Are you looking to establish a clear and fair framework for income distribution in your partnership? Understanding how to split earnings among partners can be a complex task, but it doesn't have to be. With the right letter template, you can outline the key terms and expectations, ensuring that everyone is on the same page when it comes to financial matters. Dive into our article to uncover tips and examples that will help you navigate this important aspect of your partnership.

Clear Identification of Partner Names and Roles

In a partnership income distribution agreement, it is essential to clearly identify the names and roles of all partners involved, such as John Smith (Managing Partner), Jane Doe (Financial Partner), and Michael Johnson (Operational Partner). Each partner's specific responsibilities and percentages of income distribution should be documented, with John Smith contributing strategic direction and leadership, Jane Doe managing financial accounts and budgeting with an experience of over ten years in finance, and Michael Johnson overseeing daily operations in accordance with established business practices. This clarity ensures transparency and mutual understanding, preventing potential disputes regarding income distribution and responsibilities within the partnership.

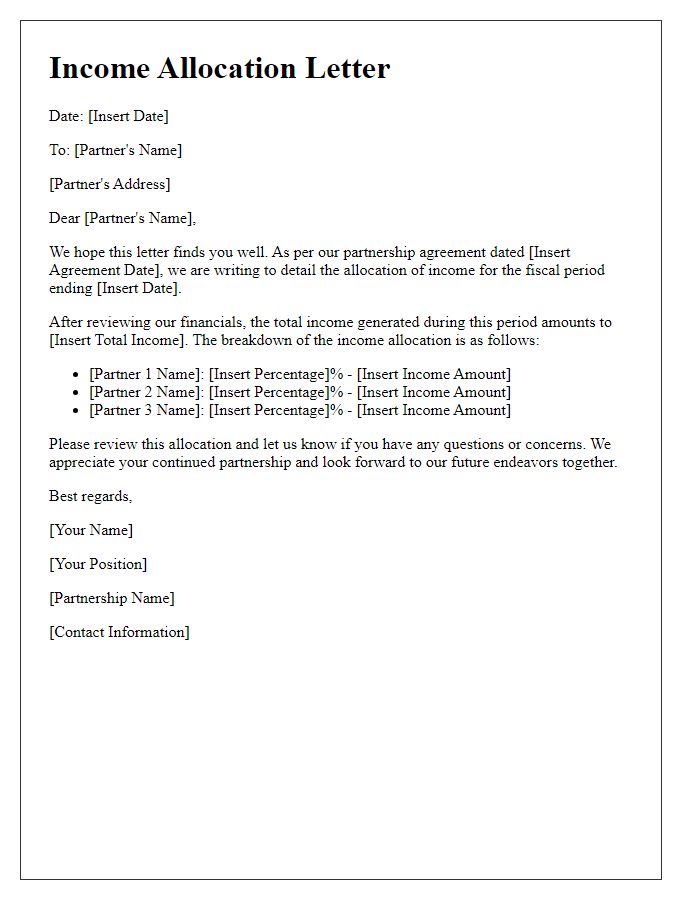

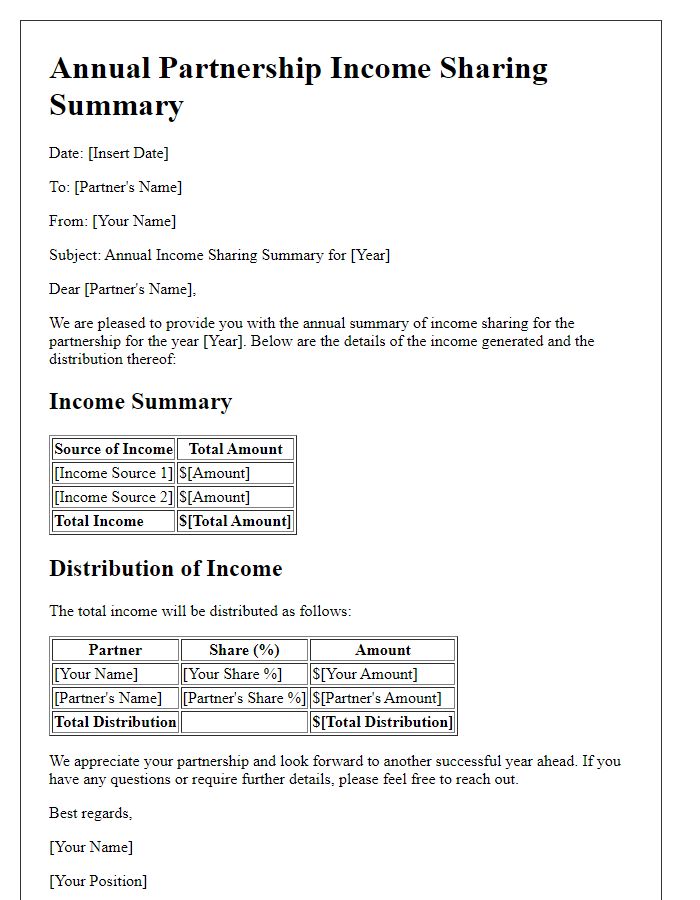

Detailed Breakdown of Income Sources

In a partnership structure, income distribution plays a critical role in ensuring fairness among partners. Sources of income may include revenue from sales, service fees, or investment returns. For example, a partnership operating a restaurant might generate income through food sales, beverage sales, and catering services. Each income type contributes to the total revenue, with specific percentages allocated to each partner based on the partnership agreement. It's essential to maintain accurate records of income sources, such as dates of transactions and amounts received, to facilitate transparent distribution. The breakdown of these sources aids in understanding individual contributions, allowing partners to assess their performance and strategize for future growth, ultimately impacting their share of the profits.

