When it comes to securing business funding, a well-crafted letter of application can set the right tone for your request. This type of letter not only highlights your business's strengths but also demonstrates professionalism and clarity in your approach. With essential details that lenders look for, such as your business's financial history and future projections, crafting the perfect letter is crucial. So, let's dive deeper into how to effectively draft your business credit application letter and get one step closer to securing that funding!

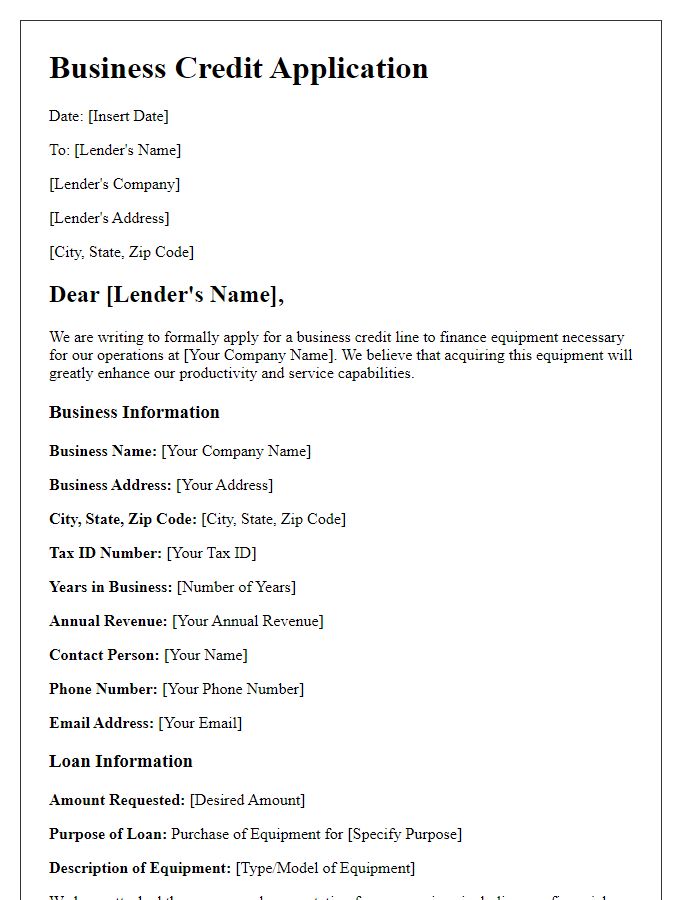

Business Information

When applying for business credit, detailed and accurate business information is crucial. Include the official business name (such as LLC or Inc.), established address (including city and zip code), and a valid phone number for contact purposes. Specify the type of business structure, for instance, sole proprietorship, partnership, or corporation, and provide the date of establishment. Ensure your Employer Identification Number (EIN) is included, along with the nature of your business activities, such as retail, manufacturing, or services. Additionally, include the average annual revenue figures (e.g., $250,000) and the number of employees to give a better context of the business size and potential growth. Details of any business licenses or permits relevant to your industry should also be provided for verification purposes.

Credit Needs and Purpose

A business credit application outlines a company's need for financing to support various operational activities and growth opportunities. Small businesses, particularly in industries like retail or construction, often seek credit to improve cash flow, purchase inventory, or invest in essential equipment. The purpose of acquiring credit could involve expanding operations, facilitating marketing campaigns, or upgrading technology infrastructure. Financial institutions typically assess the applicant's creditworthiness by analyzing financial statements, business plans, and projected revenue growth. Providing clear and detailed explanations of credit needs can enhance the likelihood of approval for loans or credit lines.

Financial Statements

Financial statements play a crucial role in a business credit application, as they provide a detailed snapshot of a company's economic health and operational performance. Typically, this includes a balance sheet, which highlights assets such as cash and inventory, liabilities like loans and payables, and shareholders' equity, illustrating the net worth of the company. Income statements are vital, detailing revenues from sales and expenses over a specific period, often a fiscal quarter or year, showcasing profitability through net income. Cash flow statements offer insights into cash inflow and outflow, revealing liquidity status and the ability of the business to cover short-term obligations. Financial ratios derived from these statements, such as debt-to-equity and current ratio, provide lenders with quantitative measures to assess risk and creditworthiness. Properly formatted statements, often reviewed by a certified public accountant, convey professionalism and reliability, boosting the confidence of potential creditors.

