Are you feeling a bit anxious about a missed mortgage payment? You're not alone; many homeowners face unexpected financial hurdles that can lead to such situations. It's vital to understand your options and stay informed so you can navigate this challenge effectively. Join us as we explore helpful strategies and insightsâread more to empower yourself today!

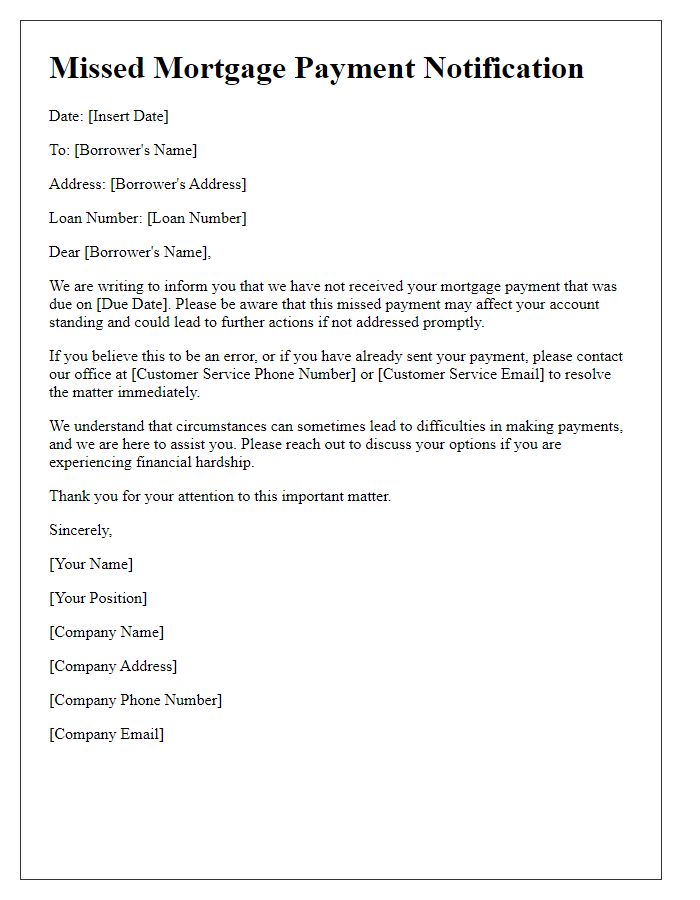

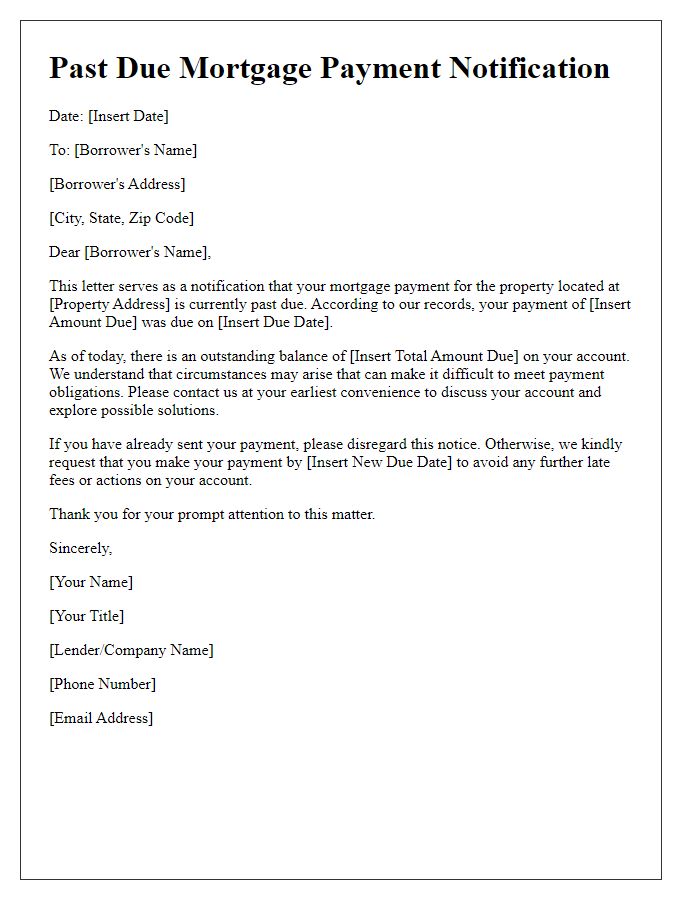

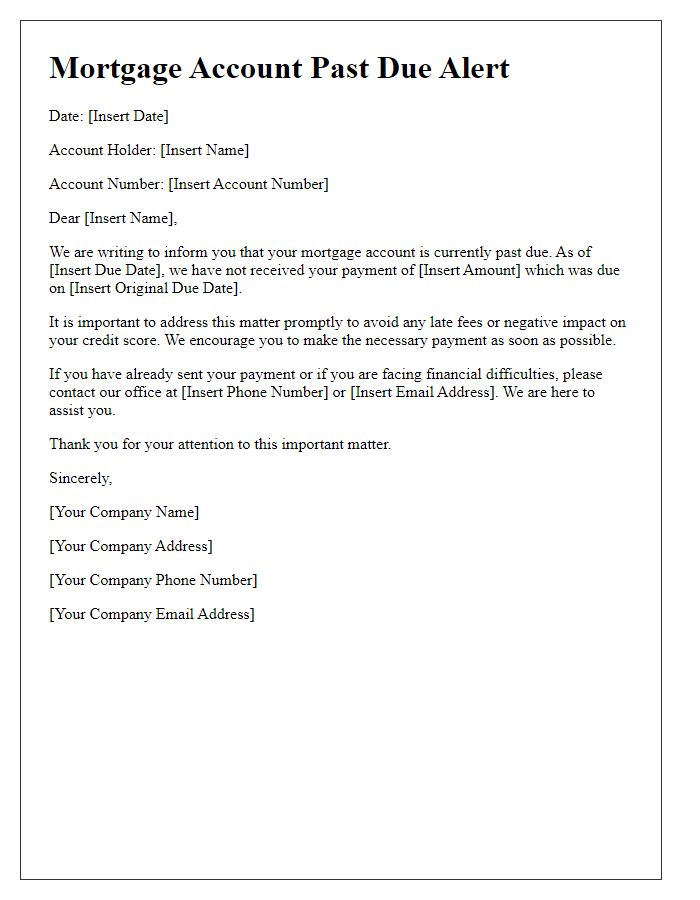

Account Information

Missed mortgage payments can lead to significant consequences for homeowners. Payment requirements typically involve monthly installments (usually due on the first day of each month) towards principal and interest on the loan amount secured by the property, often a house or condominium. Notifications regarding missed payments are generally issued by mortgage companies, emphasizing prompt corrective action. Homeowners are urged to check account information detailing payment history, outstanding balances, and any late fees incurred for overdue amounts. Immediate communication with the lender (often a bank or financial institution) can prevent further complications like foreclosure risks or deterioration of credit scores. It's vital to stay on top of these payments, especially considering potential remedies such as loan restructuring or repayment plans available for struggling borrowers.

