When it comes to verifying mortgage payoffs, having a structured letter template can make the process seamless and efficient. Whether you're a homeowner looking to confirm your mortgage status or a lender ensuring all necessary information is documented, a well-crafted letter is essential. This template not only streamlines the verification journey but also helps eliminate any confusion regarding payment details. Ready to explore how to create your own mortgage payoff verification letter? Let's dive in!

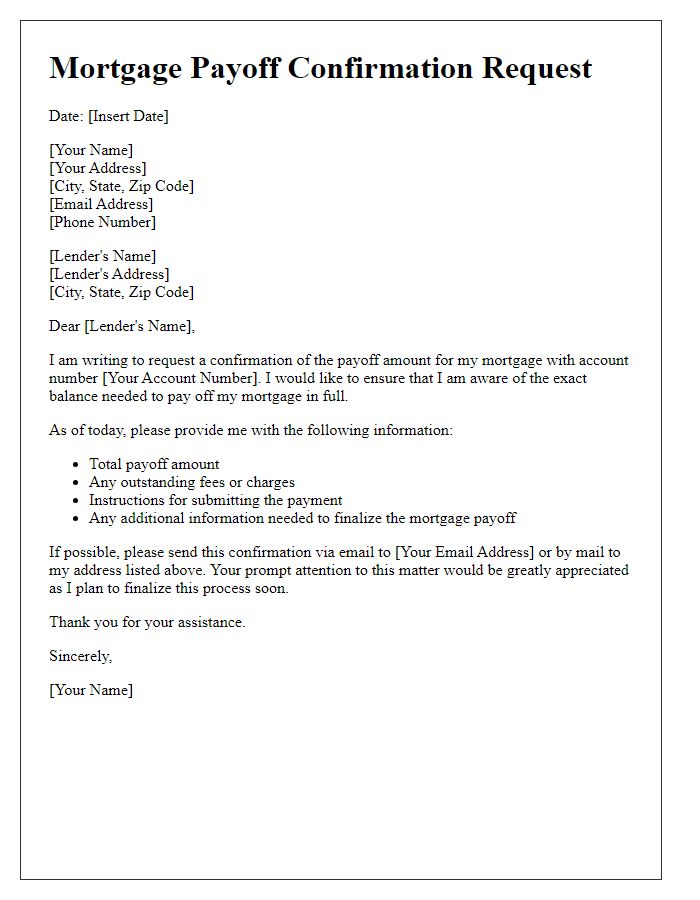

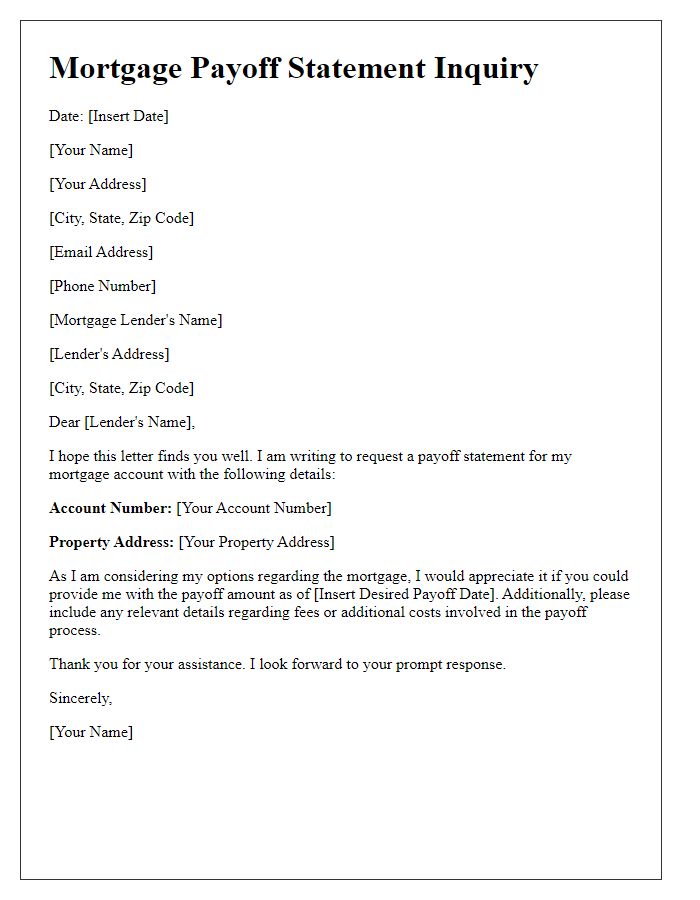

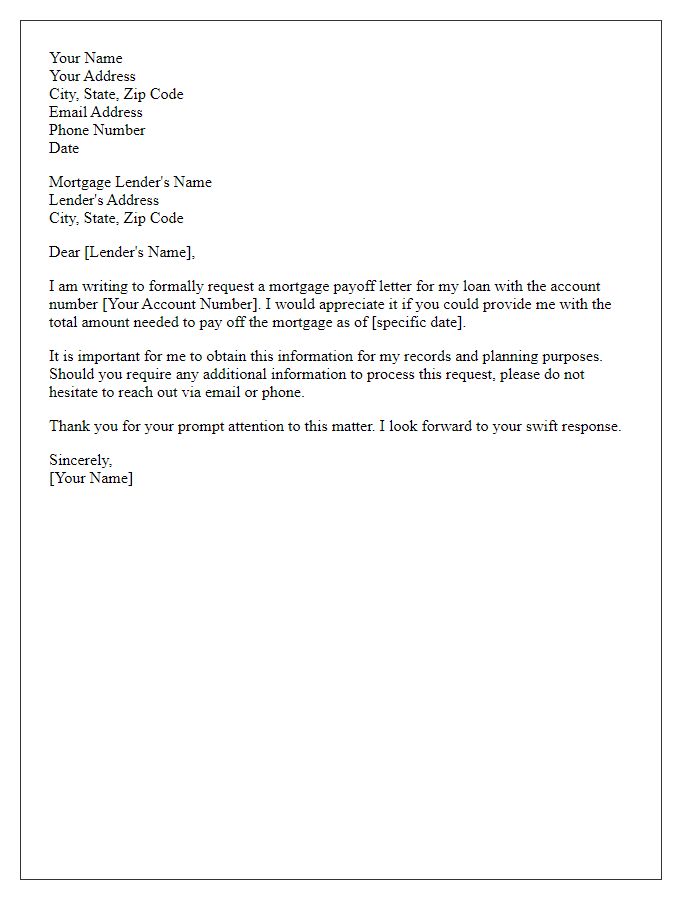

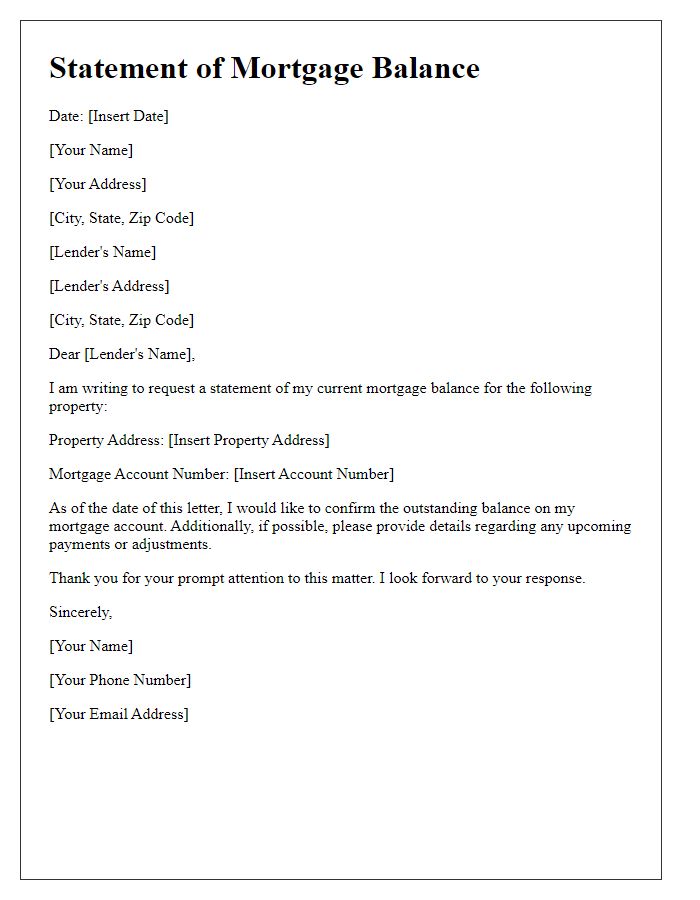

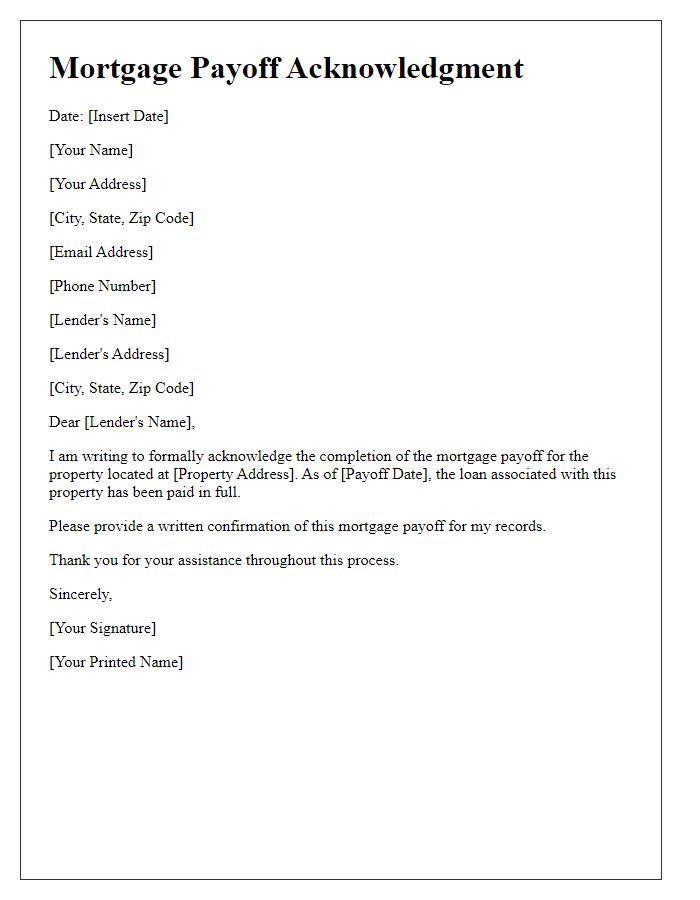

Borrower's Full Name and Contact Information

Verification of mortgage payoffs is essential for financial institutions and borrowers. This process often includes the borrower's full name, ensuring accurate identification, along with contact information, which typically consists of a phone number and email address for prompt communication. Proper documentation may also require the loan number and property address, facilitating seamless record checks. Additionally, financial entities often request the original lender's details, helping verify the payoff status efficiently. Such confirmations help maintain transparency and ensure that borrowers can proceed with property transactions without lingering financial encumbrances.

