Have you ever discovered that your paycheck doesn't quite add up? If so, you're not alone, and it's essential to address any underpayment issues promptly to ensure you receive what you rightfully earned. In this article, we'll discuss how to draft a clear and effective letter template for an underpayment correction notice that will help you communicate your concerns professionally. So, let's dive in and make sure you're fully equipped to tackle this important task!

Accurate Employee Information

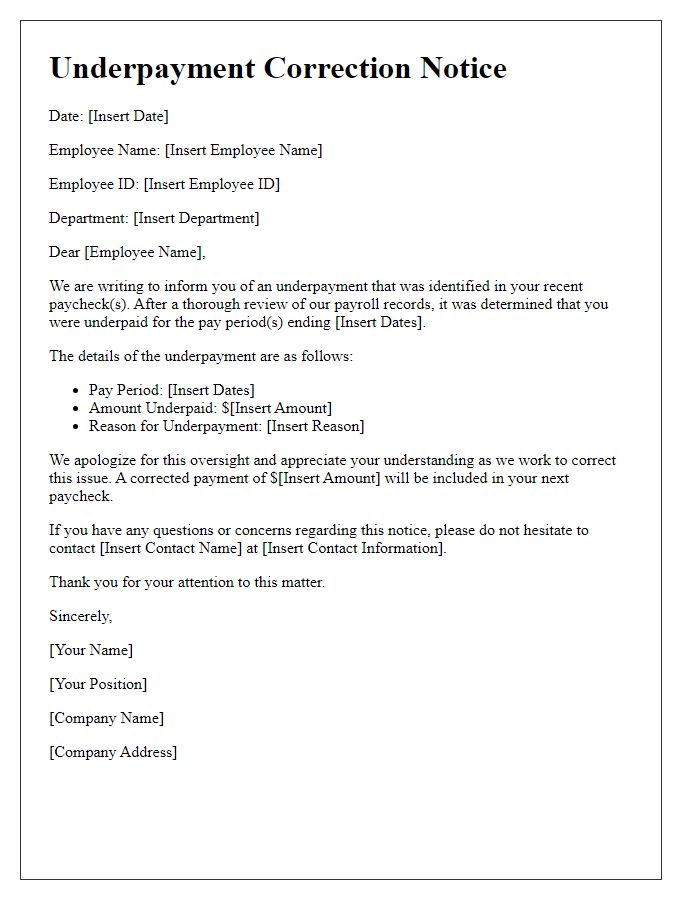

Inaccurate payroll records can lead to underpayment issues for employees, impacting financial stability. Employers must ensure employee information, including names, identification numbers, and pay rates, is meticulously maintained. For instance, discrepancies in social security numbers can complicate tax filings, while incorrect wage rates can result in violations of labor laws. Regular audits of payroll systems may identify inconsistencies, helping to prevent future errors. Additionally, maintaining accurate employee files aids in compliance with organizations like the Internal Revenue Service (IRS) and the Department of Labor (DOL), which impose stringent regulations on wage reporting. Proper documentation demonstrates an organization's commitment to ethical practices and fosters trust among employees.

