Are you feeling overwhelmed by the complexities of a mortgage deficiency waiver request? You're not aloneâmany homeowners find themselves navigating the intricate details of mortgage agreements and financial obligations. Understanding the process and having a solid template can make all the difference in successfully communicating your needs to lenders. So, join me as we explore an effective letter template that will simplify your request and get you closer to a resolution.

Borrower's Contact Information

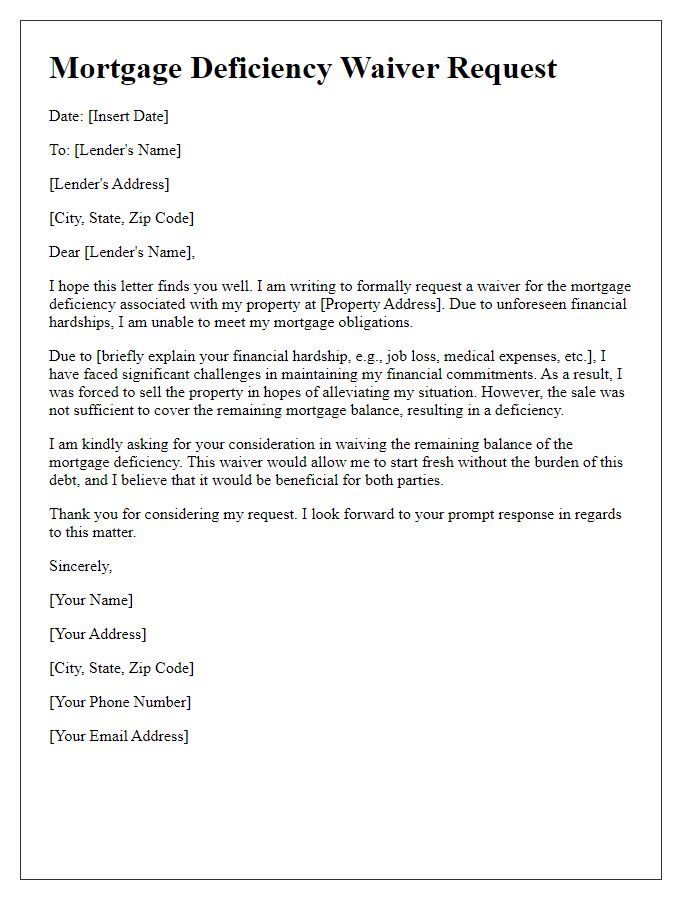

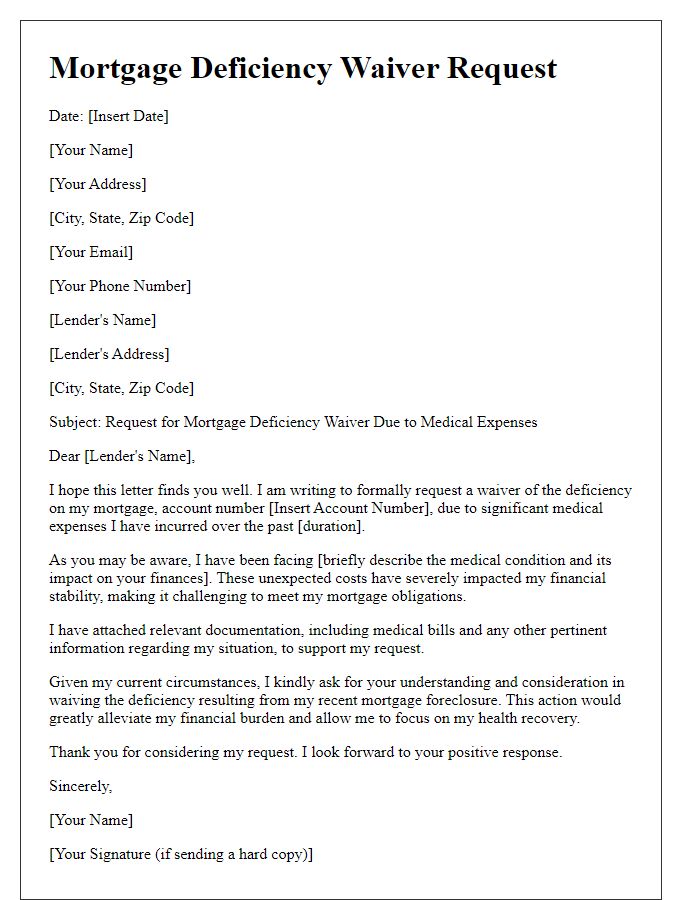

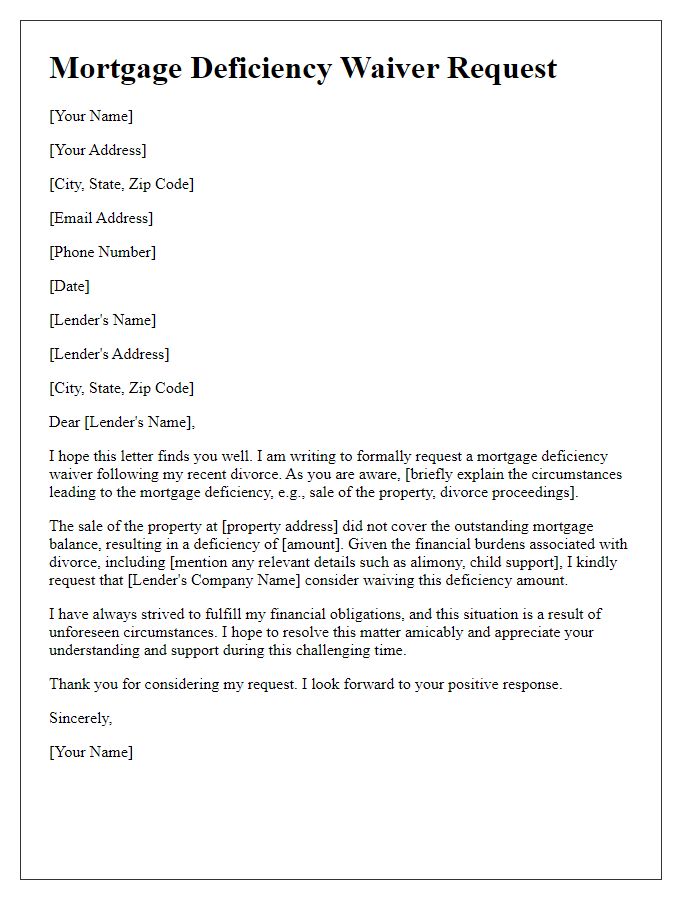

The request for a mortgage deficiency waiver involves highlighting specific financial circumstances that led to the deficiency. It typically includes the borrower's contact information, such as full name, address, phone number, and email address, enabling clear communication with the lender. The context surrounding circumstances like a house foreclosure, which might have occurred in a location like Michigan in 2020, can provide insight into the financial strain faced. Documentation such as income statements, proof of unemployment, or medical bills can substantiate the request, illustrating the borrower's genuine need for relief from remaining mortgage debts. The outcome of this request can significantly impact the borrower's financial future, offering a chance for recovery from burdensome liabilities.

Lender's Information

A mortgage deficiency waiver request involves seeking the lender's consent to forgive any remaining balance on a mortgage after a property has been foreclosed. Financial institutions often handle such requests to assist borrowers. Key factors include the lender's identity (such as Bank of America, JPMorgan Chase), property location (such as Los Angeles, California), and relevant loan details (such as original loan amount, interest rates). Important to mention are the specific circumstances leading to the deficiency, including financial hardship events (such as medical emergencies or job loss) and any attempts made to remedy the situation (like loan modifications). Documentation (pay stubs, tax returns) is crucial in showcasing the borrower's financial status and history of payments. Engaging with authorized representatives or attorneys may enhance the request's credibility.

