Getting a mortgage can be an exciting journey, but sometimes it doesn't go as planned. If your loan application has been rejected, it's essential to understand the reasons behind this decision and how you can improve your chances in the future. While this news can be disheartening, it's not the end of the road; many have successfully navigated this challenge. So stick around as we explore the next steps you can take to turn things around and improve your prospects!

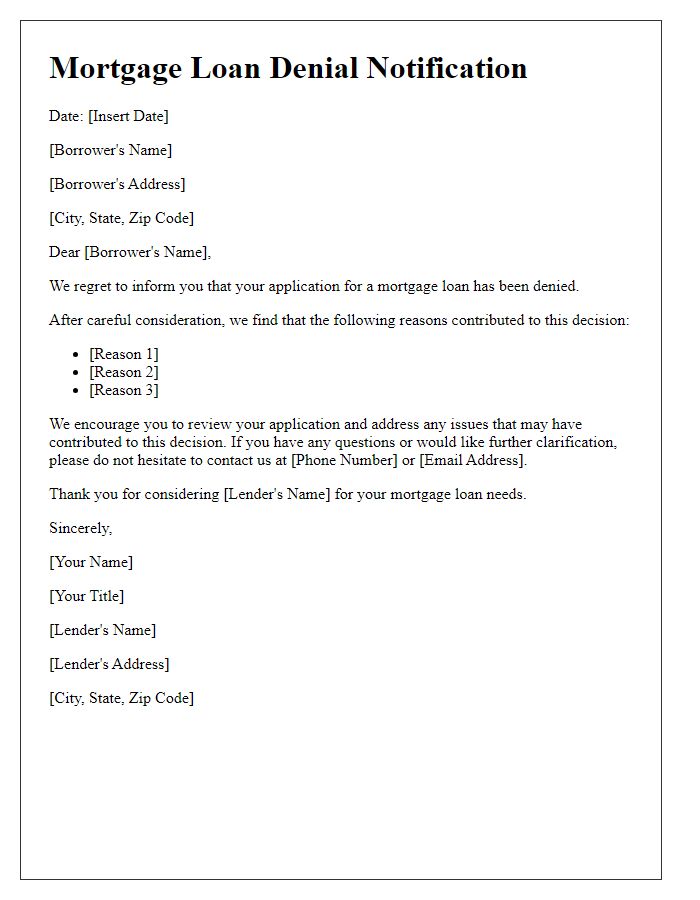

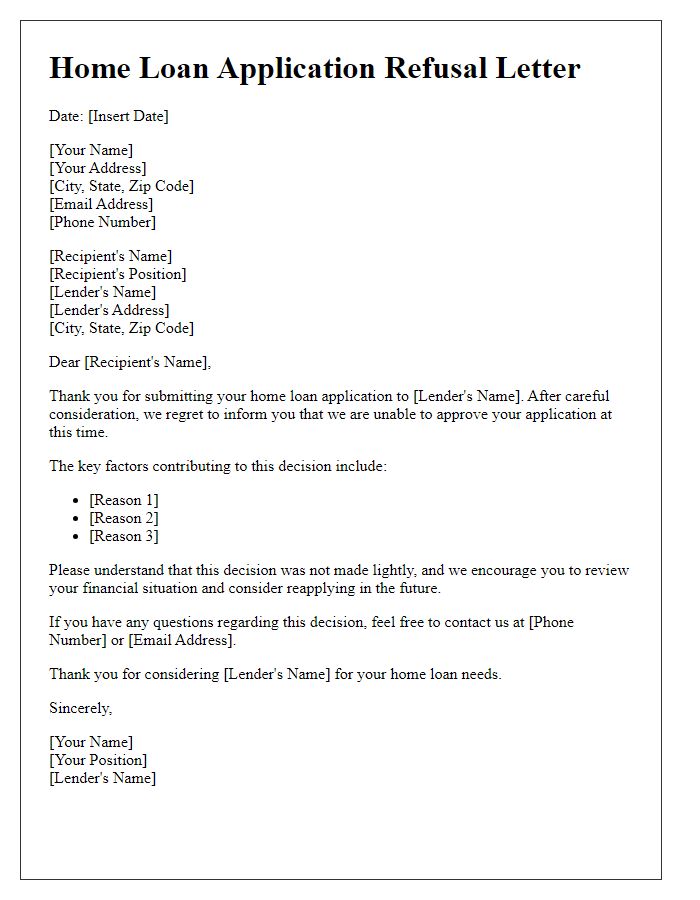

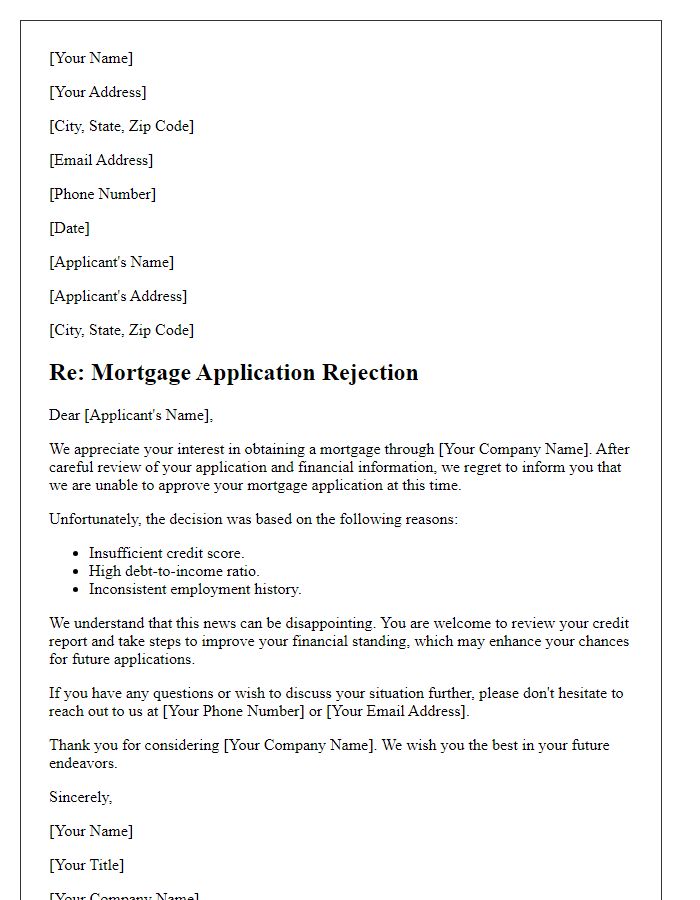

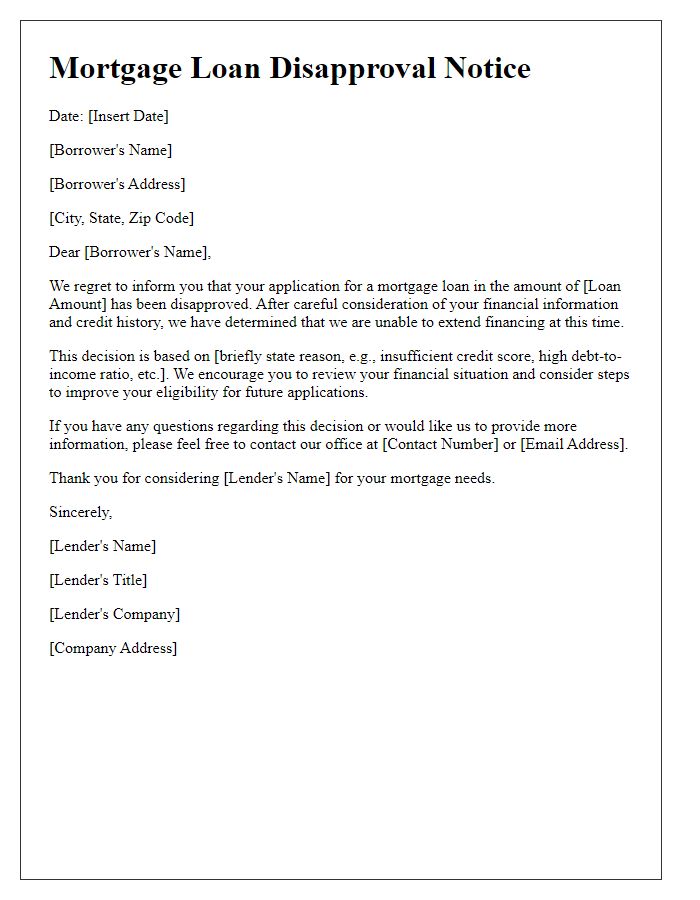

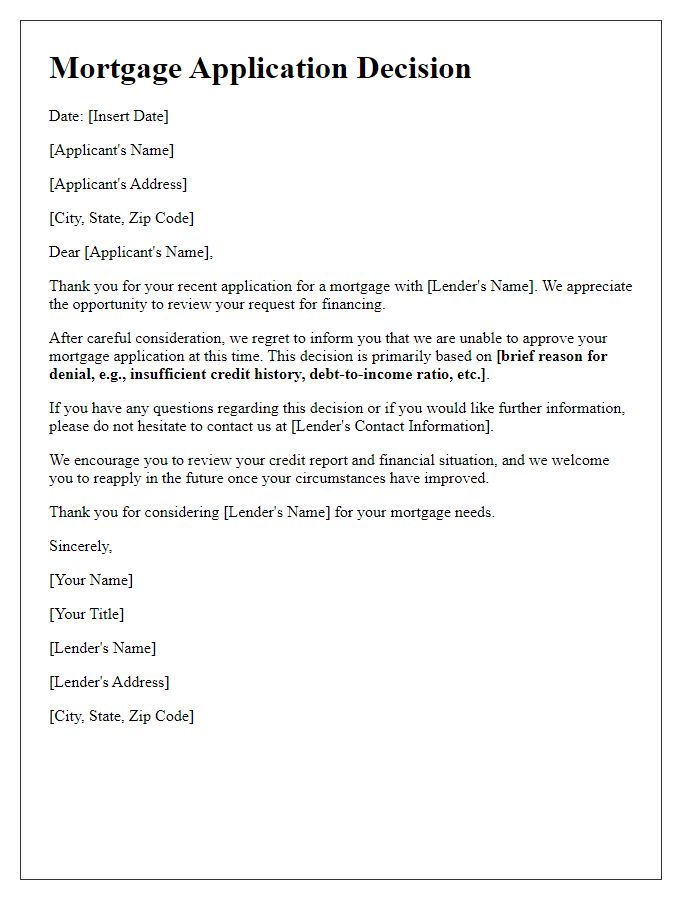

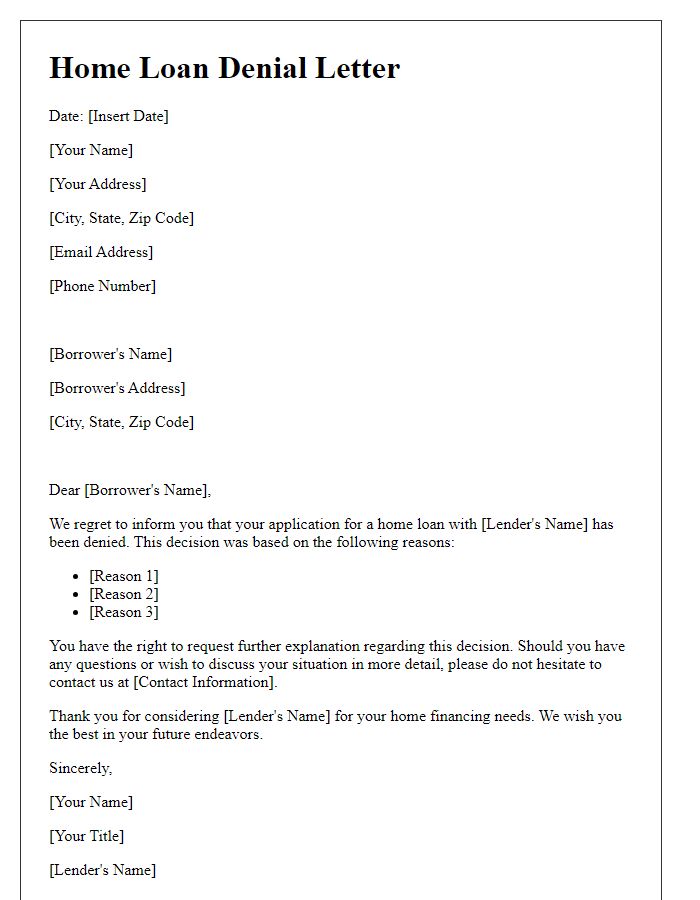

Applicant's Personal Details: Name, address, contact information.

The rejection of a mortgage loan application can significantly impact individuals seeking financial assistance for homeownership. An applicant's personal details typically include their full name, residential address, and contact information such as phone number and email address. Different mortgage lenders, including large banks like JPMorgan Chase or regional credit unions, assess these details to evaluate creditworthiness and financial stability before making a decision. A common rejection reason may involve insufficient