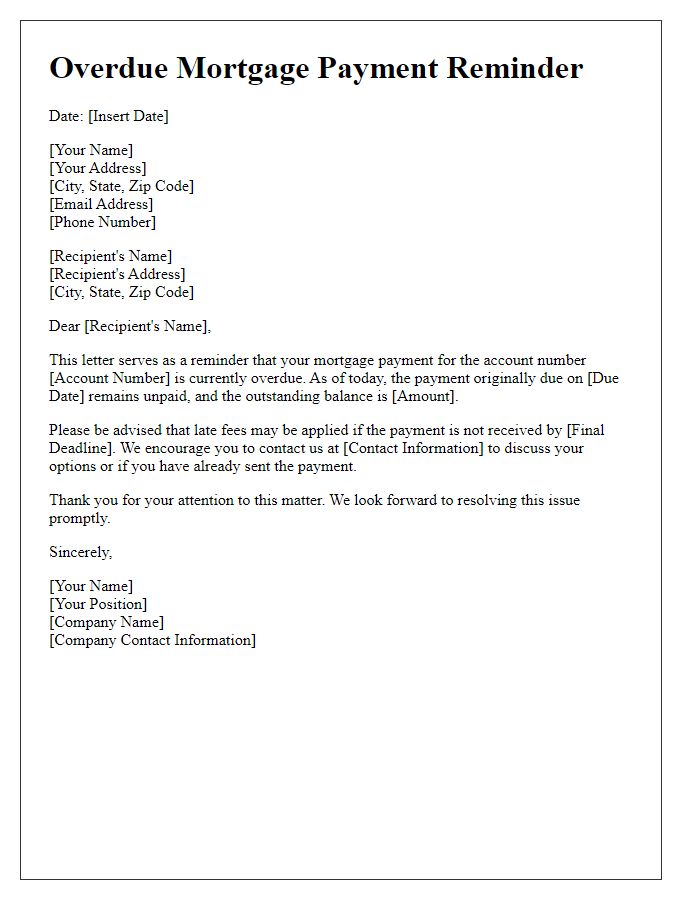

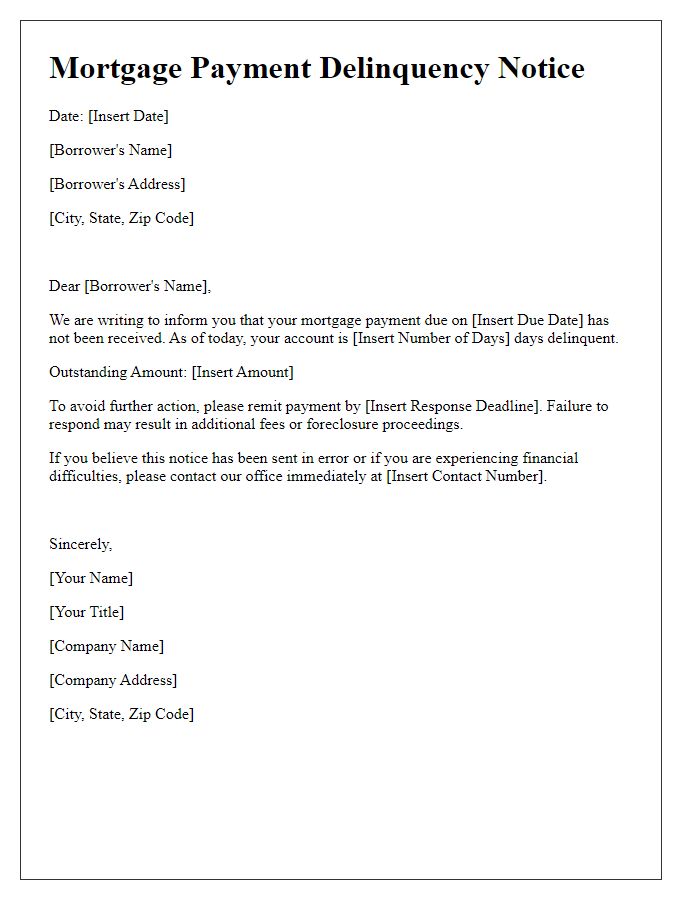

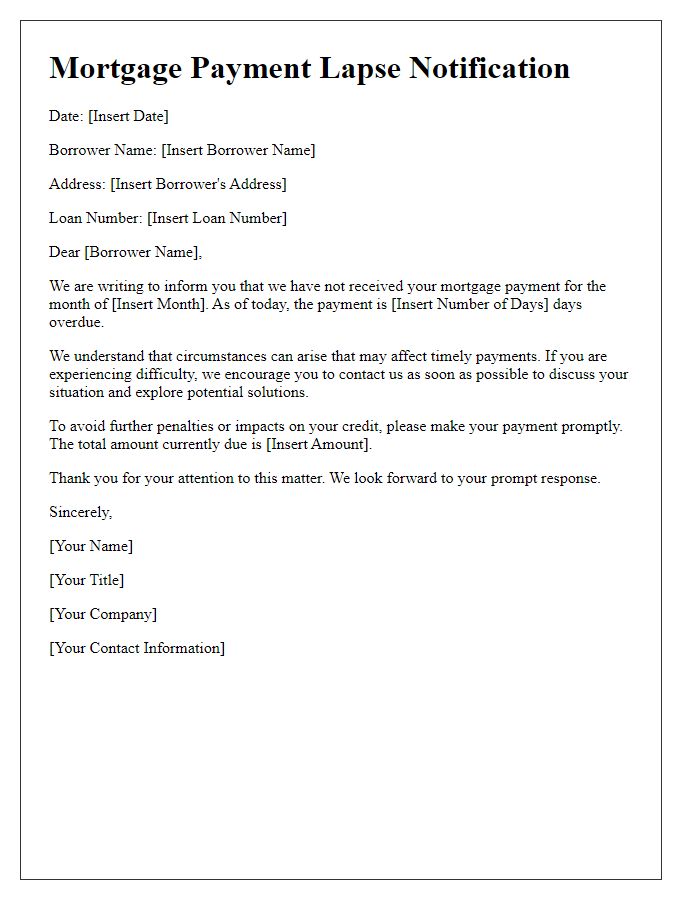

Payment Due Date and Amount

A missed mortgage payment can significantly impact the homeowner's financial stability and credit score, typically reported to credit bureaus after 30 days of non-payment. Homeowners may face late fees ranging from $25 to $50, depending on their lender's policies, and consecutive missed payments can result in foreclosure proceedings initiated by financial institutions, affecting the homeowner's property ownership. Ensuring timely payment before the next due date is critical to avoid these financial consequences, especially given that most mortgages require monthly payments often exceeding a thousand dollars, depending on the loan's principal amount and interest rate. Assistance is available through various local programs aimed at helping homeowners manage their mortgage obligations, particularly during economic hardships.

