Have you ever found yourself puzzled by a tax invoice that doesn't quite add up? Navigating discrepancies in your financial documents can be frustrating, but addressing them promptly can save you a lot of headaches in the long run. In this article, we'll explore how to effectively notify the relevant parties about any discrepancies you've encountered with your tax invoices. So, if you're ready to tackle those discrepancies with confidence, keep reading to learn more!

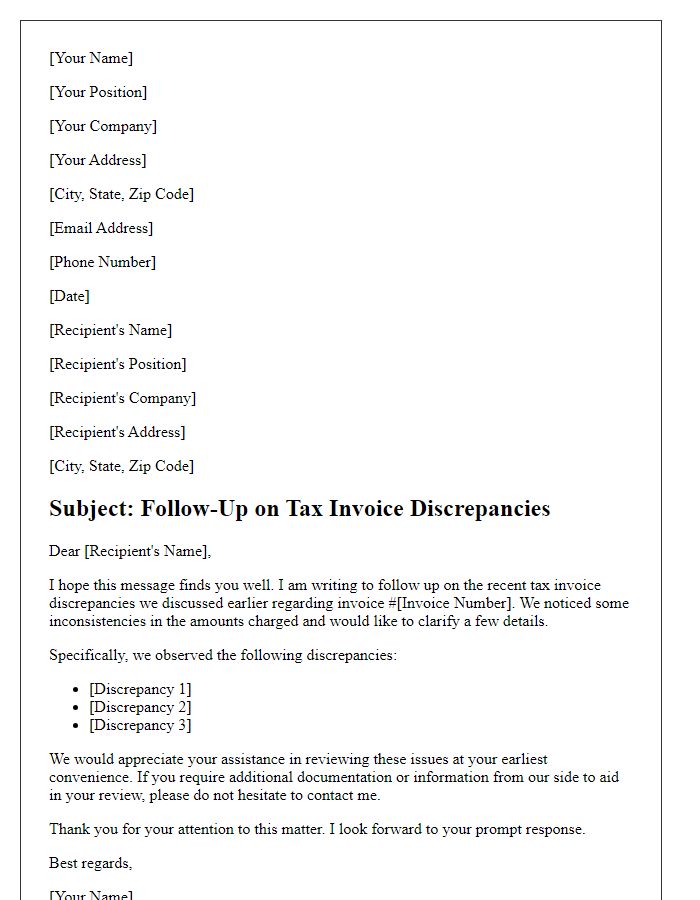

Subject Line: "Tax Invoice Discrepancy Notice

Tax invoice discrepancies can create significant issues in financial reporting and compliance. For instance, an invoice for a service rendered by a company, such as ABC Consulting, might list an incorrect amount due of $2,500 instead of the agreed $3,000. This discrepancy could arise from errors in data entry, such as mistyping the service fee. Additionally, discrepancies related to tax codes on the invoice can lead to inaccurate tax filings. For example, the incorrect application of a sales tax rate--say, 7.25% instead of the correct 8.25%--might result in underpayment of state taxes, potentially incurring fines. Addressing these discrepancies promptly is essential for maintaining accurate financial records and ensuring compliance with regulations set forth by the Internal Revenue Service (IRS).