Clear Explanation of Underpayment

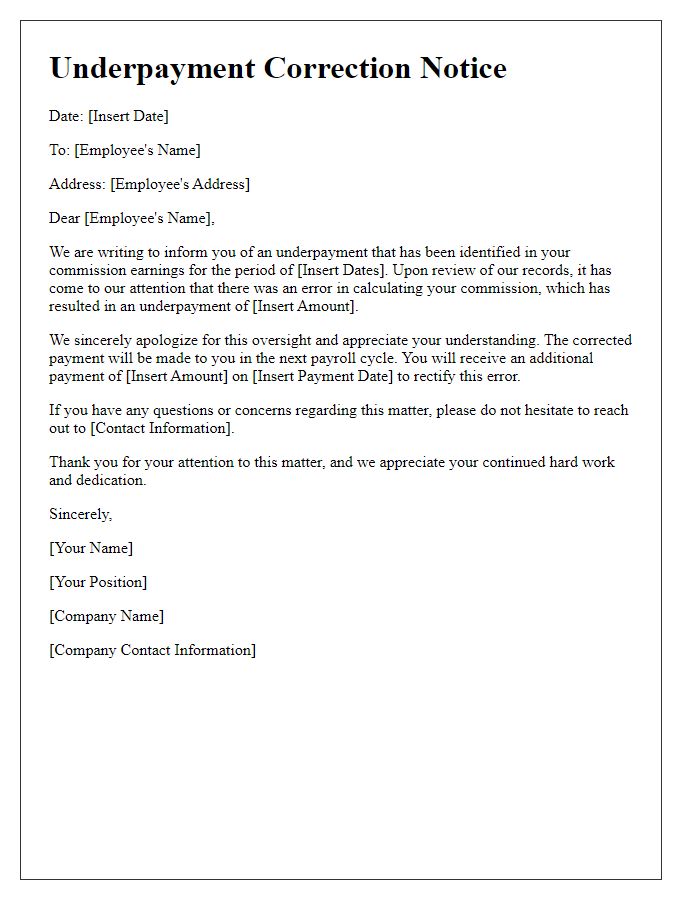

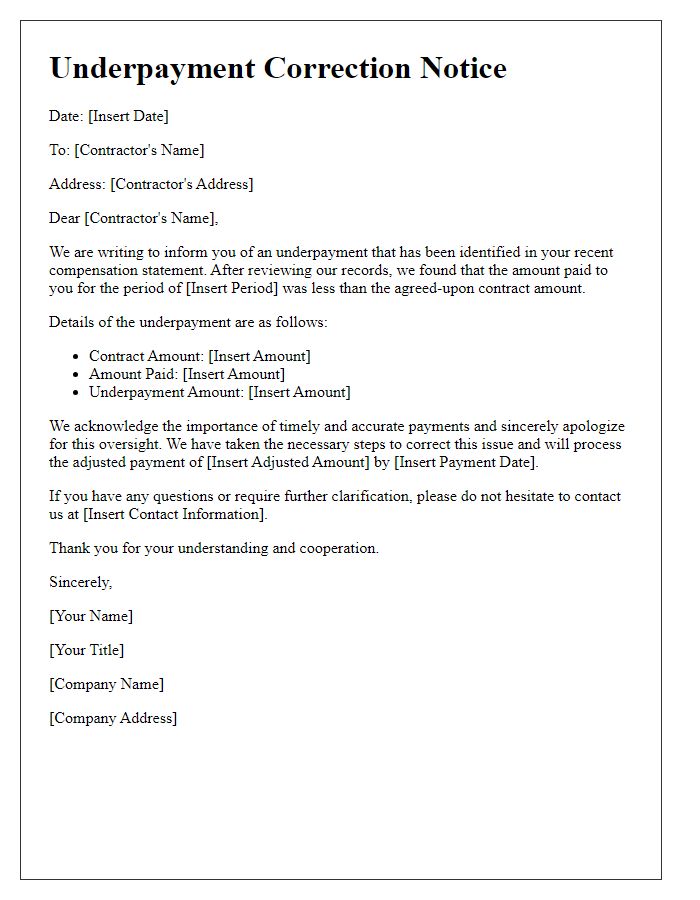

Underpayment correction notices are crucial for maintaining transparency in financial transactions. An underpayment occurs when a party receives less than the agreed amount, often due to calculation errors or miscommunication. In 2023, for example, payroll discrepancies were reported frequently in multiple industries, affecting employee satisfaction and trust. It is essential to provide detailed breakdowns of the original amounts versus the corrected amounts to clarify discrepancies. Such notices should be issued promptly to ensure timely resolution, especially in sectors like finance and retail where accuracy impacts cash flow and compliance. Further, including a timeline for correction and contact information encourages open communication, aiding in swift problem resolution.

