Are you feeling overwhelmed by the complexities of foreign income tax disclosure? You're not alone; many individuals navigate the intricacies of international tax regulations. This article aims to simplify the process and provide you with a practical letter template to help you clearly communicate your foreign income situation. So, grab a cup of coffee and read on to discover how you can tackle your tax obligations with confidence!

Personal Identification Information

Personal identification information is crucial for foreign income tax disclosure. This includes full name, which identifies the individual in legal documents. Date of birth, often required for verifying identity, can reduce instances of fraud. Social Security Number (SSN) in the United States or equivalent tax identification numbers in other countries, serve as unique identifiers for tax purposes. Address details such as residential address provide location context and can aid in tax jurisdiction analysis. Additional information like nationality or citizenship status can impact tax liabilities under international agreements. All these elements ensure compliance with tax regulations and facilitate accurate reporting to authorities.

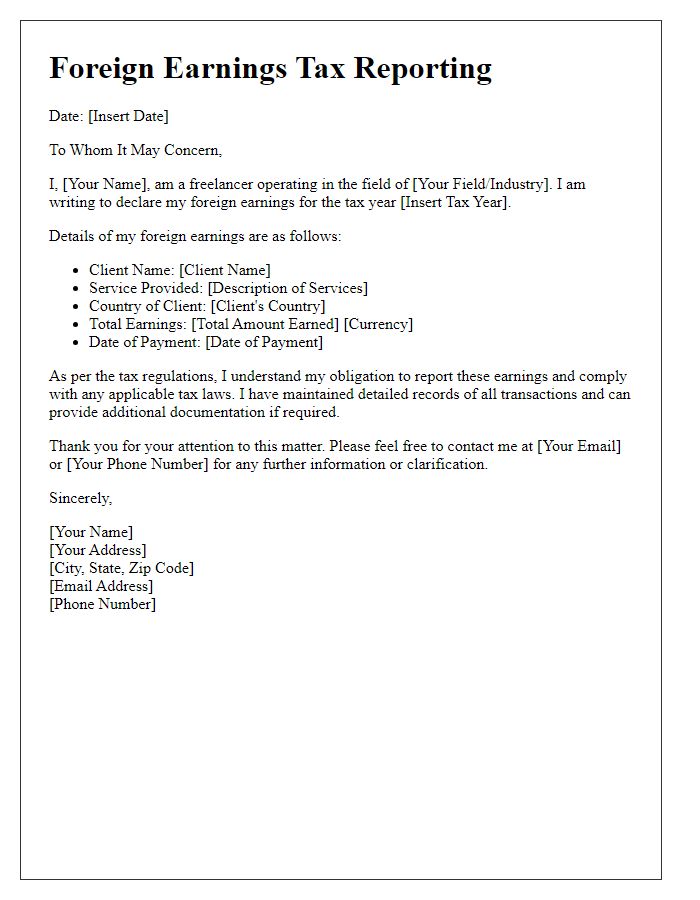

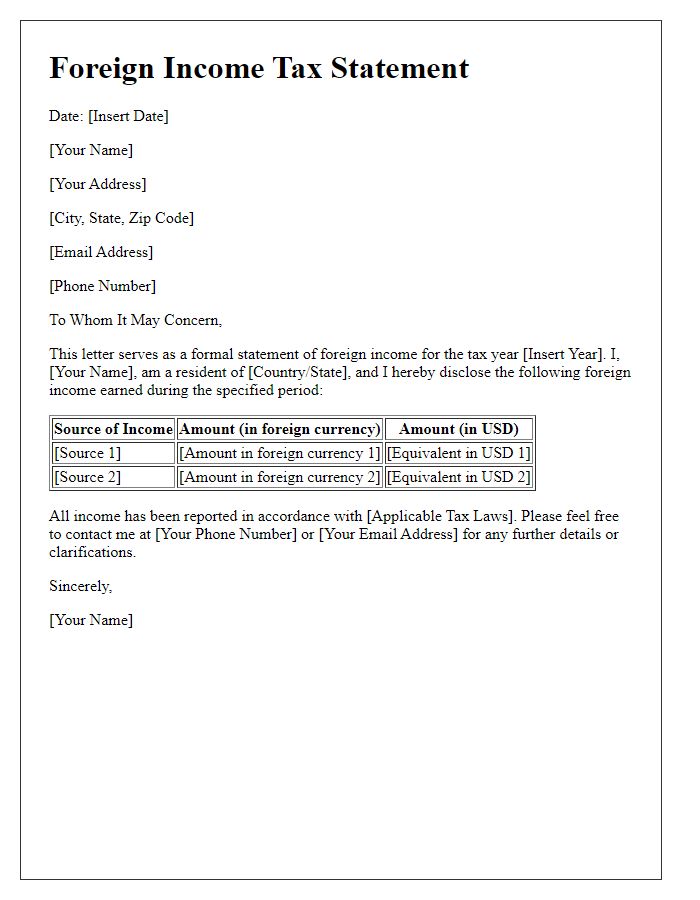

Country and Income Details

Foreign income tax disclosure requires accurate reporting of earnings from external countries to comply with tax regulations. For instance, an individual earning $50,000 from self-employment services in Canada during the 2022 tax year