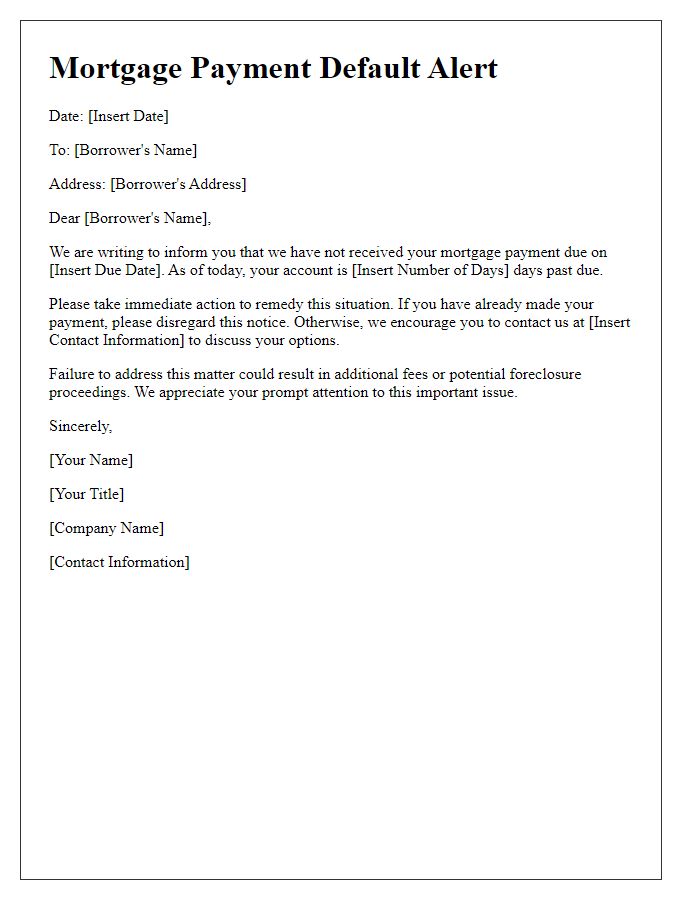

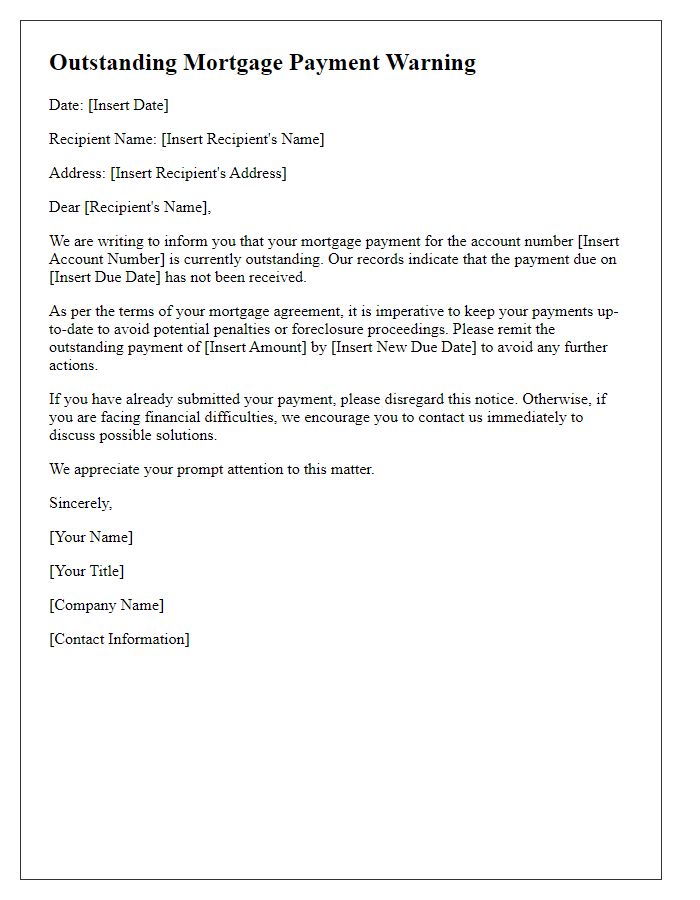

Consequences of Non-Payment

A missed mortgage payment can lead to severe consequences, including foreclosure proceedings initiated by lenders, primarily banks or financial institutions. After 30 days of non-payment, lenders typically issue a late fee, which can be 5% of the missed amount, adding financial strain. If payment lapses reach 90 days, borrowers may receive a default notice, highlighting the risk of foreclosure, the legal process that can result in the loss of property. According to the U.S. Department of Housing and Urban Development, foreclosure can significantly impact credit scores, dropping them by 100 points or more, affecting future loan eligibility. Effective communication with lenders about potential hardship can sometimes result in loan modifications or temporary forbearance, highlighting the importance of addressing missed payments promptly.