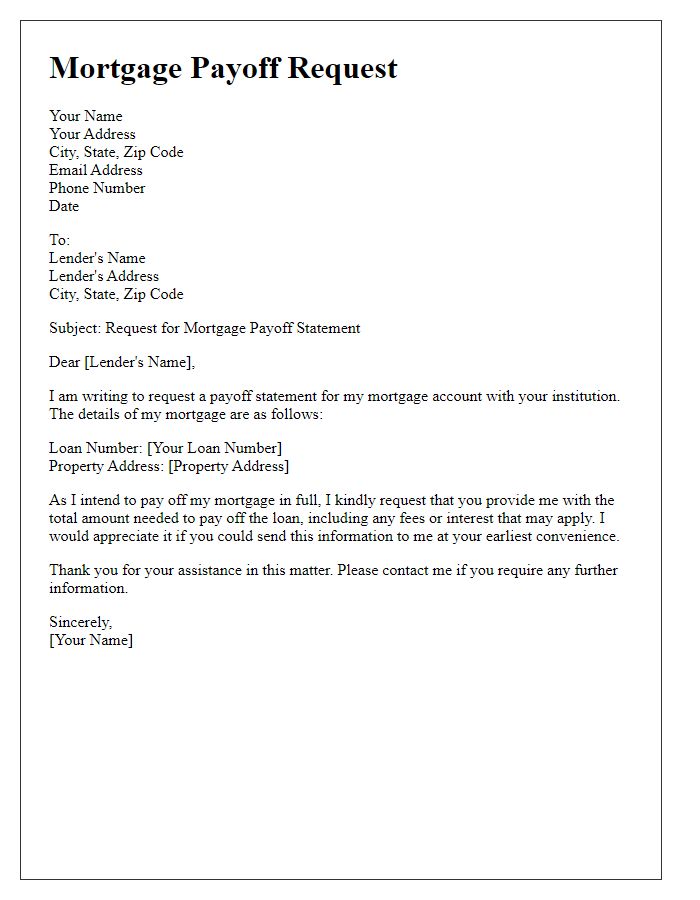

Loan Account Number

The verification of mortgage payoffs is essential for ensuring financial accountability in loans structured around real estate transactions. A Loan Account Number, typically a unique identifier consisting of numeric digits, helps lenders track payments made towards a specific mortgage agreement. This number plays a pivotal role during the payoff process, providing clear documentation of the remaining balance on the mortgage. In many cases, this verification process occurs within a set timeframe, often 30 days, after which the lender will provide a payoff statement that outlines the required amount to fully close the loan. Accurate records of payment history, including principal and interest amounts, are vital for both lenders and borrowers, creating a transparent path towards satisfying the mortgage obligation.

