Are you feeling a bit anxious about your tax situation? You're not aloneâmany people find themselves needing to correct their tax filings from time to time. Whether it's due to a simple oversight or a more complex issue, understanding how to notify the necessary parties is essential. Dive into the details with us to learn more about the steps you can take to ensure your corrected tax filing is smooth and stress-free!

Professional tone and clear language

Notification of corrected tax filings is essential for maintaining compliance with IRS regulations. Corrected tax filings, often referred to as amended returns, indicate changes made to previously submitted documents, such as IRS Form 1040 for individual income tax returns or Form 1120 for corporate tax filings. These corrections could arise from various reasons, such as errors in reported income, deductions, or credits. Taxpayers should consider the deadlines for submitting corrected filings, typically within three years from the original filing date, to avoid penalties. Additionally, it's important to include relevant supporting documents, such as W-2 forms or 1099 statements, to substantiate the amendments being made. Tracking the status of amended returns can usually be done online through the IRS website, which offers a tool specifically designed for monitoring the progress of Form 1040-X submissions.

Key details of the correction

A corrected tax filing ensures accurate reporting to the Internal Revenue Service (IRS) regarding taxpayers' financial activities for the year. The filing typically addresses discrepancies involving previous income statements, such as W-2 forms from employers, 1099 forms for freelance earnings, and potential deductions such as medical expenses or student loan interest. Key details of the correction might include the tax year (2022), the adjusted total income, changes in deductions (such as increased medical expenses from $1,500 to $2,000), and adjustments in tax liability resulting from corrected information. Filing a Form 1040-X, the Amended U.S. Individual Income Tax Return, is necessary to notify the IRS of these changes, ensuring compliance and avoiding penalties. Accurate documentation and supporting evidence are essential, with a focus on significant figures and specific amounts to prevent further complications.

Reason for the correction

Corrections in tax filings can arise from various reasons, such as data entry errors, miscalculation of income, or inaccuracies in reported deductions. Common occurrences include discrepancies in reported income from sources like Form W-2 or 1099, which can culminate from employer reporting mistakes or unreported freelance earnings. Additional adjustments may stem from newly obtained information, such as updated tax deductions or credits that were previously overlooked. In certain scenarios, the correction relates to changes in tax law that affect eligibility for certain benefits. The goal of these corrections is to ensure the tax record accurately reflects true financial status and complies with IRS regulations, thereby avoiding penalties or delayed refunds.

Contact information for further inquiries

In the case of corrected tax filings, individuals or businesses must ensure clarity in communicating the necessary information. For instance, the Internal Revenue Service (IRS) provides guidelines to support taxpayers, often listed on their official website. Taxpayers can reach out to the IRS through their toll-free number, which typically starts at 1-800, to address inquiries or seek assistance regarding any corrections made. Additionally, taxpayers may need to include their updated information, such as their Social Security Number (SSN) or Employer Identification Number (EIN), for efficient processing and quicker resolution of any issues. Local tax offices and certified public accountants (CPAs) also serve as invaluable resources for personalized support concerning corrected tax filings, ensuring compliance with federal and state regulations.

Next steps or actions required

A corrected tax filing may necessitate specific next steps or actions required by taxpayers to ensure compliance with local tax regulations. Taxpayers should review the IRS Form 1040-X, which is utilized for amending federal income tax returns. Required documentation, including W-2s or 1099s reflecting corrected income, should accompany the revised submission. Additionally, taxpayers may need to make adjustments to state tax returns, thereby consulting state-specific forms or guidelines. The deadline for submitting the corrected return typically aligns with the original filing deadline, which can vary annually, generally around April 15th. Taxpayers should also verify if any payments are owed or if refunds have been adjusted based on the corrections made, as discrepancies may impact their financial liabilities or entitlements.

