Are you looking for a clear and effective way to declare your tax treaty benefits? Understanding the nuances of tax treaties can be challenging, but having the right template can simplify the process significantly. In this article, we'll walk you through a letter template designed to help you communicate your tax situation with ease and precision. So, stick around to discover essential tips and insights to maximize your tax benefits!

Taxpayer Identification Information

Taxpayer identification information is crucial for claiming benefits under tax treaties. Tax Identification Numbers (TINs) such as Social Security Numbers (SSNs) in the United States serve as unique identifiers for individuals and entities, ensuring accurate tax reporting. Keeping records of earning entities, such as corporations or foreign affiliates, is essential for substantiating claims. Accurate and complete addresses of taxpayers enhance compliance with tax regulations and facilitate communication with tax authorities, ensuring adherence to local stipulations and treaty provisions. Additionally, dates of confirmation regarding residency status play a significant role in determining eligibility for treaty benefits, underlining the importance of documentation in international tax matters.

Treaty Article and Benefits Claimed

Individuals and entities seeking to claim benefits under tax treaties must reference the specific articles that provide relief from withholding taxes, often applicable to income such as dividends, interest, or royalties. For instance, Article 10 of the United States-United Kingdom tax treaty offers reduced withholding tax rates on dividends, potentially as low as 5% for qualifying corporate shareholders. Article 11 addresses interest income, allowing for exemption or reduced rates, which can significantly alleviate tax burdens on cross-border transactions. To substantiate claims, taxpayers must submit Form W-8BEN or Form W-8BEN-E, providing necessary identification and eligibility certifications, alongside a tax identification number from the relevant jurisdiction, ensuring compliance with both domestic and international tax laws.

Residency Certification from Tax Authority

A Residency Certification from a tax authority plays a critical role in verifying an individual's or entity's residency status, particularly in the context of international tax treaties. Governments, such as the Internal Revenue Service (IRS) in the United States or Her Majesty's Revenue and Customs (HMRC) in the United Kingdom, issue this certification to confirm that a taxpayer complies with the residency requirements stipulated in specific tax treaties. For instance, the United States has tax treaties with numerous countries like Canada and Germany, allowing for reduced withholding tax rates on dividends, interest, and royalties. The certification must include details such as the taxpayer's name, address, and tax identification number, along with the period of residency. This document is essential for claiming treaty benefits, enabling taxpayers to avoid double taxation on their income accrued from foreign sources. Fields must be completed accurately to ensure compliance with both domestic law and international agreements, safeguarding the taxpayer's financial interests.

Withholding Agent Information

The declaration of tax treaty benefits requires careful attention to Withholding Agent Information, essential for establishing eligibility for reduced withholding rates under international tax treaties. Key elements include the withholding agent's name (e.g., ABC Financial Services), address (123 Tax Lane, Suite 456, Washington D.C.), and unique identification number (EIN: 12-3456789). The agent's status--whether individual or corporate--must also be clearly stated, along with the relevant tax treaty country (such as Canada) and the specific articles of the tax treaty that apply (Article 12 on royalties). Proper documentation ensuring compliance with the IRS regulations can facilitate smoother processing and optimal withholding tax applications, protecting the interests of both payers and recipients involved in cross-border transactions.

Signature and Date of Declaration

Tax treaty benefits declarations enable eligible individuals or entities to claim reduced withholding rates or exemptions under specific agreements between countries. These benefits often pertain to the provisions established in treaties such as the United States-United Kingdom Income Tax Treaty, signed in 2001, which eliminates double taxation on certain income types, including dividends and interest. To officially declare eligibility, a signed statement detailing the taxpayer's name, identification number, and residence address is necessary. Effective dates for treaty benefits may vary, typically aligned with the treaty's ratification date. Submitting this declaration usually occurs prior to payment events to ensure reduced withholding rates apply. Ensure proper record keeping, as the IRS may require supporting documentation for compliance purposes.

