Are you navigating the ins and outs of applying for educational tax benefits? It can be overwhelming with so much information to sift through, and you want to ensure you're taking full advantage of the opportunities available to you. In this article, we'll break down the essential steps and provide a handy letter template to streamline your application process. Ready to boost your tax benefits for education? Let's dive in!

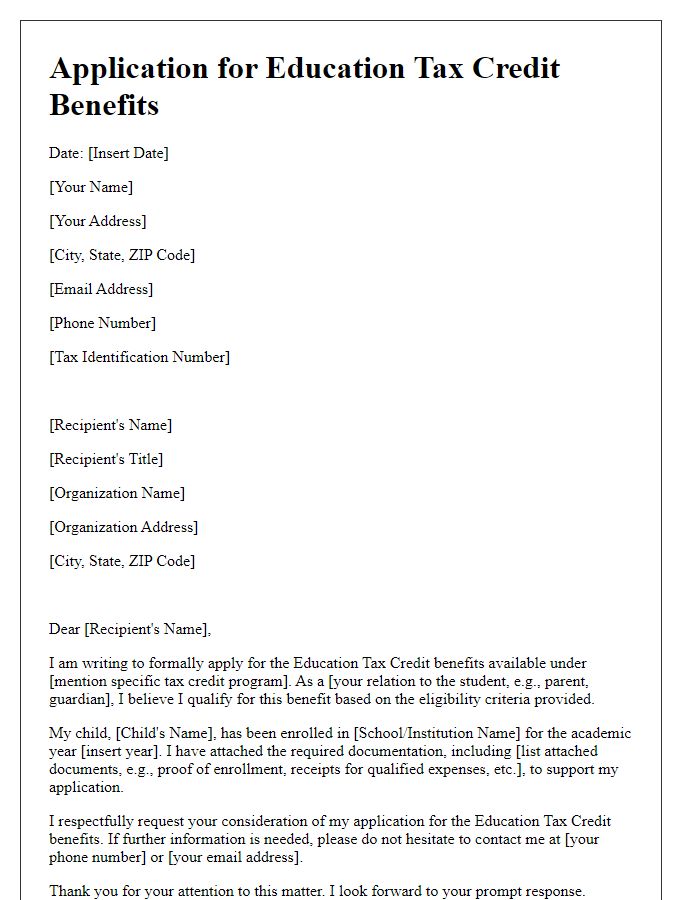

Applicant's personal and contact information

When applying for an education tax benefit, providing comprehensive personal and contact information is essential for processing your application efficiently. Include your full name as recorded on official documents, social security number (or equivalent identification number for your country), date of birth reflecting age for eligibility assessment, and physical address including street, city, state, and zip code for accurate correspondence. Additionally, provide a valid email address for electronic communication and a reliable phone number enabling direct contact if any clarification regarding your application is required. Ensure that this information remains consistent across all submitted documents to avoid processing delays.

Educational institution details and enrollment verification

Educational institutions such as universities, colleges, and technical schools often provide critical information necessary for tax benefit applications related to education expenses. Details include institution name, address, and federal tax identification number, which may be essential for verification purposes. Enrollment verification must display dates of attendance, degree programs, and enrollment status, whether full-time or part-time. This information assists in determining eligibility for educational tax credits such as the American Opportunity Credit or Lifetime Learning Credit, which are significant for taxpayers aiming to offset the cost of higher education. Providing accurate documentation can ensure compliance with IRS regulations and facilitate the processing of claims in a timely manner.

