Are you ready to take the exciting plunge into homeownership? Securing a pre-approval letter is a crucial step that not only solidifies your budget but also enhances your credibility as a buyer. This document acts as a powerful tool in a competitive market, showing sellers that you're serious and prepared. Join us as we delve deeper into the essentials of obtaining a home buyer pre-approval letter!

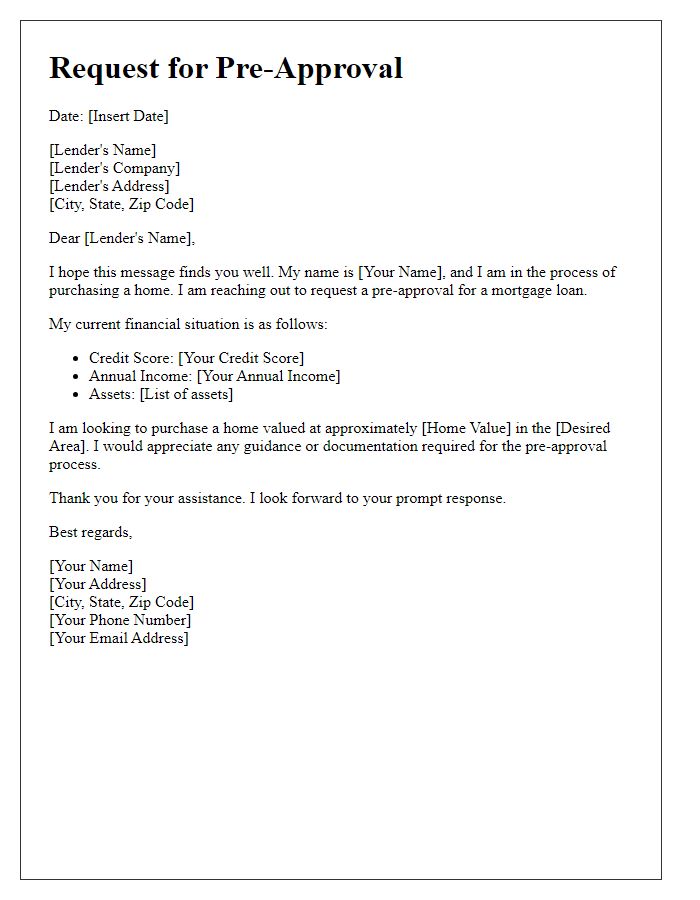

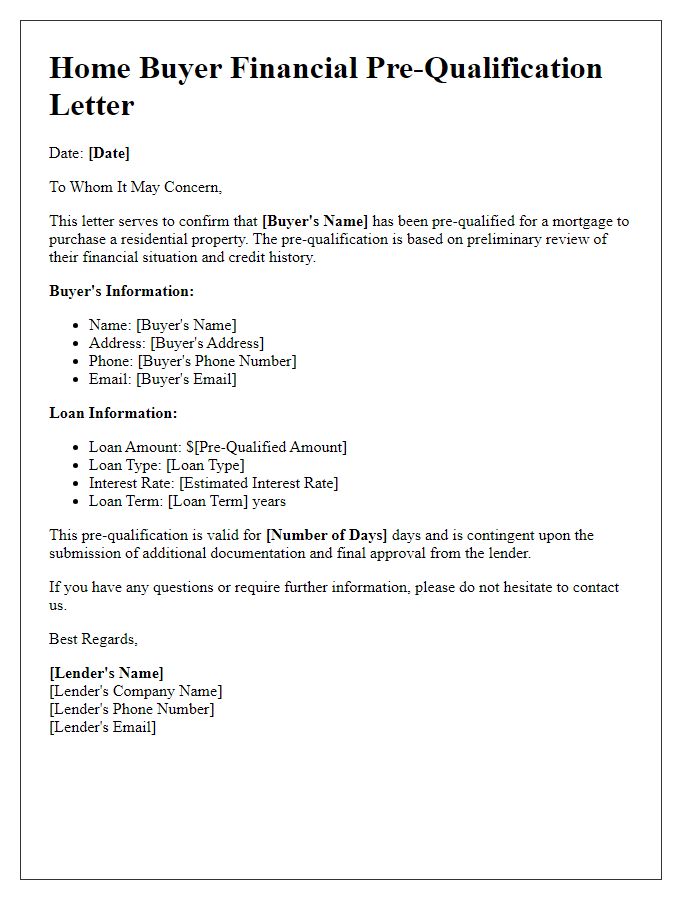

Borrower's information

Home buyer pre-approval provides important details that demonstrate a borrower's (individual seeking mortgage) financial viability. Borrower's information typically includes full name, residential address, date of birth, and Social Security number for identity verification. Income details such as monthly salary, bonus, and employment history, usually spanning at least two years, present a clear picture of financial stability. Additionally, assets like bank statements and retirement accounts support the assessment of available funds for down payment. Credit score analysis from agencies like FICO or VantageScore further aids lenders in evaluating the risk associated with granting financing for home purchases. This comprehensive overview of a borrower's financial profile helps in determining pre-approval amounts, ultimately shaping the home-buying journey.