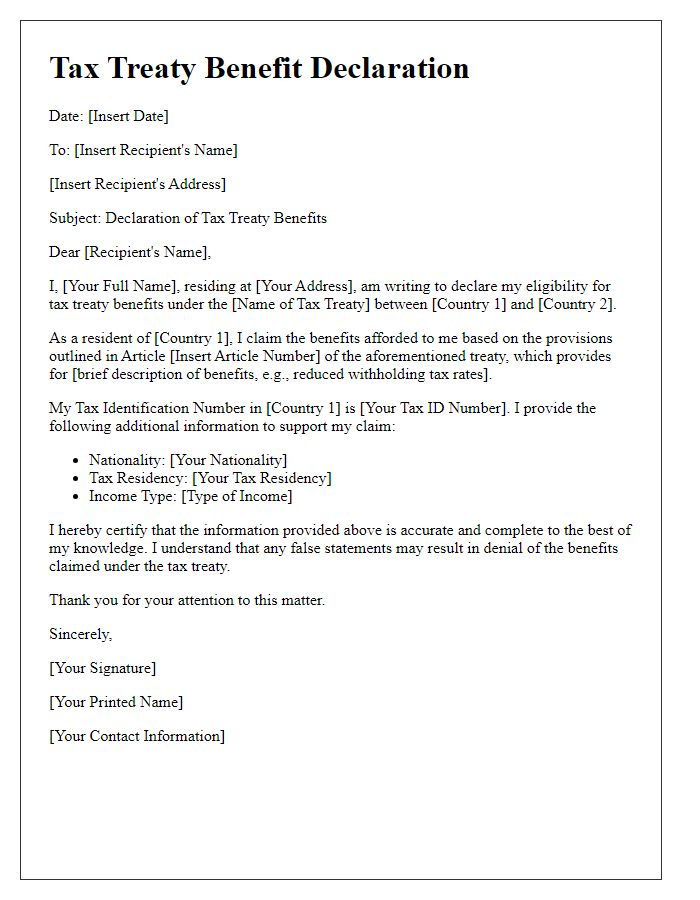

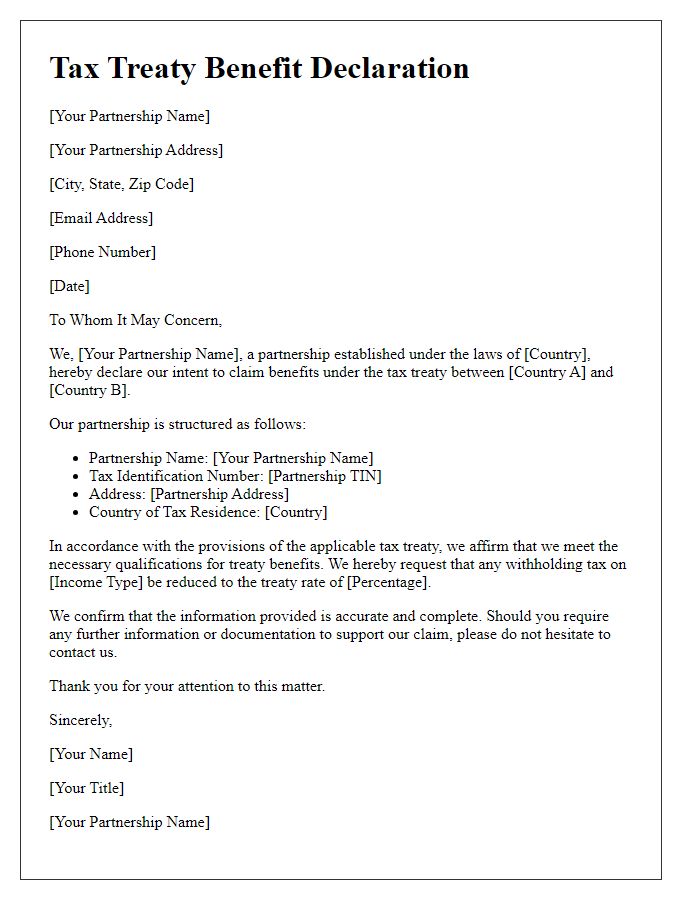

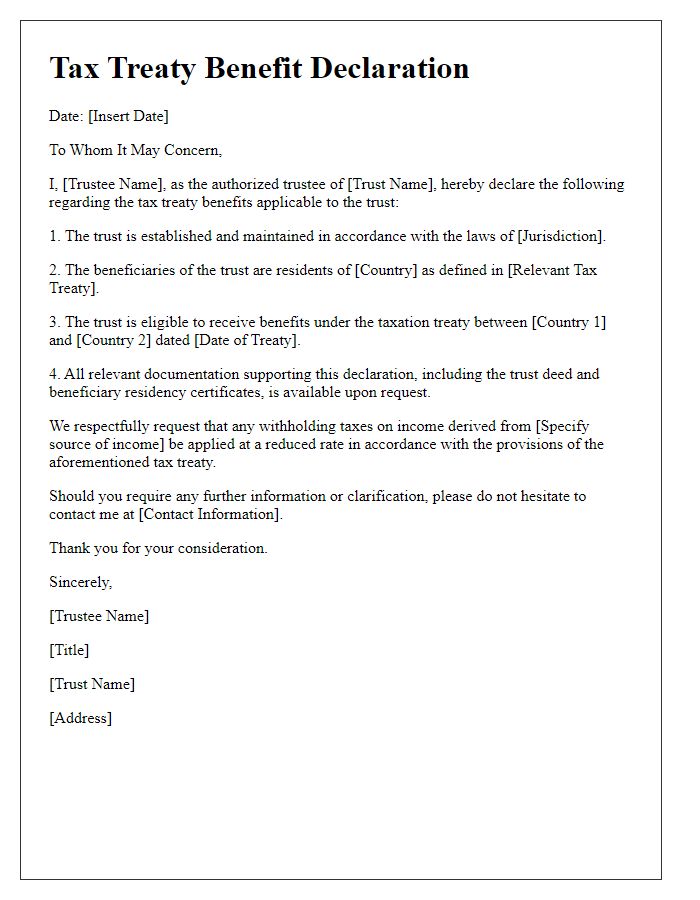