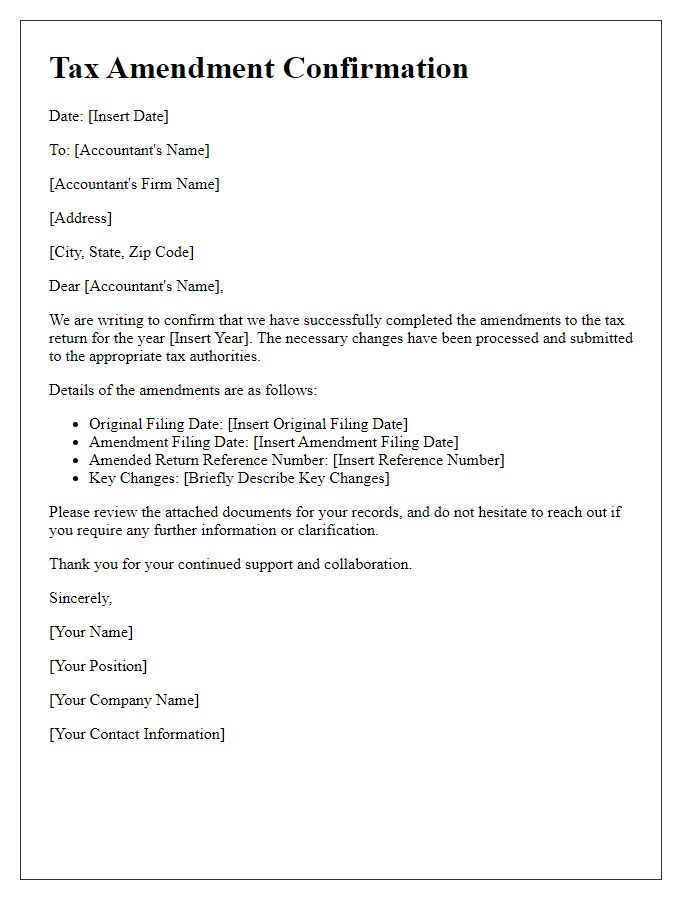

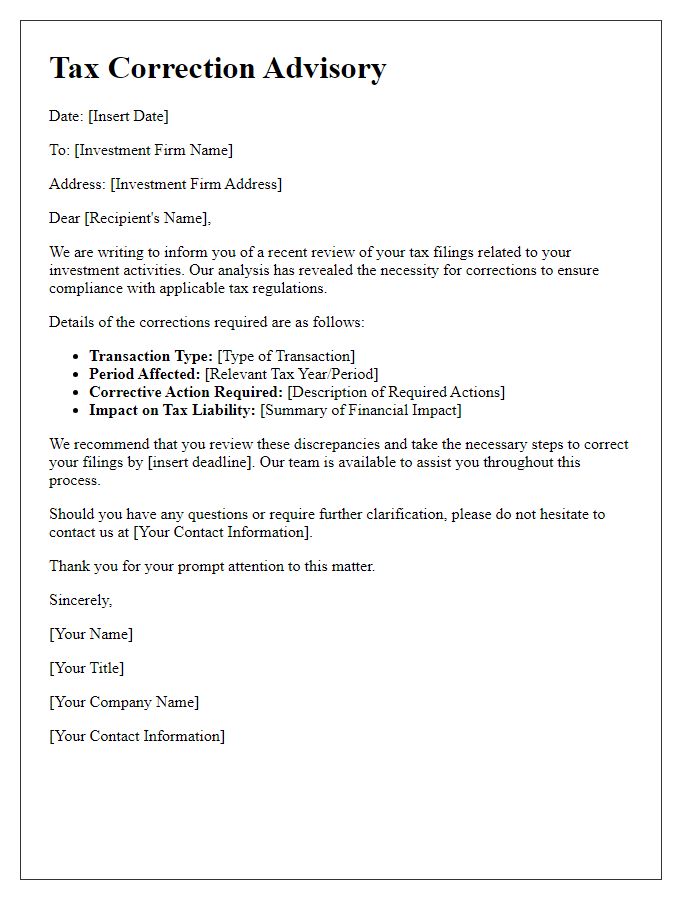

Letter Template For Notification Of Corrected Tax Filing Samples

Letter template of revised tax submission alert for small business owners

Letter template of tax revision announcement for self-employed individuals

Letter template of updated tax documentation notice for real estate professionals

Comments