Hello there! Navigating the complex world of tax liability can often feel overwhelming, and it's completely normal to seek clarity. Whether you're a business owner or an individual taxpayer, understanding your tax obligations is crucial for maintaining financial health and compliance. In this article, we'll break down common misconceptions while providing you with practical tips to ensure you're on the right trackâso let's dive in!

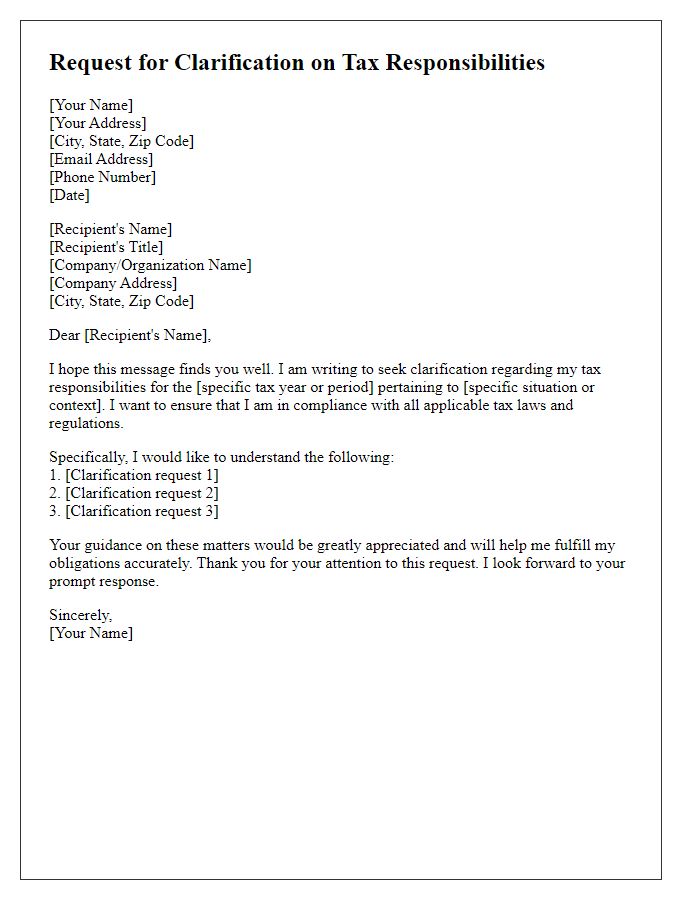

Clarity of Query

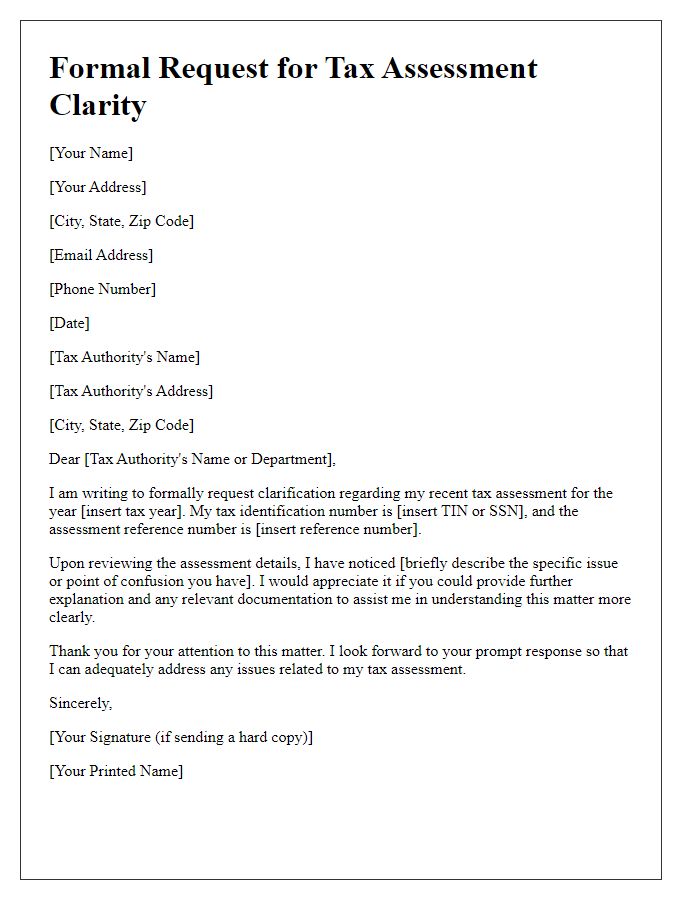

Tax liability can be complex, particularly concerning specific deductions and credits available for individuals and businesses. The Internal Revenue Service (IRS) outlines detailed guidelines for tax obligations in the United States, including documents like Form 1040 and Schedule C. Understanding the distinction between different income types is crucial, as ordinary income and capital gains are taxed at varying rates. Furthermore, having clarity on residency status can significantly impact tax liability. For instance, states like California impose a progressive income tax structure, while states such as Texas have no state income tax, making it essential to review local regulations. Keeping accurate records and seeking professional advice can ensure accurate reporting and compliance, minimizing potential penalties during audits.

