When applying for a rental property, it's essential to communicate openly with your potential landlord, especially when it comes to past financial hiccups. If you've experienced late payments in the past, providing a clear and honest explanation can help clarify your situation and demonstrate your commitment. In this article, we'll guide you through crafting an effective letter template that addresses late payment issues while emphasizing your reliability as a tenant. So, let's dive in and explore how you can turn a challenging situation into a positive opportunity!

Reason for Late Payment

Consistent late rental payments can significantly impact tenant-landlord relationships. Many factors contribute to these financial delays, including unexpected medical expenses, job loss, or technical banking issues. For instance, a sudden medical emergency costing around $5,000 could deplete personal savings, causing missed payment deadlines. Additionally, timing discrepancies in direct deposits from employers can lead to unexpected shortfalls in available funds. Such situations often necessitate clear communication with landlords, detailing the reasons and proposing realistic repayment plans to maintain a positive rental history.

Financial Recovery Plan

Individuals facing late payment issues in rental applications often cite unforeseen circumstances, such as medical emergencies or job loss, severely impacting financial stability. Financial recovery plans are essential in addressing these challenges by outlining steps taken to regain economic stability. Budgeting efforts, including reducing discretionary spending by approximately 20%, alongside establishing a side income stream, can effectively demonstrate commitment to timely future payments. Regular communication with landlords, proposing realistic repayment schedules, can enhance transparency and trust. Additionally, providing proof of new employment or freelance income could reassure landlords about the applicant's commitment to fulfilling obligations in future rental payments.

Assurance of Future Timely Payments

Timely payment of rent is crucial for maintaining a good tenant-landlord relationship. A history of late payments may arise from unforeseen circumstances such as job loss, medical emergencies, or other financial strains. A proactive approach to communication can help ease concerns. Providing documentation, such as bank statements or proof of income, can illustrate the effort made towards financial stability. Furthermore, offering a detailed plan, including dates for upcoming payments and potential increases in income, ensures landlords that the commitment to timely payments is being prioritized for future rental periods. Demonstrating consistency, such as positive payment history prior to the incident, also reinforces reliability as a tenant.

Apology and Acknowledgment of Responsibility

Late payment of rent can lead to significant consequences for tenants, including eviction notices, damaged credit scores, and strained landlord-tenant relationships. Situations such as unexpected medical emergencies, job loss, or financial hardships can contribute to these delays. Clear communication with the landlord about the reasons for the late payment is essential, emphasizing personal responsibility and willingness to rectify the situation. Additionally, tenants should demonstrate their commitment to fulfilling future financial obligations by outlining a plan to prevent future delays, such as setting up automatic payments or creating a budgeting strategy. Engaging with local resources or community organizations might offer additional support in managing financial difficulties.

Contact Information for Further Discussion

In the context of a rental application, late payment explanations may require additional communication with potential landlords or property management. Providing clear contact information facilitates seamless discussions concerning financial matters. Including full name, email address (preferably a professional one), and a phone number ensures that landlords can reach the applicant directly for any inquiries or clarifications. Furthermore, specifying preferred contact times enhances the likelihood of prompt responses. This proactive approach not only demonstrates responsibility but also fosters transparency and open communication regarding any financial challenges faced previously.