Letter Template For Declaration Of Tax Treaty Benefits Samples

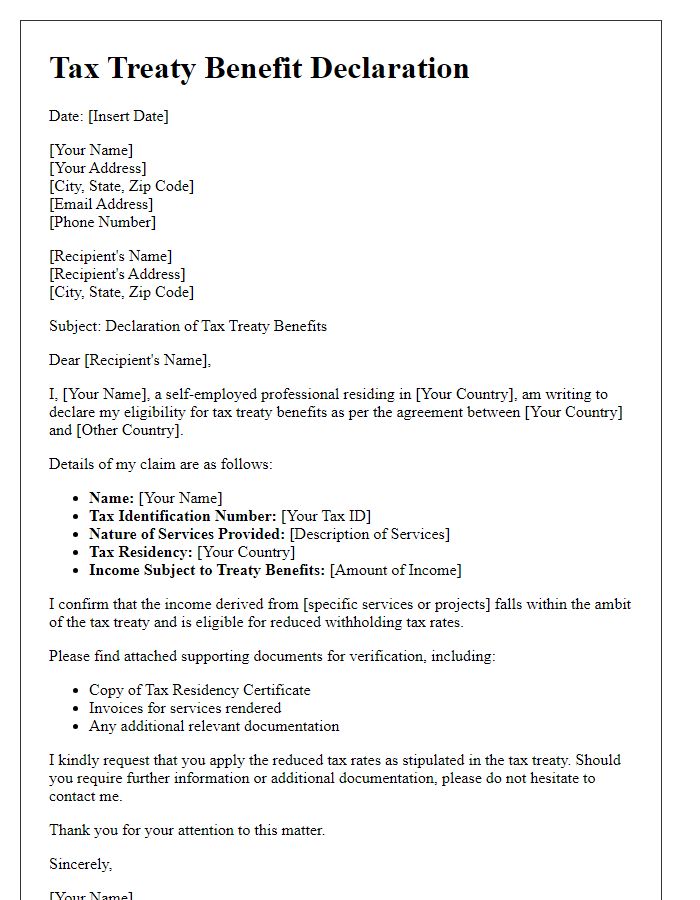

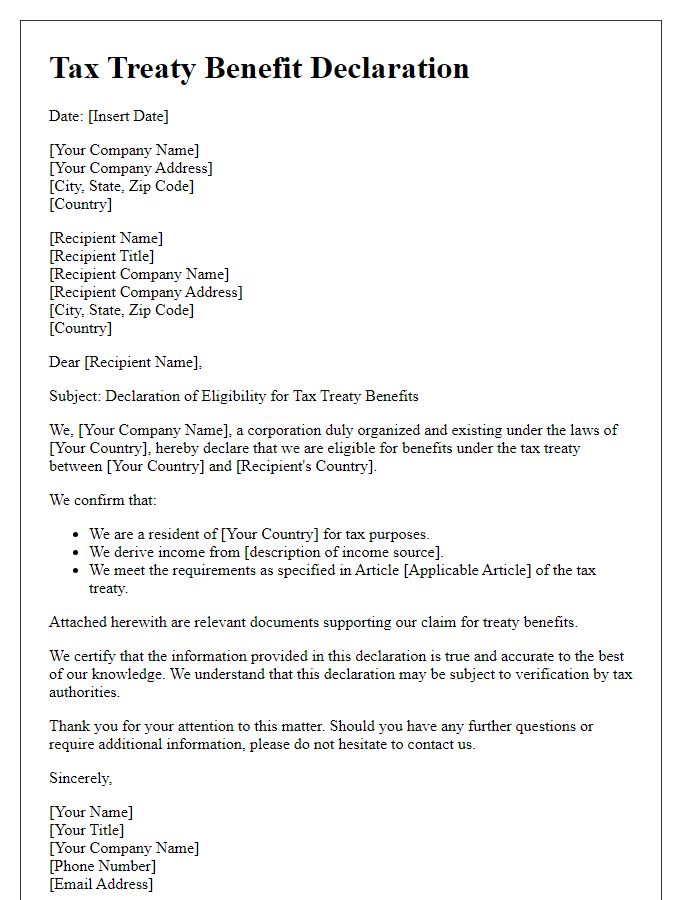