credit scores, which can be below the required threshold of 620, or high debt-to-income ratios exceeding 43%. Understanding the rejection might assist applicants in improving their financial profiles for future applications.

Loan Application Details: Amount requested, property details.

Mortgage loan applications can be affected by various factors, leading to rejection. Specific details such as the loan amount requested (e.g., $250,000 for a single-family home in Austin, Texas, valued at $280,000) play a critical role in decision-making. The lender evaluates the applicant's credit score (a numerical representation of creditworthiness, typically on a scale of 300 to 850) and income verification (essential documentation proving the applicant's financial stability). Property details, including location, condition, and market trends, significantly influence the appraisal value. Guidelines set by financial institutions often require a debt-to-income ratio not exceeding 43% to qualify. Additionally, factors such as employment history, bankruptcy filings, and existing debts contribute to the assessment. An unfavorable combination of these elements can ultimately lead to a mortgage loan rejection.

Reason for Rejection: Specific criteria or requirements not met.

Mortgage loan applications can be rejected for a variety of reasons, often tied to unmet criteria or requirements established by lending institutions. Common issues include insufficient credit scores, typically below 620, which indicate creditworthiness concerns. Additionally, a debt-to-income ratio exceeding 43% raises red flags, suggesting that potential borrowers may struggle to manage monthly obligations. Employment history, lacking stability or longevity--for example, less than two years in the same position--can also result in denial. Furthermore, inadequate documentation, such as missing proof of income, taxes, or bank statements, may hinder the application. Each lending institution has specific underwriting guidelines that must be carefully adhered to in order to secure approval for a mortgage loan.

Suggestions for Improvement: Steps to enhance creditworthiness or financial profile.

A mortgage loan rejection often highlights essential areas for potential improvement. Addressing credit score issues, typically below 620, can significantly enhance eligibility. Timely bill payments, reducing credit card balances, and disputing any inaccuracies on credit reports from major agencies like Experian and TransUnion are crucial. Additionally, increasing income through employment opportunities or side jobs can bolster financial stability. Maintaining a stable job for at least two years, as preferred by lenders, improves trustworthiness. Saving for a larger down payment, ideally 20% of the home's purchase price, can reduce the loan-to-value ratio and thus the perceived risk. Consulting with financial advisors or engaging in credit counseling can provide tailored strategies for financial health improvement. Implementing these steps may lead to a stronger mortgage application in the future.

Contact Information for Further Assistance: Customer service or loan officer contact details.

In cases of mortgage loan rejection, potential borrowers may seek further assistance from customer service representatives or dedicated loan officers. Contact information typically includes a customer service hotline number, such as 1-800-555-0199, for immediate inquiries or support. Additionally, loan officers usually provide direct phone numbers and email addresses for personalized assistance; for example, Officer John Smith may be reached at 1-800-555-0133 or via email at john.smith@lender.com. Accessing these resources allows individuals to clarify rejection reasons, explore alternative lending options, or receive guidance on improving future applications, enhancing financial literacy and preparedness for subsequent submissions.

Comments