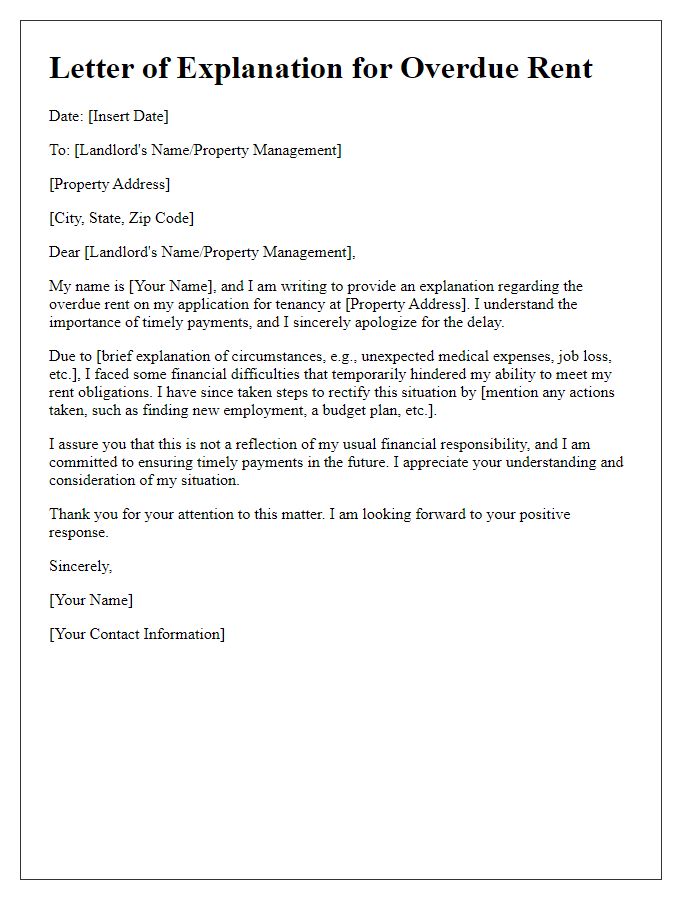

Letter Template For Rental Application Late Payment Explanation Samples

