Are you looking to make homeownership more accessible for your clients? Proposing a mortgage interest discount can be a game-changer, enhancing your competitive edge in the housing market. By offering lower rates, you not only attract new borrowers but also build long-lasting relationships based on trust and savings. Ready to explore how to craft the perfect proposal? Read on!

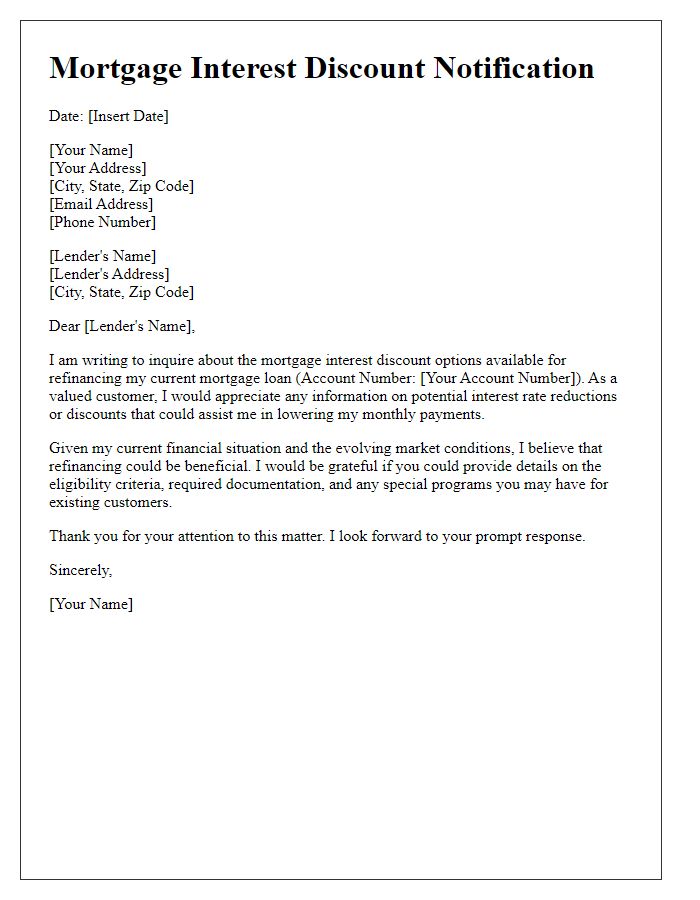

Recipient and lender details

A proposal for mortgage interest discounts can significantly benefit both the borrower and the lending institution. The recipient, typically a mortgage lender such as a bank or credit union, plays a crucial role in defining interest rates that can impact the overall cost of homeownership for borrowers. Through measures such as a discount on interest rates, lenders can attract a larger client base while simultaneously promoting responsible borrowing behaviors among homeowners. This proposal should outline potential scenarios where discounts might apply, including specifics like a reduction in the nominal interest rate by 0.5% for borrowers with a consistent payment history or for those refinancing into a fixed-rate mortgage. Furthermore, detailing market trends in the local area, such as the average home price in places like Los Angeles (approximately $800,000) or interest rates hovering around 4% in October 2023, provides context for lenders to assess the viability and competitiveness of such discounts.

Subject line

Subject: Proposal for Mortgage Interest Discount Opportunities

Introduction and relationship

Proposing mortgage interest discounts can significantly benefit both lenders and borrowers through fostered trust and collaboration. Acknowledgment of the existing relationship between the lender (often a financial institution like a bank or credit union) and the borrower (individuals or families seeking home loans) sets a positive tone. Over the years, consistent communication and timely repayments strengthen this relationship, making the borrower an attractive candidate for interest rate adjustments. Demonstrating a commitment to shared goals, such as financial stability and mutual growth, can leverage this relationship in proposing tailored discounts on mortgage interest rates. A detailed analysis of the borrower's payment history, current market trends, and competitive rates offered by rival lenders can support the proposal, enhancing the rationale for discount consideration.