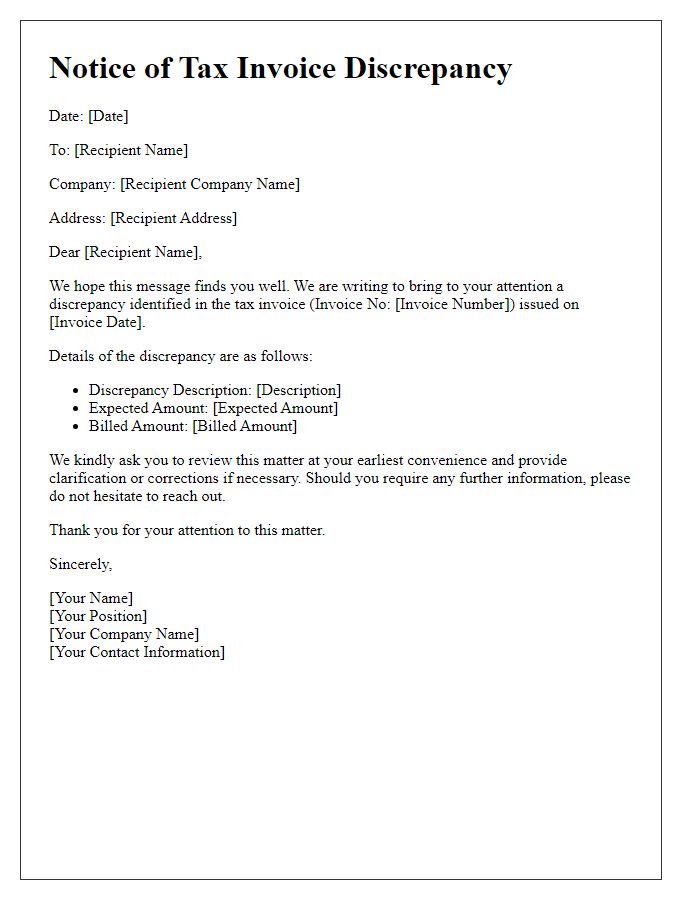

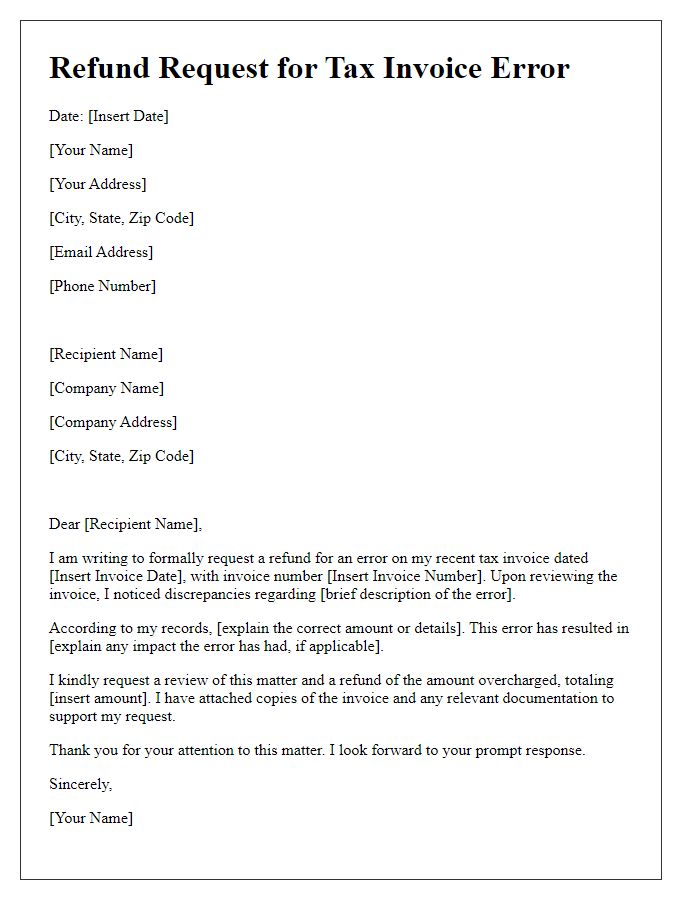

Address Recipient: Include full name and company details

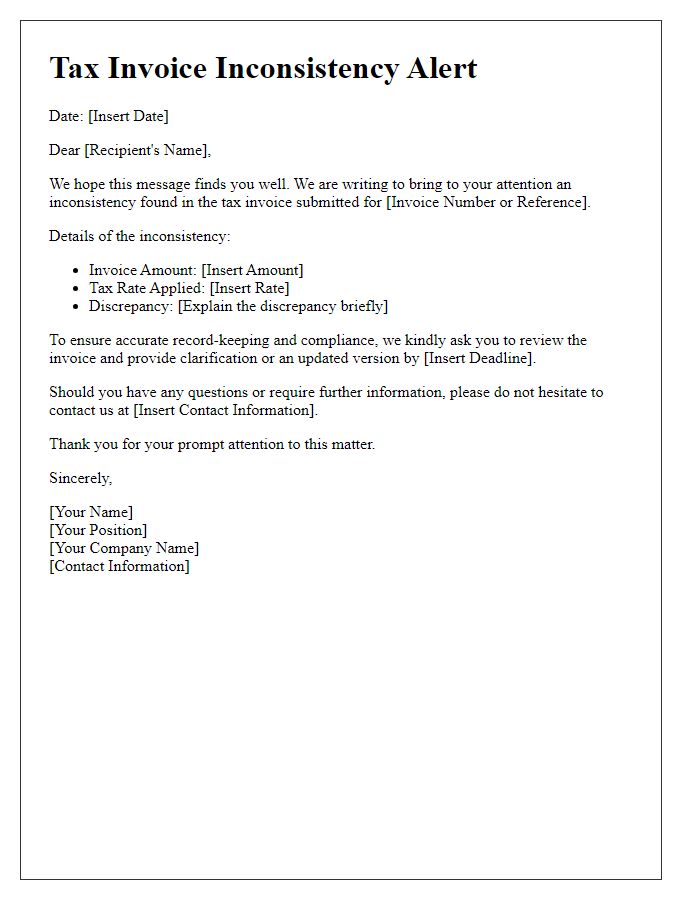

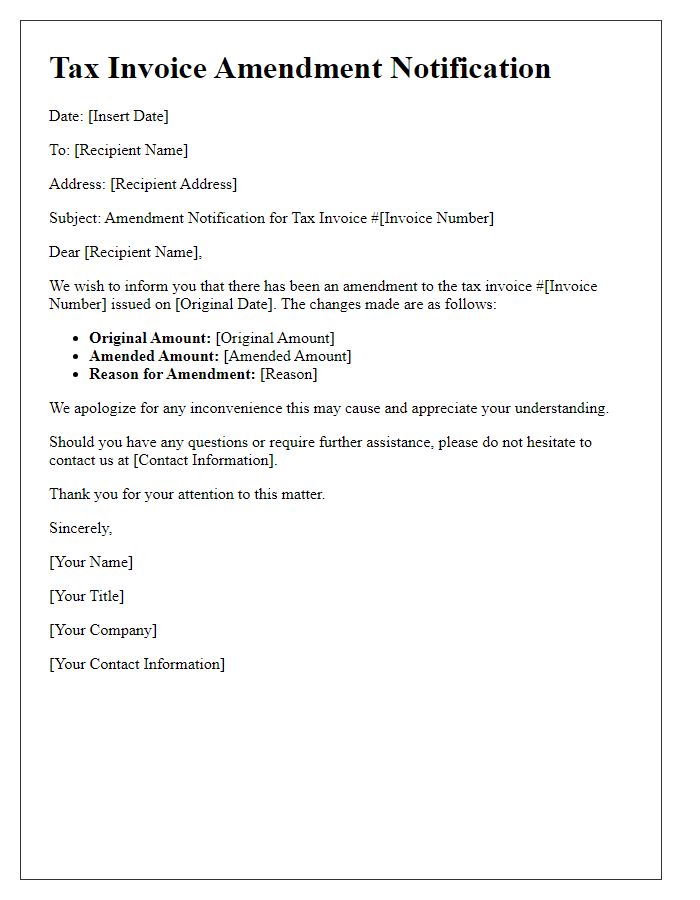

A discrepancy in tax invoices may lead to significant issues in financial reconciliation processes. Specific details, such as invoice number and date, should clearly identify the affected documents. Providing accurate recipient information, including full name, title, and company address, ensures proper communication. The discrepancy could involve incorrect amounts, missing items, or incorrect tax percentages applicable. Prompt resolution of this matter is crucial to maintain accurate financial records and adhere to compliance regulations set forth by the Internal Revenue Service (IRS) or relevant authorities. Including a request for clarification or correction can facilitate timely processing.