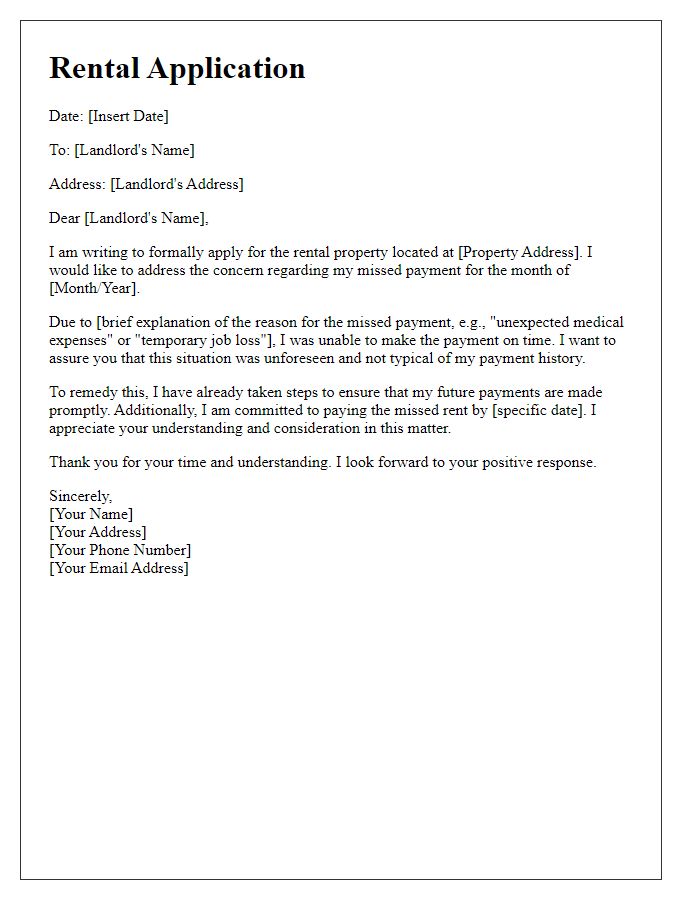

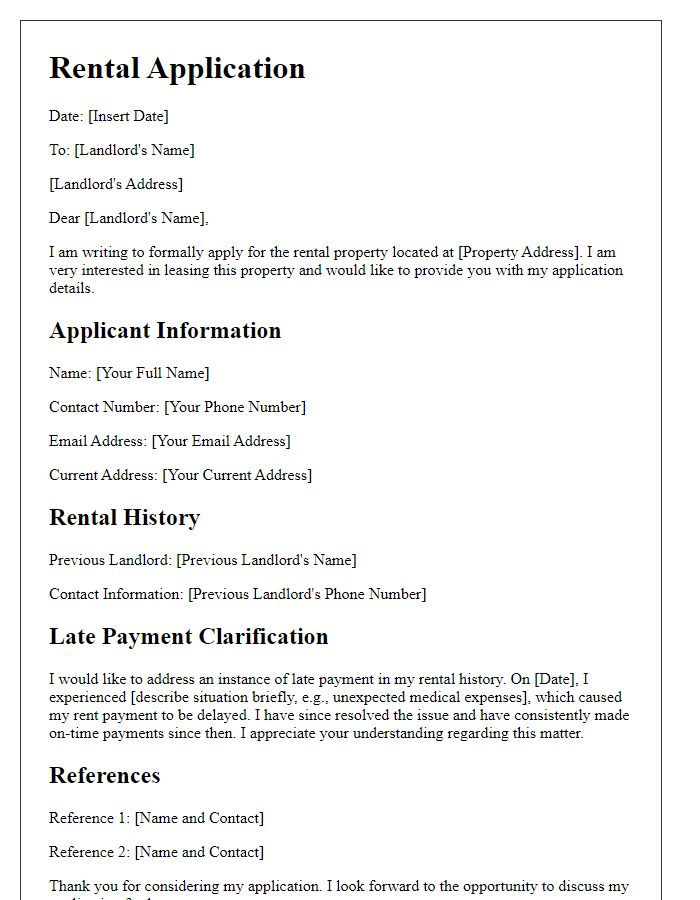

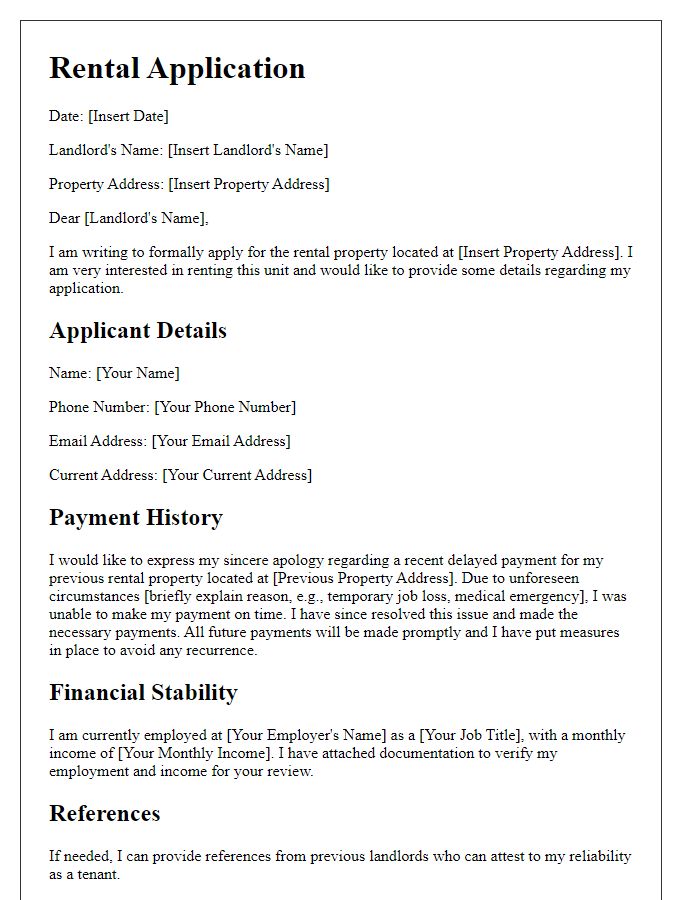