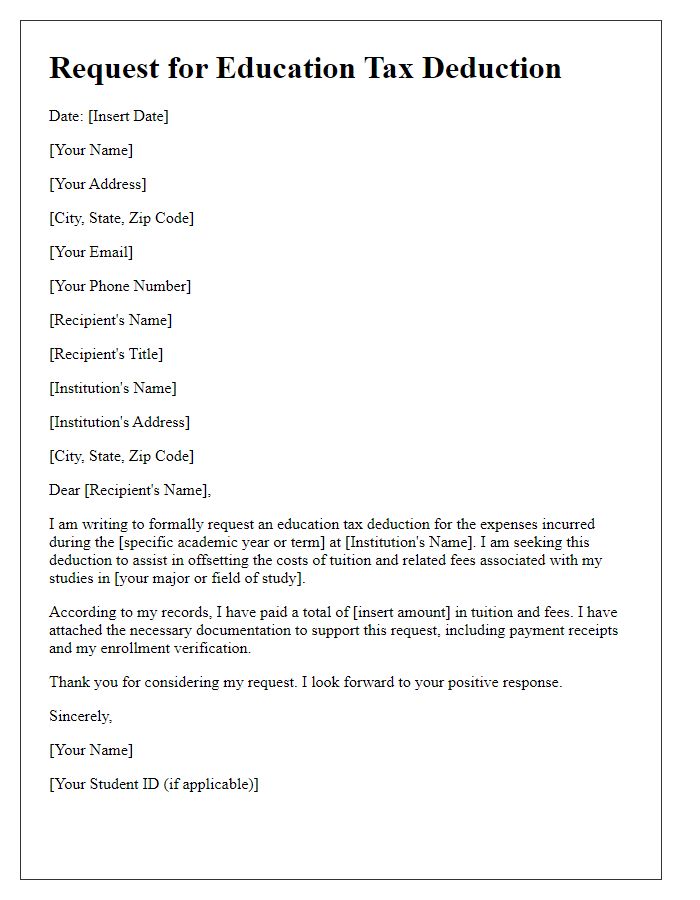

Description of educational expenses

Educational expenses often include a broad range of costs associated with pursuing higher education. Tuition fees at accredited institutions, such as public universities like the University of California or private colleges like Harvard University, comprise a significant portion of these expenses and can average between $10,000 to $60,000 annually, depending on enrollment status. Additional costs, such as mandatory student fees for technology and facilities, textbooks averaging $1,200 per academic year, and supplies necessary for specific courses, contribute to the overall financial investment. Moreover, expenses for on-campus living, commonly exceeding $12,000 annually, along with transportation costs to and from campus--ranging from $500 to $2,000 depending on distance--also play a crucial role in the total amount deemed necessary for education. Understanding these components helps in substantiating claims for education tax benefits, ensuring compliance with IRS guidelines.