must report this income. Additional income from rental properties, such as $15,000 from a property in Mexico, should also be included. Furthermore, individuals may need to disclose any taxes paid to foreign governments, such as $7,500 to the Canadian Revenue Agency and $2,000 to the Mexican Tax Authority. Accurate detailing of these amounts ensures compliance with IRS requirements and helps avoid penalties associated with misreporting foreign income.

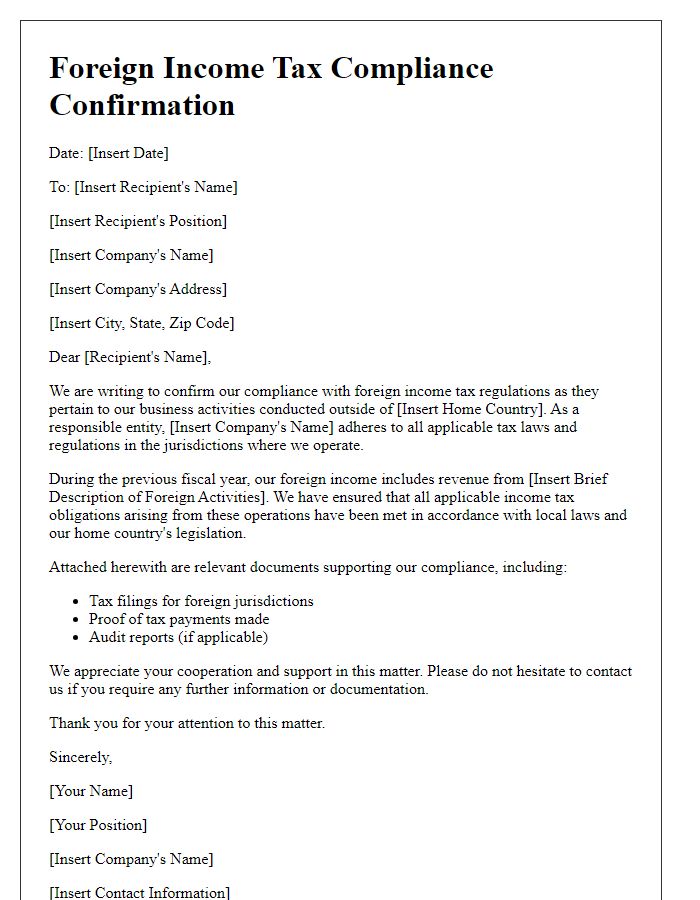

Compliance Statement

Foreign income tax disclosure requires meticulous reporting, ensuring adherence to regulations established by entities such as the IRS (Internal Revenue Service) and the OECD (Organisation for Economic Co-operation and Development). Taxpayers (individuals or corporations) need to report foreign financial accounts (FBAR) when the combined value exceeds $10,000, highlighting transactions across global borders. Non-compliance can lead to severe penalties, potentially up to 50% of the account balance, depending on the circumstances of the negligence. Specific forms, like Form 8938 for FATCA (Foreign Account Tax Compliance Act), require thorough documentation of foreign assets including bank accounts, securities, and other income-generating properties. Accurate translation of international transactions into U.S. dollars is often necessary, considering the exchange rates at the time of each transaction. This compliance statement serves to affirm the commitment to transparency and legal obligations regarding foreign income reporting.