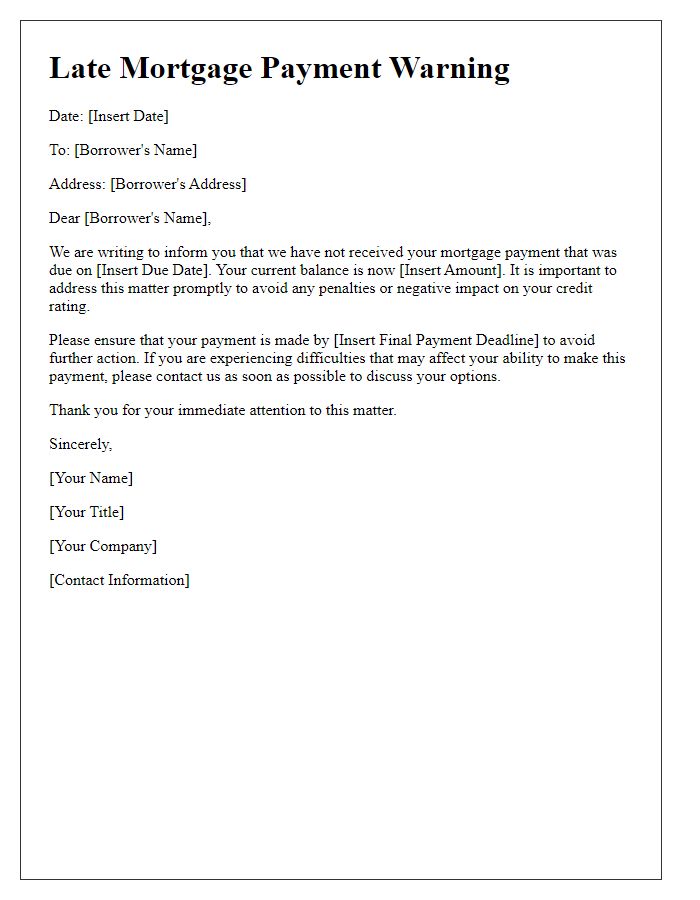

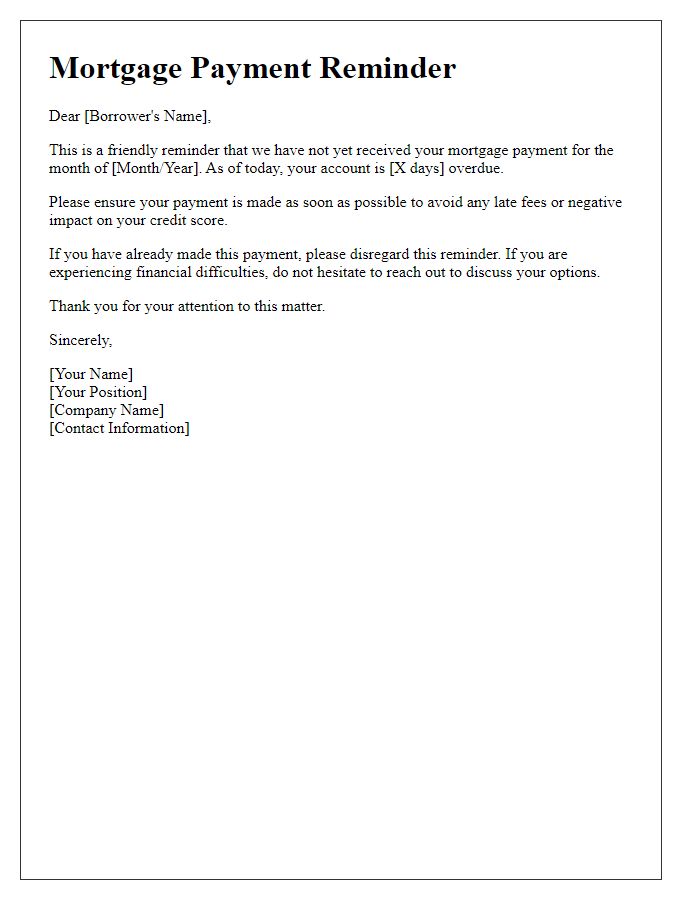

Contact Information for Assistance

Mortgage payment alerts often indicate financial stress, prompting immediate action for resolution. Homeowners may face penalties if payments are delayed beyond the grace period, typically 15 days after the due date. Seeking assistance can mitigate negative consequences, such as foreclosure or damage to credit scores. Mortgage servicers, equipped with customer service departments, can provide options such as payment plans or loan modifications. Contact information for these services is usually found on mortgage statements or lender websites, often accessible 24/7. Local housing agencies can also offer additional resources for distressed borrowers, providing valuable support and guidance.

Payment Options and Methods

Missed mortgage payments can significantly impact credit scores and financial stability. Numerous options exist for homeowners facing difficulties, including loan modification, forbearance, or repayment plans. These methods allow borrowers to adjust monthly payment amounts based on financial circumstances, such as job loss or medical expenses. Key institutions like Fannie Mae and Freddie Mac provide resources and guidance for individuals in need. Homeowners are encouraged to reach out to their mortgage servicer promptly to discuss potential alternatives and avoid foreclosure, which can affect homeownership status and equity. Timely communication is essential for exploring solutions and mitigating financial repercussions.

Comments