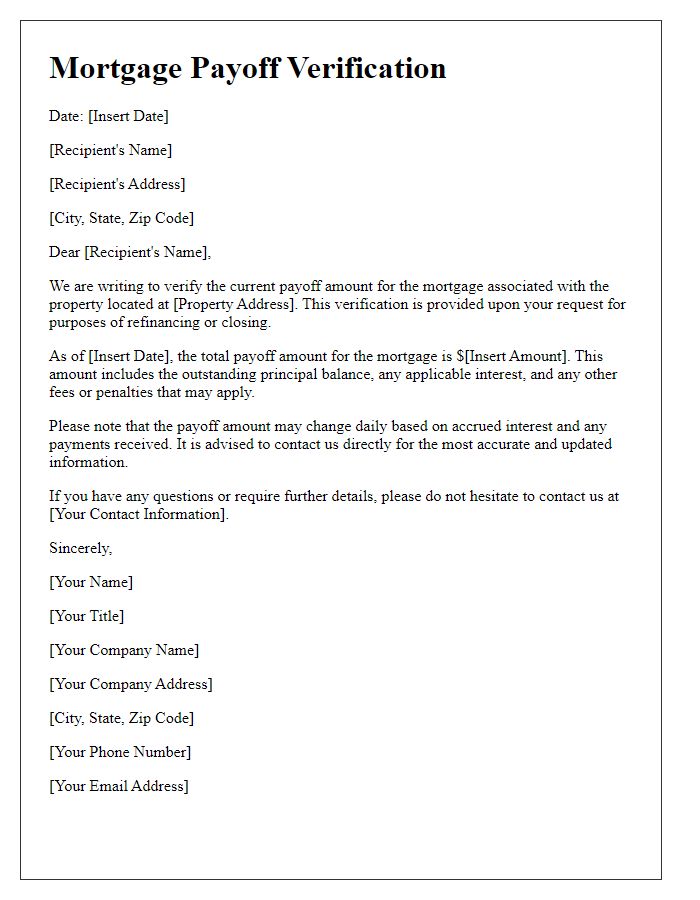

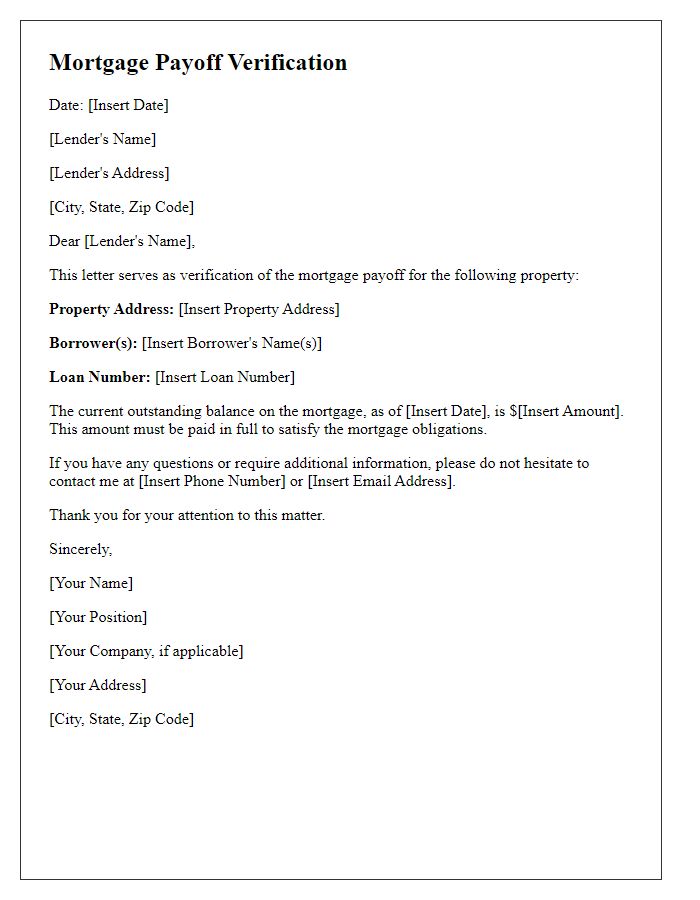

Lender's Name and Address

Mortgage payoffs are crucial financial transactions that require precise documentation. The lender's name, such as XYZ Bank, ideally located at 1234 Financial Avenue, Springfield, should be clearly mentioned. This bank, established in 1980, holds a significant market position in the mortgage sector. Additionally, the address must include state and zip code details for accurate identification. Verification of mortgage payoffs typically requires Final Payoff Statements, detailing principal balance, accrued interest, and any fees. Timely processing ensures compliance with regulatory standards, allowing homeowners to smoothly transition to their next property or financial milestone.

