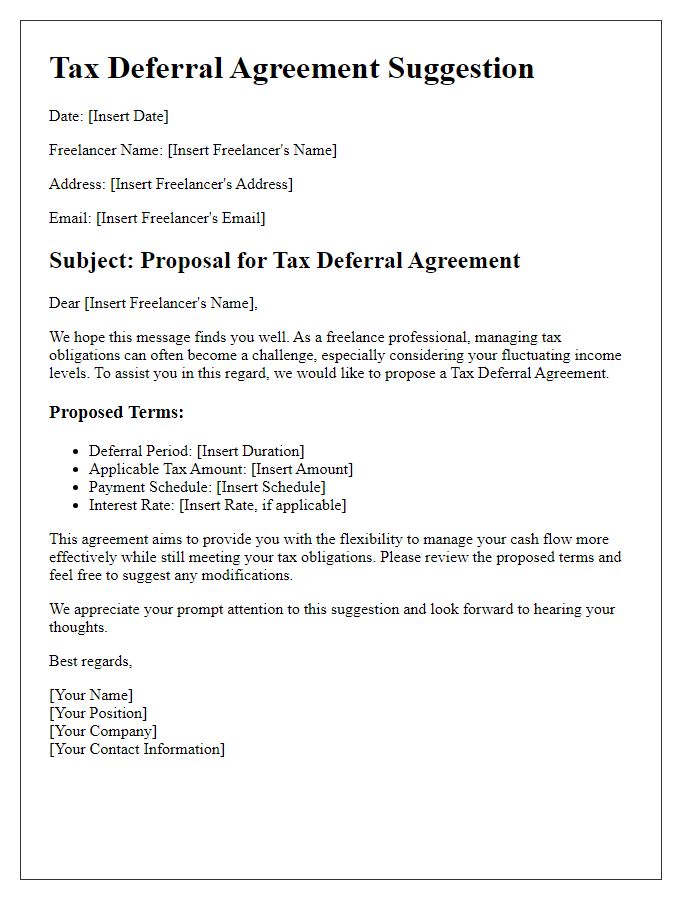

Letter template of tax deferral agreement suggestion for freelance professionals.

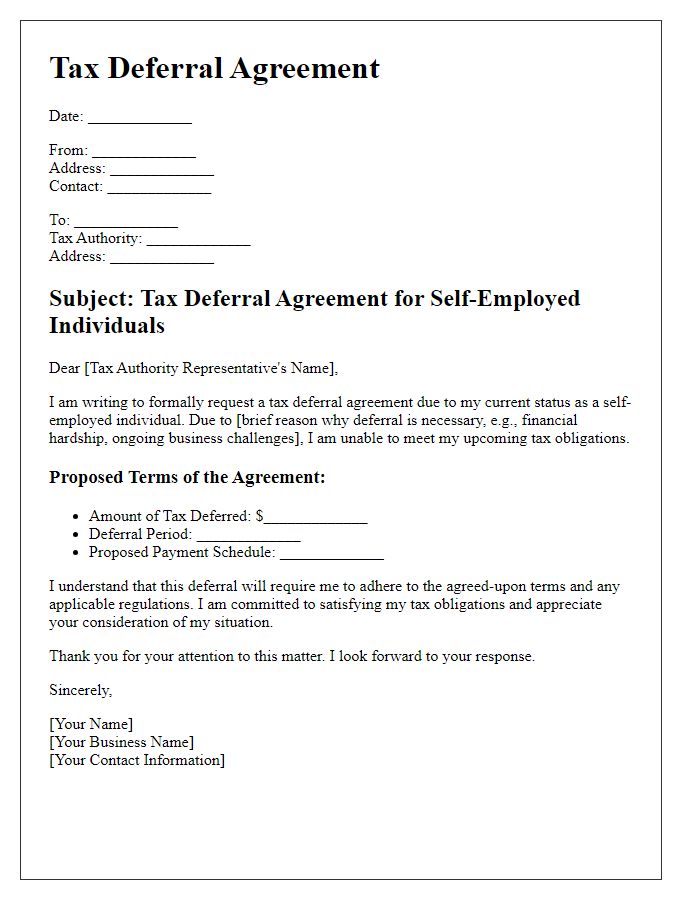

Letter template of tax deferral agreement outline for self-employed individuals.