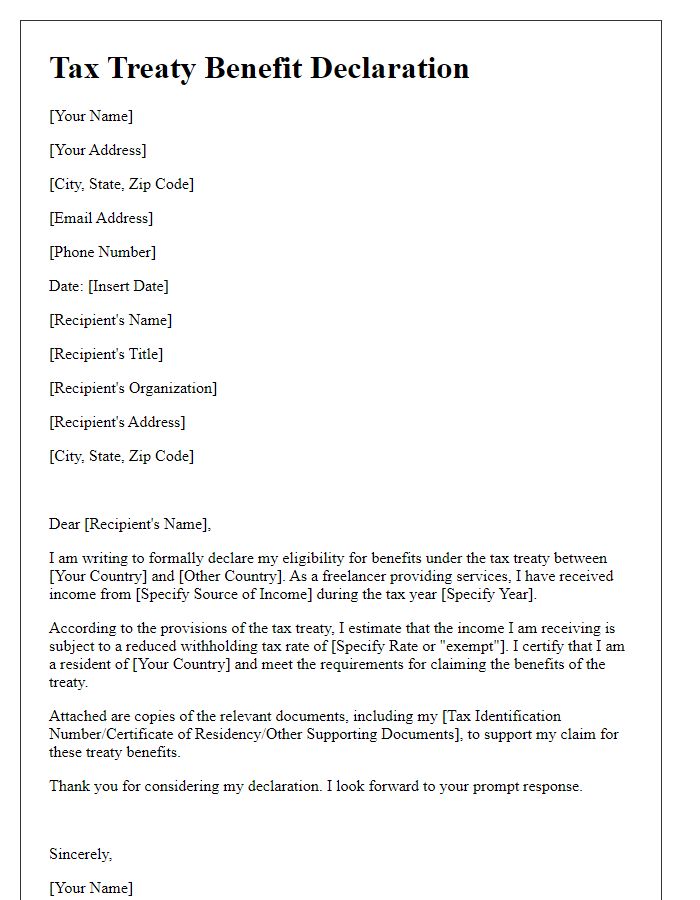

Letter template of tax treaty benefit declaration for self-employed professionals.