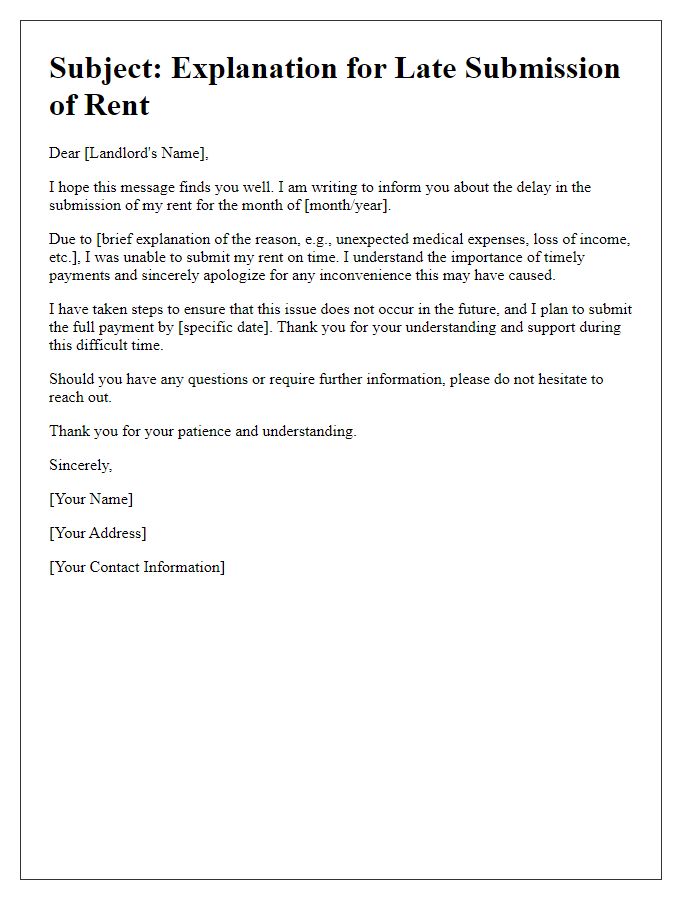

Letter template of rental application with explanation for missed payment.