Specific Tax Issue

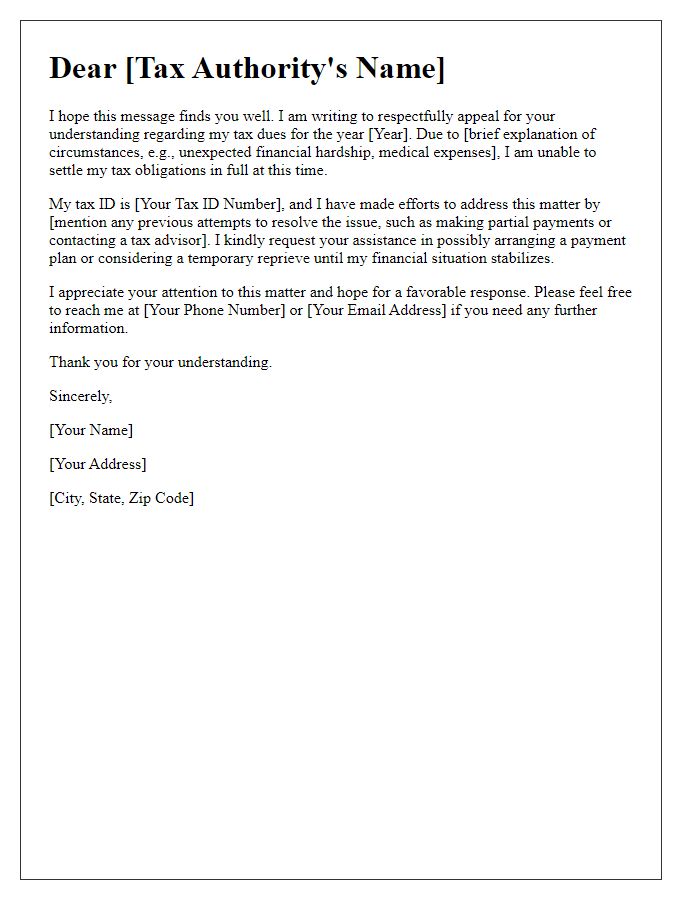

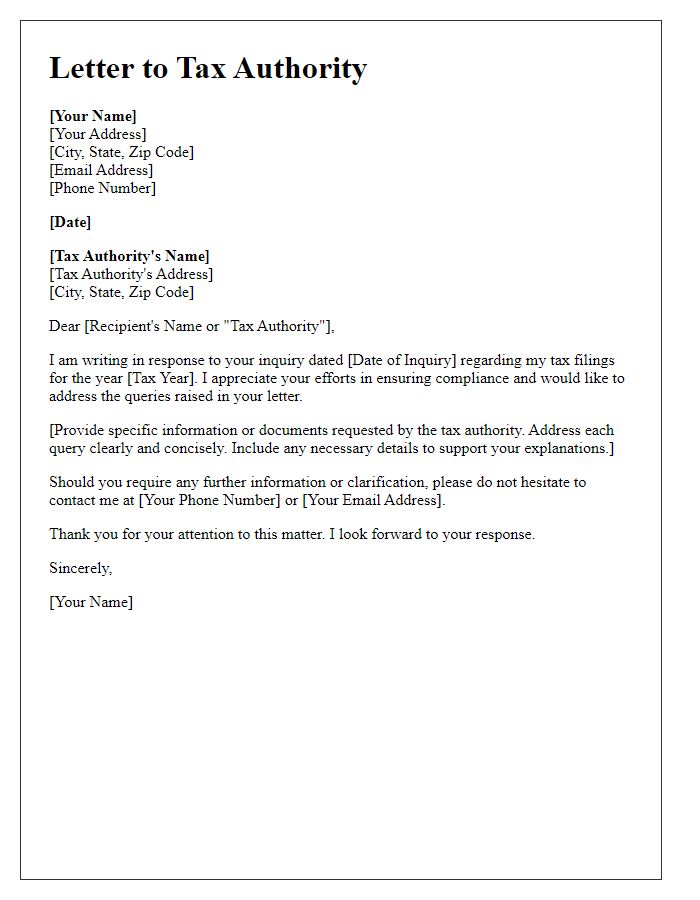

Tax liabilities can significantly impact both individuals and businesses, necessitating a clear understanding of specific tax obligations outlined by authorities like the Internal Revenue Service (IRS) in the United States. Tax codes, such as the Internal Revenue Code (IRC) (particularly Sections 61-63 regarding gross income), delineate what constitutes taxable income and deductions available to taxpayers. Clarifying issues related to tax liability often involves contextual elements like the nature of income, applicable tax rates (for example, the current federal income tax rate, which can be as high as 37% for high earners), and potential credits that could mitigate financial obligations (such as the Earned Income Tax Credit). Additionally, deadlines for filing returns (April 15 for most individuals) and penalties for non-compliance underscore the importance of addressing specific queries timely. Consulting with tax professionals or utilizing IRS resources can provide crucial insights into navigating these complexities.

Relevant Tax Codes

Clarification on tax liability is critical for ensuring compliance with applicable laws. The Internal Revenue Code (IRC) governs federal tax obligations within the United States, specifically Sections 61 and 162 which outline gross income and business expenses, respectively. State-specific tax codes, such as New York Tax Law SS 601 or California Revenue and Taxation Code SS 17041, dictate additional filing requirements and tax rates. It is vital to review IRS guidelines, like Publication 535 regarding business expenses or Publication 17 for individual taxpayers, to accurately determine liability. Due dates for filing taxes, typically April 15 for federal taxes, should be adhered to, along with any relevant extensions. Documentation of all financial transactions is essential for substantiating claims and reducing the risk of audits or penalties.