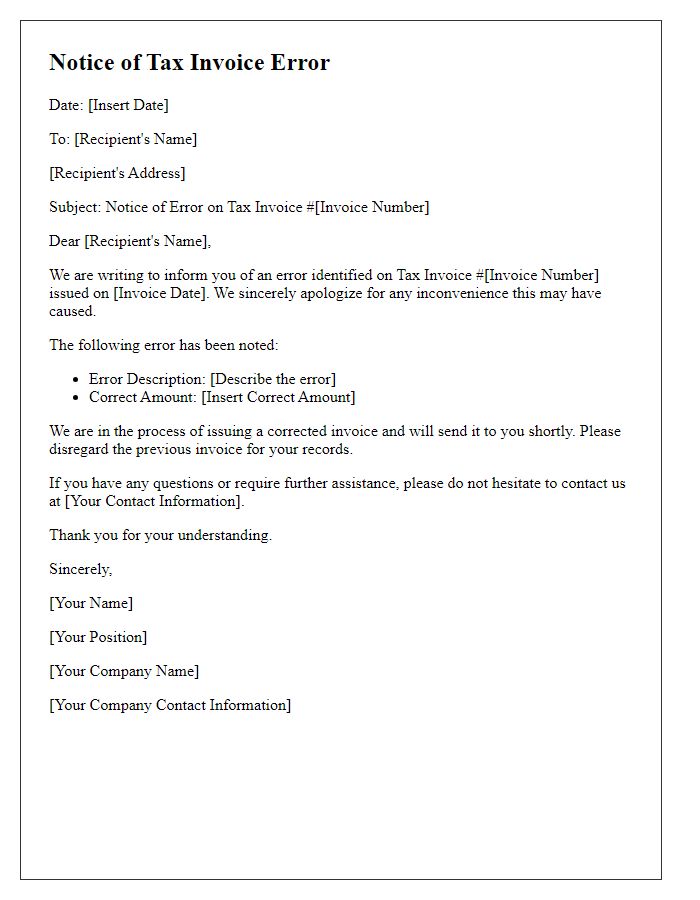

Description of Discrepancy: Clearly outline errors or differences

A recent review of the tax invoice from the vendor, ABC Supplies, dated September 15, 2023, highlighted a discrepancy in the total amount billed. The invoice amount indicates $2,500 while the original purchase order (PO) number 12345 specified a total of $2,200 for the ordered items, including five units of Product X at $400 each and two units of Product Y at $200 each. This $300 difference requires clarification as it may result from either an additional unauthorized charge or an accounting error. Additionally, the tax applied on the invoice calculates to $250, consistent with the 10% rate but applied to an inflated total. Prompt resolution of this discrepancy is necessary to ensure accurate financial reporting and compliance with tax regulations.

Required Actions: Specify corrective measures and deadline

Notification of tax invoice discrepancies can lead to financial complications for businesses. Common issues include incorrect amounts, missing details like Tax Identification Numbers, or mismatched invoice dates. Immediate corrective measures may include issuing a revised invoice within seven days, re-confirming payment terms, and ensuring accurate data entry into accounting tools such as QuickBooks. Delays beyond this period can incur late fees or interest charges, potentially escalating discrepancies into disputes with clients or auditors. Addressing these issues promptly ensures compliance and maintains trust in financial relationships.

Contact Information: Provide details for clarification or support

Notification of tax invoice discrepancies requires immediate attention to ensure accurate financial records. The invoice, numbered 1023, issued on March 15, 2023, reflects an incorrect amount of $5,000 instead of the agreed-upon $4,500 for services rendered within the New York metropolitan area. Such discrepancies can lead to potential issues during tax filing with the Internal Revenue Service (IRS). For clarification or support regarding this matter, please contact the accounts department by phone at (555) 123-4567 or via email at invoicesupport@company.com. Additional documentation, including service agreements and previous invoices, will be readily available to facilitate the correction process promptly.

Comments