Credit References

When applying for business credit, accurate credit references are crucial. Credit references from established financial institutions, such as banks or credit unions, enhance credibility. Potential lenders often seek references from suppliers, like wholesale distributors or manufacturers, demonstrating reliable payment history. Including details such as account numbers (if applicable), credit limits, and contact information for each reference streamlines verification. Additionally, highlighting specific trade items or services acquired on credit terms reinforces trustworthiness, showing a robust financial relationship with various vendors. This comprehensive approach can significantly improve the likelihood of securing favorable credit terms for your business needs.

Contact Information

A business credit application typically requires essential contact information for effective communication and processing. This includes the business name, which signifies the official entity seeking credit; the business address, typically the registered location where operations occur, including street name, city, state, and zip code for precision; the phone number, often the main line of communication for inquiries and updates, ensuring timely responses; and the email address, which serves as a digital point of contact for receiving notifications and documents. Additional details might include the owner's name, providing a personal touch and accountability, and the business's tax identification number (TIN), which is essential for legal and financial verification purposes.

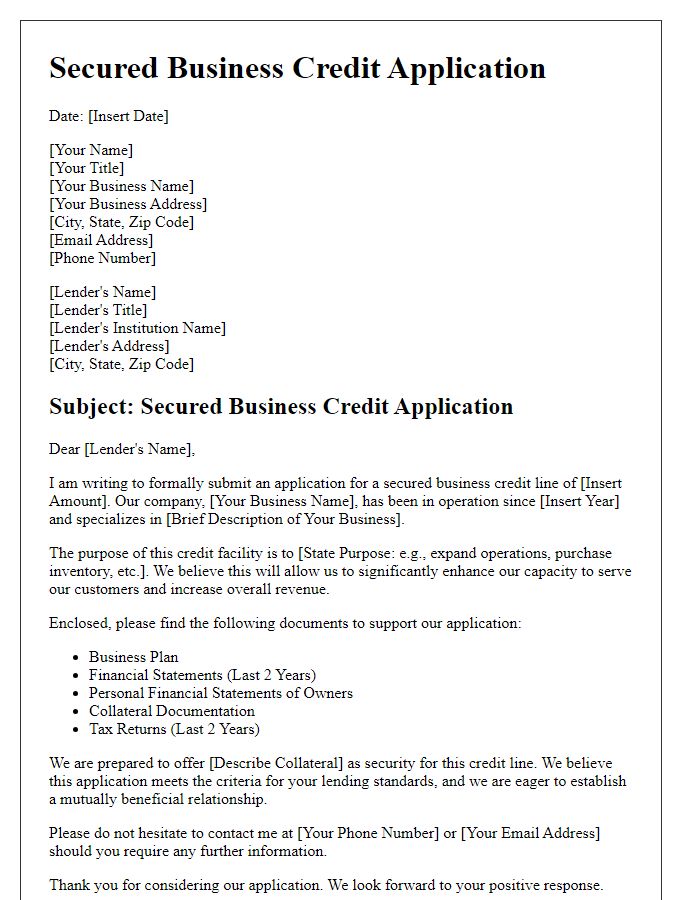

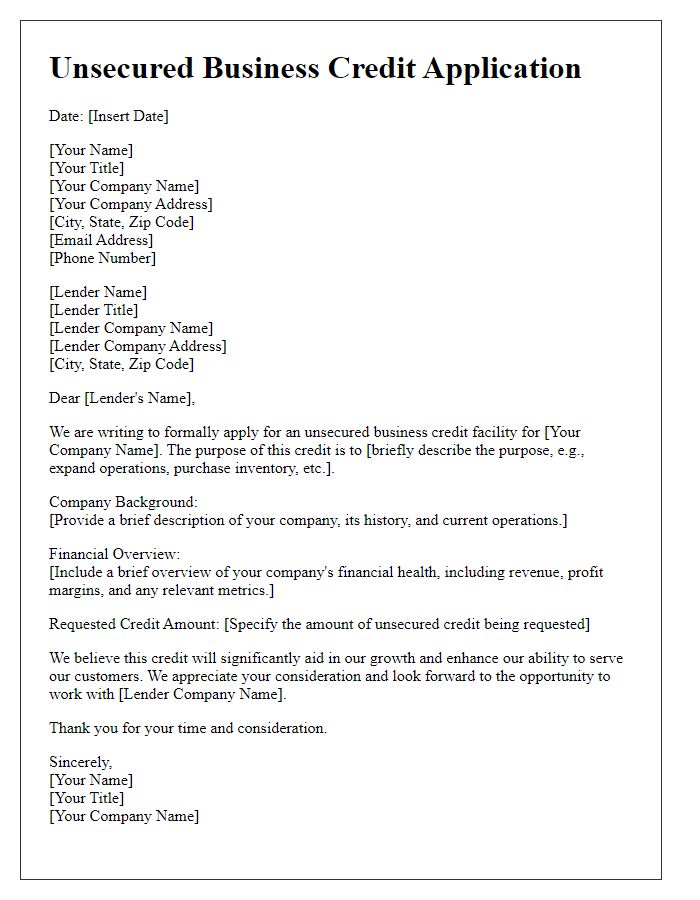

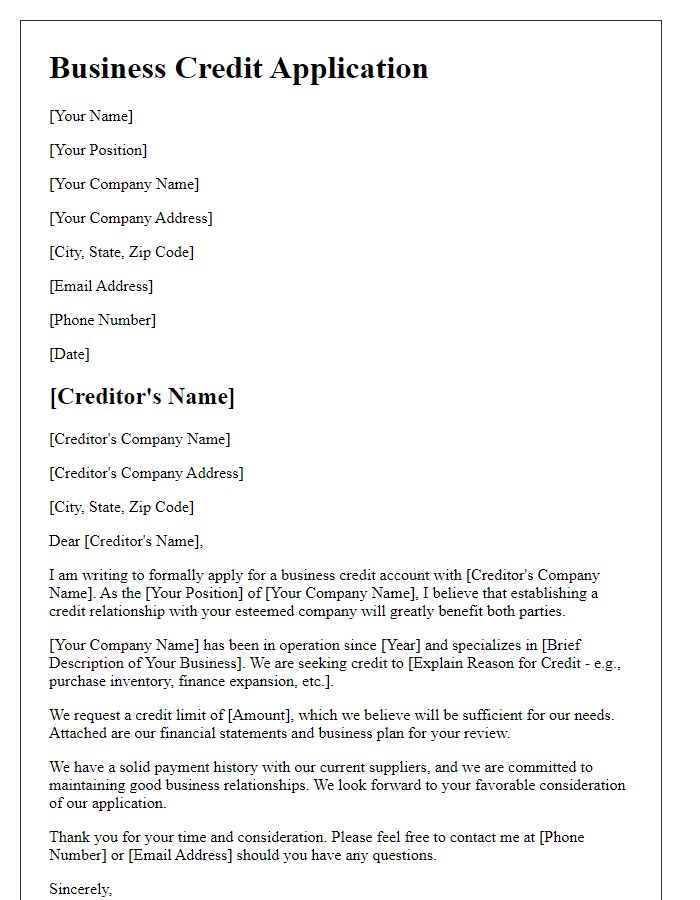

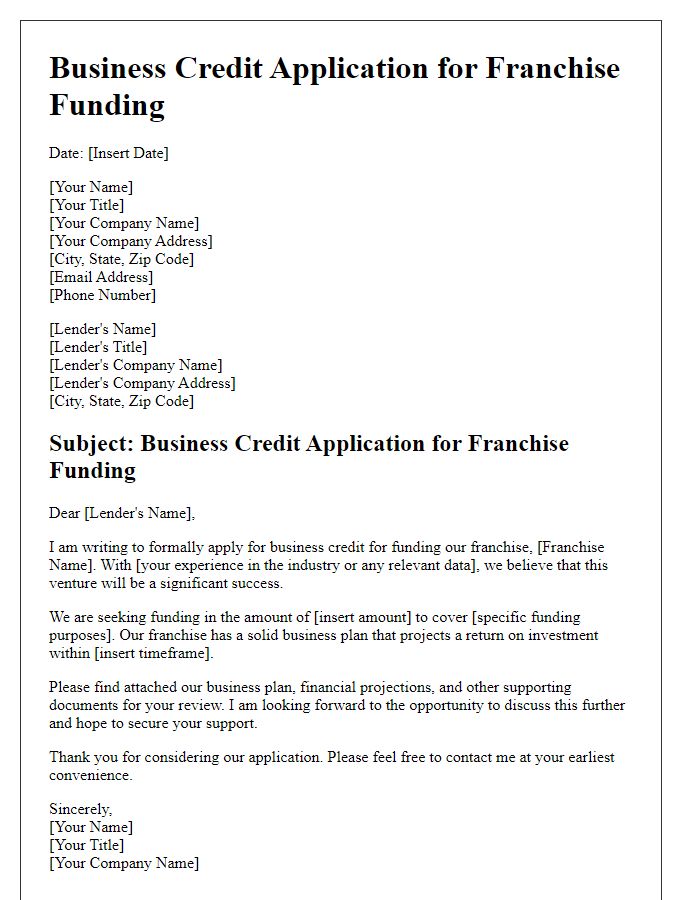

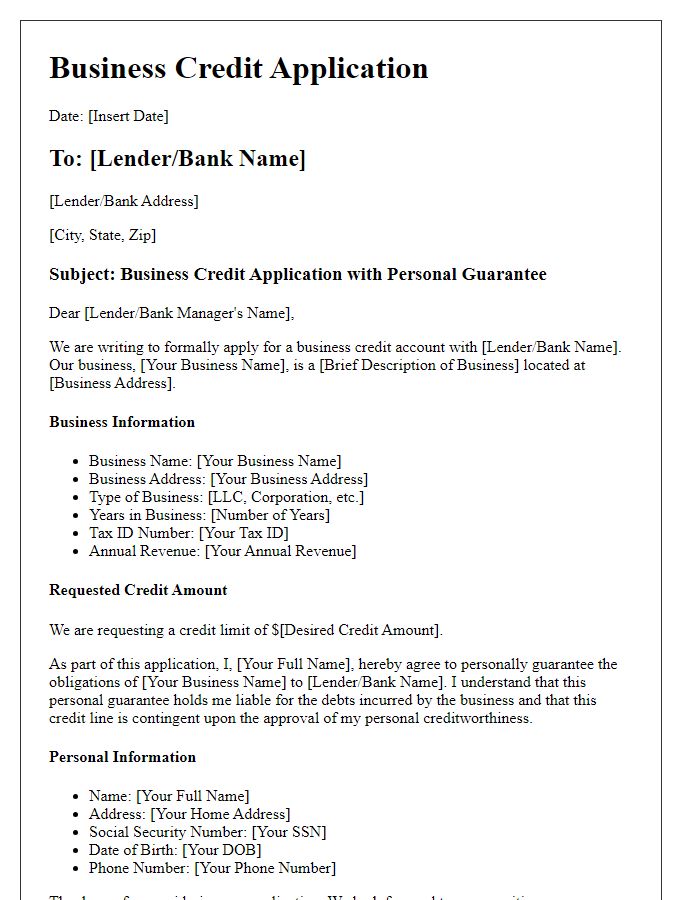

Letter Template For Business Credit Application Samples

Letter template of business credit application with financial statements

Comments