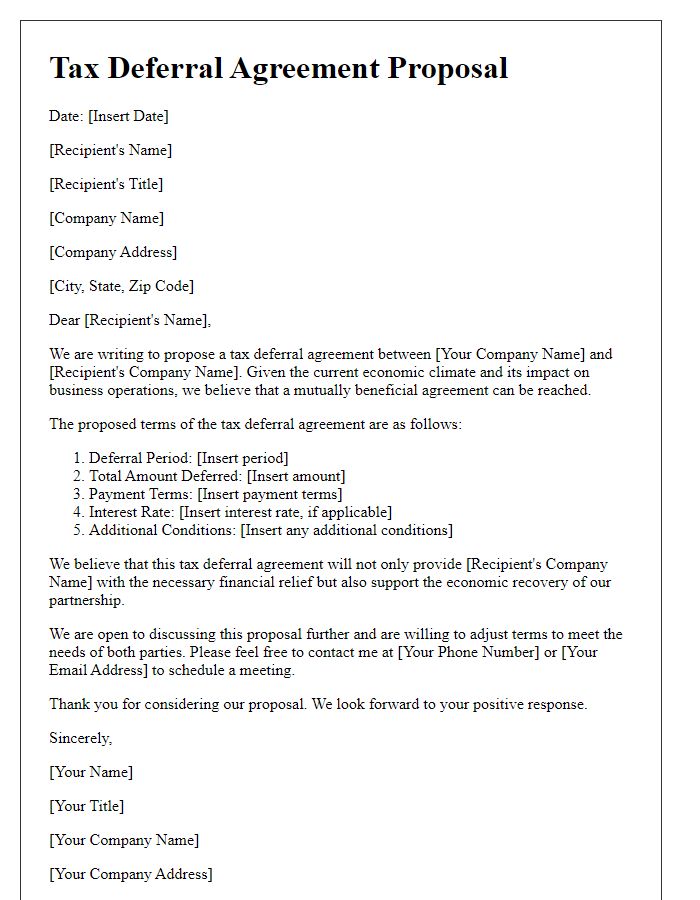

Letter template of tax deferral agreement proposal for corporate entities.

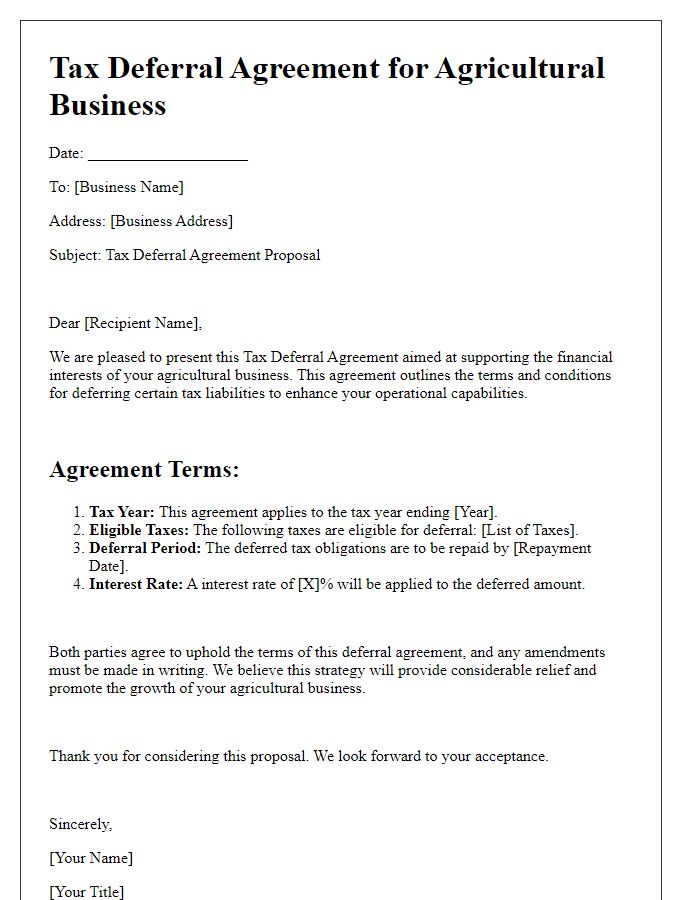

Letter template of tax deferral agreement strategy for agricultural businesses.

Letter template of tax deferral agreement negotiation for estate planning.

Comments