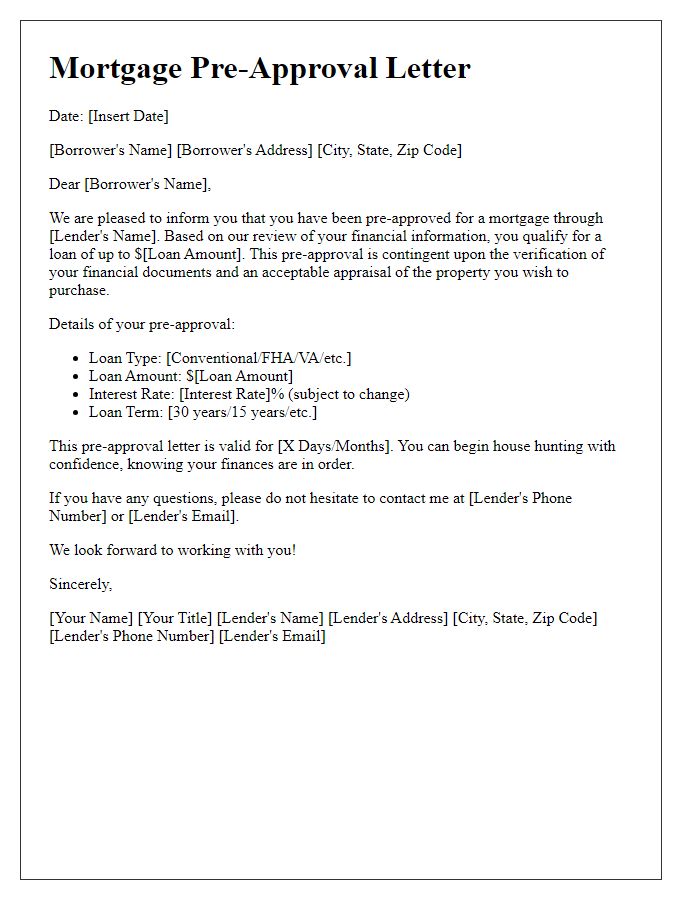

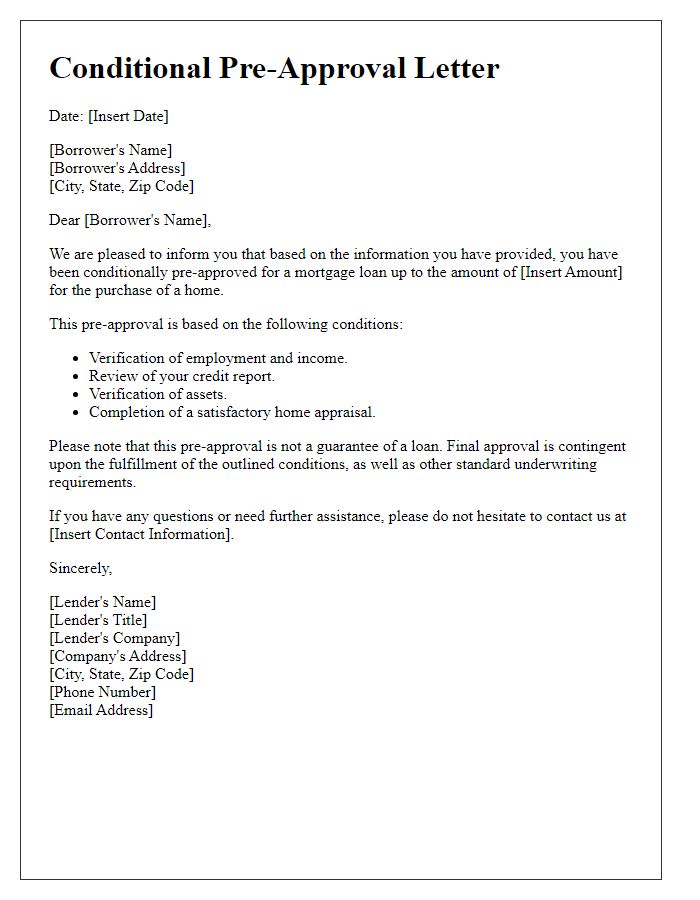

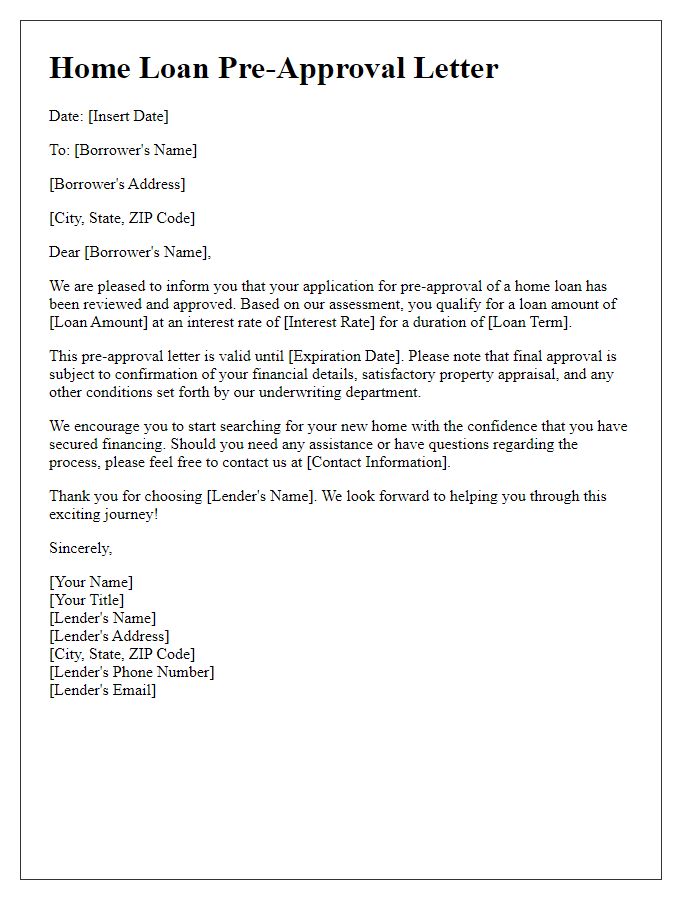

Loan amount and type

Home buyers seeking pre-approval must understand the significance of the loan amount and loan type. A loan amount, typically ranging from $100,000 to over a million dollars, determines the financial support available for purchasing property. Common loan types include Conventional loans (often requiring 20% down payment), FHA loans (offering lower down payments and catering to first-time buyers), and VA loans (available to veterans with no down payment). These factors play a crucial role in establishing a realistic budget for acquiring homes in designated neighborhoods or cities. Home buyers should ensure their pre-approval letter clearly states the maximum loan amount and the specific loan type to streamline the home-buying process.