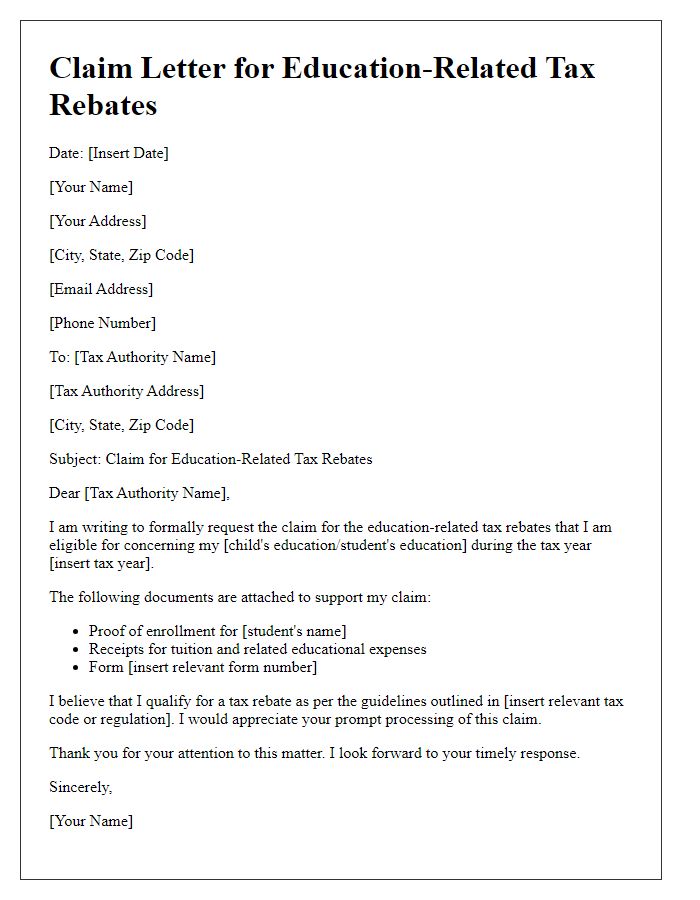

Tax benefit eligibility criteria

Education tax benefits, such as the American Opportunity Credit and the Lifetime Learning Credit, provide financial relief to eligible students and their families. Eligibility criteria include filing tax returns while enrolled in an eligible educational institution, such as a college or university recognized by the Department of Education. Students must be pursuing a degree or other recognized credential, with qualifying expenses not exceeding $2,500 for the American Opportunity Credit, covering tuition, fees, and course materials. Taxpayers should have a modified adjusted gross income (MAGI) below specified thresholds, typically $80,000 for single filers and $160,000 for joint filers. Additionally, applicants must be U.S. citizens or eligible non-citizens. Proper documentation, including Form 1098-T from the educational institution, is essential for claiming these credits on federal tax returns.

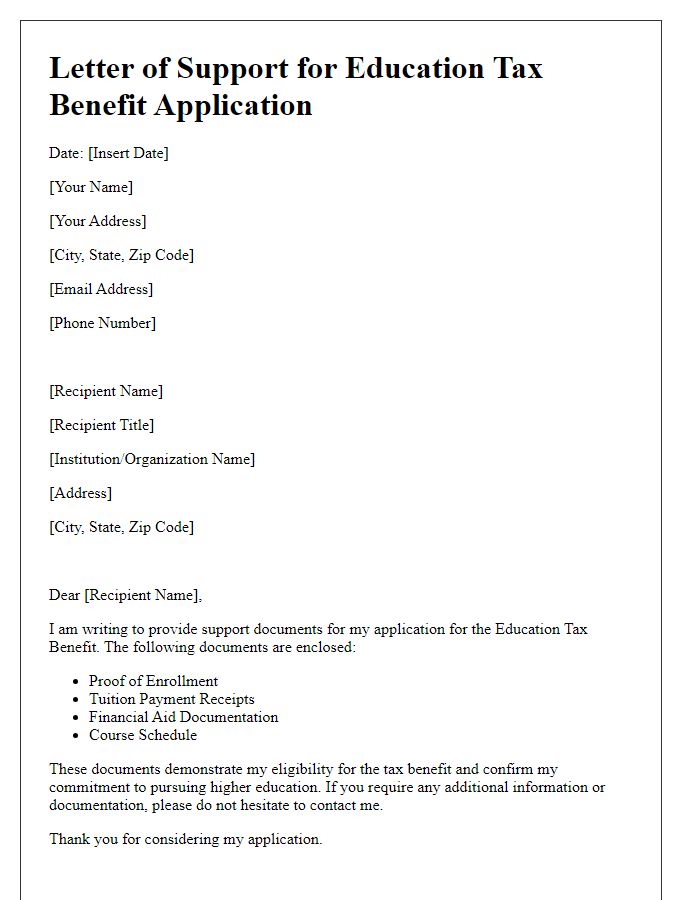

Required supporting documentation list

The education tax benefit application requires specific supporting documentation to verify eligibility and maximize potential claims. These documents include Form 1098-T (Tuition Statement) issued by eligible educational institutions, which outlines qualified tuition and related expenses for the tax year. Additionally, IRS Form 8863 (Education Credits) must be completed to claim the American Opportunity or Lifetime Learning Credits, detailing eligible students and associated qualified expenses. Receipts for tuition payments, textbooks, and other qualifying educational materials must be provided to substantiate the expenses claimed. Furthermore, proof of enrollment, such as an official acceptance letter or enrollment verification, is vital to demonstrate attendance at the qualifying institution during the academic year. Lastly, the application may require a personal identification document (such as a driver's license or Social Security card) to validate the applicant's identity and ensure accurate processing by tax authorities.

