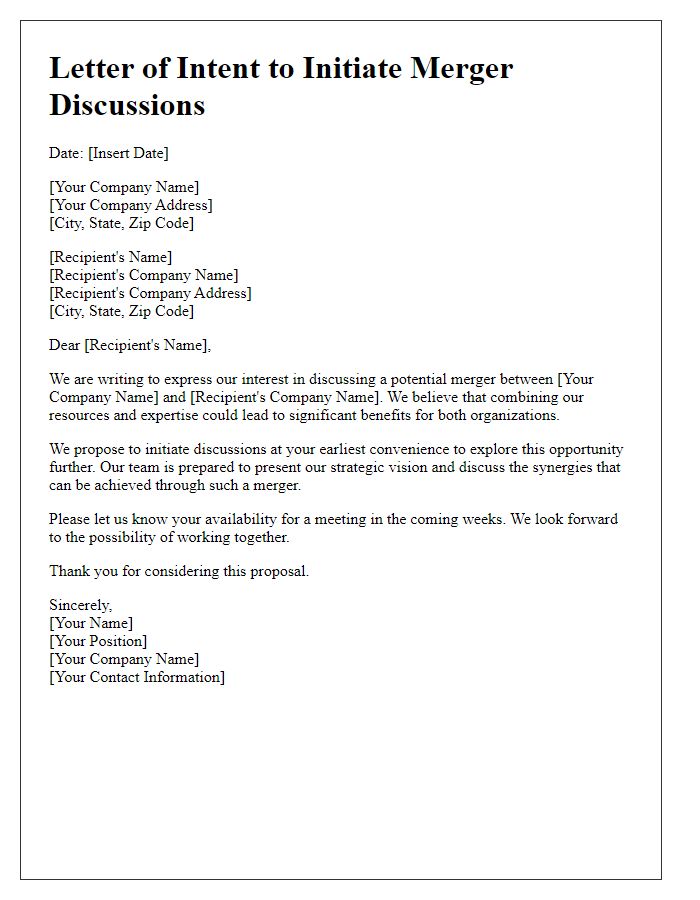

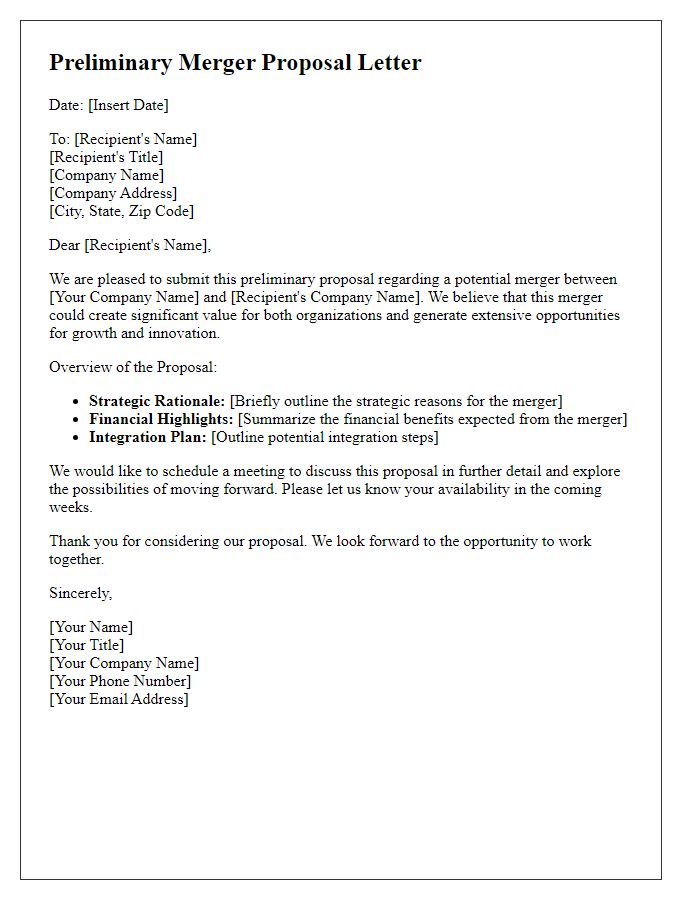

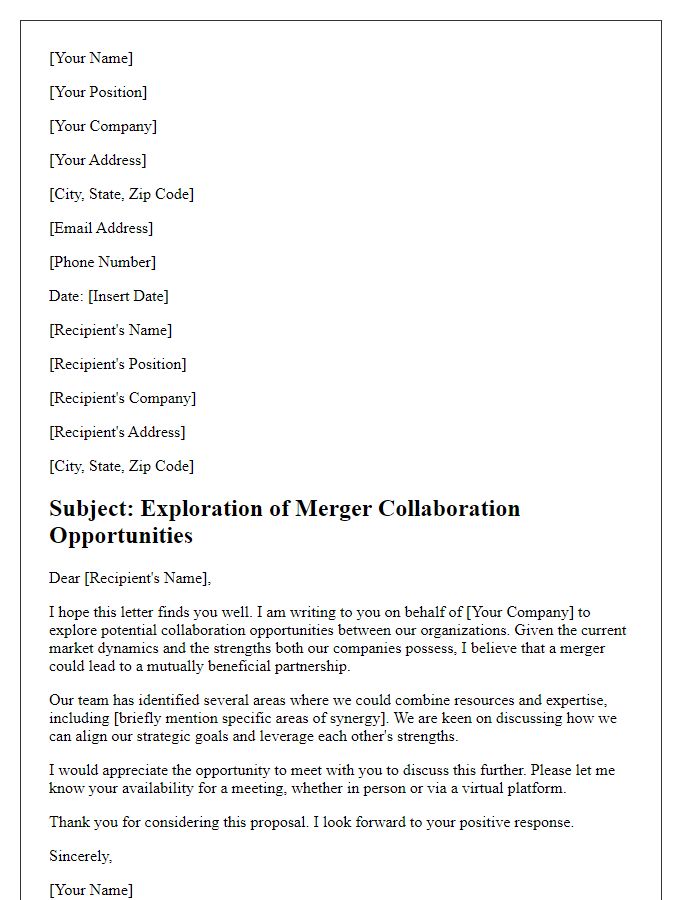

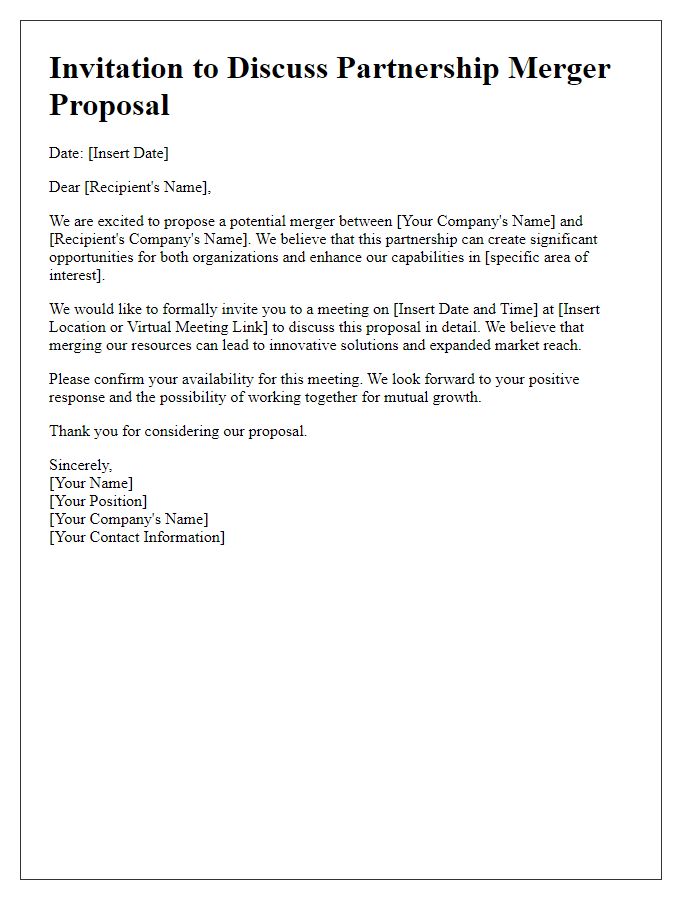

Hello there! If you're considering a merger, drafting a proposal letter is a crucial first step in sparking a successful conversation. It's all about clarity, mutual benefits, and establishing trust, so the structure you use can really set the tone for the negotiations ahead. In this article, we'll explore essential tips and templates to help you frame your merger proposal effectivelyâso stick around for insights that can guide your journey!