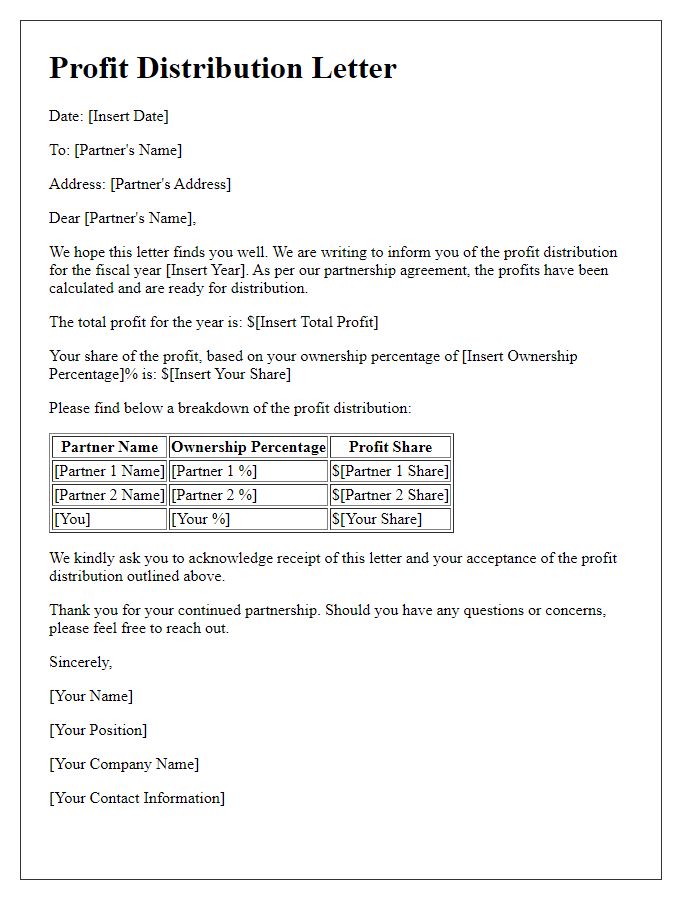

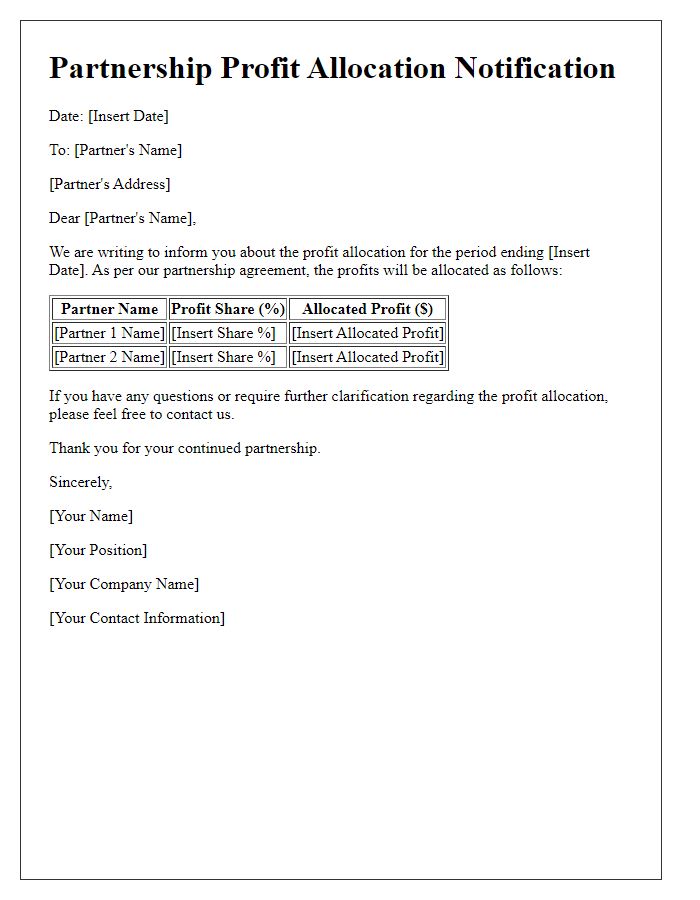

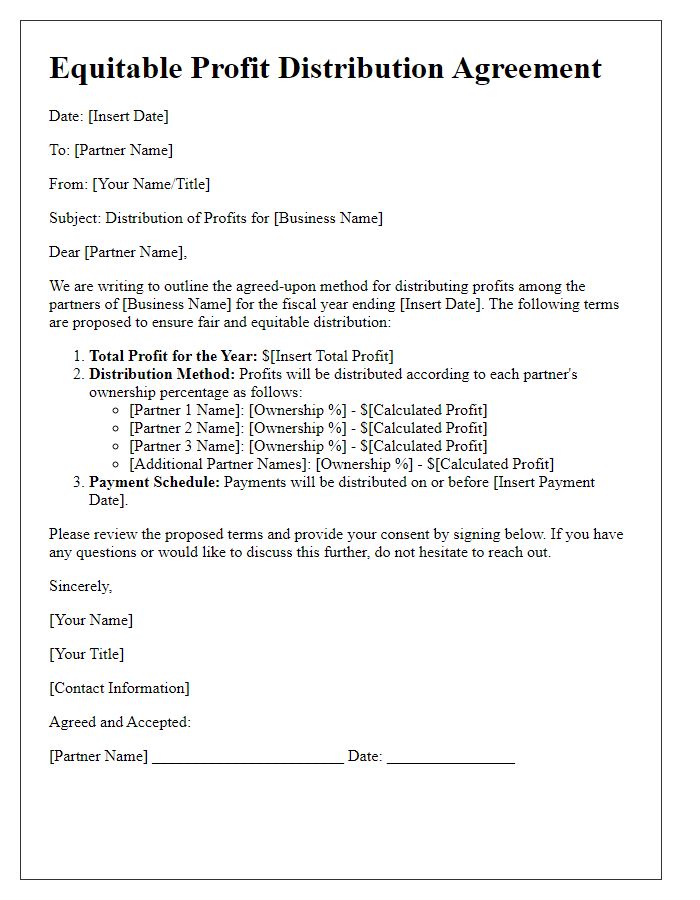

Precise Calculation Methodology for Distribution

In the realm of partnership income distribution, the methodology requires meticulous attention to proportions related to ownership interests and contributions. For instance, if Partnership A consists of three partners with respective ownership stakes of 50%, 30%, and 20%, the net income (e.g. $200,000 for the fiscal year) is allocated based on these percentages. Thus, Partner 1 receives $100,000, Partner 2 receives $60,000, and Partner 3 receives $40,000. Additionally, adjustments may arise from factors such as guaranteed payments (specific compensation due to partners regardless of partnership income) or losses incurred (expenses that exceed revenue), further complicating the distribution. Clearly documented agreements in the partnership contract, as well as adherence to local and federal taxation laws, remain crucial to ensure compliance and equitable distribution of profits among the partners in locations like California or New York where state regulations may impose further restrictions.

