If you've found yourself needing to adjust your mortgage payment, you're not aloneâlife has a way of throwing unexpected challenges our way. Whether it's a change in income, unexpected expenses, or just a desire for a more manageable payment plan, knowing how to approach your lender is crucial. Crafting a clear and professional letter can pave the way for a successful adjustment, ensuring you communicate your needs effectively. Ready to learn how to write the perfect mortgage payment adjustment letter? Let's dive in!

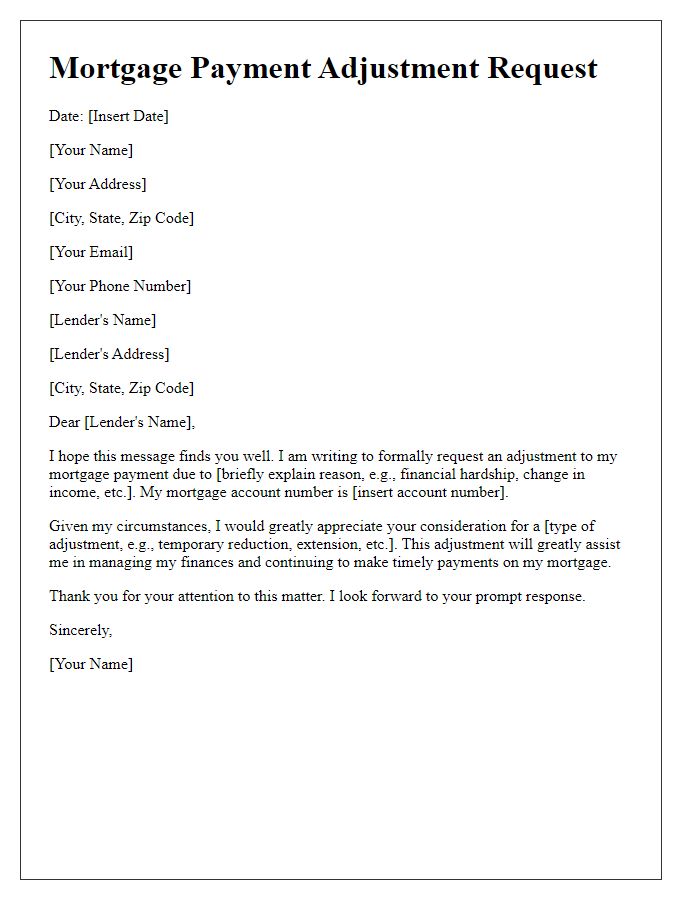

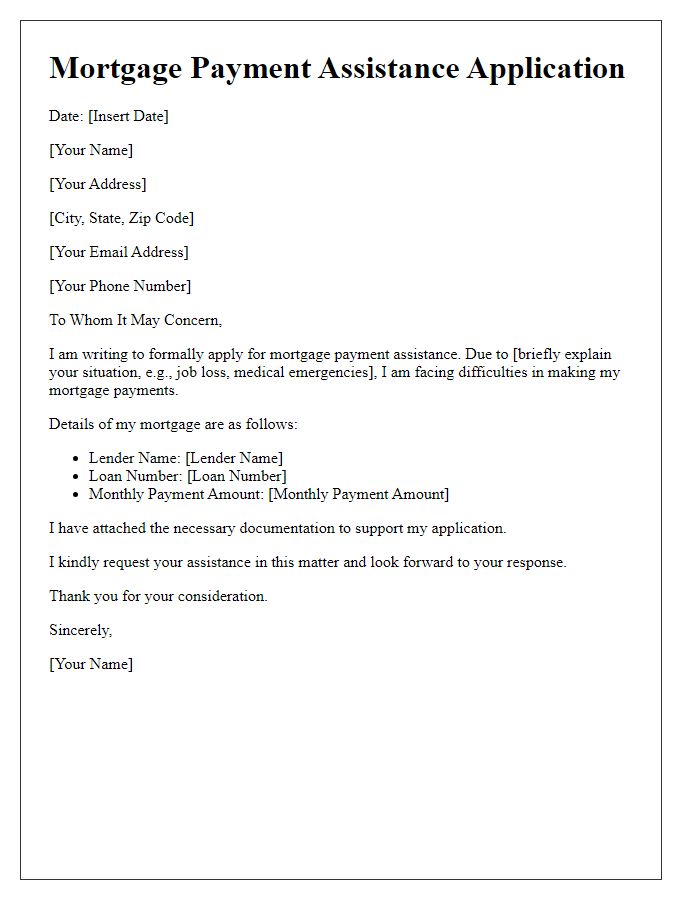

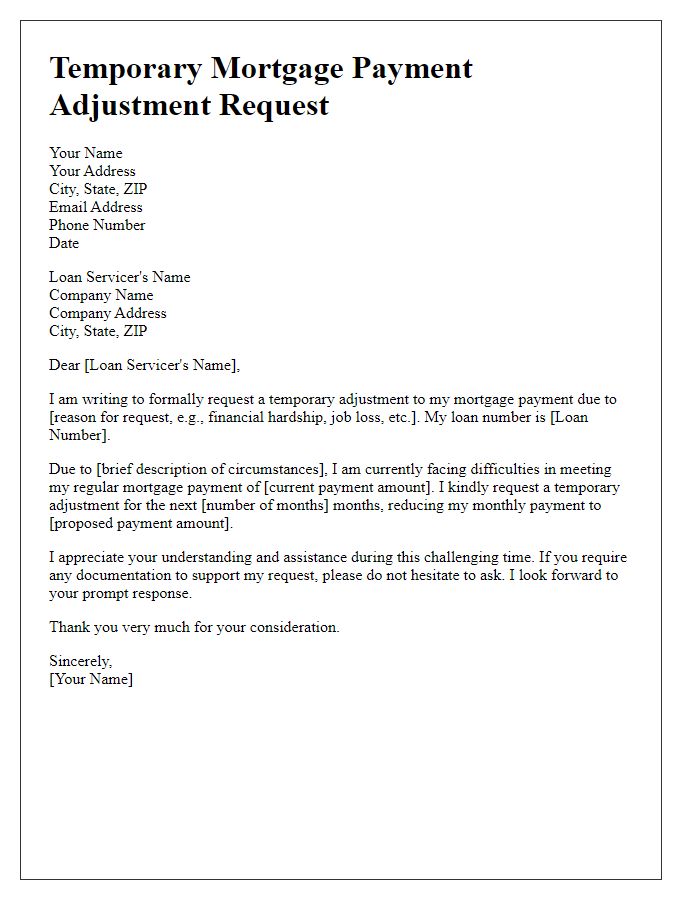

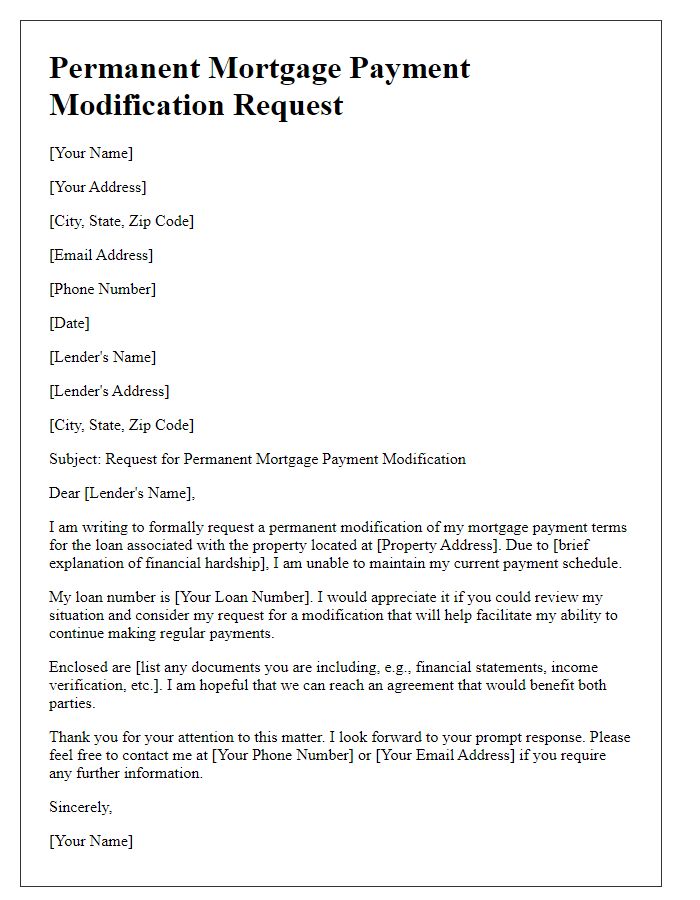

Borrower's personal information

Mortgage payment adjustments can significantly impact homeowners' financial stability. When borrowers provide personal information such as full name, current address (including street, city, state, and zip code), and contact details (phone number, email address), this data is essential for lenders to accurately process the adjustment request. Additional information may include loan account number, property address (if different from the primary address), and financial documentation detailing income or changes in circumstances. Timely submission of accurate personal information ensures that the mortgage payment adjustment reflects the borrower's current financial situation, fostering effective communication with the lending institution.

