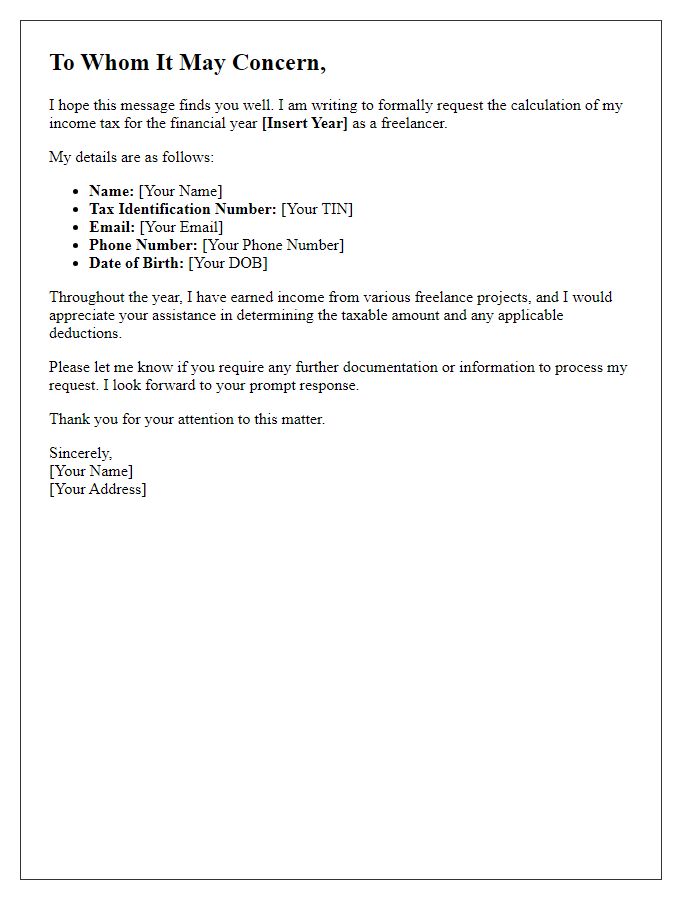

Are you a freelancer navigating the complexities of income tax estimation? Understanding how to accurately estimate your tax obligations can be a daunting task, but it doesn't have to be. With the right tools and knowledge, you can streamline the process and ensure you're setting aside enough for Uncle Sam. Join us as we explore essential tips and strategies to simplify your tax estimation journey!

