Dear valued shareholder, we understand that corporate restructuring can often stir curiosity and concern. In this letter, we aim to share our upcoming changes, which are not only pivotal for our growth but also designed to enhance your investment's potential. We believe that these strategic transitions will position us for greater success in the ever-evolving marketplace. We invite you to read more about the exciting developments ahead and how they will benefit you.

Clear Subject Line

Corporate restructuring is a significant event for shareholders, influencing company stability and future profitability. As of October 2023, companies may undergo transformations to streamline operations and enhance efficiency, often aiming to adapt to market conditions. Key stakeholders, including investors in top Fortune 500 firms, should be informed about changes that could impact stock performance and dividends. During this process, legal advisors must ensure compliance with regulations set by the Securities and Exchange Commission to protect shareholder interests and maintain transparency. Notifications typically entail details on restructuring plans, timelines, and projected outcomes, underscoring the importance of keeping shareholders well-informed amidst corporate transitions.

Salutation and Addressing

Corporate restructuring often necessitates clear communication. Shareholders must be informed about significant organizational changes, typically occurring within financial institutions or multinational corporations. In this context, an official notification addresses individuals or entities holding ownership stakes in the company, ensuring they receive crucial information regarding the restructuring process's impact on their investments. The communication should include an appropriate salutation, acknowledging the shareholder's status, followed by a concise yet informative message outlining the reasons for restructuring, its anticipated benefits, and any implications for their shares or voting rights. The aim is to maintain transparency and uphold trust between the company and its shareholders.

Purpose of Restructuring

Corporate restructuring aims to enhance operational efficiency, improve financial stability, and adapt to changing market dynamics. Restructuring efforts may involve divestitures, mergers, or strategic realignments to better position the company for future growth in competitive sectors. The primary purpose includes streamlining processes, reducing costs, and reallocating resources effectively. This initiative aims to strengthen the company's overall financial health, ensuring the ability to deliver value to shareholders and stakeholders alike. Furthermore, addressing evolving customer needs and technological advancements remains essential in maintaining market relevance and achieving sustainable business success.

Impact on Shareholder Interests

Corporate restructuring initiatives can significantly alter the financial landscape for shareholders, often impacting stock performance and dividend yields. For instance, during a strategic realignment, a company like General Electric (GE), which underwent similar changes in 2018, may implement a reduction in workforce or divestiture of non-core assets. Such actions aim to enhance operational efficiency, potentially leading to an uptick in share price over the long term. However, during the restructuring phase, shareholders could experience short-term volatility, which may reflect in fluctuating stock values or delayed dividend distributions. Communication strategies, such as detailed reports and shareholder meetings, are crucial in clarifying the restructuring goals and anticipated outcomes, thus addressing any concerns regarding shareholder interests and investment stability.

Contact Information for Queries

Corporate restructuring often affects shareholder interests significantly. Clear communication is crucial during this process. For shareholders with questions regarding this restructuring, it is essential to provide comprehensive contact information. Designated contact points may include investor relations representatives or specific departments responsible for handling inquiries. Contact methods should cover various channels, including phone numbers (direct lines to representatives), email addresses (dedicated inboxes for efficiency), and office locations (physical addresses for in-person meetings). Including business hours ensures shareholders can reach out at appropriate times. This information reassures stakeholders of transparency and accessibility during corporate changes, fostering trust and confidence in the company's future direction.