Required Documentation List

Foreign income tax disclosure requires meticulous attention to detail and documentation to ensure compliance with local and international tax regulations. Essential documentation may include items such as completed foreign tax return forms, proof of income sources (such as bank statements or pay stubs), and records of foreign taxes paid (receipts or payment confirmations). Additionally, taxpayers must provide documentation confirming residency status, which could involve residency certificates or utility bills showing the individual's address. Foreign financial account information is crucial, necessitating bank statements or financial institution records that demonstrate account balances and transactions. Taxpayers may also need to submit forms such as the IRS Form 8938 for reporting specified foreign financial assets or FBAR (FinCEN Form 114) for reporting foreign bank accounts, both of which have specific reporting thresholds and deadlines. Each document serves as a critical element in accurately reporting foreign income and ensuring that all tax obligations are met.

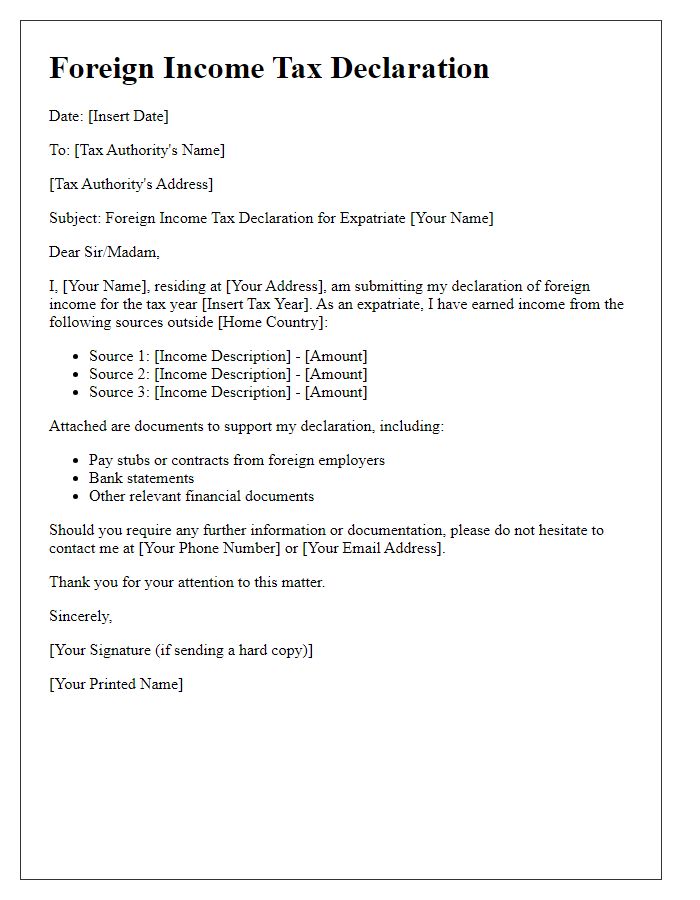

Signature and Contact Information

When preparing for foreign income tax disclosure, one must include pertinent details in the signature and contact information section to ensure clarity and compliance. Full legal name (matching passport or identification documents) stands paramount, along with the current residential address (including country and postal code for international recognition). Contact number should be specified, preferably including the country code (such as +1 for the United States or +44 for the United Kingdom), to facilitate seamless communication with tax authorities. Email address must be professional and regularly monitored. If applicable, inclusion of the taxpayer identification number (such as Social Security Number in the USA or National Insurance Number in the UK) is crucial for identity verification purposes. Each entry should be clear to mitigate any potential delay in processing tax disclosures.

Comments