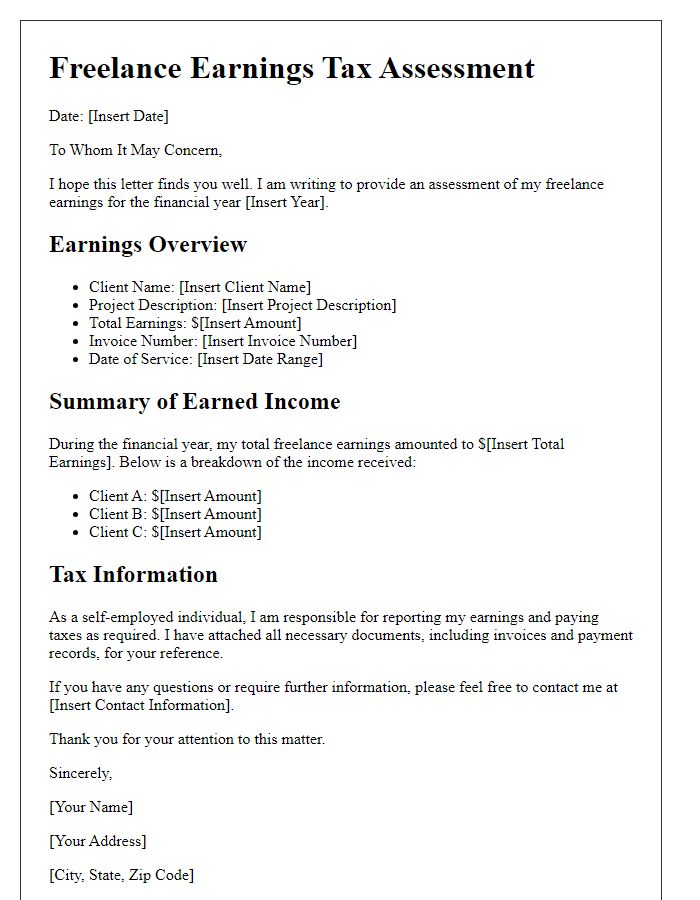

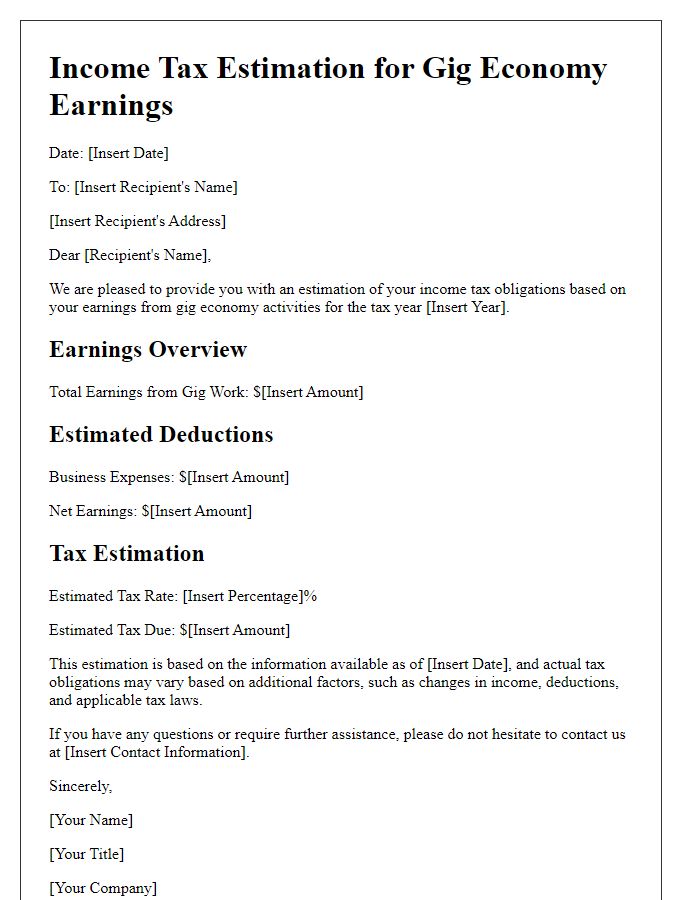

Income Sources: List all clients and projects.

Freelancers often accumulate income from various clients across multiple projects, necessitating precise tracking for tax estimation purposes. Document all clients, categorizing each by project name, ensuring to note the corresponding income amount received from each. For instance, Client A may involve Project X, contributing $5,000 in 2023, while Client B engages in Project Y, yielding $3,500. It's crucial to maintain accurate records of payment dates and methods, considering factors like the percentage of project completion. Furthermore, tracking any additional income sources, such as digital products or affiliate marketing, boosts clarity in estimating total earnings for effective tax planning.

Deductions: Identify eligible business expenses.

Freelancers can optimize their taxable income through thorough documentation of eligible business expenses. Common deductions include office supplies, such as laptops and printers, that can range from $300 to $1,500 depending on quality. Professional services, like accounting fees typically around $200 to $500 annually, also qualify. Home office expenses, proportionate to the space utilized for work purposes, can significantly reduce taxable income, with expenses varying based on location. Travel costs for business meetings, including airfare and lodging, can accumulate quickly, with average costs for domestic flights hovering around $300. Marketing expenses, such as website fees (approximately $100 to $500 annually) and promotional materials, also contribute to overall deductions. Staying organized and maintaining detailed records can lead to substantial savings during tax season.

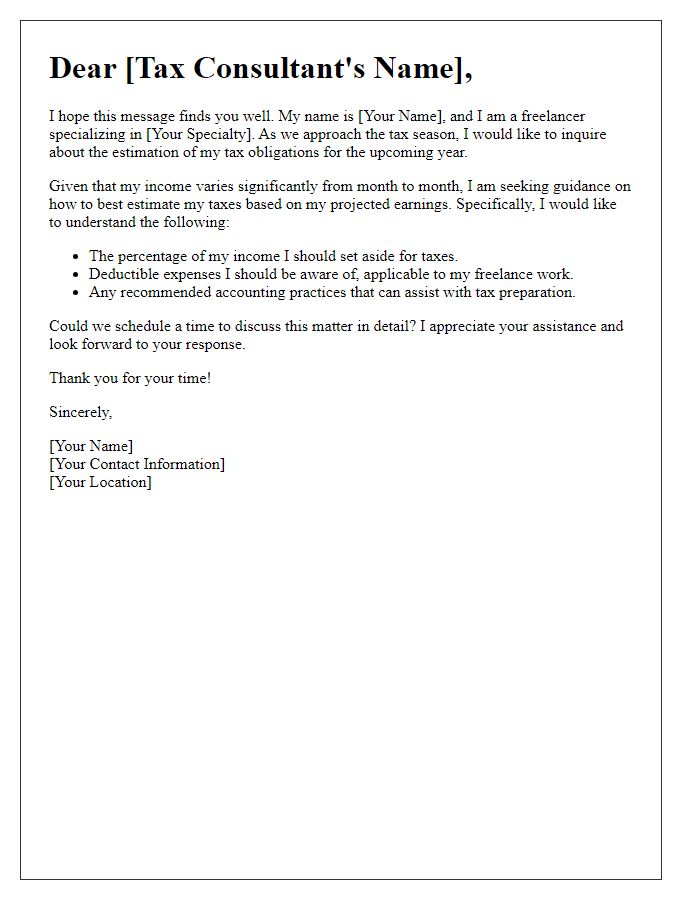

Tax Rate: Determine applicable tax bracket.

