Are you considering diving into the world of investment properties? Understanding cash flow analysis is essential for maximizing your profits while minimizing risks. This process not only helps you evaluate potential returns but also guides your investment decisions. Join us as we explore the intricacies of cash flow analysis in detail, ensuring you have all the insights needed to make informed choices!

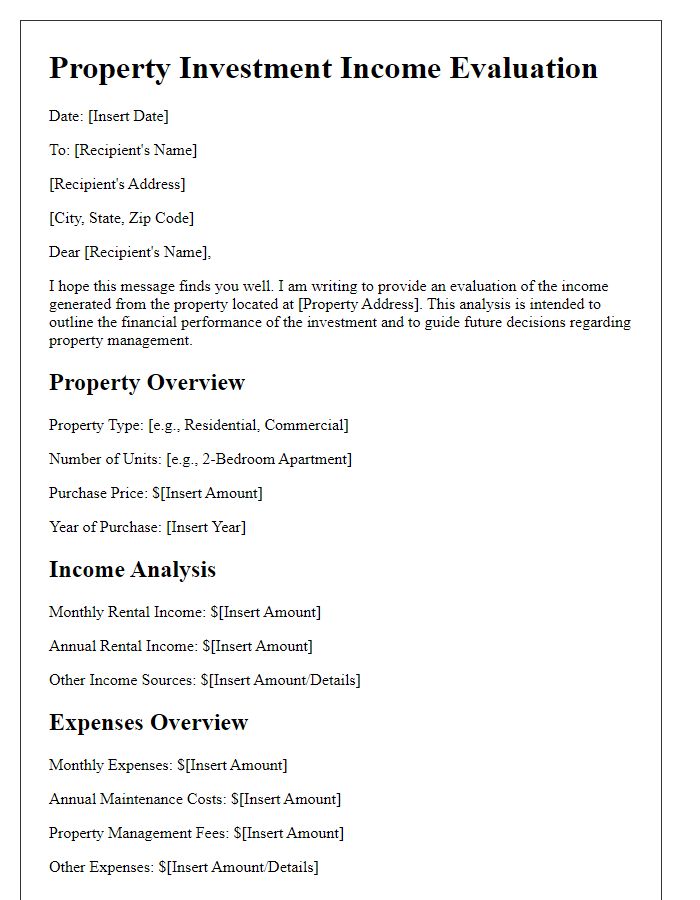

Property Description

The investment property's description details a single-family home located at 123 Elm Street, Anytown, USA, constructed in 2018 with three bedrooms and two bathrooms. The property features a total living area of 1,500 square feet, situated on a 6,000 square foot lot. Current market value estimated at $350,000, offering potential for appreciation. Monthly rental income averages $2,200, based on comparable properties in the area, contributing to positive cash flow. Annual property taxes approximate $3,500, while homeowners insurance costs around $1,200 per year. Recent renovations, including a new roof July 2022 and modern kitchen upgrades, enhance its rental appeal, ensuring higher occupancy rates. Additionally, the neighborhood boasts a low vacancy rate of 5%, alongside an increase in median home prices by 10% over the past year, indicating strong demand.