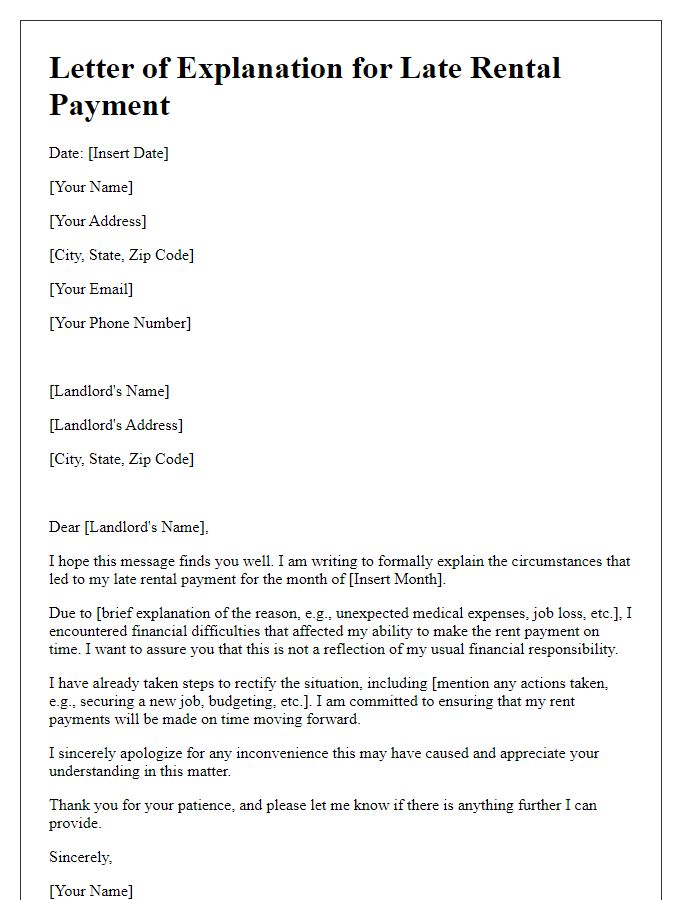

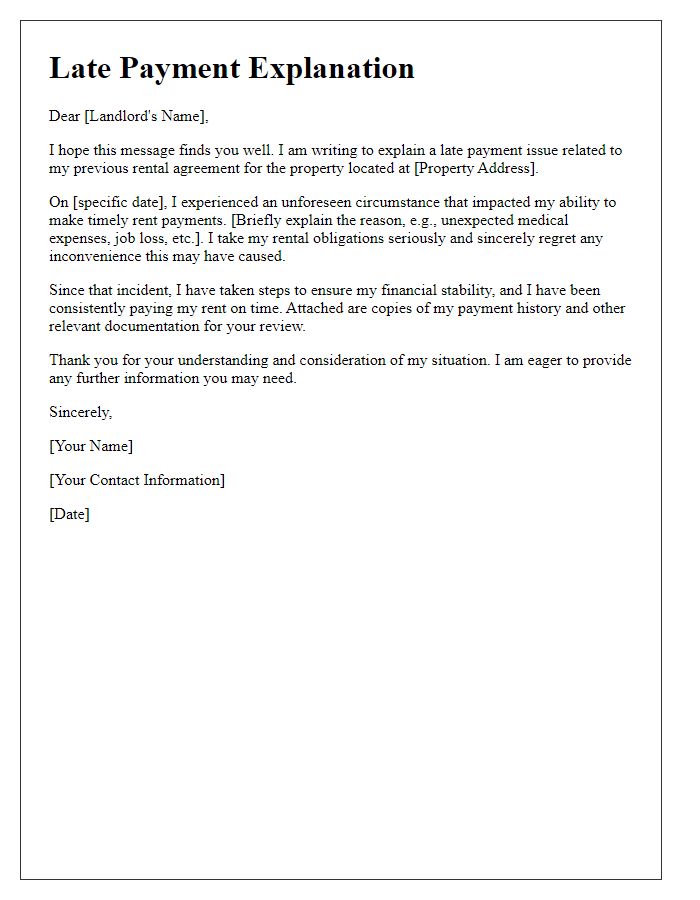

Letter template of explanation regarding late rental payment for application.