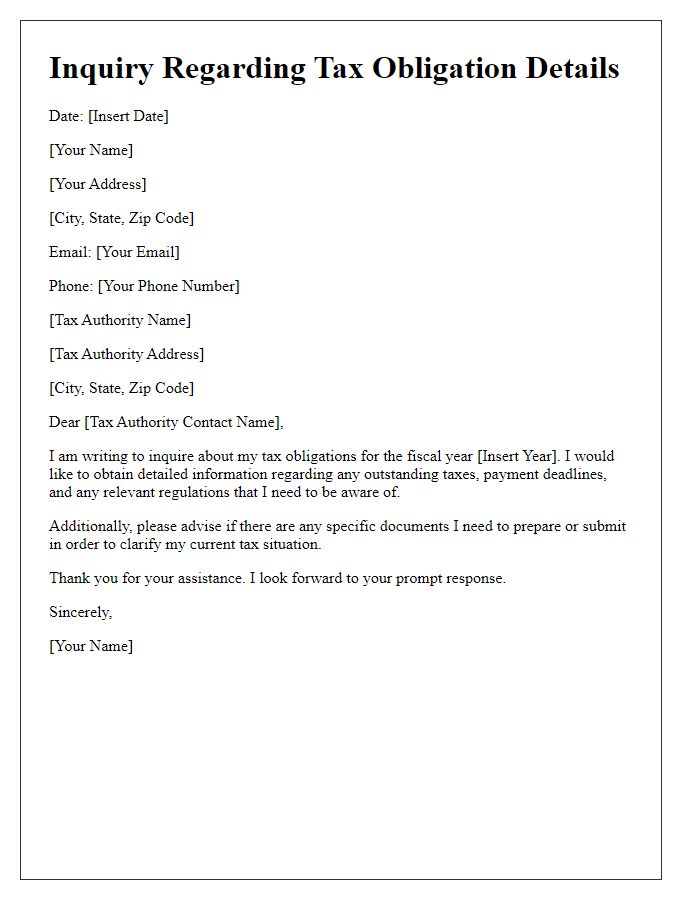

Contact Information

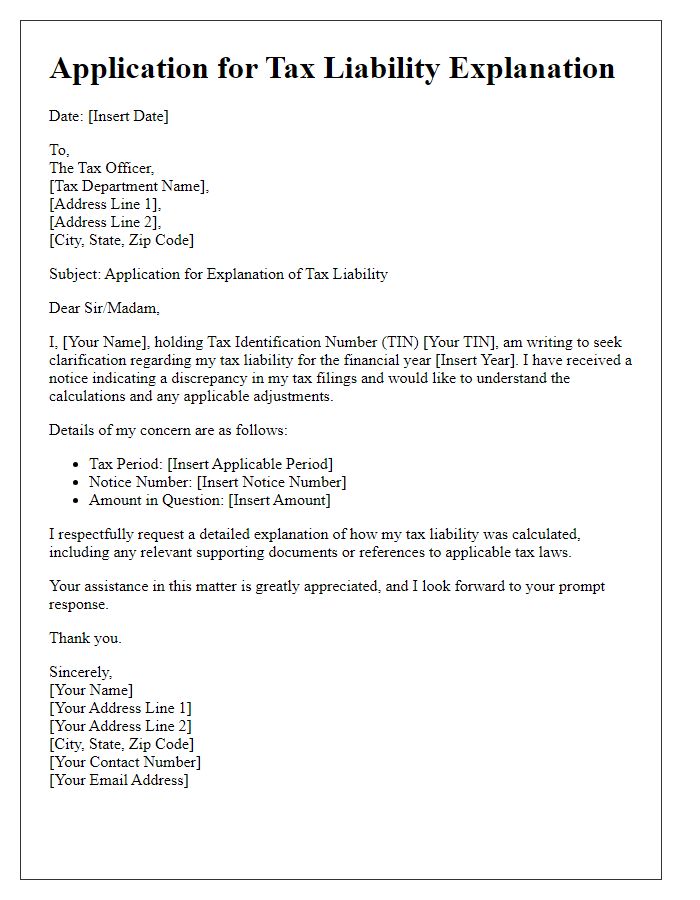

Tax liability clarification requests require precise documentation. Key details include taxpayer identification number, income figures, and filing year. Gather relevant forms such as IRS Form 1040 and supporting documents like W-2s (for wage statements) and 1099s (for miscellaneous income). Include a clear, concise statement outlining specific concerns regarding taxable income, deductions, and credits claimed. Mailing address should reflect the appropriate tax office, such as the Internal Revenue Service (IRS) office in Ogden, Utah, known for processing individual tax returns. Ensure contact information is updated for timely response, including phone number and email address for efficient communication.

Supporting Documents