Introduction and Purpose

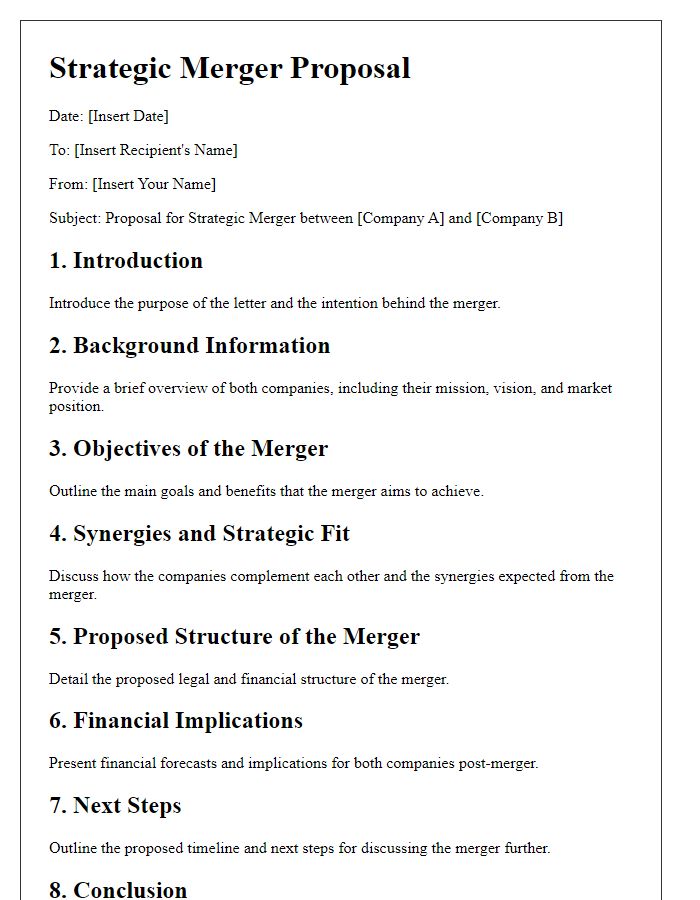

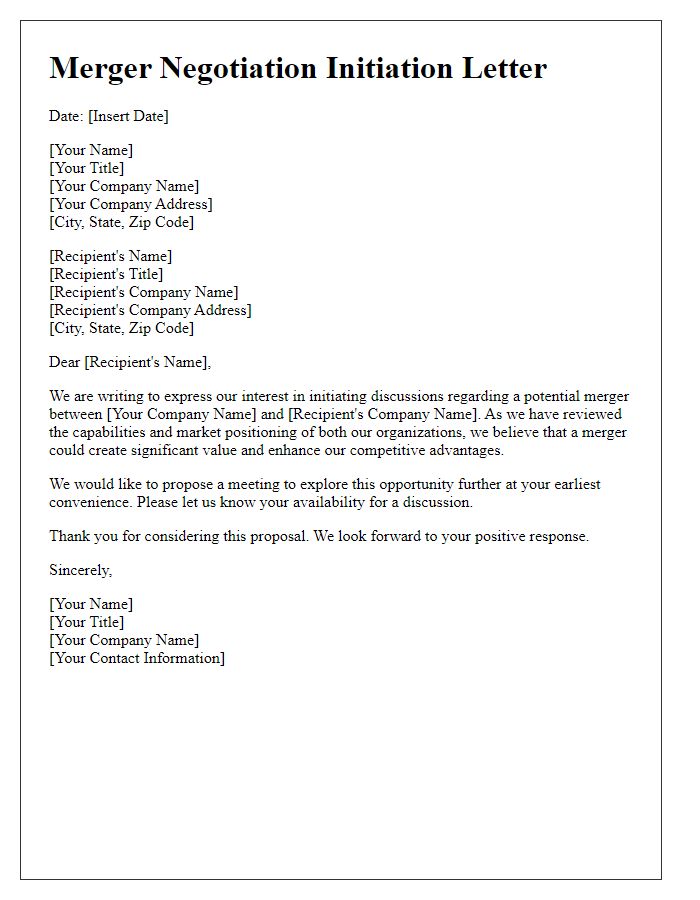

Mergers and acquisitions present strategic opportunities for growth and synergy. Companies engaging in these discussions typically aim to enhance market presence, increase operational efficiency, and leverage combined expertise to drive innovation. The primary purpose of this proposal is to initiate dialogue regarding a potential merger that would align with shared goals, optimize resource allocation, and maximize shareholder value. This proposal seeks to establish a strong foundation for collaborative exploration, addressing mutual benefits, potential challenges, and outlining a vision for the future integration process.

Strategic Benefits and Synergies

A merger proposal between Company A and Company B presents substantial strategic benefits and synergies that could revolutionize market positioning within the technology sector. Potential annual revenue growth could reach 30% following the consolidation of research and development operations in Silicon Valley, a hub known for innovation. By integrating complementary product lines--such as Company A's software solutions with Company B's hardware offerings--the new entity can create bundled offerings, enhancing customer value. The combined workforce of approximately 2,500 skilled professionals facilitates knowledge sharing, leading to improved efficiency and faster product development cycles. Additionally, leveraging Company B's extensive distribution network across Europe, which covers over 15 countries, can significantly expand market reach, ultimately increasing market share in competitive landscapes. These strategic advantages position the merged entity for sustained operational excellence and long-term profitability.