Corrected Payment Details

Underpayment correction notices communicate important financial rectifications. The corrected payment details usually include essential information such as the payment amount, date of correction, and the responsible department or organization. For instance, if the underpayment was on a salary, the notice might state the correct gross amount owed after tax deductions, which could be impacted by regional tax rates such as those applicable in California (where state tax might be as high as 13.3%). Additional clarifications might involve how the underpayment occurred, reference to related invoices if applicable, and a timeline for when the corrected payment will be issued, ensuring transparency and trust in the financial process.

Apology and Acknowledgment of Error

Underpayment correction notices address discrepancies in financial transactions, particularly in payroll situations. Organizations often encounter errors in payroll processing, leading to employees receiving less compensation than owed. For instance, inaccuracies in time tracking or wage calculations can result in an underpayment scenario. Timely acknowledgment of the error is crucial for maintaining employee trust and morale. The notice typically includes an apology for any inconvenience caused, a clear explanation of the mistake, and the specific amount being corrected, alongside assurance that future payments will reflect the correct amounts. This process is essential for compliance with labor laws and adherence to ethical standards in business practices.

Contact Information for Further Assistance

Underpayment correction notices are essential for addressing discrepancies in financial transactions, particularly in payroll systems. Employers must provide accurate details regarding the employee's name, identification number, and job title for clarity. The notice should include specific amounts representing unpaid wages, with reference to particular pay periods and any applicable laws or regulations, such as those outlined by the Fair Labor Standards Act (FLSA). Contact information for further assistance is crucial; include the name of the payroll administrator, department phone number, and email address to facilitate swift resolution. Addressing such issues promptly can help maintain employee trust and compliance within the organization.

