Are you looking to navigate the often complex world of sales tax refunds? Understanding your rights and the steps involved can feel overwhelming, but it doesn't have to be. In this article, we will break down what a sales tax refund notification looks like and provide you with a handy template to follow. So grab a cup of coffee and dive in to discover how to simplify your refund process!

Recipient's Contact Information

The notification of sales tax refund provides essential information to the recipient regarding their financial reimbursement. The recipient's contact information typically includes their full name (ensuring accurate identification), mailing address (linked to the registered account or purchase location), email address (for digital communication), and phone number (to facilitate any direct inquiries or clarifications). This structured information is key to ensuring that the refund process is swift and that all communications are clear, ultimately enhancing the customer's experience during this financial transaction.

Date of Notification

Businesses receiving a sales tax refund notification from the Department of Revenue should carefully review the details presented. States like California and New York often issue refunds due to overpayment or incorrect assessments related to sales tax collections. Important information includes the amount refunded, which may vary widely depending on the transaction history, and the specific tax period under review, such as fiscal years that often run from July to June. This notification might include guidelines for proper documentation needed for record-keeping purposes, ensuring compliance during future audits. Timely communication regarding these refunds is crucial, as businesses must meet deadlines to avoid complications. Additionally, understanding the implications of this refund on overall tax liability is essential for accurate financial planning.

Refund Amount Details

Sales tax refund notifications are essential for both businesses and consumers to ensure compliance with tax regulations. A refund typically occurs when a consumer has overpaid sales tax or when a transaction is eligible for a tax-exempt status. In the United States, the process may vary by state, with some states like California (known for its complex sales tax regulations) requiring detailed documentation for refunds, while others may offer online portals for a more streamlined process. The refund amount should include specific details, such as the original sales tax charged, the total purchase amount, and any applicable interest on the overpaid tax. Companies, like Amazon, can manage their refunds efficiently due to robust accounting systems, ensuring that customers receive notifications promptly. Accurate record-keeping is crucial in the refund process to facilitate timely reimbursements and maintain compliance with state tax laws.

Reference Number or Case ID

The notification of a sales tax refund involves a formal communication to a taxpayer regarding the reimbursement of excess tax paid. A reference number or case ID, often unique to individual transactions, facilitates tracking and processing of the refund. Such refunds may arise from various contexts, including overpayment due to clerical errors or adjustments in tax rates. For instance, a refund could stem from a recent tax audit conducted by the Department of Revenue, which revealed an overpayment of $1,000 from 2022. The notification will typically outline the amount refunded, the method of refund, and the timeline for processing, ensuring clarity for the taxpayer in understanding their financial corrections.

Instructions for Next Steps

Sales tax refund notifications outline essential steps for recipients to efficiently claim their refunds. For example, individuals receiving a notification from the Department of Revenue of a specific state such as California may be instructed to complete Form 3500, detailing the refund amount and applicable tax period. Submission deadlines, typically 30 days from the notification date, ensure timely processing. Supporting documents, including sales receipts or proof of tax payment, must be attached to validate the claim. Refunds usually process within 6-8 weeks, with direct deposit options available for expedited funds transfer. Recipients may also verify their claim status online through the state's revenue portal, ensuring transparency and accountability in the refund process.

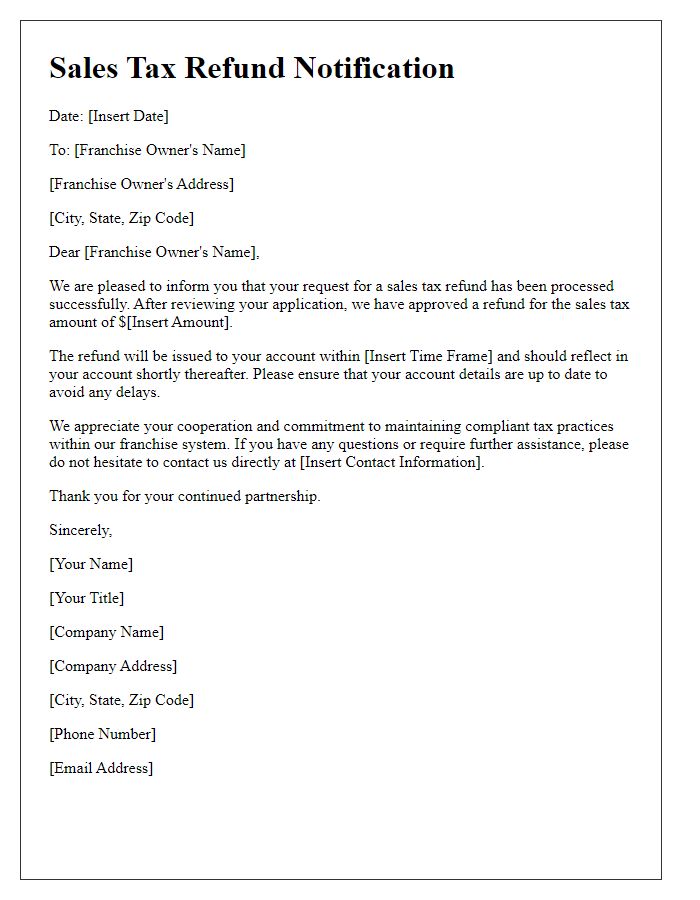

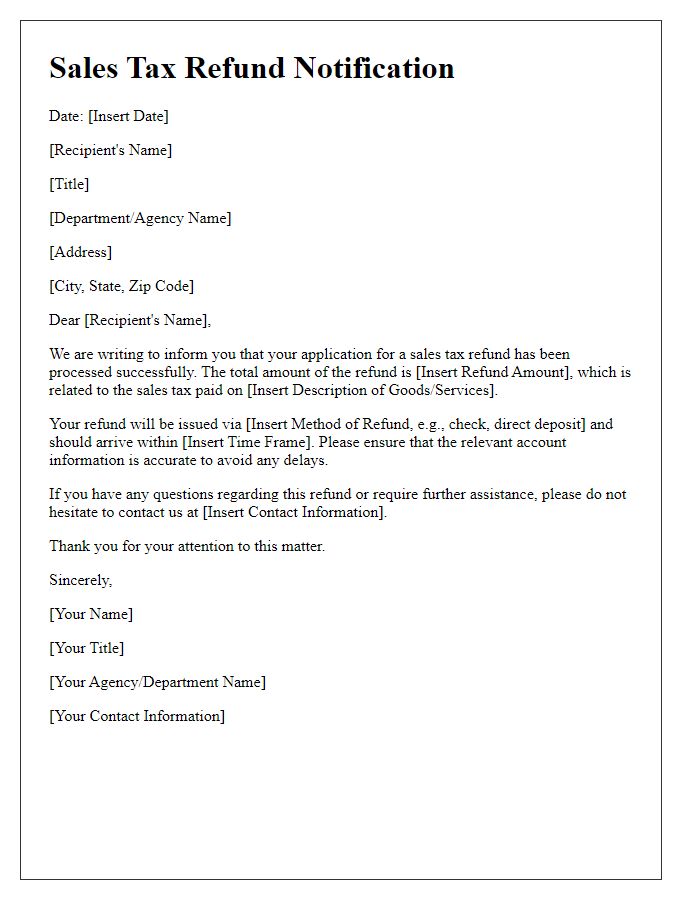

Letter Template For Notification Of Sales Tax Refund Samples

Letter template of sales tax refund notification for individual taxpayers

Letter template of sales tax refund notification for non-profit organizations

Comments