Are you ready to unlock new opportunities in your business? A direct sales partnership agreement can be a game changer, providing a structured way to collaborate and boost sales through joint efforts. Whether you're just starting out or looking to expand your current partnerships, understanding the essentials of this agreement is key to success. Join me as we explore the vital components of a direct sales partnership agreement and how it can elevate your business effortsâread on to discover more!

Parties Involved

A direct sales partnership agreement outlines the business relationship between two parties: the manufacturer or supplier (Company A) and the distributor or sales agent (Company B). Company A, based in New York City, specializes in premium organic skincare products, while Company B operates in Los Angeles and has a strong network of retail partners. The agreement details the responsibilities of each party, including Company A's obligation to provide high-quality products and marketing support, while Company B commits to achieving specific sales targets in the first quarter. The partnership encourages collaborative marketing efforts, including promotional events and online campaigns, aiming to increase brand awareness and drive sales in the competitive beauty industry.

Scope of Partnership

The direct sales partnership agreement outlines the scope of partnership between Company A, based in San Francisco, California, and Company B, established in New York City, on November 15, 2023. The partnership focuses on the distribution of product lines including eco-friendly household cleaners, which are gaining popularity in urban markets. Each partner will have defined responsibilities, with Company A providing marketing support and training resources, while Company B will leverage its salesforce for effective outreach in metropolitan areas. The objective is to achieve a sales target of $500,000 within the first year of collaboration. Regular strategy meetings, scheduled quarterly, will ensure alignment in goals and assessment of sales performance metrics.

Responsibilities and Obligations

In a direct sales partnership agreement, clear responsibilities and obligations delineate the expectations for each party involved. The sales partner, for instance, may be tasked with promoting products (such as health supplements or home goods) within designated geographical areas, utilizing marketing strategies tailored to target demographics (specific age groups or interests). Additionally, the partner is responsible for maintaining accurate sales records (including revenue figures and customer feedback) and reporting them regularly to the principal company. Meanwhile, the principal company is obligated to provide necessary training (product knowledge and sales techniques) and support (marketing materials and promotional events) to ensure that the partner can effectively sell the products. Compliance with relevant laws (regulations specific to direct sales) and ethical standards (honesty in advertising and privacy for customer data) is expected of both parties to foster trust and a sustainable business relationship. Each party is also encouraged to engage in regular communication (scheduled meetings or updates) to discuss sales performance, identify challenges, and strategize potential improvements.