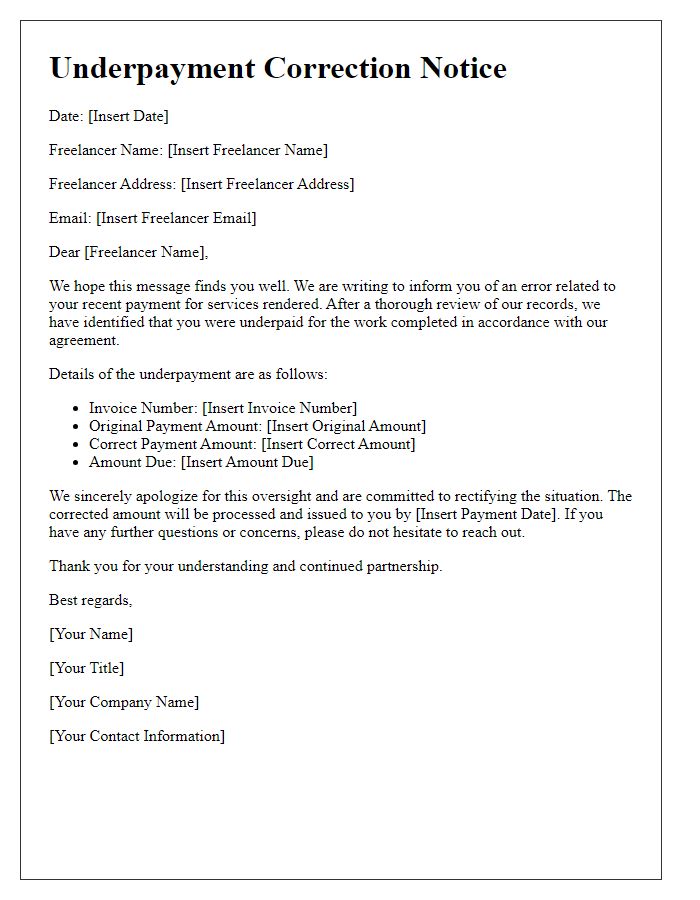

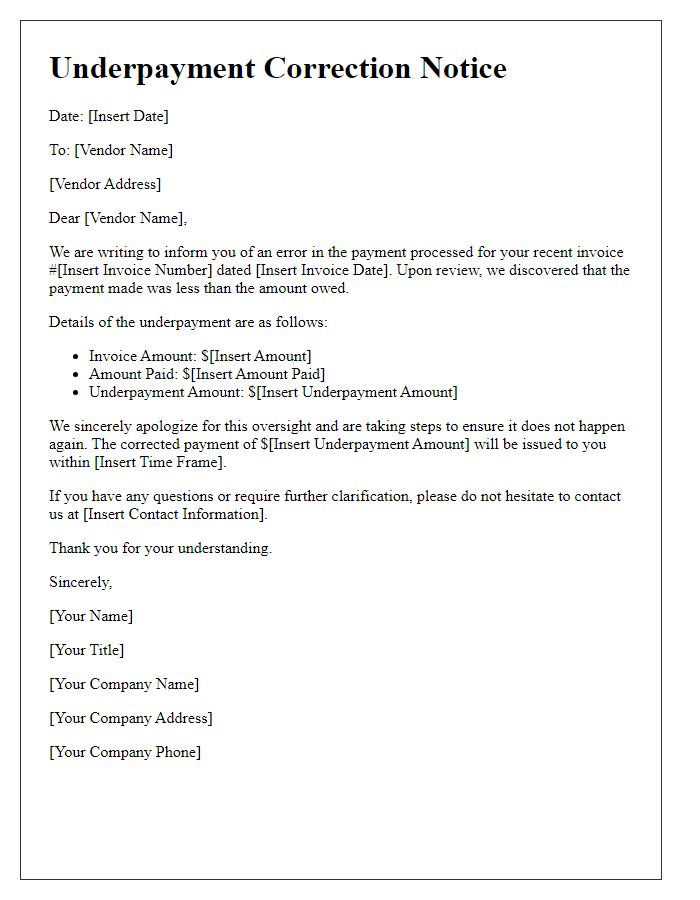

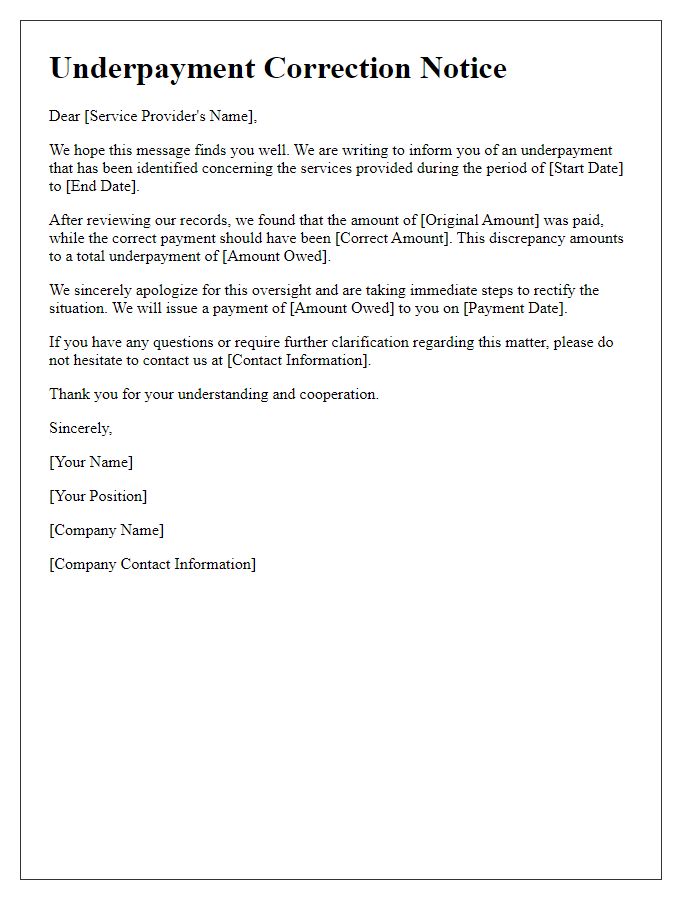

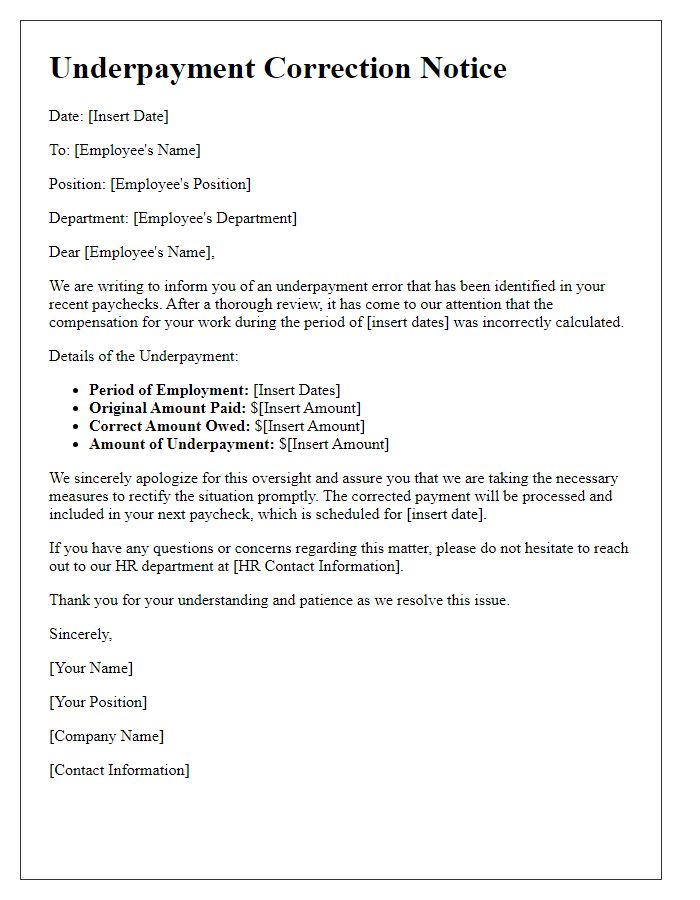