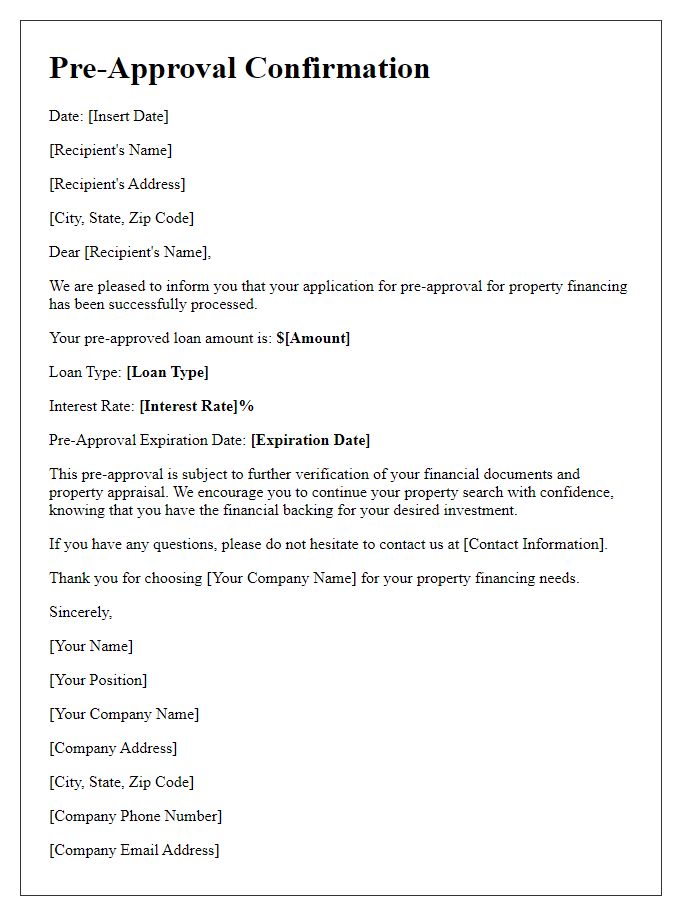

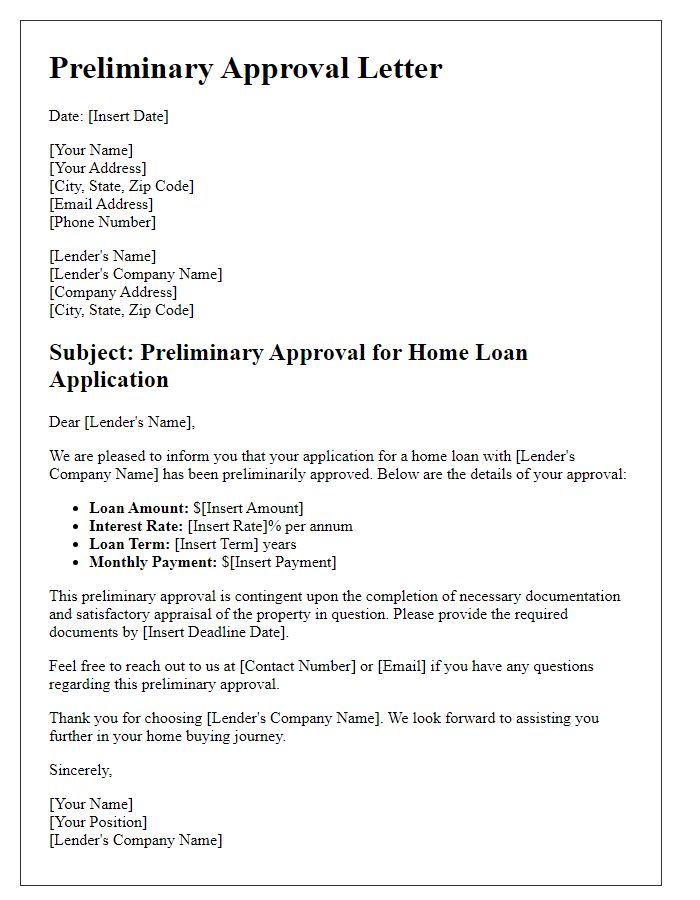

Lender's contact details

Home buyers seeking pre-approval should first contact reputable lenders that specialize in residential mortgages. Key details include the lender's contact information, such as company name, complete address, and phone number. Additionally, it is essential to acquire an email address for direct communication. Lending institutions often have dedicated mortgage advisors or loan officers; including their names can personalize the interaction. Availability hours also provide insight into when support can be accessed. Ensuring accessibility facilitates smoother transactions during the home purchasing process, particularly in highly competitive markets like California or New York.