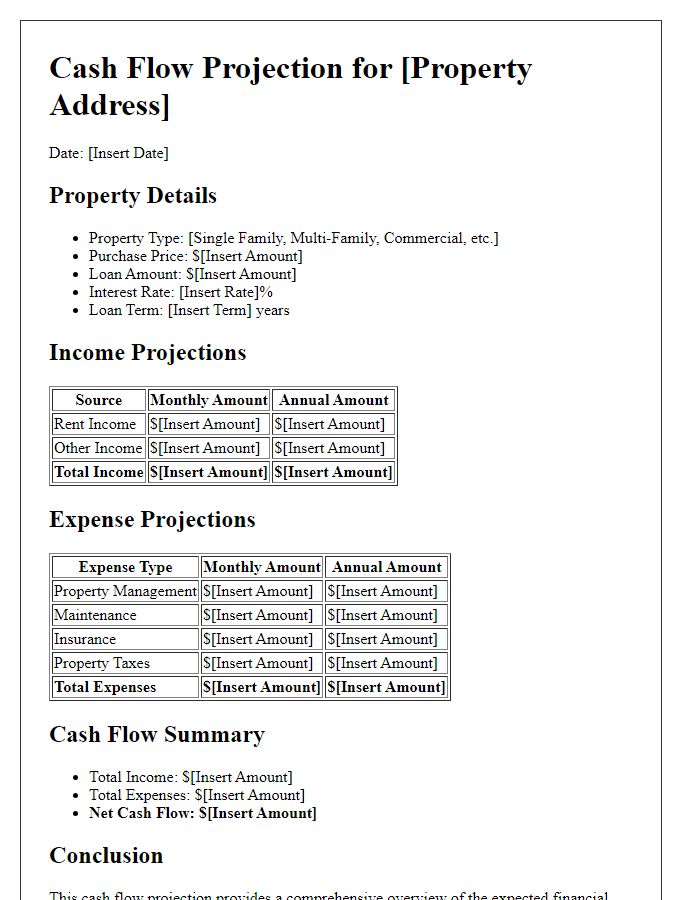

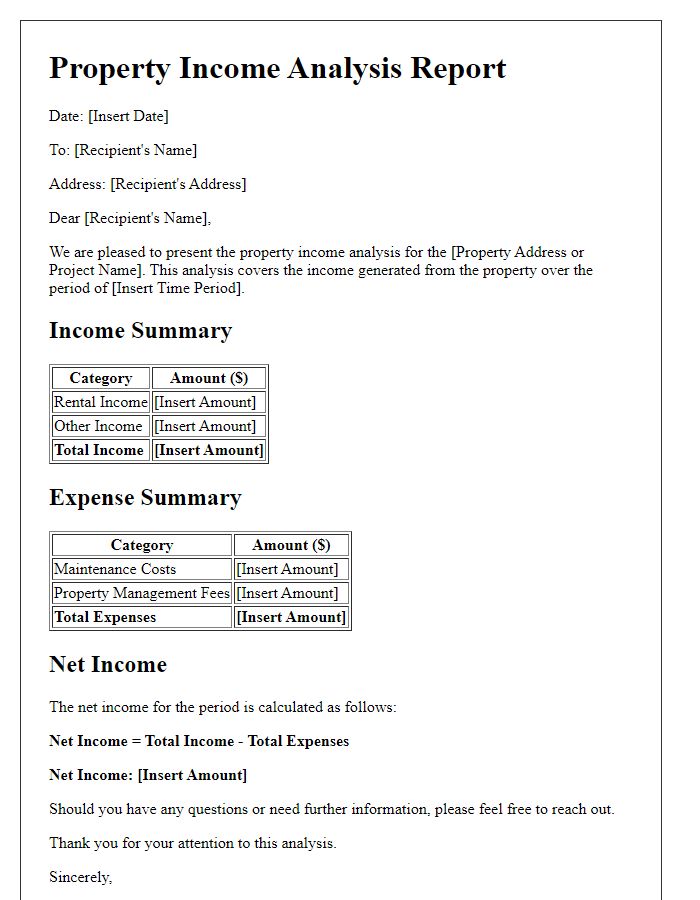

Income Generation Analysis

Investment properties, particularly residential rentals in metropolitan areas, can yield significant cash flow when properly analyzed for income potential. Gross rental income, which might range from $1,200 to $3,500 per month depending on location and property type, serves as the primary revenue source. Operating expenses, typically accounting for 30-50% of gross income, include property management fees, maintenance costs, property taxes, and insurance premiums. Net operating income (NOI) is derived by subtracting total operating expenses from gross rental income, providing a clearer picture of profitability. Additionally, factors such as vacancy rates--common rates of 5-10% in urban settings--impact overall income generation. Real estate market trends, influenced by economic indicators like unemployment rates or median household income, also play a crucial role in assessing potential returns on investment. Understanding and monitoring these financial metrics ensures informed decision-making for sustainable cash flow.