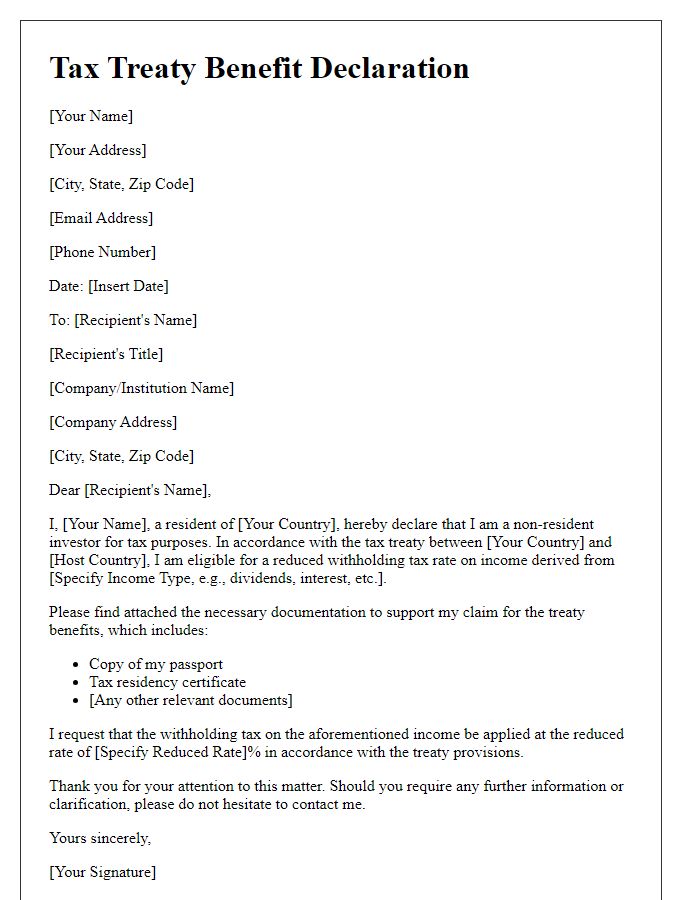

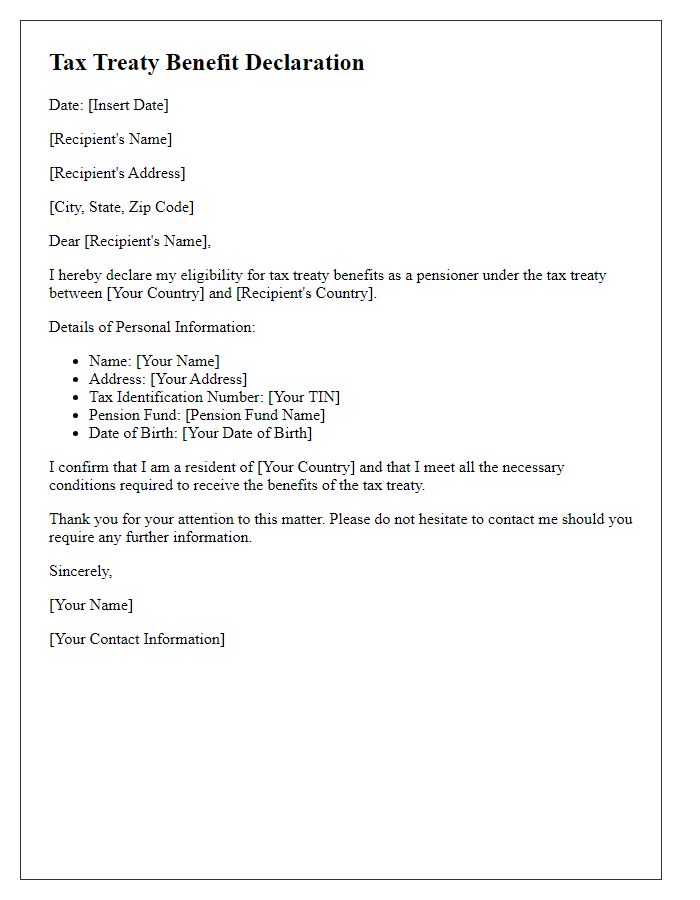

Letter template of tax treaty benefit declaration for non-resident investors.