Letter Template For Notifying Shareholder Of Corporate Restructuring Samples

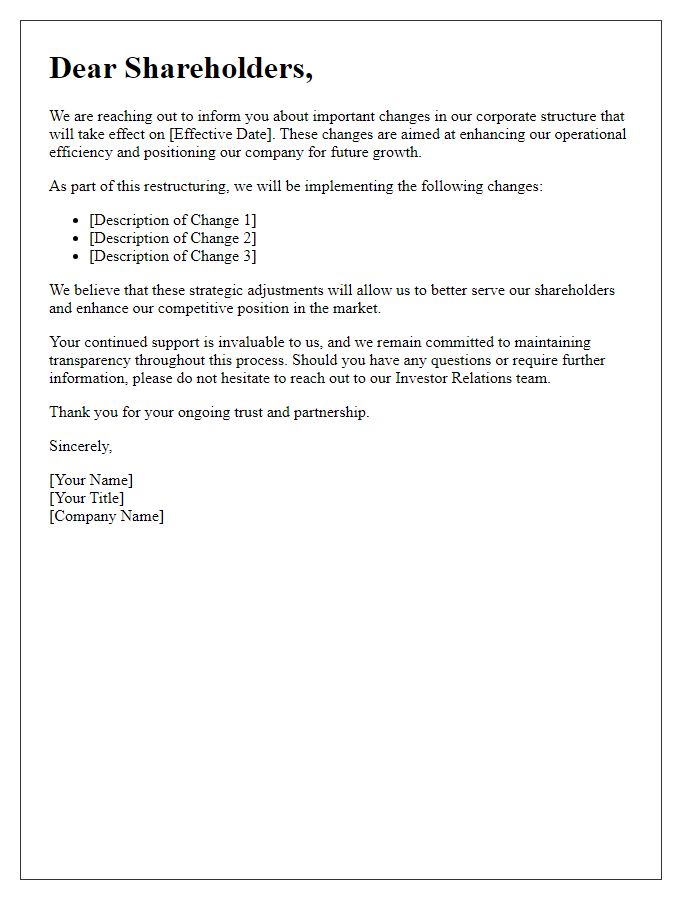

Letter template of announcing changes in corporate structure to shareholders

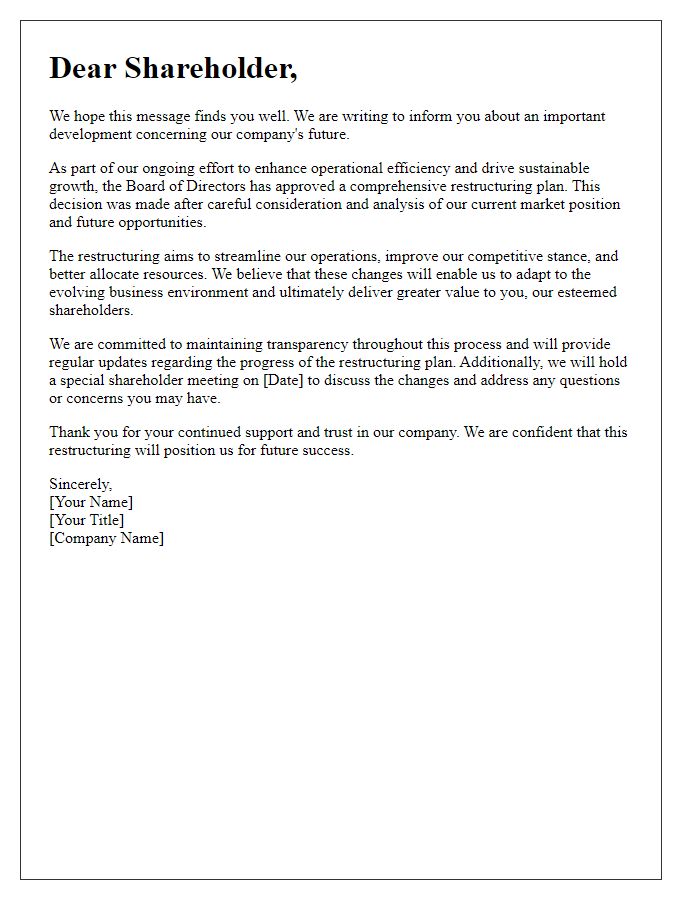

Letter template of shareholder communication regarding business restructuring

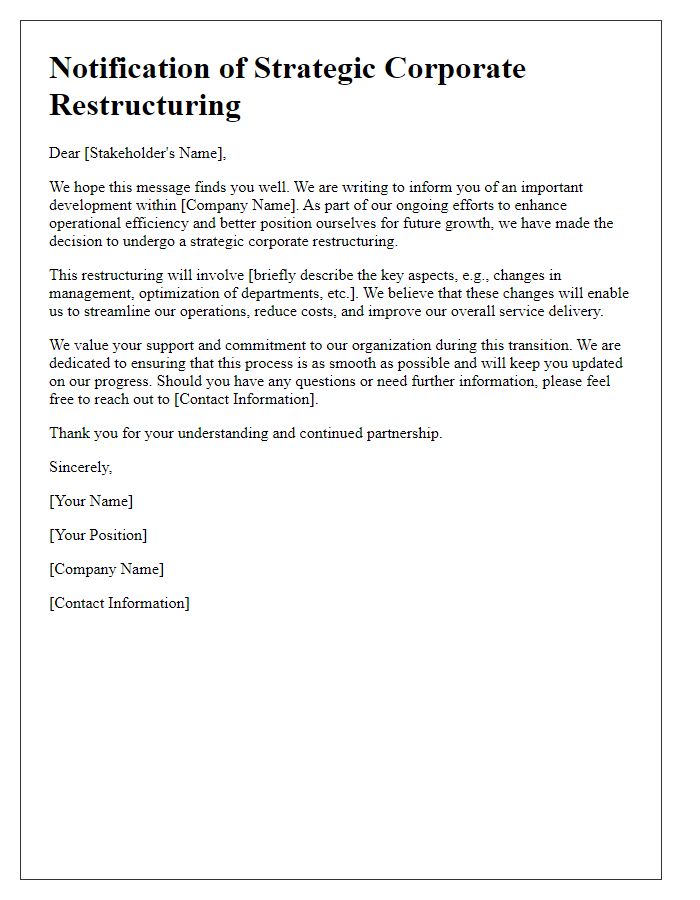

Letter template of notifying stakeholders of strategic corporate restructuring

Comments