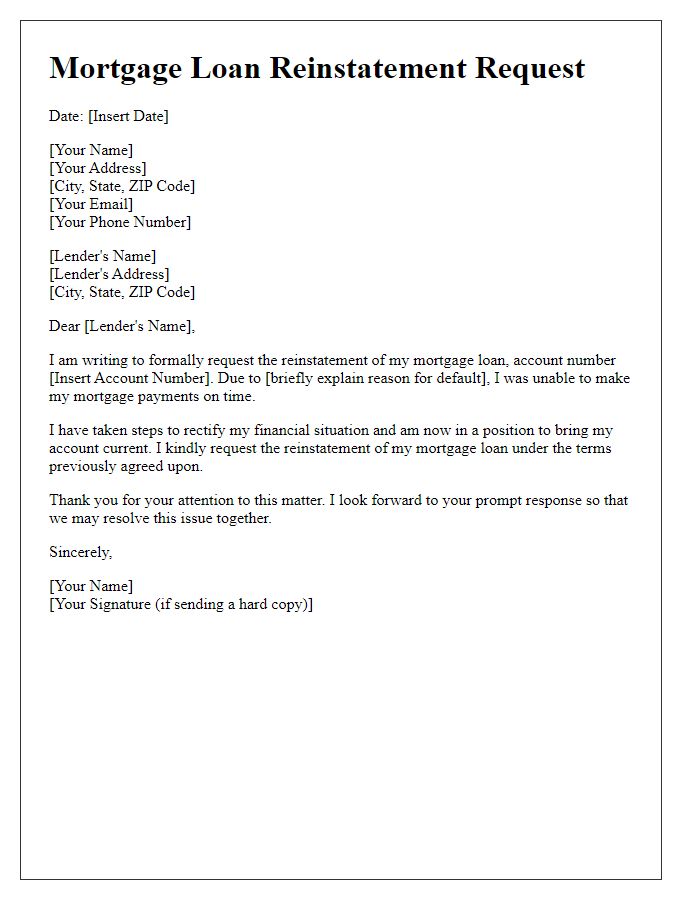

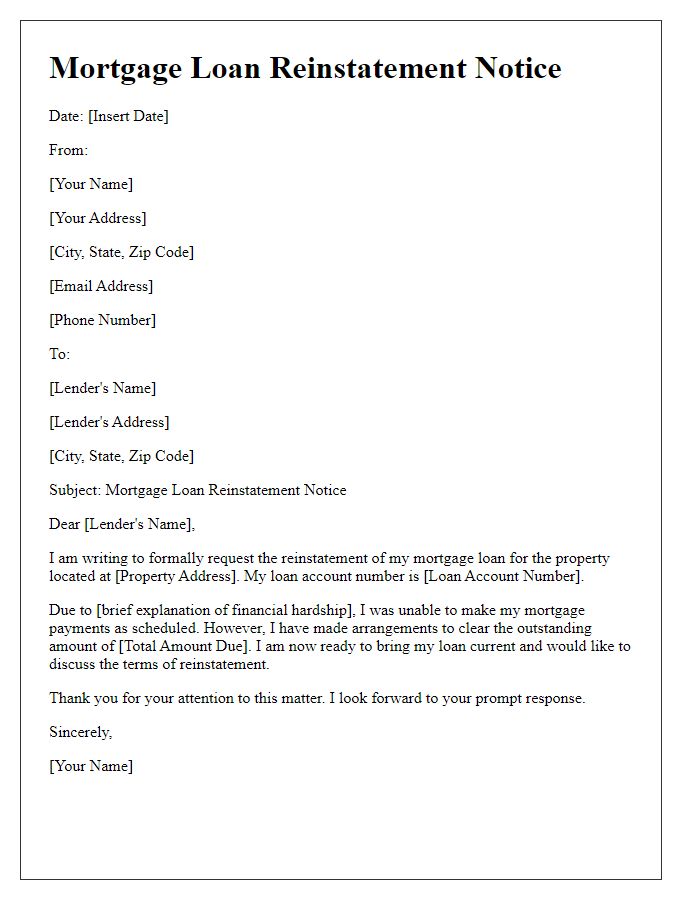

Are you in a situation where you need to reinstate your mortgage loan? Writing a clear and concise letter to your lender can help you navigate this process more smoothly. In this article, we'll guide you through the essential elements to include in your reinstatement request to ensure it gets the attention it deserves. Stick around to discover tips and a helpful template that can make your letter easy to draft!

