Are you feeling overwhelmed by debt and unsure of where to start? You're not aloneâmany people find themselves in similar situations, often needing a clear plan to regain financial stability. Crafting a debt repayment plan can be a game-changer, allowing you to take control and work towards a debt-free future. If you're interested in learning how to create an effective repayment strategy, keep reading for valuable tips and templates!

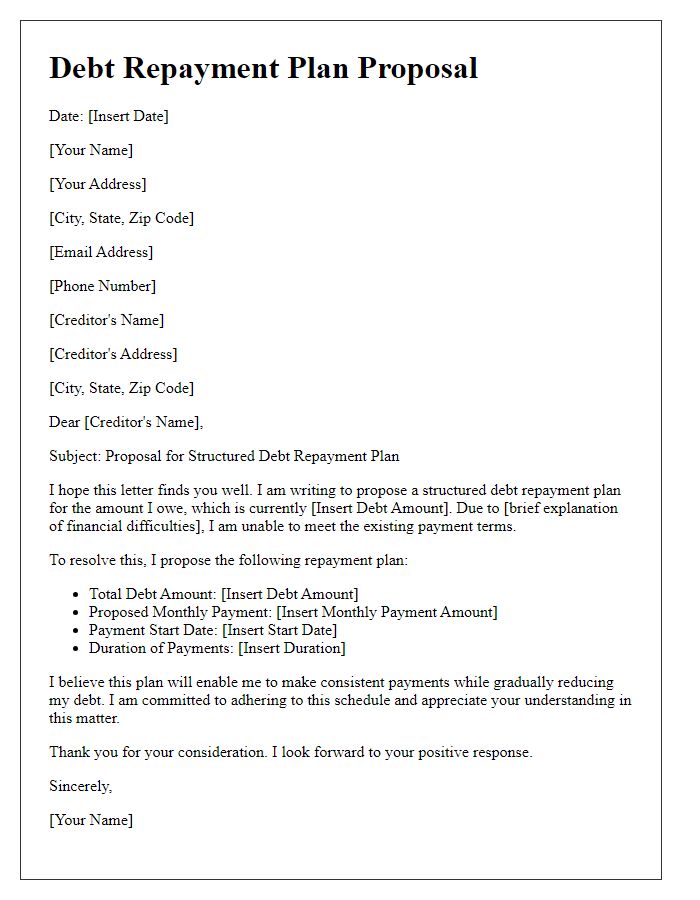

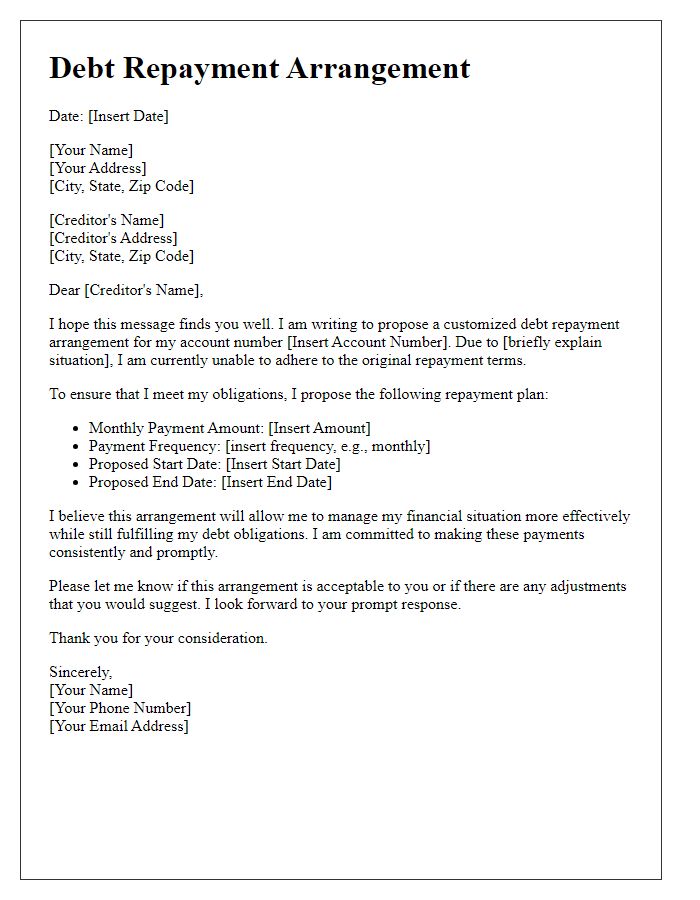

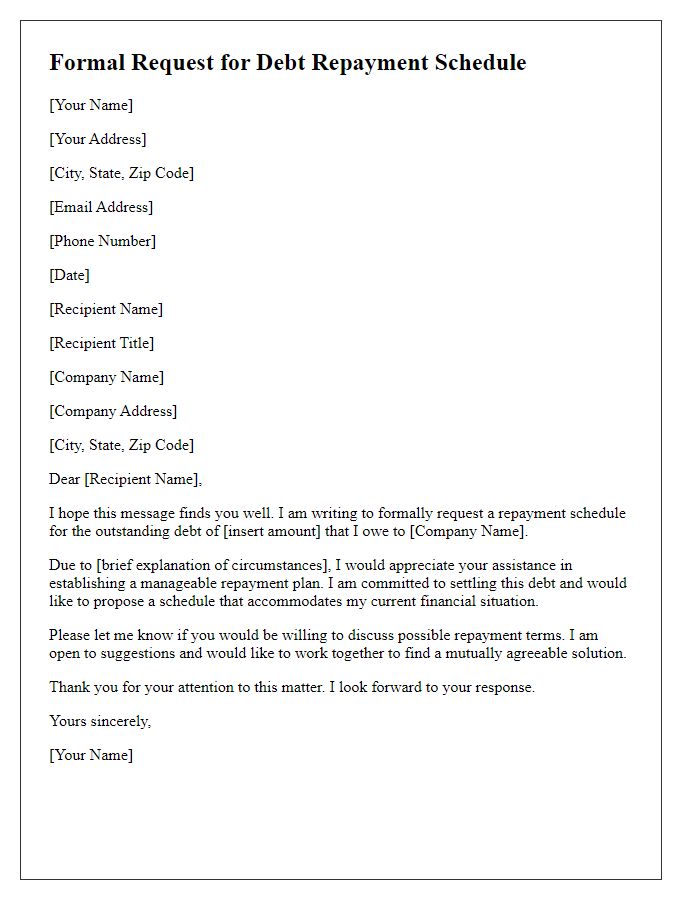

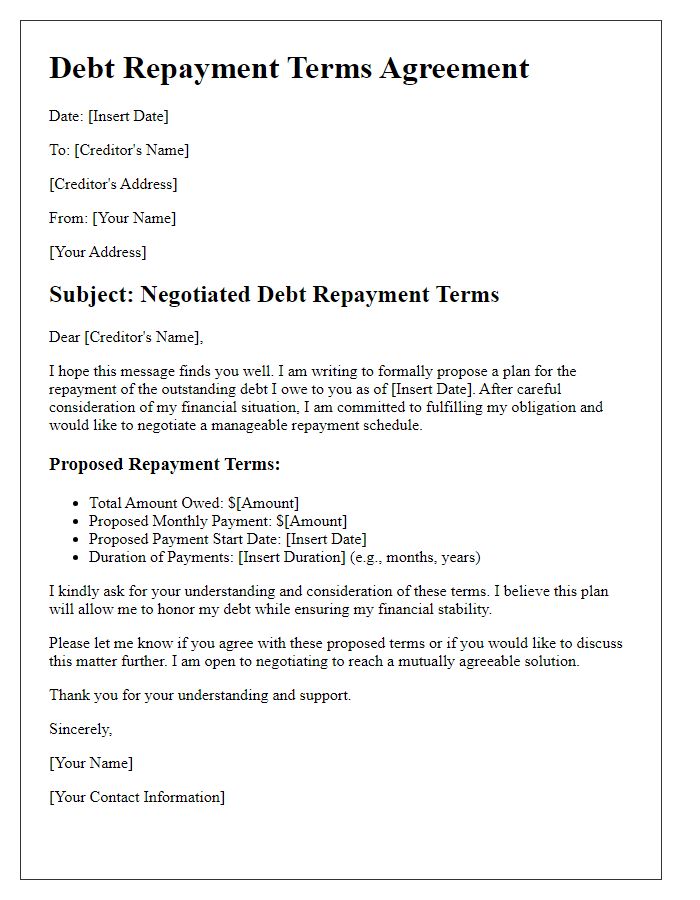

Clear Subject Line

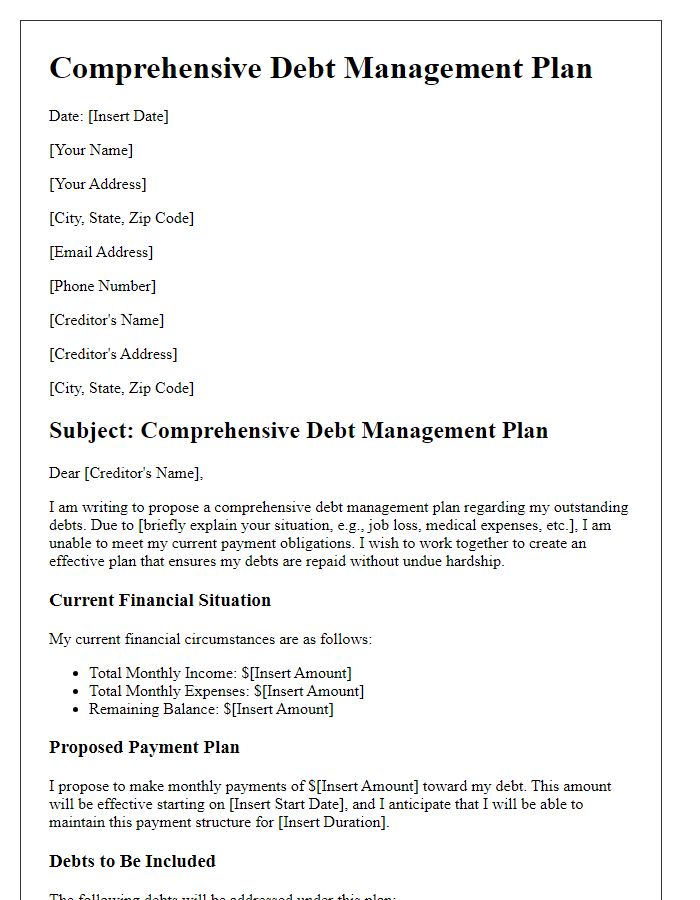

Effective debt repayment plans can help individuals regain financial stability and improve credit scores. Such plans typically outline monthly payment amounts, interest rates, and target dates for full repayment. Timely payments may enhance relationships with creditors, demonstrating commitment to resolving debts. Tools like budgeting apps or financial planners can aid in organizing expenses and ensuring adherence to repayment schedules. Establishing a clear communication strategy with creditors may also assist in negotiating favorable terms or modifications if necessary.