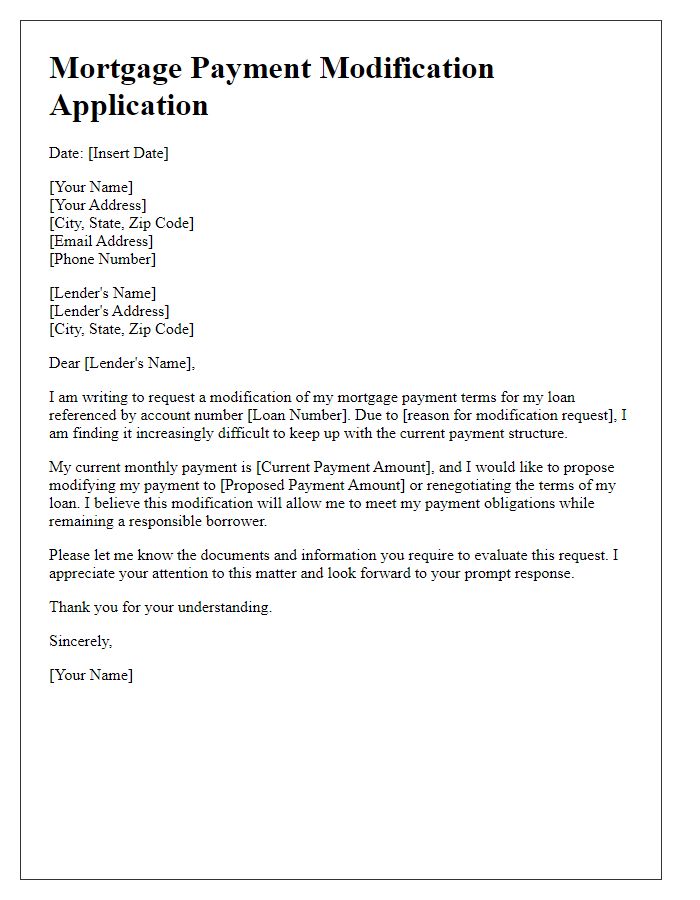

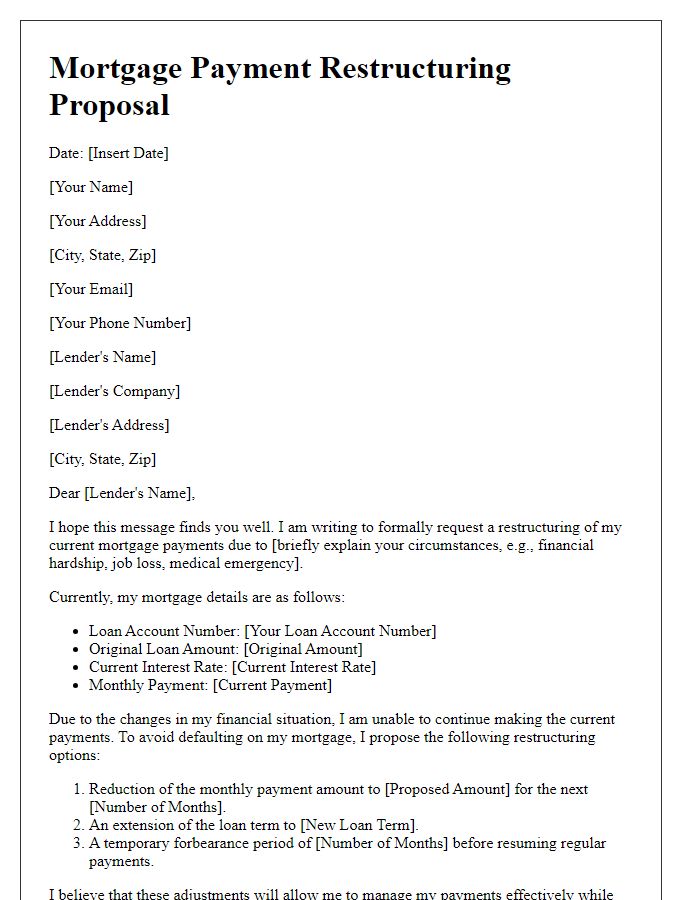

Loan account details

A mortgage payment adjustment involves reviewing critical elements of a mortgage agreement, including loan account details, interest rates, and monthly payment amounts. Loan account details, such as the unique account number (often a 10- or 12-digit number), should be accurately referenced to ensure proper handling of the request. The principal balance, which may be substantial, typically remains a focal point for adjustments, especially if the homeowner's financial circumstances have changed. Variables like loan type (fixed or adjustable-rate), original loan amount, remaining loan term (often 15 or 30 years), and current interest rates impact the monthly payment recalculations. Additionally, factors like property taxes and homeowner's insurance should be considered when discussing adjustments to the overall monthly payment.