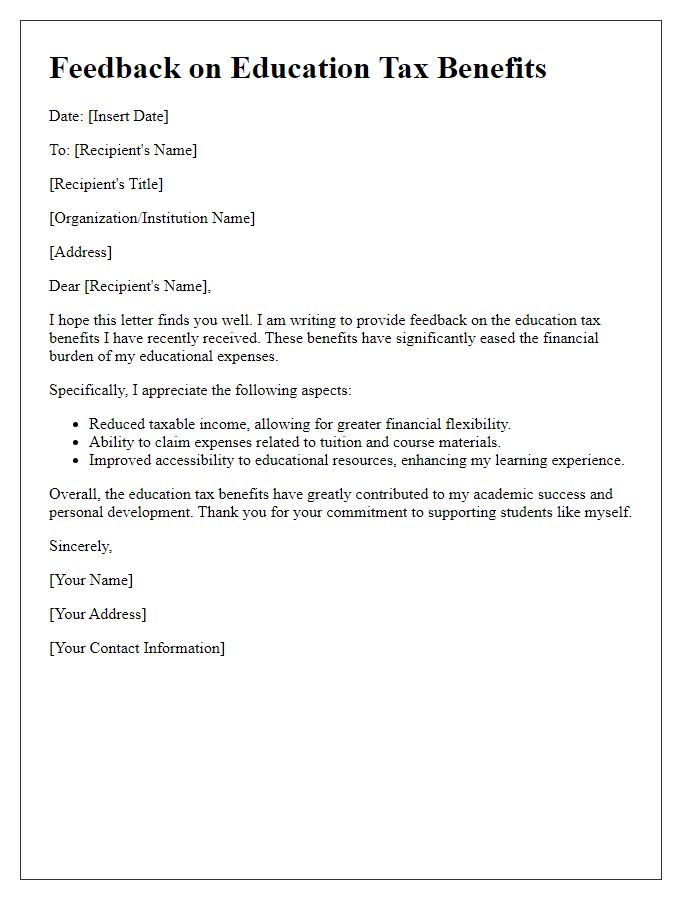

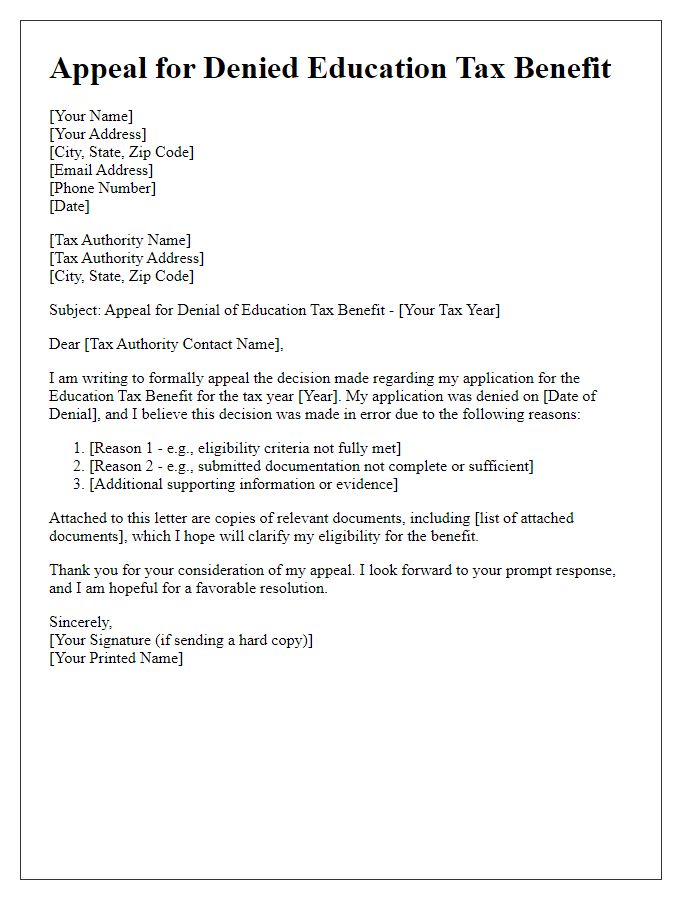

Comments