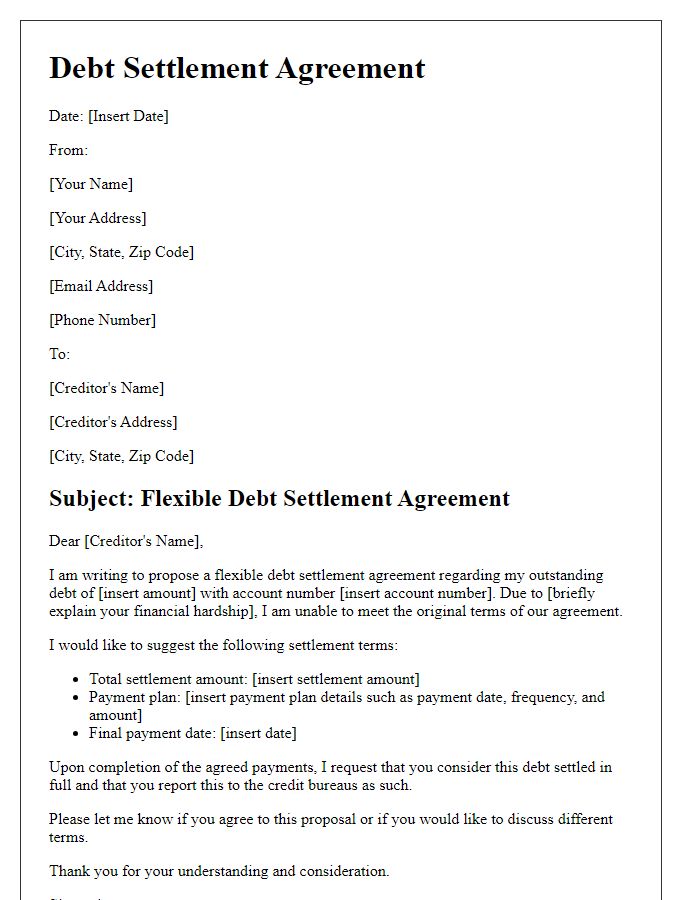

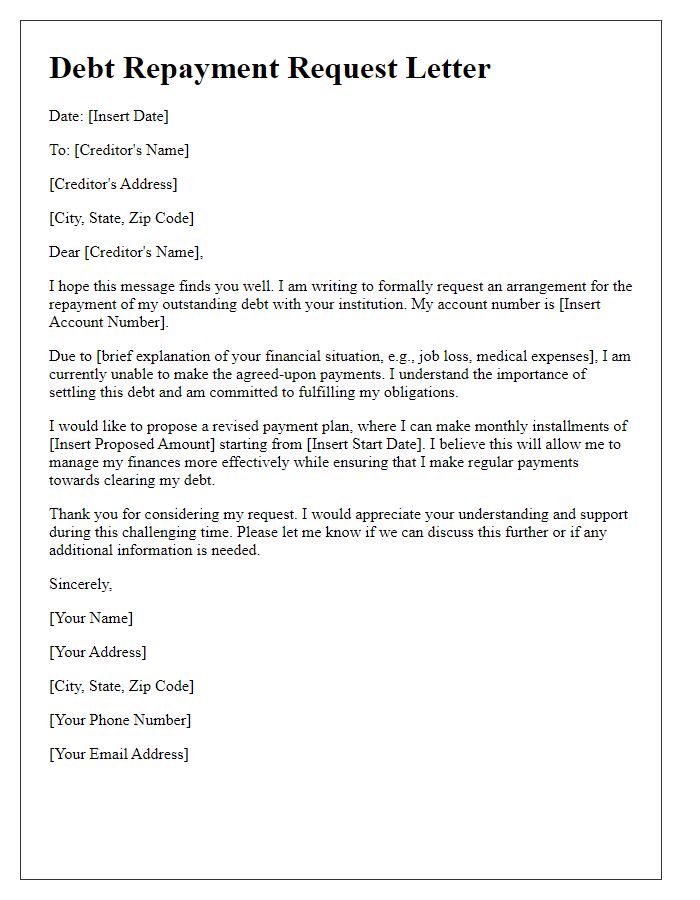

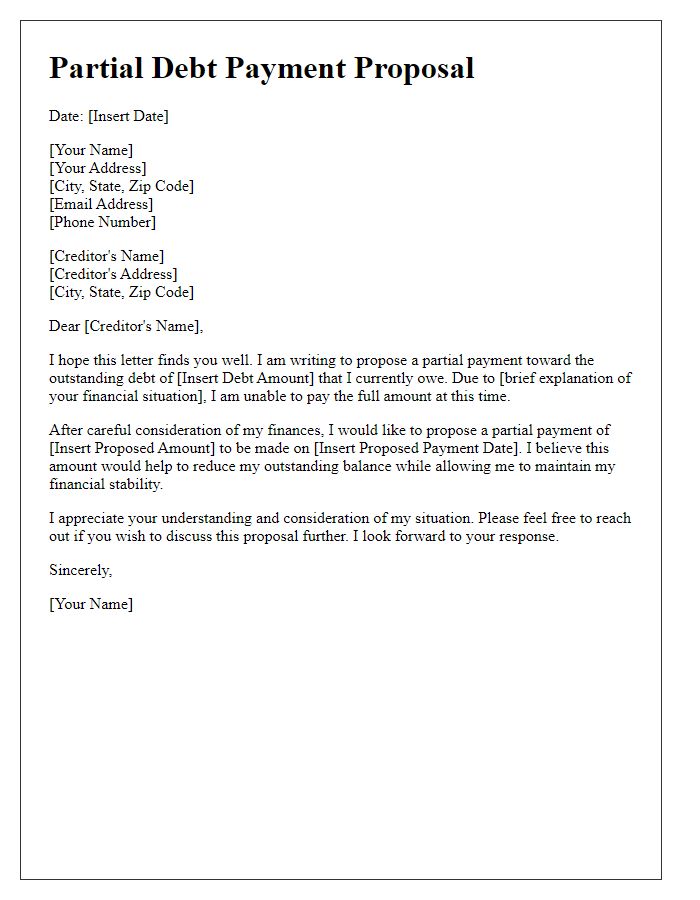

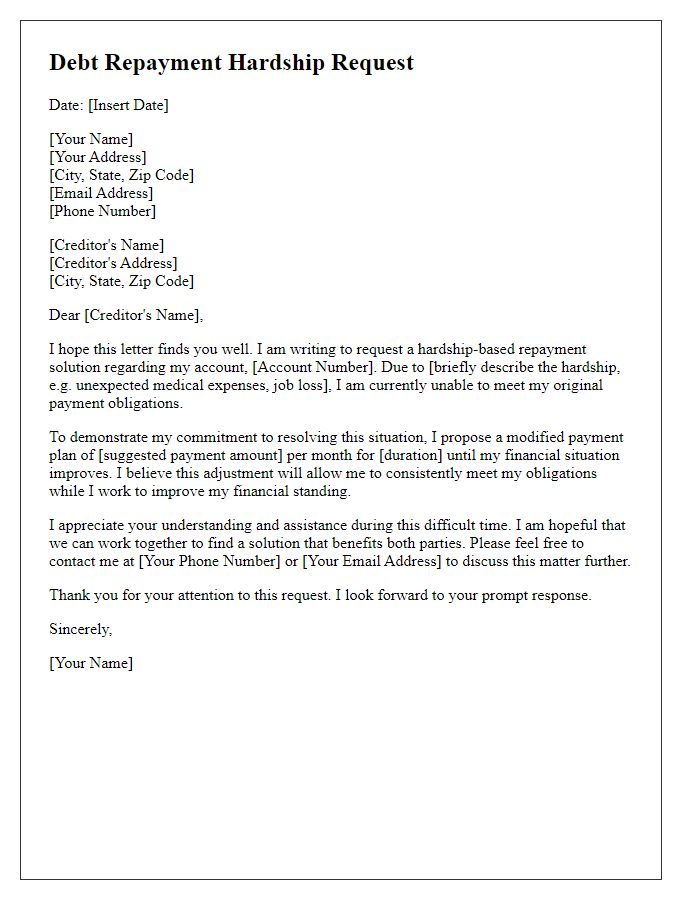

Debtor Information

Individual or business debtors often experience financial challenges leading to the necessity for a structured debt repayment plan to address outstanding balances. Essential creditor details include the debtor's full name, address, contact number, and email. Clarity on the total debt amount, comprising principal, interest, and any fees, is critical. Furthermore, outlining the repayment schedule with specific dates and amounts shows a commitment to resolving the obligation. An effective plan might involve regular payments, such as monthly installments, potentially with a proposed duration of six months to two years, depending on the total debt. The inclusion of any payment preferences, whether via bank transfer, cheque, or online payment portal, should also be clearly stated, facilitating smoother transactions. This document should also note any changes in the debtor's financial situation, such as employment status or income fluctuations, providing context for the repayment terms being proposed. Additionally, potential strategies like negotiating interest rates or seeking professional financial advice can strengthen the repayment plan's viability.