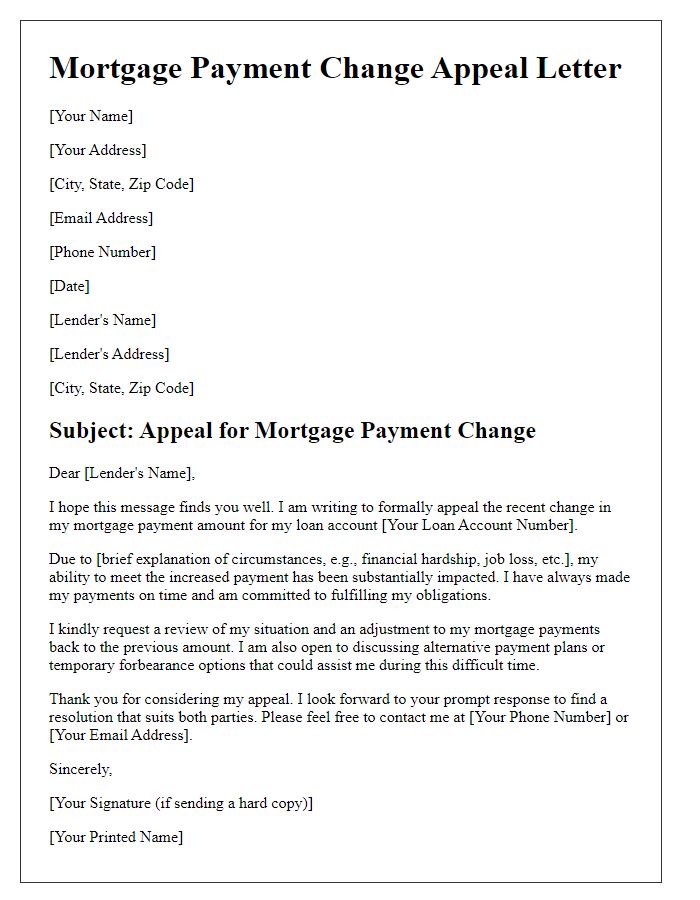

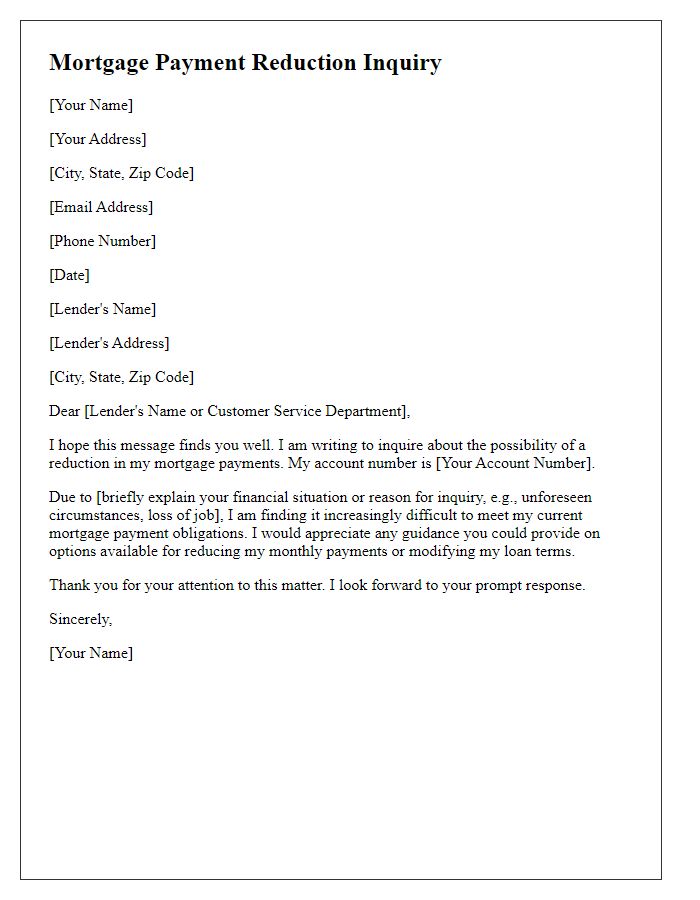

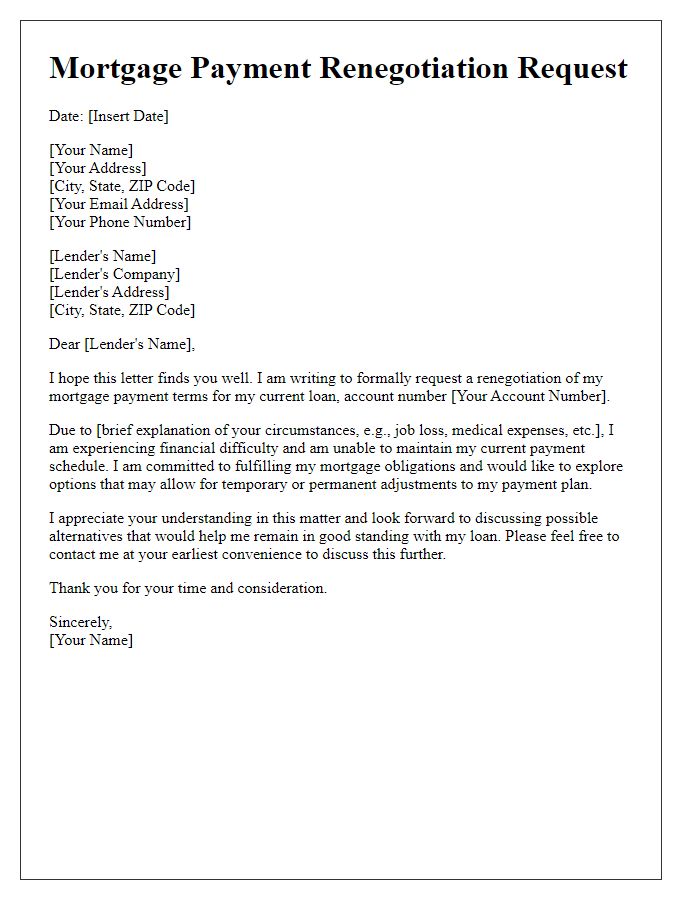

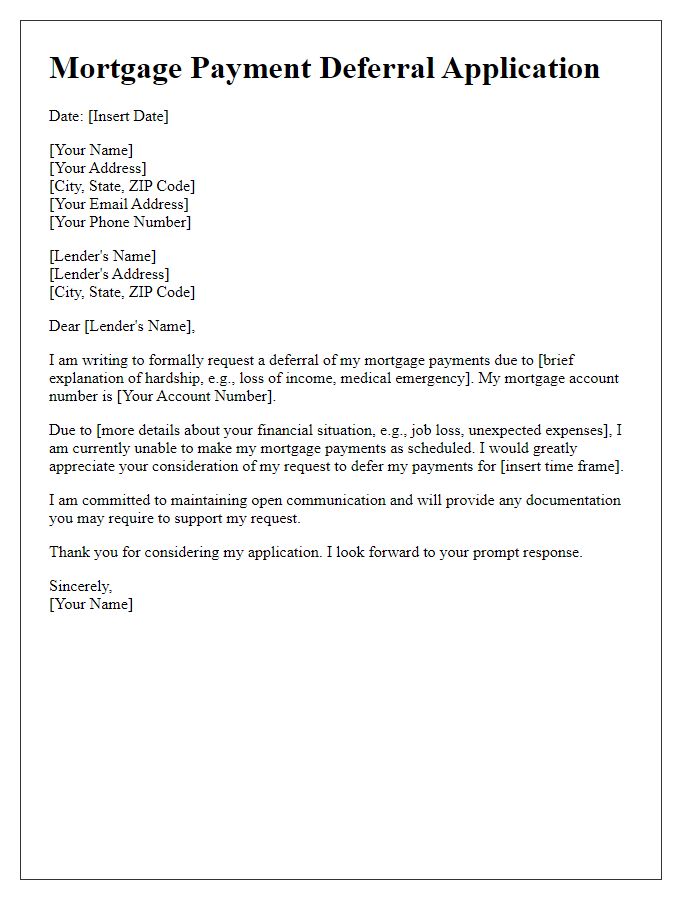

Reason for payment adjustment

Mortgage payment adjustments are necessary when borrowers face changes in financial circumstances, such as job loss or medical emergencies. A significant life event, like a divorce, might lead an individual to request a temporary reduction in payments. Additionally, alterations in interest rates can prompt adjustments. Economic factors, such as inflation or changes in local housing market conditions, may also necessitate a review of repayment terms. Borrowers typically seek adjustments to alleviate financial strain and prevent default, ensuring they maintain homeownership while navigating challenging times. The loan servicer reviews these requests thoroughly, considering documentation provided by the borrower to make informed decisions about payment modifications.

Proposed new payment terms

Adjusting mortgage payment terms can provide significant financial relief for homeowners facing economic challenges. A mortgage payment adjustment typically includes a detailed breakdown of proposed new payment terms, which may feature a reduction in monthly payments, an extension of the loan term, or a temporary forbearance period. Homeowners should document any changes to income, unexpected expenses, or economic downturns, such as the COVID-19 pandemic, affecting their ability to meet current obligations. Essential information may include the loan number, the name of the lending institution, and any relevant dates such as the original loan agreement date and the proposed adjustment date. Clear communication outlining the rationale behind the request is crucial for lenders to assess eligibility for new terms successfully.

Contact information for follow-up

In the mortgage payment adjustment process, clear communication is vital. Typically, borrowers should include relevant contact information, such as a full name, mailing address, email address, and phone number for follow-up inquiries. Including a specific department or officer, like the mortgage servicing department or a loan officer, ensures that the request reaches the correct personnel. Providing references to any previous account numbers or payment history can help expedite the review process. Moreover, including the date of the correspondence and any deadlines for response fosters urgency and accountability in the adjustment process. A meticulous approach to these details can significantly streamline the resolution of mortgage payment concerns.

Comments