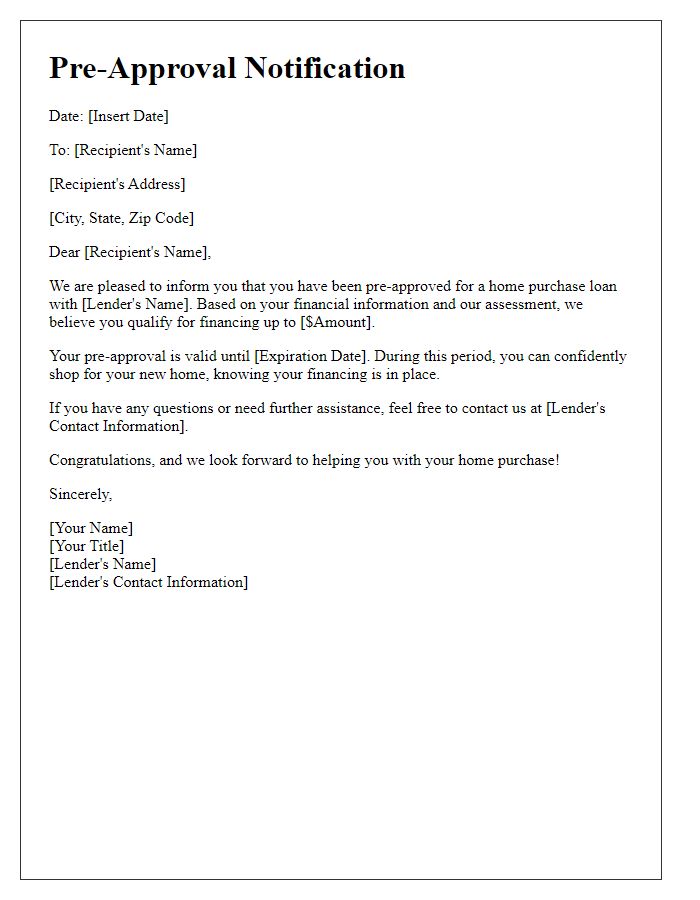

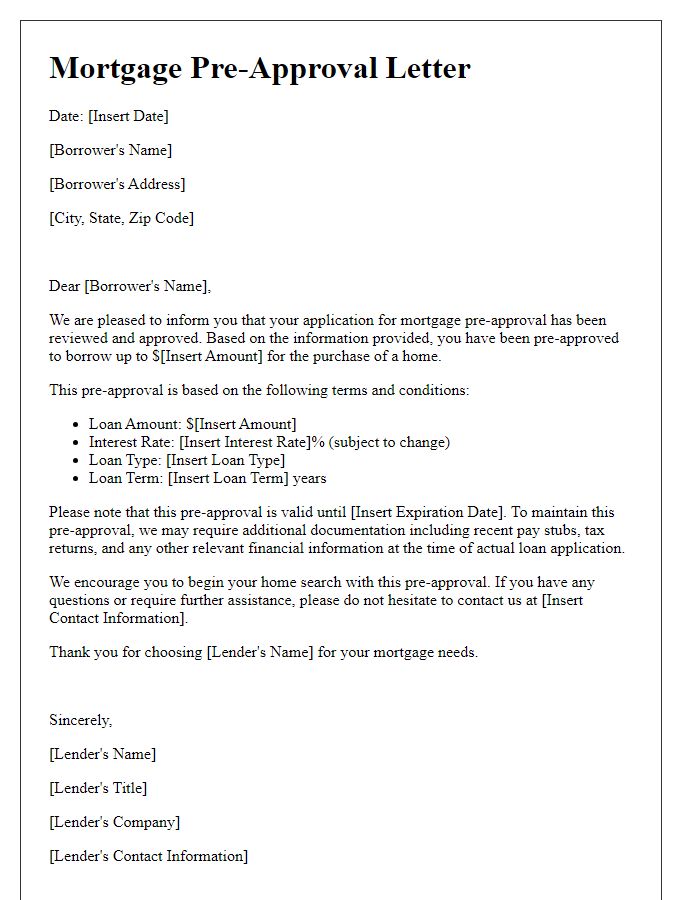

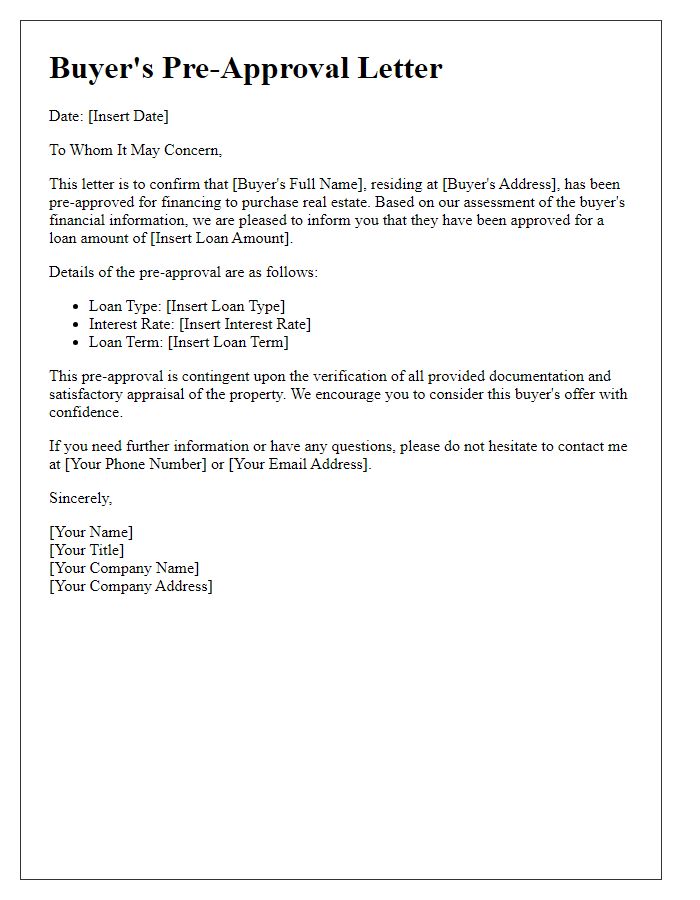

Expiration date of pre-approval

Gone are the days of uncertainty for prospective homeowners; the pre-approval process provides clarity and confidence. A mortgage pre-approval typically holds a validity period of 60 to 90 days, depending on the lender's policies. This time frame allows buyers to search for properties without the worry of financing falling through. Important factors influencing the expiration include changes in financial status and interest rates, which can impact loan terms. Buyers need to remain proactive by checking with lenders about expiration dates to avoid missing out on ideal opportunities in competitive markets like San Francisco or New York City, where real estate dynamics shift rapidly.

Property details

Obtaining pre-approval for a home purchase requires careful attention to property details, such as the address, listing price, and square footage. For instance, a property located at 123 Maple Street in Springfield may have a listing price of $350,000 and offers approximately 2,000 square feet of living space. This single-family home could feature three bedrooms and two bathrooms, appealing to families. Local amenities, such as schools (Springfield High School rated 8/10) and parks (Maple Park with walking trails and playground), can significantly influence financing options. Additionally, understanding the property's age (built in 2010) and potential maintenance costs is crucial for a comprehensive financial assessment.

Comments