Legal Terms and Compliance Statements

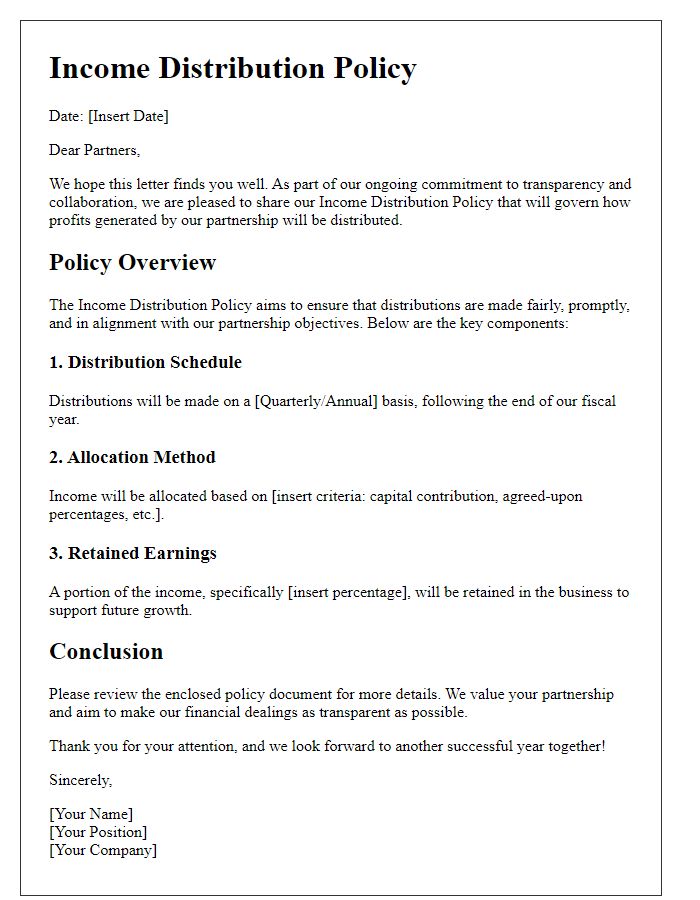

Partnership income distribution processes require careful adherence to legal terms and compliance statements to ensure equitable sharing among partners. In business partnerships, income allocation often follows specific percentages outlined in partnership agreements, which detail each partner's contribution, whether financial or operational. Compliance with tax regulations, such as the IRS guidelines in the United States, ensures that income reporting aligns with legal standards. Additionally, adherence to state laws governing partnership operations is critical; for example, states like California may have distinct requirements regarding income distribution disclosures. Clear documentation of distributions, including supporting financial statements, helps maintain transparency and accountability, essential for fostering trust among partners. Regular reviews and updates of the partnership agreement ensure that all partners remain informed about their rights and responsibilities regarding income distribution.

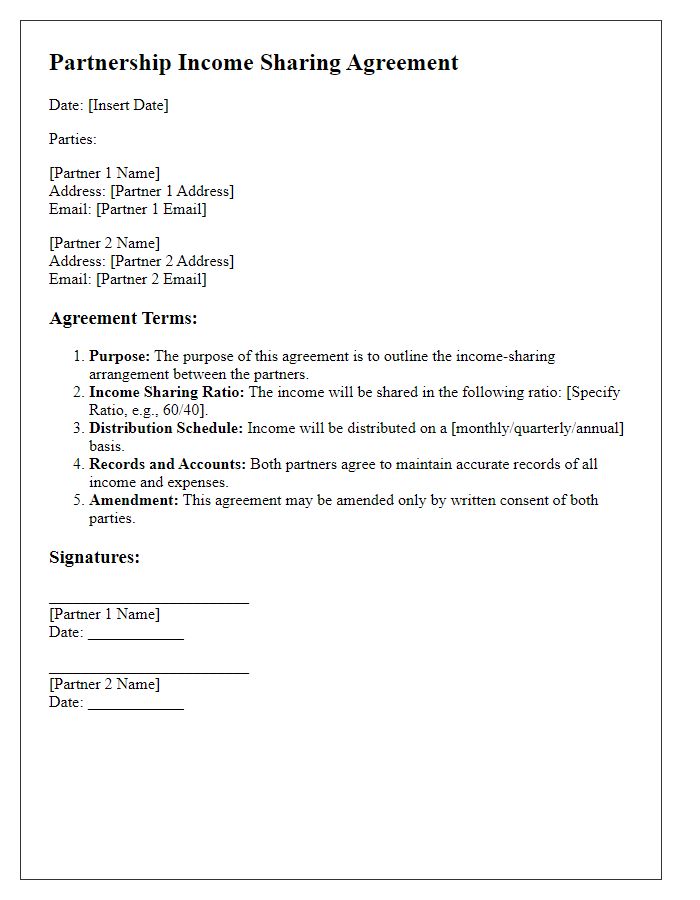

Signature and Agreement Acknowledgement

A well-established partnership agreement outlines the distribution of income among partners, detailing how profits and losses are calculated and shared. Key elements such as the percentage of ownership interest--often reflecting each partner's investment--provide clarity on expected financial returns. Legal documentation, including signatures, signifies consent and acknowledges acceptance of the outlined terms. This formal recognition helps prevent disputes related to income distribution, especially during financial audits, or conflicts arising from varying contributions to the partnership's capital. Properly documenting each partner's role, responsibilities, and contributions establishes a foundation for transparent financial practices.

Comments