Hey there! As the year rolls around, it's that time again when we all need to pay attention to our property taxes. Staying on top of these deadlines can save you from late fees and unexpected penalties, which nobody wants. In this article, we'll provide you with a handy letter template to remind you and your loved ones about those annual property tax payments. So, let's dive in and ensure you've got everything you need to stay ahead of the game!

Property identification details

Annual property tax reminders are crucial for homeowners. Each property, identified by a unique tax identification number (TIN), includes essential details such as the property address (for example, 123 Main Street, Springfield) and assessed value (which could be listed at $250,000). Local government bodies, such as the Springfield Tax Assessor's Office, determine tax rates, which often range between 1.1% to 2.5% depending on jurisdiction. Timely payment deadlines are typically set for April 15th annually, ensuring property owners remain compliant and avoid penalties. Accurate record-keeping of tax receipts is vital, as homeowners may require documentation for future property transactions or audits.

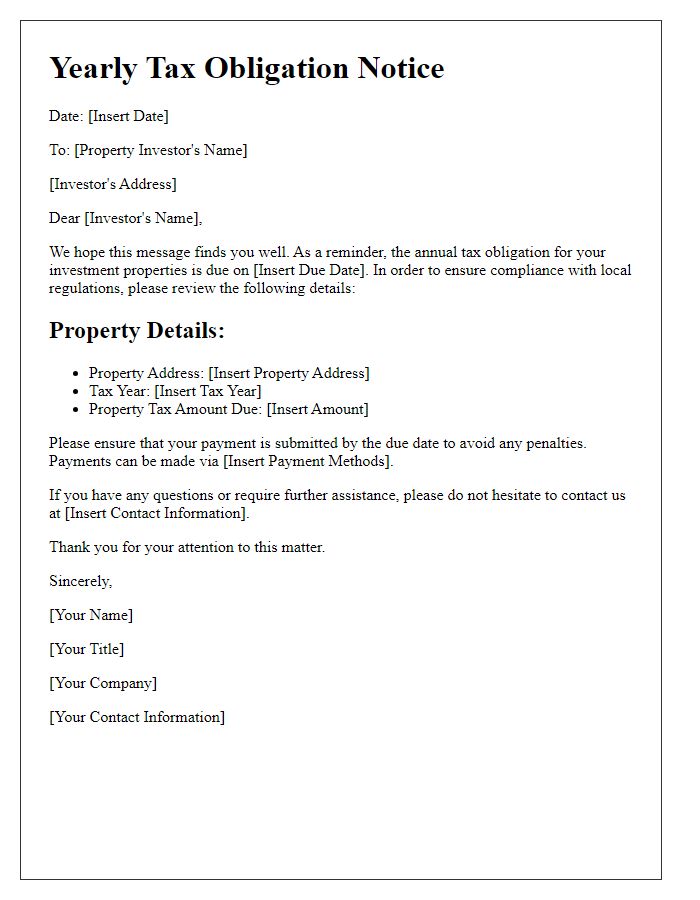

Tax amount due

Annual property taxes, often due in early December in many regions, typically require homeowners to be prepared for significant financial commitments. For example, the average property tax rate in the United States is approximately 1.1% of assessed property value, which can vary widely by state and locality, such as California or Texas. Homeowners should verify the specific due date and tax amount, often outlined in local government notices or on municipal websites, to avoid penalties and ensure timely payment. Additionally, utilizing various payment methods, including online payment platforms, can facilitate easier processing of these payments, ensuring compliance with local tax regulations.

