Hello valued shareholders! We're excited to share some important updates regarding changes to our stock options that aim to enhance your investment experience. As we navigate an evolving market landscape, these adjustments are designed to align with our growth strategy and improve shareholder value. Curious to learn more about how these changes could impact you? Keep reading!

Introduction and Purpose

The introduction of a shareholder change in stock options outlines a significant development impacting equity distribution within a corporation. Shareholder changes may include recent mergers, acquisitions, or shifts in management, leading to the reassessment of equity incentives that can affect both current shareholders and employees holding stock options. The purpose of this notification often includes clarifying adjustments to stock option plans, explaining eligibility for new options, and detailing how these changes align with organizational goals such as enhancing employee retention or driving company performance. Additionally, this communication serves to maintain transparency, ensuring all stakeholders are informed about alterations in their financial interests. Such changes may have implications for key events like shareholder meetings or financial disclosures, making timely communication essential to foster trust and engagement among stakeholders.

Details of Shareholder Change

A shareholder change in stock options can impact various aspects of corporate governance and financial performance. When a shareholder transfers stock options to another entity, it typically involves legal documentation to ensure compliance with regulations set forth by the Securities and Exchange Commission (SEC). The details of the stock options, including the date of issuance, expiration date, and exercise price, play a crucial role in assessing the implications for both the selling and receiving parties. For instance, if a shareholder transfers 1,000 options with an exercise price of $15, and the current market price is $25, this creates an immediate financial benefit for the recipient. Additionally, a shareholder's decision to sell or transfer options may signal changes in their investment strategy or company outlook, potentially affecting stock market perception and shareholder value. This change must be recorded and communicated to the board of directors to ensure transparency and adherence to company policies and bylaws.

Stock Options Alteration Summary

Stock options alterations can greatly impact shareholder value and company strategy, particularly in publicly traded companies like Tech Innovations Inc. A stock option alteration often involves adjustments to the number of options granted or changes in the exercise price, which can follow significant corporate events such as mergers or acquisition announcements. Recent regulatory changes, such as the SEC's updated rules regarding stock compensation (enacted in 2022), also play a crucial role in determining how these options are structured. Public announcements of stock options changes typically occur during quarterly earnings reports, where key financial data, including EPS (Earn Per Share) projections, may influence investor sentiment and stock performance on exchanges like the NASDAQ. Understanding these dynamics is essential for shareholders when evaluating potential impacts on their investment portfolios.

Legal and Compliance Considerations

Shareholder changes in stock options necessitate close attention to legal and compliance considerations, particularly under securities regulations. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, impose strict guidelines for disclosures related to stock option modifications. Key dates, like the annual shareholder meeting or proxy voting deadlines, should be noted to ensure compliance with timelines for notification and amendments. Documentation, including shareholder agreements and amendments to option plans, must accurately reflect changes and be filed properly to maintain transparent communication with all stakeholders. Additionally, tax implications under Internal Revenue Code Section 409A should be evaluated, as they can significantly affect both the company and the shareholders involved, leading to potential penalties if not adhered to correctly.

Contact Information for Inquiries

Shareholder notifications regarding changes in stock options are critical for ensuring clear communication between the company and its investors. These notifications typically include vital information about the changes, such as the new terms of the stock options, the rationale behind the adjustments, and any important deadlines for acceptance or action. To facilitate inquiries about the changes, a dedicated contact information section is essential, providing shareholders with direct lines of communication. This should include email addresses, phone numbers, and possibly links to online portals or investor relations websites where shareholders can access full details. Transparency in contact information reassures shareholders and fosters trust in corporate governance practices.