Freelancers must accurately estimate their income tax to ensure compliance with tax regulations. Income brackets vary by jurisdiction and can impact overall tax obligations significantly. For instance, in the United States, federal income tax rates for single filers may range from 10% to 37%, depending on annual income levels. In addition, freelancers should consider state and local tax rates, which can add an average of 5% to 10% more. Self-employment tax also applies, which currently stands at 15.3%, covering Social Security and Medicare. Keeping meticulous records of earnings and deductible expenses is crucial for accurate tax estimation. Understanding specific deductions available to freelancers, such as home office or business-related expenses, can significantly reduce taxable income. Ultimately, consulting a tax professional or using dedicated accounting software can aid in navigating the complexities of income tax estimation for freelancers.

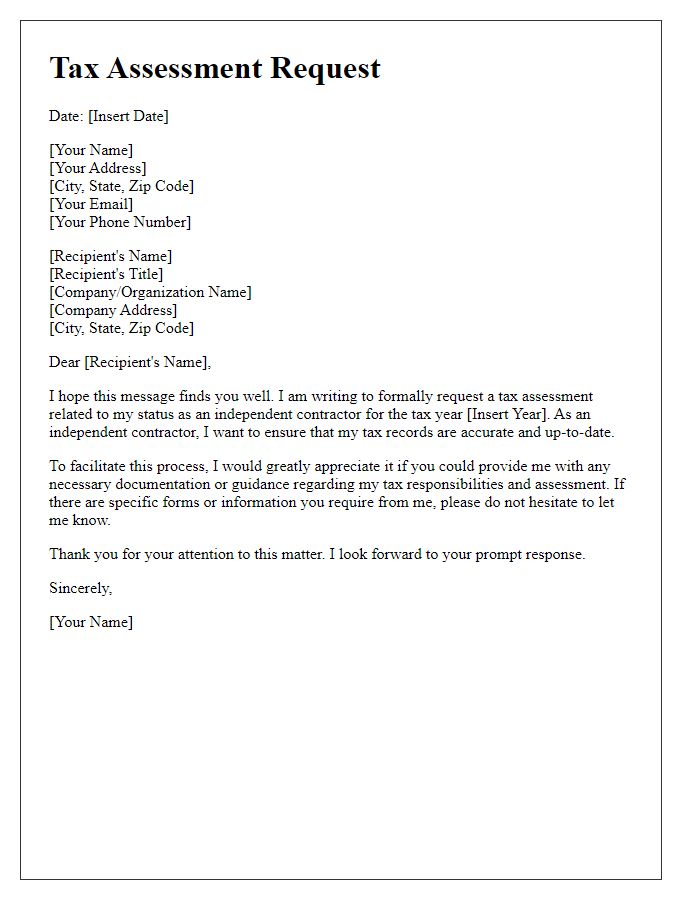

Payment Deadlines: Note submission dates for tax payments.

Freelancers preparing for income tax estimation must be vigilant about payment deadlines to ensure timely submissions. The first estimated tax payment is typically due on April 15, coinciding with the end of the first fiscal quarter. Following that, the second payment deadline usually falls on June 15, aligned with the end of the second quarter. The third installment is ordinarily due on September 15, which marks the conclusion of the third quarter. Finally, the fourth and last estimated tax payment is generally due on January 15 of the following year, after the close of the fourth quarter. Adhering to these deadlines is crucial for avoiding penalties and interest on unpaid taxes.

Documentation: Gather invoices, receipts, and records.

Freelancers need to accurately estimate their income tax obligations to ensure compliance with tax regulations in their jurisdiction. Documentation acts as the foundation of this process, requiring the collection of specific financial records. Invoices issued throughout the fiscal year, representing income earned from clients or projects, should be compiled meticulously. Receipts for business-related expenses, such as software subscriptions or equipment purchases, will provide necessary deductions and support expense claims. Additionally, maintaining records of transactions within accounting software, like QuickBooks or FreshBooks, can streamline the estimation process. This organized approach to documentation will not only aid in tax estimation but also facilitate a smoother filing process during the annual tax season.

Comments