Financial Implications and Valuation

Financial implications of a merger between two companies, such as Company A and Company B, encompass various factors like increased market share (potential rise to 30% in the industry), cost synergies (estimated savings of $5 million annually), and enhanced revenue growth (projected increase of 15% over three years). Valuation methods, including discounted cash flow (DCF) analysis, compare future cash flows discounted back to present value for both entities, facilitating a fair assessment of their worth. Additionally, comparative company analysis evaluates similar organizations to determine a suitable valuation multiple. Key elements such as regulatory approvals (anticipated from the Federal Trade Commission), integration costs (up to $2 million), and potential tax implications (tax liabilities based on local tax legislation) significantly influence strategic decisions. A clear understanding of these financial aspects ensures a thorough evaluation in the merger process.

Integration Plan and Management Roles

An integration plan outlines the strategy for combining two organizations post-merger, focusing on aligning resources, processes, and cultures. Key elements include identifying management roles crucial for overseeing the merger's implementation, ensuring clear communication channels between departments. Human resources play an essential role in managing employee transitions, addressing concerns, and facilitating training on new systems and practices. Financial management oversees budgetary allocations to support integration, ensuring fiscal health during the transition. Operational managers must coordinate logistics across business units, maintaining efficiency while integrating differing operational infrastructures. Cultural integration strategies aim to blend corporate cultures, ensuring employee engagement and a unified workforce. Successful execution of the integration plan requires ongoing assessment of progress against set milestones, adapting strategies as necessary to mitigate risks.

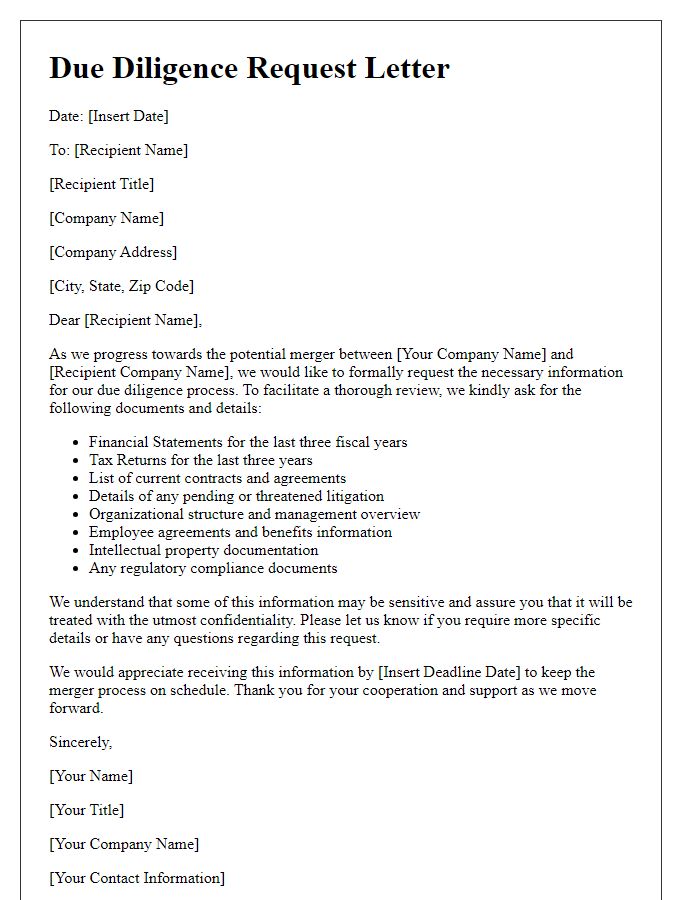

Confidentiality and Next Steps

Confidentiality agreements are crucial in merger proposal discussions. These agreements protect sensitive information shared between parties involved in the merger, typically companies looking to consolidate operations or explore strategic partnerships. Key elements include the definition of confidential information, obligations of the parties to keep information secure, and the duration of confidentiality (often spanning several years). Next steps in the merger discussions may involve due diligence (analyzing financial records, operational capabilities), negotiating terms of the merger (including valuation, share distribution), and setting timelines for final agreements. Engaging legal counsel, such as corporate attorneys, enhances compliance with regulatory requirements, ensuring a smooth transition.

Comments