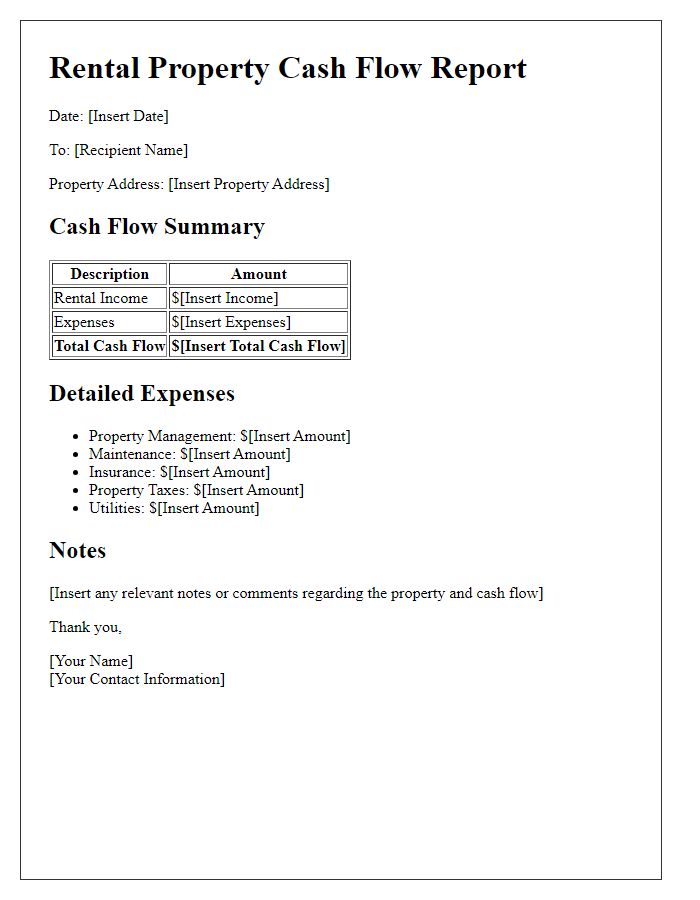

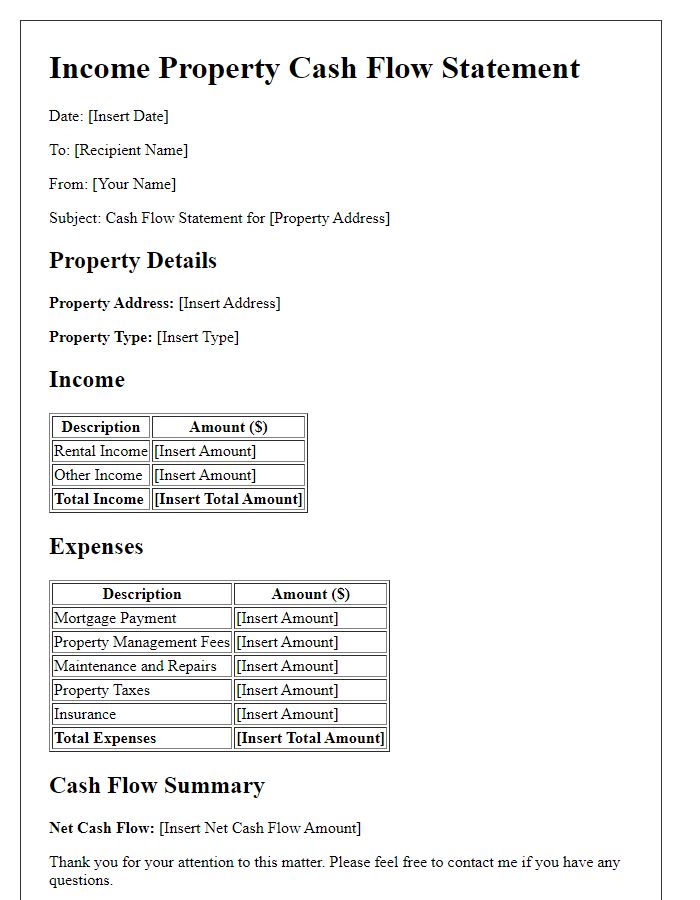

Expense Breakdown

A comprehensive expense breakdown for investment properties is crucial for assessing cash flow sustainability. Common expenses include property management fees, which can range from 8% to 10% of rental income; maintenance costs, typically budgeted at approximately 1% of the property's value annually; insurance premiums, often around $1,000 to $1,500 for single-family homes; property taxes, which can vary widely by region, averaging 1.1% of assessed property value in the United States; and utilities, which may range from $100 to $300 per month, depending on property type and tenant agreements. Additional expenses might involve advertising costs for vacancy periods, legal fees for lease agreements, and occasional repairs, which can average between $500 to $2,000 annually. Accurate documentation and forecasting of these costs ensure a clear understanding of the investment's financial health and long-term viability.