Reason for requesting discount

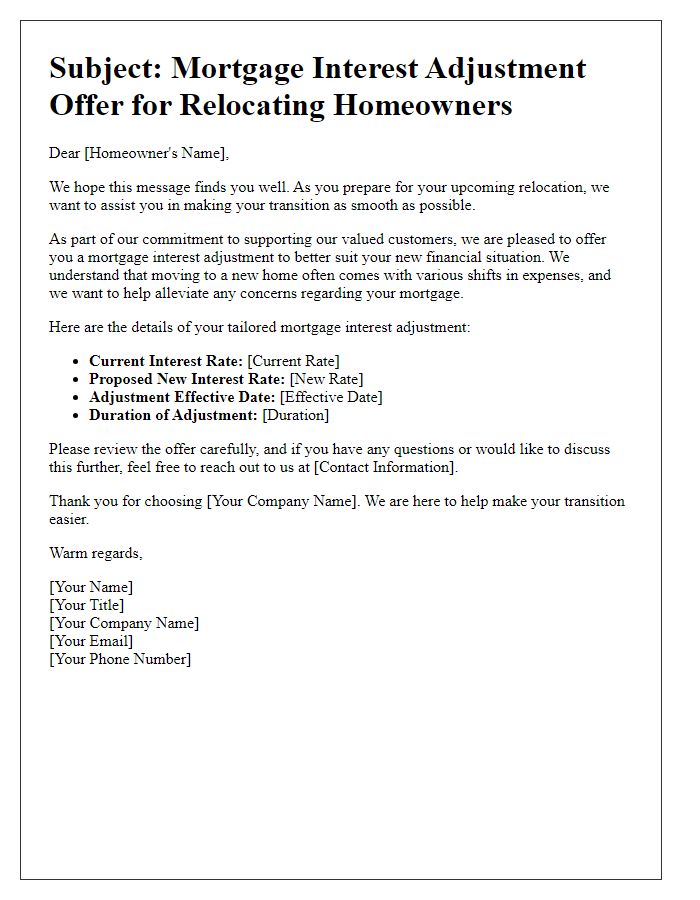

Rising housing expenses and fluctuating market conditions have prompted homeowners to seek mortgage interest discounts. Currently, the average annual percentage rate (APR) for 30-year fixed mortgages stands at approximately 6.5%, significantly impacting monthly payments and overall affordability. Economic factors, such as the Federal Reserve's interest rate adjustments and inflation trends, also contribute to financial strain for many borrowers. Homeowners, striving to maintain their financial stability, are requesting adjustments in their mortgage rates to secure more manageable monthly obligations. By obtaining a discount, borrowers can alleviate financial pressure, promote timely payments, and improve overall customer satisfaction, which could foster beneficial relationships with lenders. Such adjustments not only support individual budgets but also create a more favorable lending environment in the current unpredictable economic landscape.

Financial standing and creditworthiness

Proposing mortgage interest discounts can significantly benefit borrowers who showcase strong financial standing and creditworthiness. Lenders often assess factors such as credit score (typically above 700), income stability (consistent employment for over two years), and low debt-to-income ratio (preferably below 36%) to determine eligibility for reduced rates. Moreover, maintaining a solid payment history on any existing loans and demonstrating savings (ideally three to six months' worth of expenses) can further strengthen a borrower's position. These elements not only reflect an individual's ability to manage finances effectively but also reduce the lending risk for mortgage providers, creating opportunities for mutually beneficial agreements.

Letter Template For Proposing Mortgage Interest Discounts Samples

Letter template of mortgage interest discount proposal for first-time homebuyers.

Letter template of competitive mortgage interest rates for repeat buyers.

Letter template of promotional mortgage interest rates for seasonal buyers.

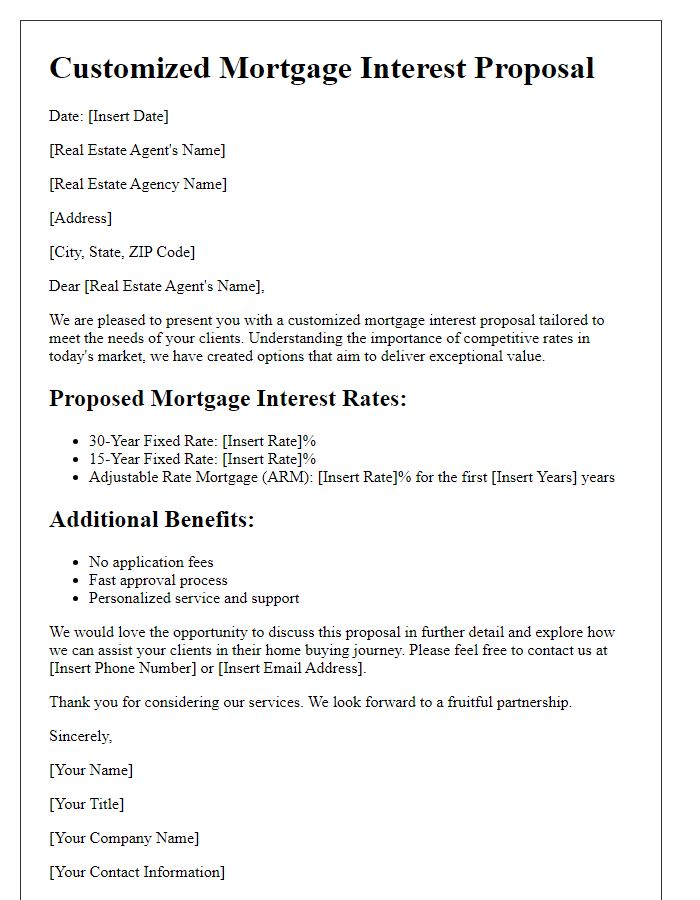

Letter template of customized mortgage interest proposals for real estate agents.

Letter template of community outreach mortgage interest discounts for local residents.

Comments