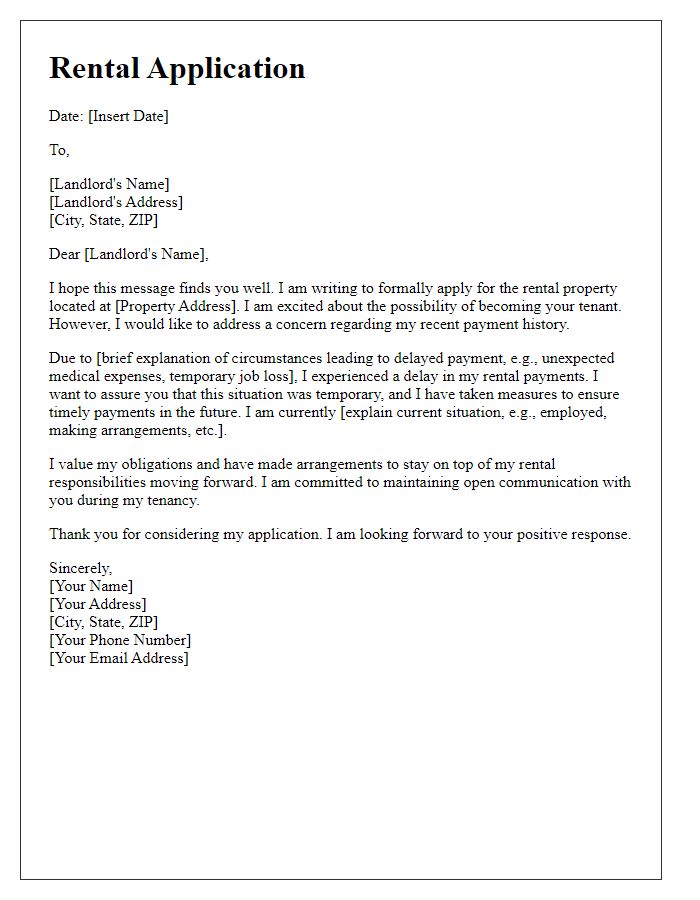

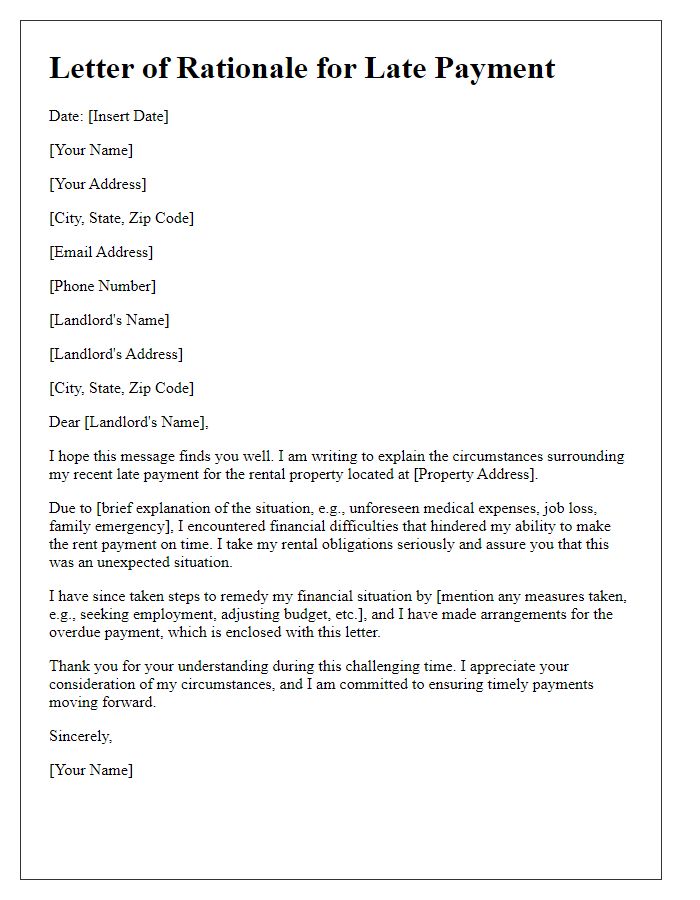

Letter template of rental application addressing delayed payment circumstances.

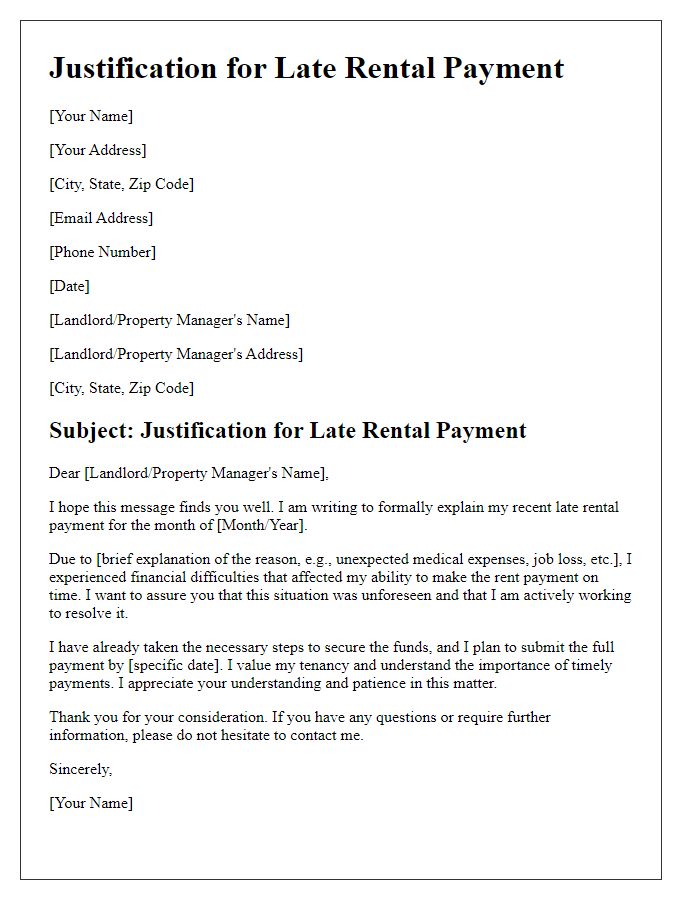

Letter template of justification for late rental payment during application process.

Letter template of rental application including late payment clarification.

Comments