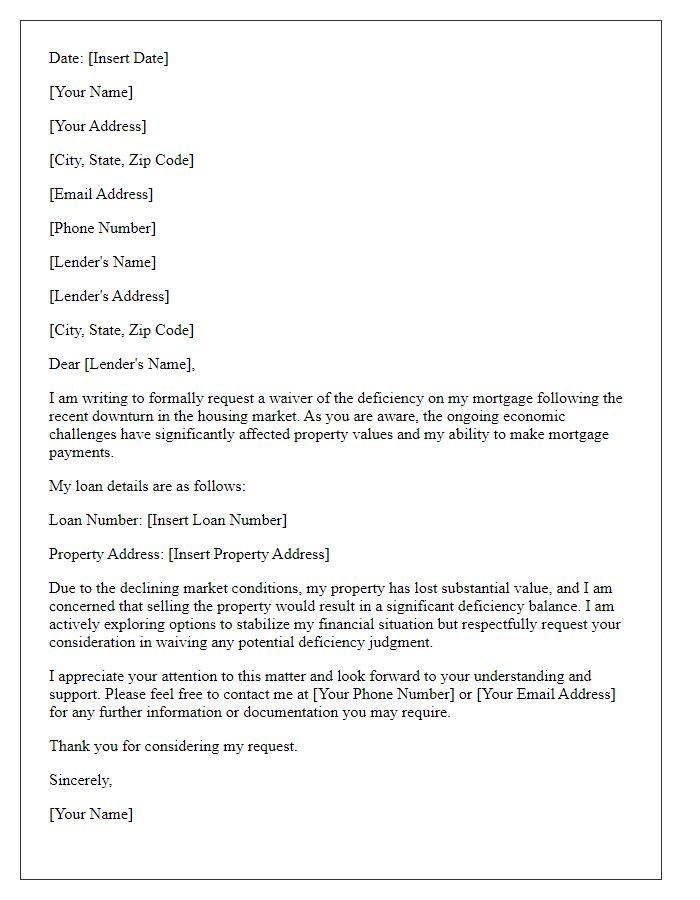

Loan Details and Account Number

A mortgage deficiency waiver request seeks leniency regarding a mortgage debt. Loan details include Loan Number 123456789 and Account Number 987654321. A deficiency occurs if a home sells for less than the outstanding mortgage balance during foreclosure. In 2022, the average foreclosure sale price in the United States was approximately $250,000, while the average outstanding mortgage balance was around $300,000, creating potential deficiencies. Requesting a waiver may involve submitting financial statements, tax returns, and hardship letters, explaining personal circumstances. It's important that the request is sent to the lender's Loss Mitigation Department, which handles alleviating financial burdens related to mortgage accounts.

Explanation of Hardship Circumstances

A mortgage deficiency waiver request is essential for homeowners facing financial hardship after foreclosure proceedings, typically occurring when the sale of a foreclosed property does not cover the outstanding mortgage balance. Hardship circumstances may include job loss due to economic downturns, such as the 2008 financial crisis, significant medical bills from unexpected illnesses, particularly those requiring long-term care, or divorce, which often results in diminished household income. Additionally, regions with high unemployment rates, like certain areas in Michigan or California, amplify financial strain on families struggling to meet mortgage obligations. Detailed documentation of these circumstances, including income statements and medical bills, will provide insight into the difficulties faced during this challenging period, strengthening the request for a waiver of remaining deficiency balances.

Request for Deficiency Waiver and Supporting Documentation

A mortgage deficiency waiver request involves seeking a formal forgiveness of the remaining balance owed after a foreclosure, typically submitted to banks or lending institutions. The request should include supporting documentation such as loan details (account number, original loan amount), property information (address, type of property), and the circumstances leading to foreclosure (job loss, medical emergencies). Including a personal statement detailing financial hardship can strengthen the waiver request. Supporting evidence includes income statements, tax returns, and any communication with the lender regarding payment difficulties. This documentation demonstrates the requestor's genuine hardship, increasing the likelihood of a favorable outcome.