Letter Template For Shareholder Change In Stock Options Samples

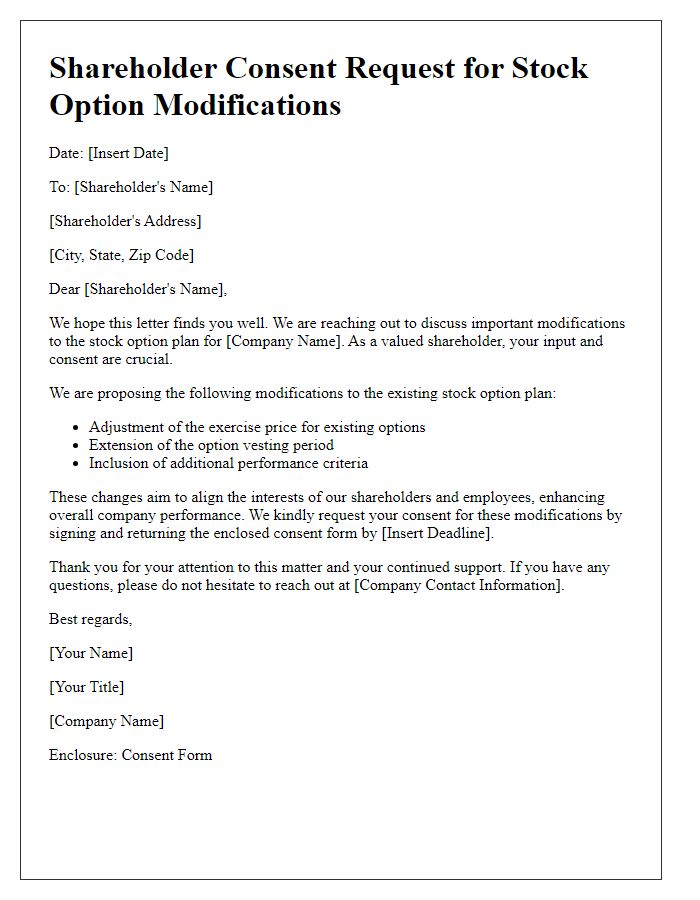

Letter template of shareholder consent request for stock option modifications

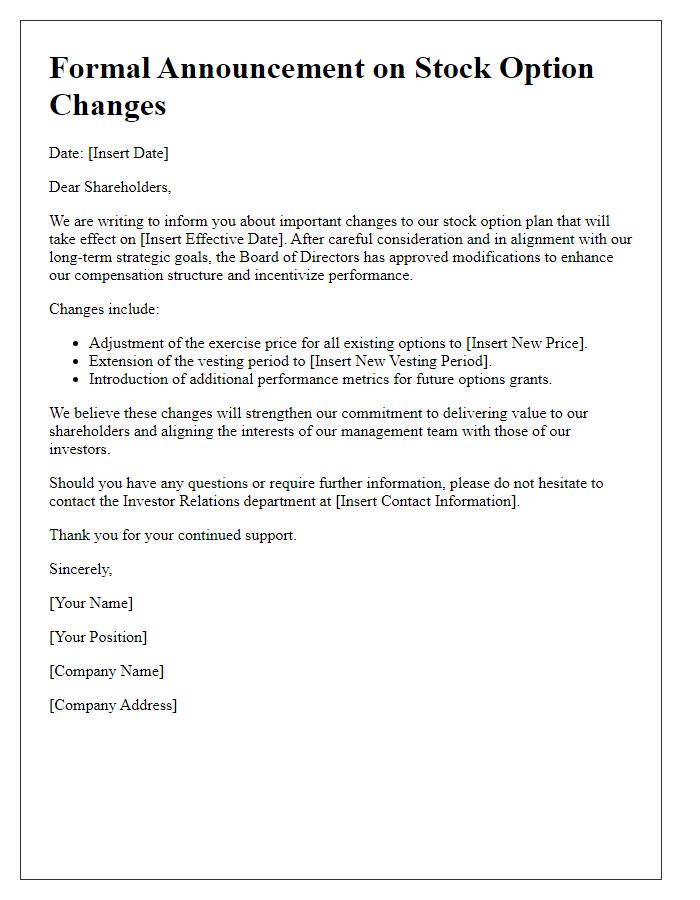

Letter template of formal announcement for stock option changes to shareholders

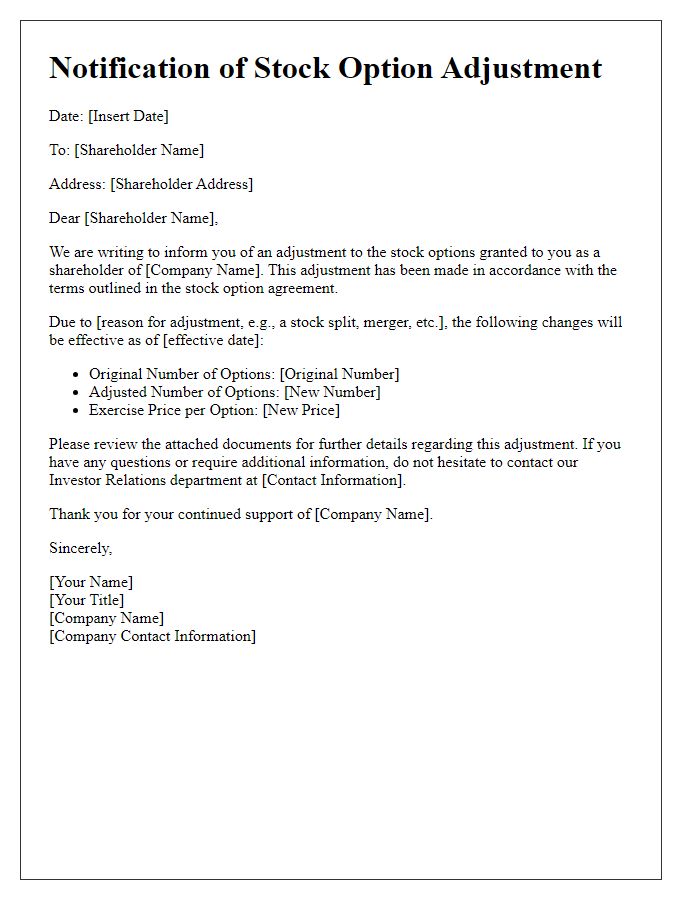

Letter template of notification of stock option adjustment for shareholders

Letter template of shareholder communication regarding stock option alterations

Letter template of information release for shareholders on stock option revisions

Letter template of stock option change proposal for shareholder approval

Comments