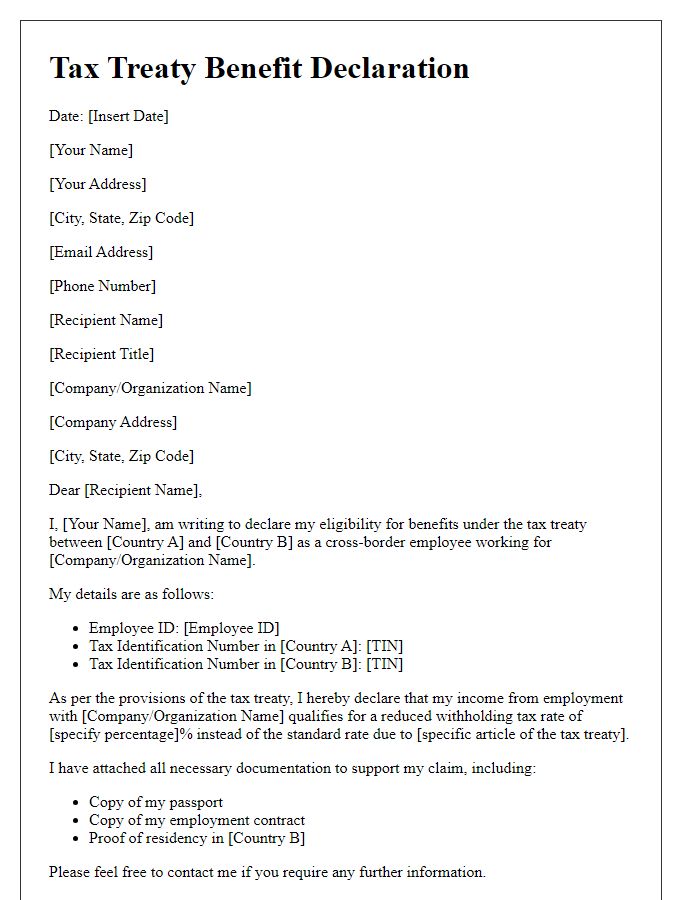

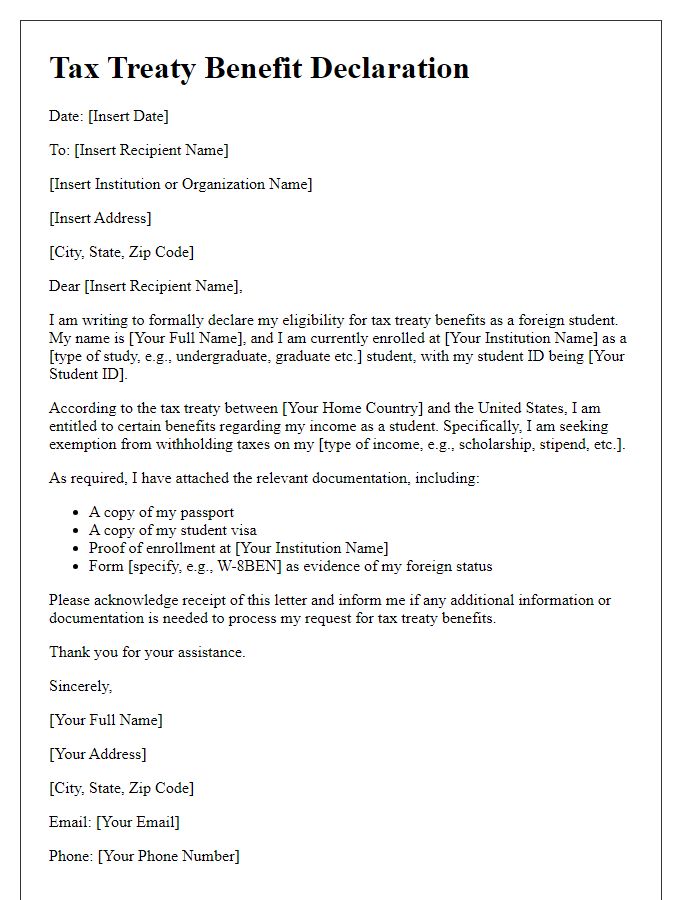

Letter template of tax treaty benefit declaration for cross-border employees.

Comments