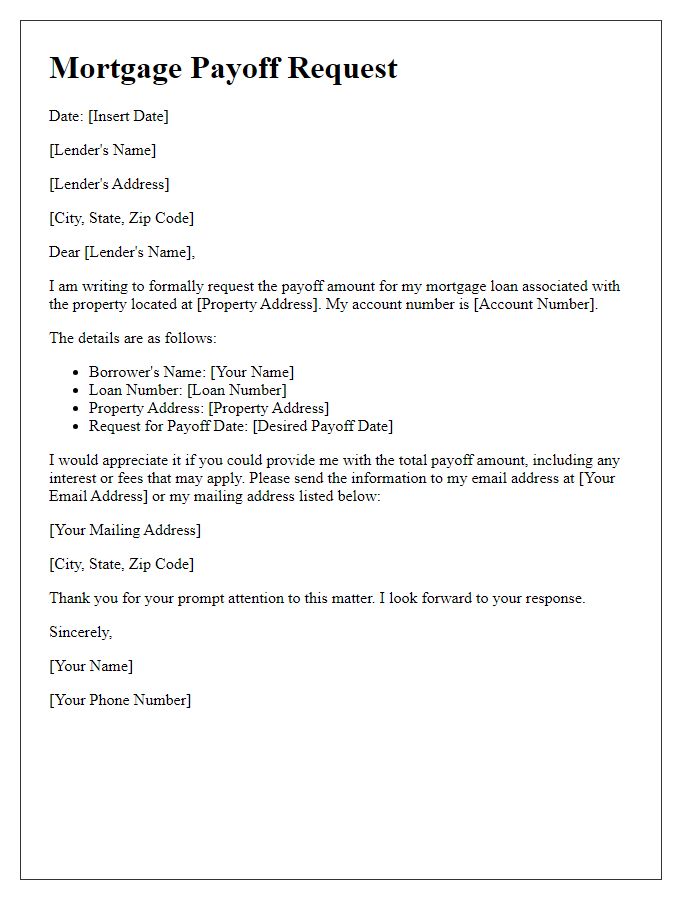

Request for Payoff Statement

A payoff statement is crucial for verifying mortgage balances and understanding the closing amounts required to settle outstanding debts. Financial institutions, such as banks and credit unions, typically generate this document upon request. The payoff statement details the remaining principal balance, accrued interest, applicable fees, and any potential penalties for early payoff. When requesting this statement, borrowers should provide pertinent information including loan number, property address, and specific dates to ensure accuracy. This document plays a vital role in facilitating real estate transactions, refinancing processes, and estate settlements, and must be obtained directly from the lender to avoid discrepancies or delays.

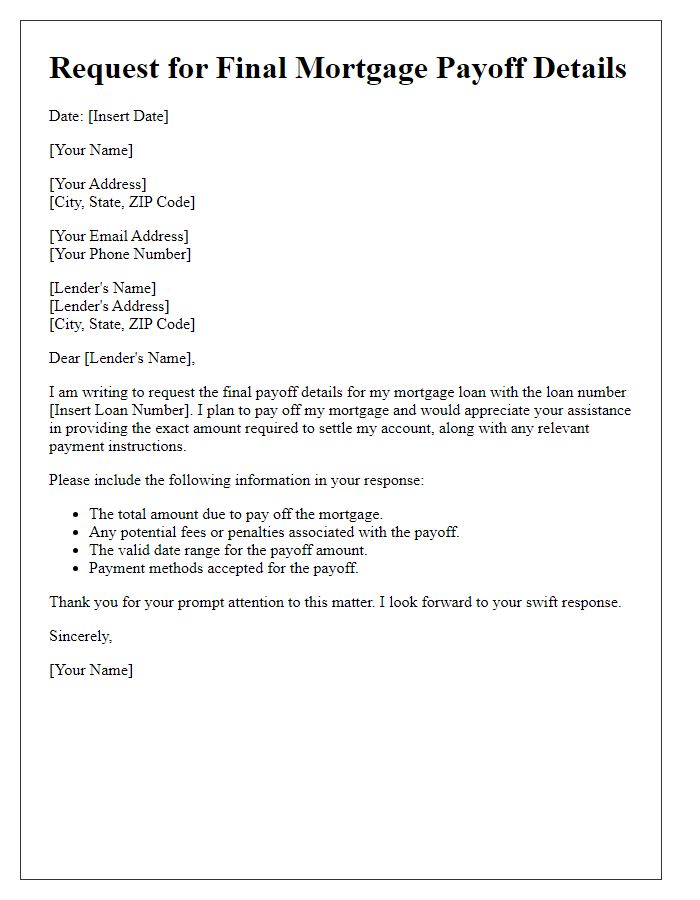

Deadline for Receiving Payoff Information

Mortgage payoffs require timely verification to ensure accuracy during real estate transactions. Financial institutions often set a deadline for receiving payoff information, typically within 5 to 10 business days before the closing date. This timeframe allows lenders, such as Bank of America or Wells Fargo, to prepare necessary documents without delays. Key details needed include the loan number, outstanding balance, and instructions for wiring funds. Accurate and prompt communication between stakeholders -- borrowers, title companies, and real estate agents -- is crucial for a smooth closing process. Failing to meet the deadline may result in complications, affecting future property title transfers.

Comments