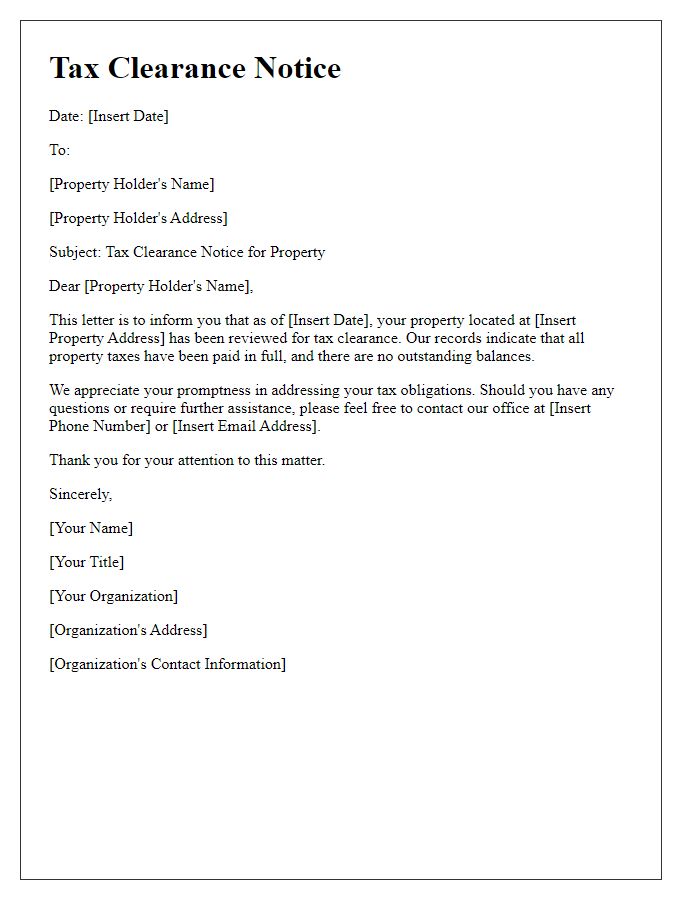

Payment deadline

Annual property tax assessments are crucial for homeowners, ensuring local governments can fund essential services. The payment deadline for this year's property tax in Harris County, Texas, is January 31, 2024, which maintains funding for schools, roads, and emergency services. Homeowners should verify their assessed property values to avoid discrepancies. Failure to pay by the deadline may incur penalties, increasing the total due by approximately 6% for each month the payment is overdue. Local officials encourage utilizing online payment systems or visiting designated offices in downtown Houston for assistance and guidance.

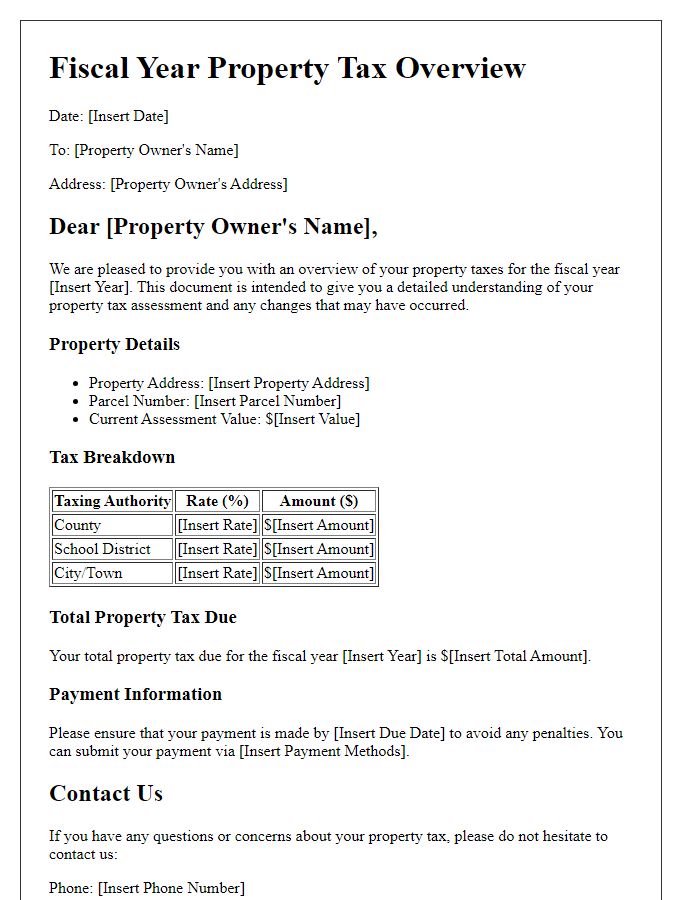

Accepted payment methods

Property owners in [City Name] can prepare for the annual property tax deadline by reviewing accepted payment methods, including online payments via the official [City Name] website, electronic funds transfer (EFT) through banks, and automated phone payments using [specific service number]. Additionally, taxpayers may opt for traditional methods such as checks or money orders mailed to the [Local Tax Collector's Office address]. In-person payments can also be made at the [Local Tax Collector's Office location] during regular business hours from [start time] to [end time] on weekdays. It is important to note that the property tax deadline is typically set for [specific date], and any taxes paid after this date may incur penalties and interest.

Contact information for inquiries

Annual property tax reminders play a crucial role in alerting homeowners about their financial obligations. These notifications typically include essential contact information for inquiries, such as the local tax assessor's office located in Springfield, which can be reached at (555) 123-4567. Moreover, the website www.springfieldtaxes.gov provides further resources, allowing property owners to access detailed information regarding assessment values and payment deadlines. Timely communication with the tax office ensures property owners understand their tax assessments set for the fiscal year of 2024, avoiding penalties associated with late payments.

Letter Template For Annual Property Tax Reminder Samples

Letter template of annual property taxation update for real estate stakeholders

Letter template of reminder for upcoming property tax payments for homeowners associations

Comments