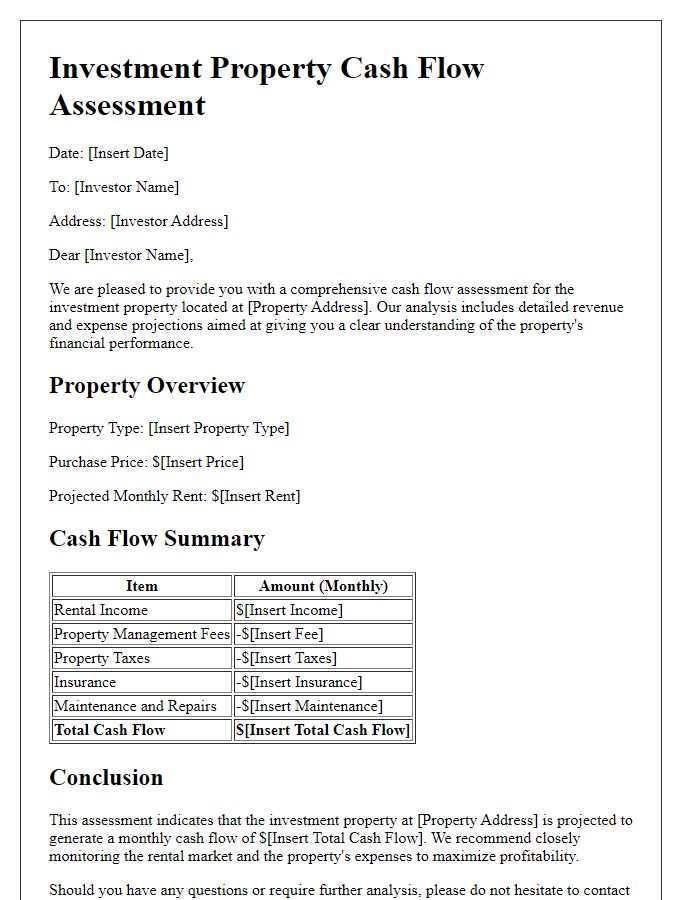

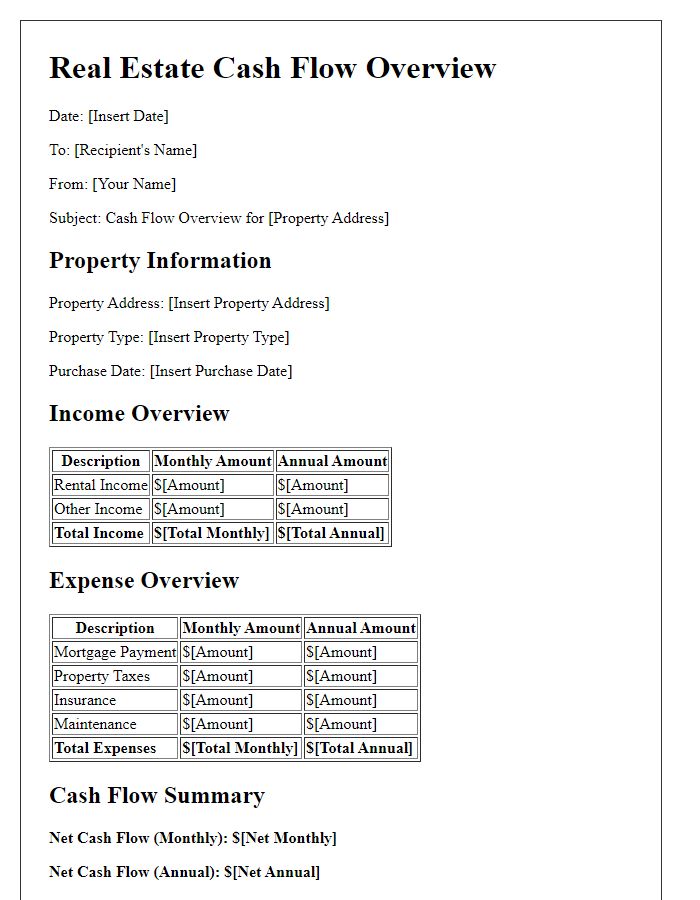

Net Cash Flow Summary

Net cash flow analysis for investment properties involves assessing the income generated by rental activities against the associated expenses to determine financial viability. Rental income, often derived from tenants in residential units or commercial spaces, can vary significantly by location, size, and condition of the property. Mortgage payments on the property, which typically include principal and interest, influence cash flow, with adjustable-rate mortgages potentially causing fluctuating monthly obligations. Operating expenses, including property management fees, maintenance costs, property taxes, and insurance, are crucial to delineate. Additionally, vacancy rates, which can fluctuate based on market conditions, impact overall cash flow; properties in high-demand areas may experience lower vacancy rates. Understanding these variables helps investors project future cash flows, making informed decisions regarding property acquisition and portfolio management.

Investment Return Metrics

Investment property cash flow analysis involves evaluating various investment return metrics to assess profitability. Key metrics include Net Operating Income (NOI), calculated by subtracting operating expenses from rental income, which is critical for understanding property performance. Cash Flow, derived from NOI after deducting mortgage payments, provides insight into immediate financial health. Capitalization Rate (Cap Rate), representing the ratio of NOI to property value, helps investors gauge return on investment relative to market conditions. Additionally, Internal Rate of Return (IRR), which reflects the rate of growth an investment is expected to generate annually, is vital for long-term planning. Investors must also consider Cash-on-Cash Return, which analyzes annual pre-tax cash flow against the total cash invested, ensuring projections align with financial goals. Evaluating these metrics within the context of local market trends and economic indicators is essential for making informed investment decisions.

Comments