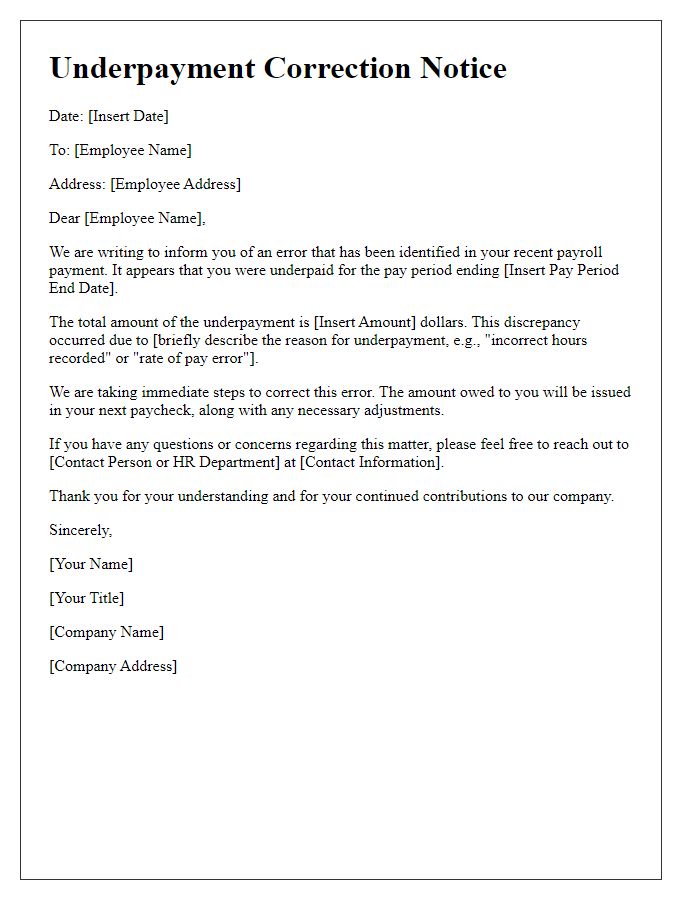

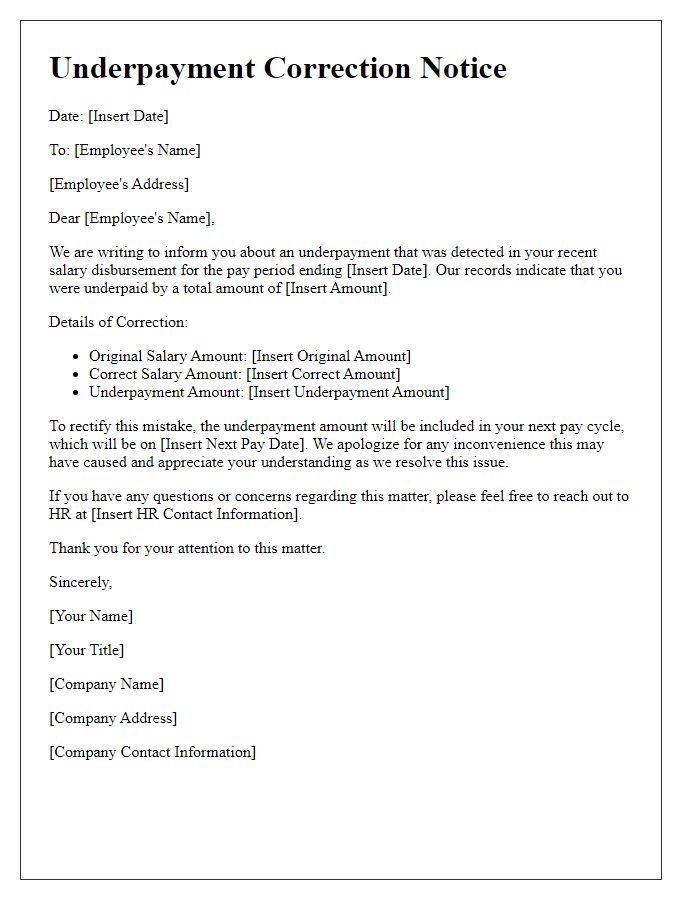

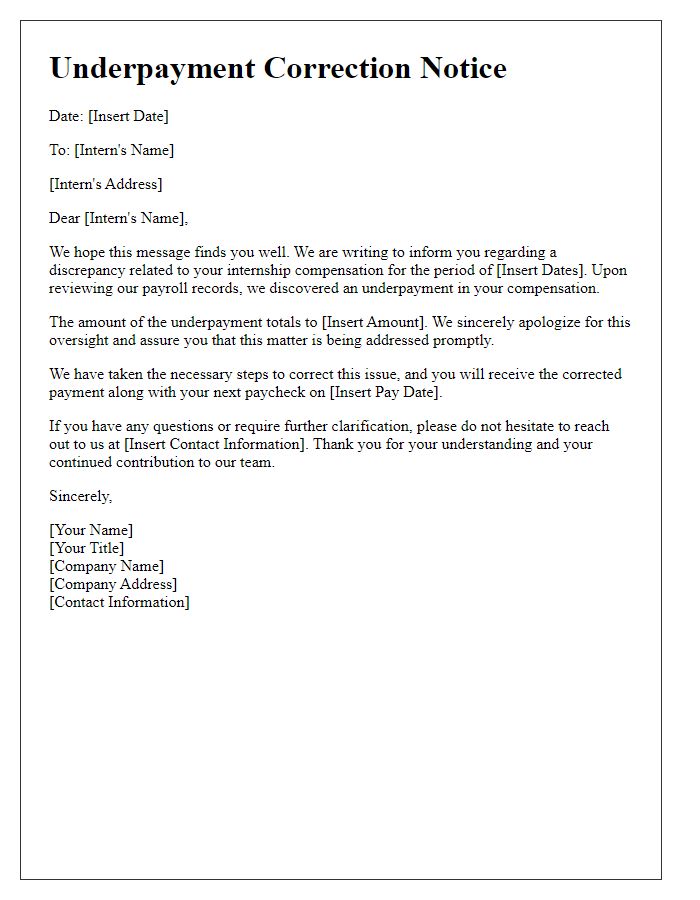

Letter Template For Underpayment Correction Notice Samples

Letter template of underpayment correction notice for commission-based workers

Comments