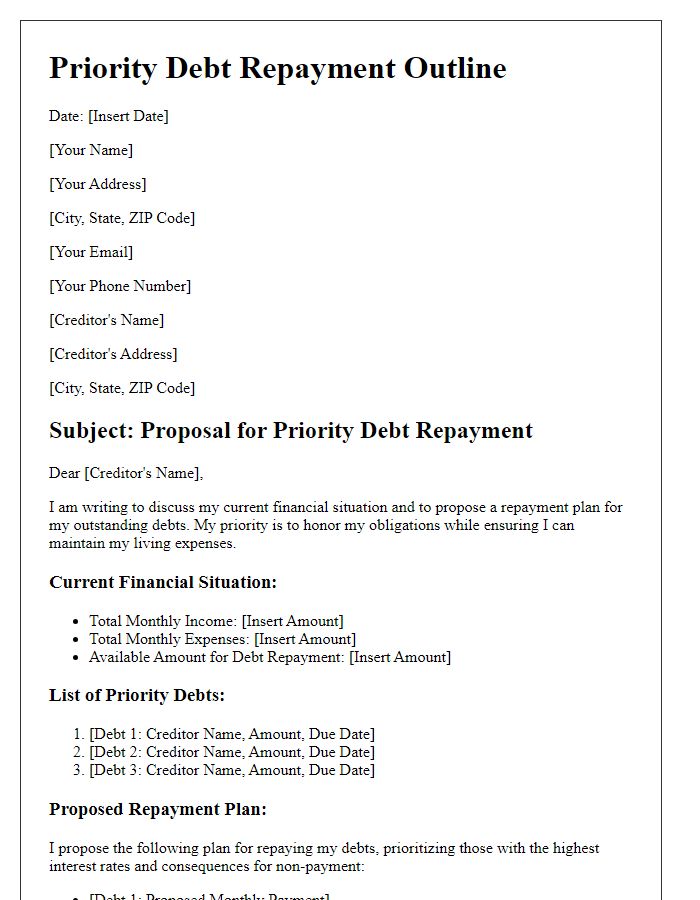

Debt Details

A comprehensive debt repayment plan outlines specific financial obligations, offering clear details about the total amount owed. Outstanding debts may include credit card debts, personal loans, or medical bills, often categorized by creditors such as banks or financial institutions. Interest rates on these debts can vary significantly, sometimes exceeding 20% APR for credit cards, leading to increased financial strain. Total outstanding amounts should also be itemized, with due dates specified for each payment. Establishing a budget for monthly contributions, aligned with available income, can foster a strategic approach to debt elimination. Priority may be given to high-interest debts, aiming to reduce overall financial burden more effectively over time.

Proposed Repayment Terms

A structured debt repayment plan outlines specific terms for settling outstanding financial obligations, typically involving principal amounts and accrued interest. Key elements include total outstanding debt amount, scheduled monthly payments, maturity dates, and interest rates, often specified as annual percentage rates (APR). Borrowers might propose an initial payment deadline, such as a specific day within the month, alongside a schedule spanning several months or years, addressing known financial constraints. Communication channels for updates or adjustments, like email or direct telephone numbers, are essential for ongoing dialogue. Additionally, acceptable payment methods--such as bank transfers, checks, or digital wallets--should be clarified to ensure timely transactions and reduce misunderstandings.

Contact and Response Instructions

Debt repayment plans often involve specific contact details and response guidelines to ensure clarity and effective communication between parties. For a customized debt repayment plan, individuals should provide their primary contact number, such as a mobile or home phone, along with an email address to facilitate electronic correspondence. Respondents may receive instructions to confirm their understanding of the repayment terms, with response timelines typically set within 7-14 days to acknowledge receipt and agreement. It's crucial to include mailing addresses for sending physical documents or payments, especially if traditional methods of correspondence are preferred. These contact and response instructions should be clear to avoid misunderstandings and support the timely resolution of the debt obligations.

Comments