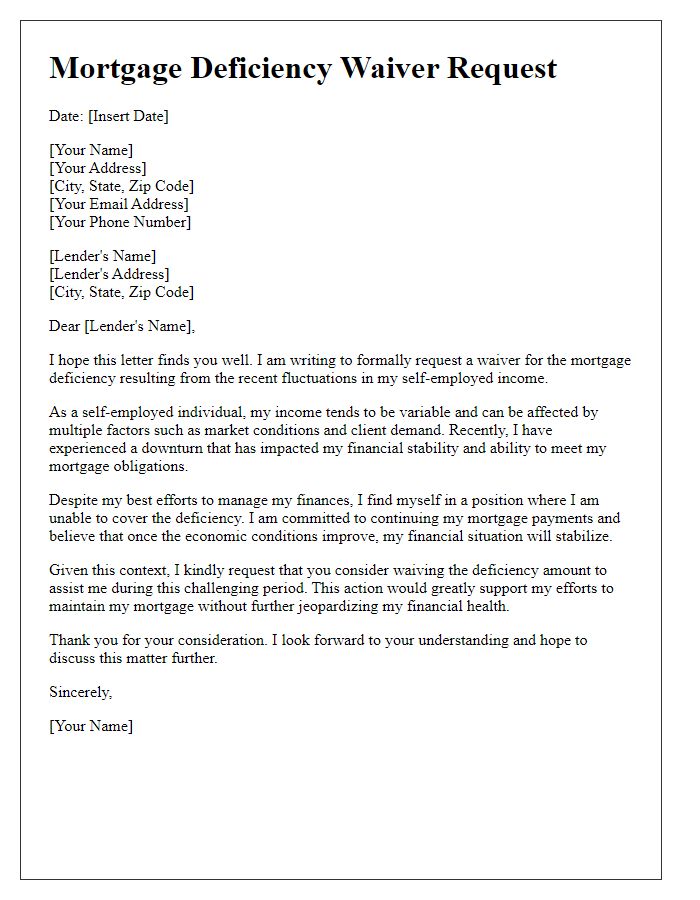

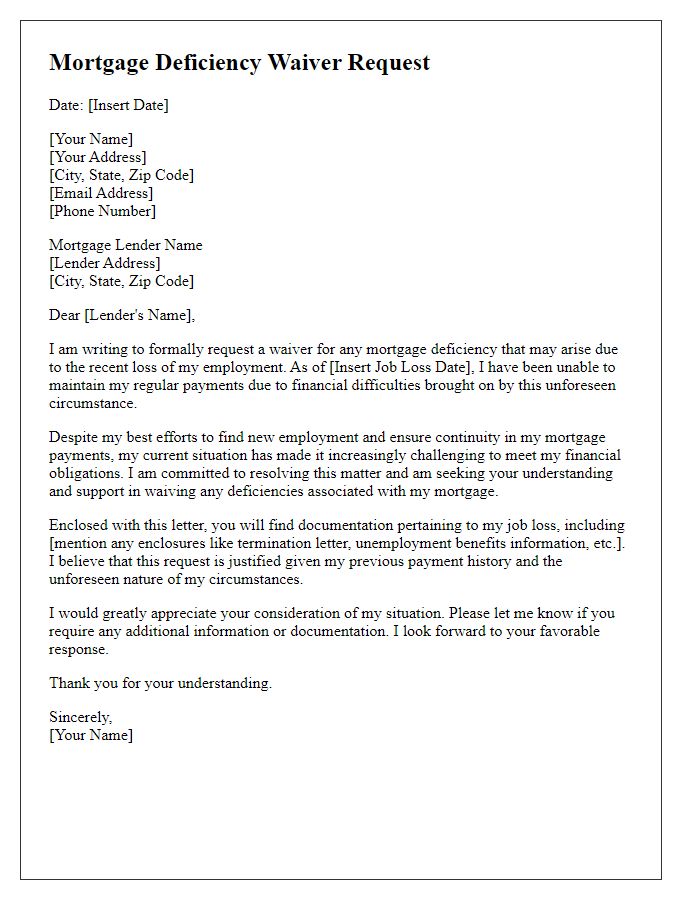

Letter Template For Mortgage Deficiency Waiver Request Samples

Letter template of mortgage deficiency waiver request for financial hardship.

Letter template of mortgage deficiency waiver request for medical expenses.

Letter template of mortgage deficiency waiver request following divorce.

Letter template of mortgage deficiency waiver request for unexpected emergencies.

Letter template of mortgage deficiency waiver request for extended unemployment.

Letter template of mortgage deficiency waiver request due to a family crisis.

Letter template of mortgage deficiency waiver request for retirement income reduction.

Letter template of mortgage deficiency waiver request for self-employed income fluctuation.

Comments