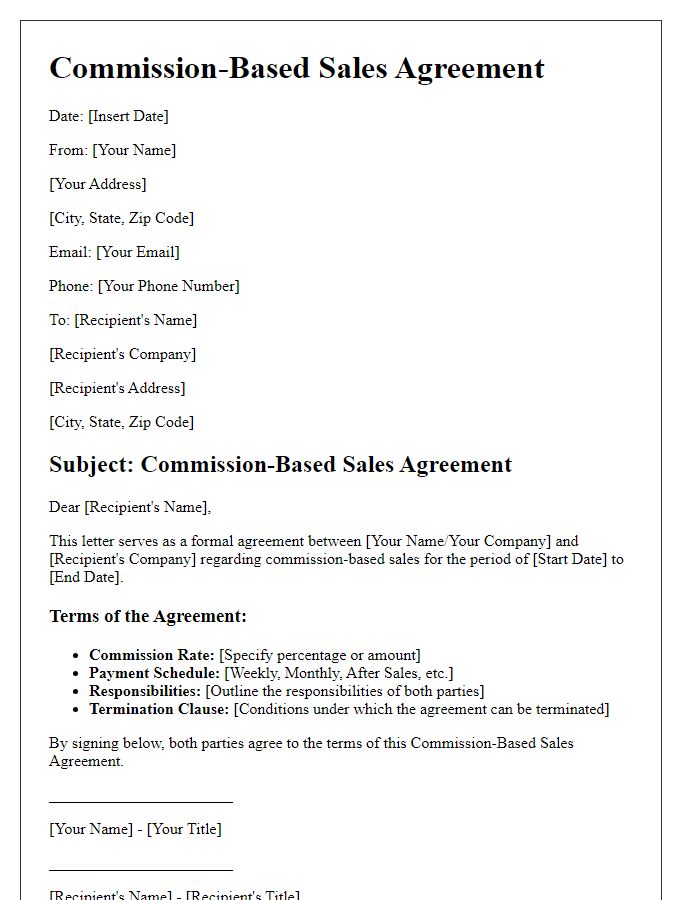

Compensation and Payment Terms

In a direct sales partnership agreement, compensation and payment terms outline the financial aspects of the collaboration between the parties involved. Typically, compensation structures may include commission rates, which can range from 5% to 30% based on sales volume or product categories. Payment schedules often specify monthly or quarterly disbursement timelines to ensure timely compensation for sales made. Additionally, the agreement may include clauses detailing the conditions for returns and chargebacks that could affect commission payouts. Important financial metrics, such as the total sales threshold that activates higher commission tiers, can also be articulated. Clear definitions of allowable expenses and deductions, along with compliance requirements for tax documentation, further enhance the transparency of this financial arrangement.

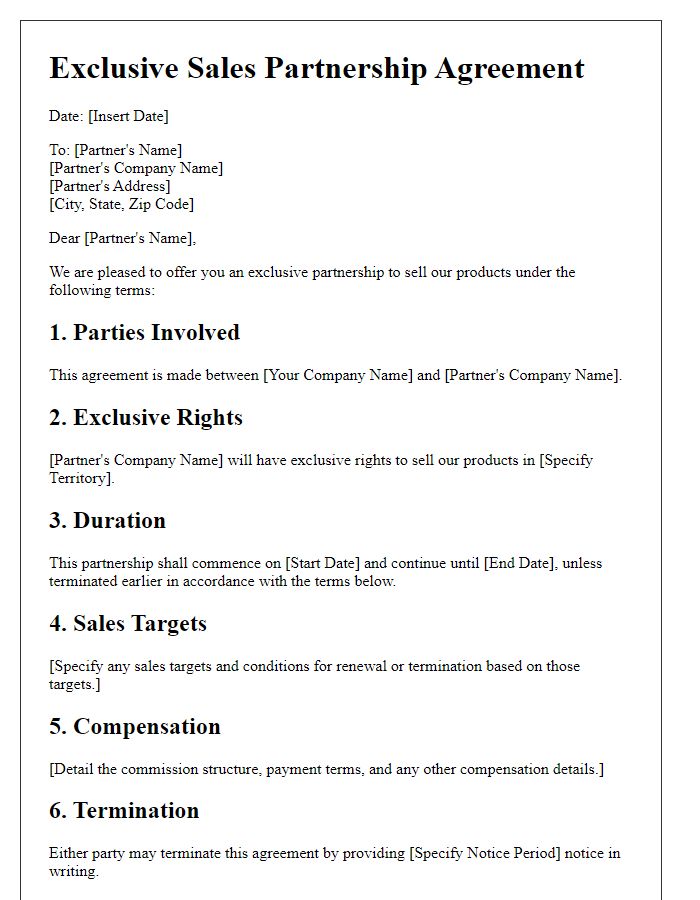

Termination and Renewal Conditions

Termination and renewal conditions in a direct sales partnership agreement provide essential guidelines for both parties involved. Termination may occur under specific circumstances, such as breach of contract, failure to meet sales targets (often defined as a percentage of annual revenue), or insolvency (a financial state where debts exceed assets). Notice of termination may require a minimum of 30 days written notice, allowing the other party to address the concerns. Renewal conditions typically stipulate a timeframe, commonly one year, for evaluation based on performance metrics, sales growth percentages, and market conditions. Successful renewal may depend on mutual agreement regarding compensation structures and territory exclusivity, with specific terms outlined to ensure clarity and accountability. Both parties should also review and negotiate changes to incentives, marketing support, and product offerings to adapt to evolving market dynamics before the formal renewal initiation process.

Comments