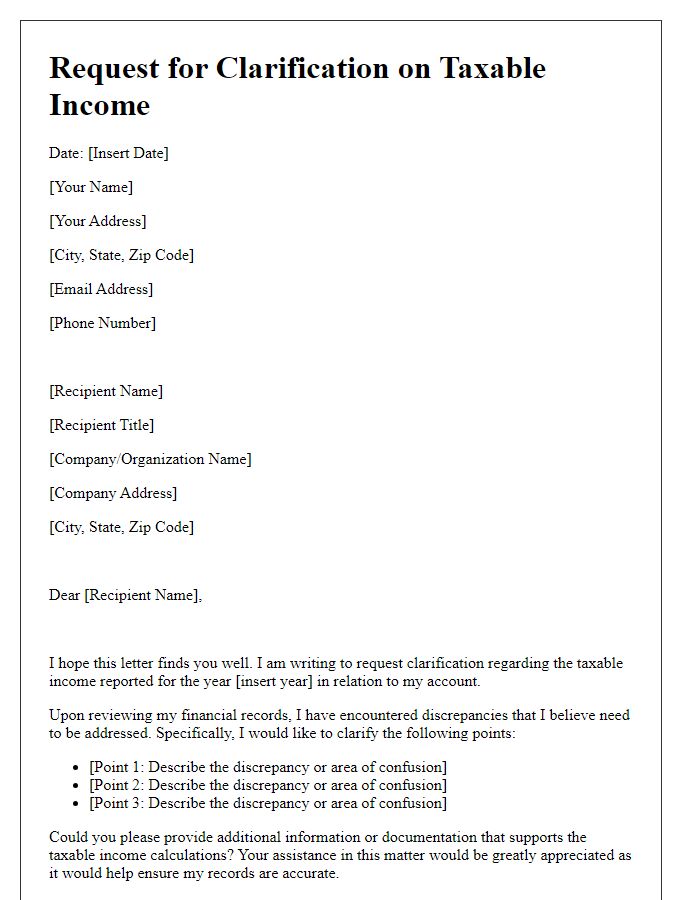

Tax liability clarification requests often require additional documentation for accuracy. Relevant supporting documents may include tax returns from previous years, W-2 forms, 1099 forms, and receipts for deductible expenses, including charitable donations and business-related purchases. Important deadlines, such as the tax filing due date of April 15th in the United States, should also be adhered to. Document organization is crucial; each submission should be clearly labeled with the corresponding tax year and tax category. Additionally, a detailed explanation of any discrepancies or inquiries regarding taxable income or deductions strengthens the request's clarity. Taxation authorities, such as the Internal Revenue Service (IRS), require comprehensive information to resolve any issues efficiently.

Comments