Account Information

Reinstating a mortgage loan account requires accurate and detailed account information to ensure proper processing and acknowledgment. The critical components include the account number, which uniquely identifies the mortgage loan, the property address, representing the physical location tied to the loan, and the borrower's full name, providing clear identification of the account holder. Additionally, outlining the specific reinstatement amount, including any arrears, fees, and interest, gives lenders precise figures for evaluation. Including a clear statement regarding any previous communications about the reinstatement process can further support the request. Ensuring all this essential information is presented accurately can significantly enhance the efficiency of processing the mortgage loan reinstatement.

Borrower and Loan Details

The borrower, John Smith, residing at 123 Maple Avenue, Springfield, has a mortgage loan account number 456789012. This mortgage, issued by Springfield Bank, was obtained for a property purchased in June 2020, valued at $250,000. Initially, the loan was taken with a 30-year fixed interest rate of 3.5%, facilitating monthly payments of approximately $1,125. Due to unforeseen circumstances, John fell behind on payments in January 2023, leading to a temporary default situation. The reinstatement request seeks to address the missed payments totaling $3,375, restoring the loan to its current standing and allowing John to maintain ownership of the home.

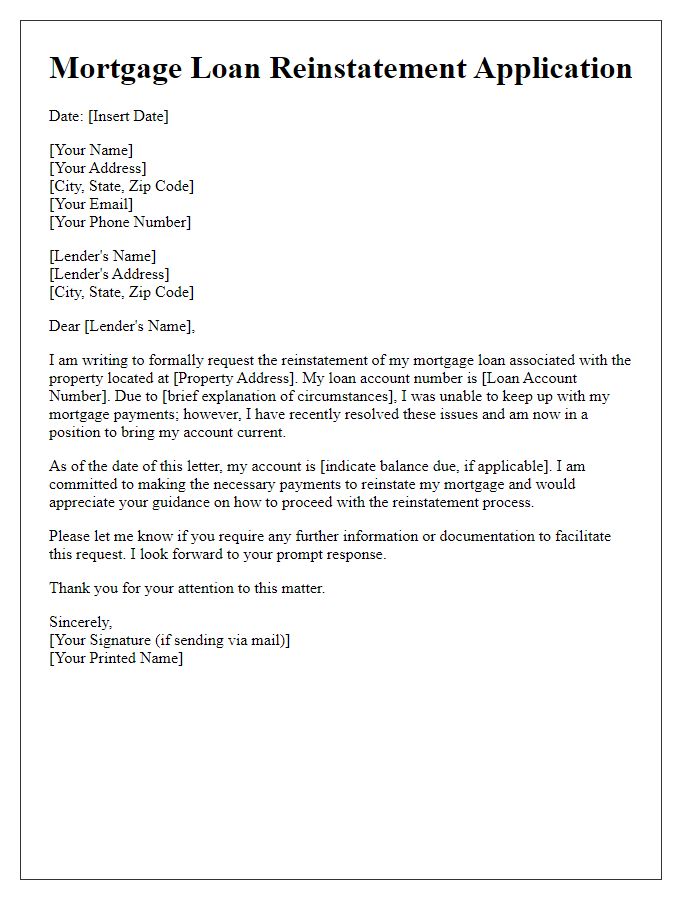

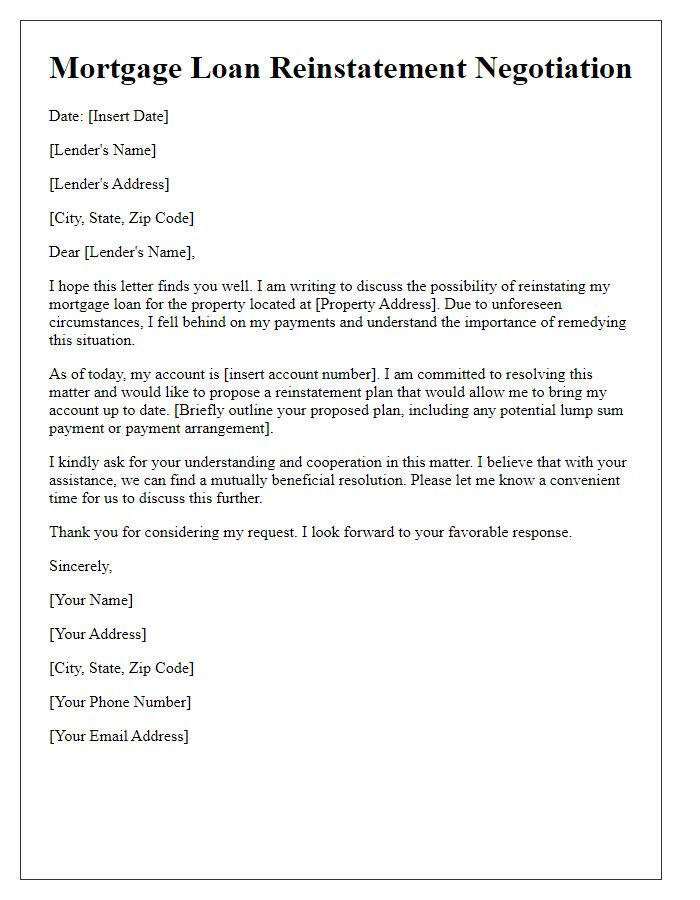

Reinstatement Amount and Breakdown

The reinstatement amount for a mortgage loan represents the total funds necessary to bring a loan back into good standing after a period of delinquency. This amount typically includes the past due principal balance, accrued interest, late fees, and any additional charges incurred during the delinquency period. For example, a loan with a principal balance of $200,000 may have an outstanding monthly payment of $1,500. If the borrower missed three payments, totaling $4,500 in principal and interest, late fees of $200, and property taxes of $300, the overall reinstatement amount would equal $5,000. The borrower may need to provide evidence of income or other financial documentation to verify their ability to resume regular payments. Timely reinstatement can prevent foreclosure, allowing the homeowner to retain their property within markets like Los Angeles or Chicago, where real estate values are significantly impacted by foreclosure rates.

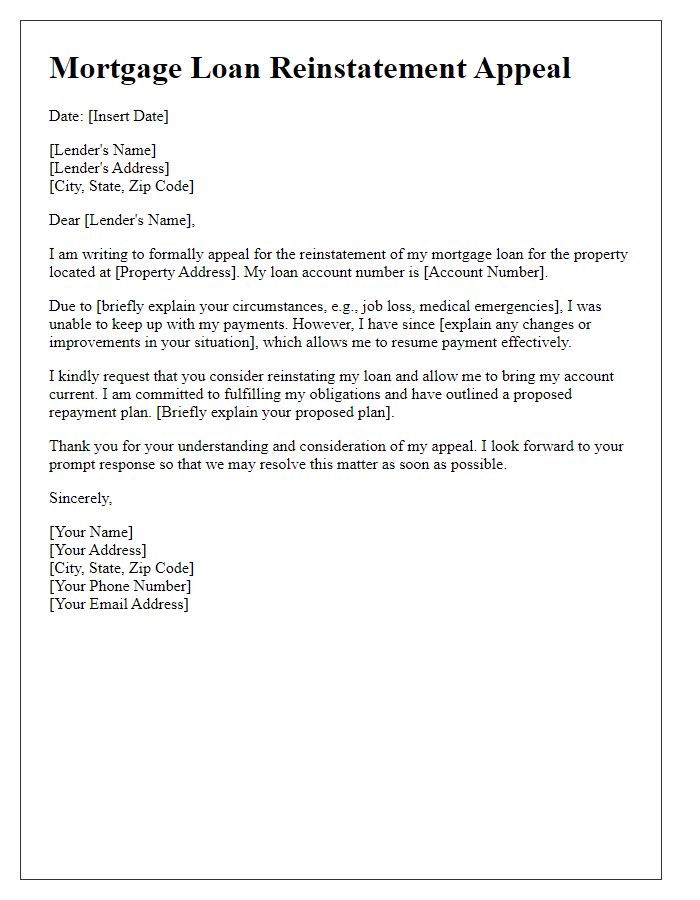

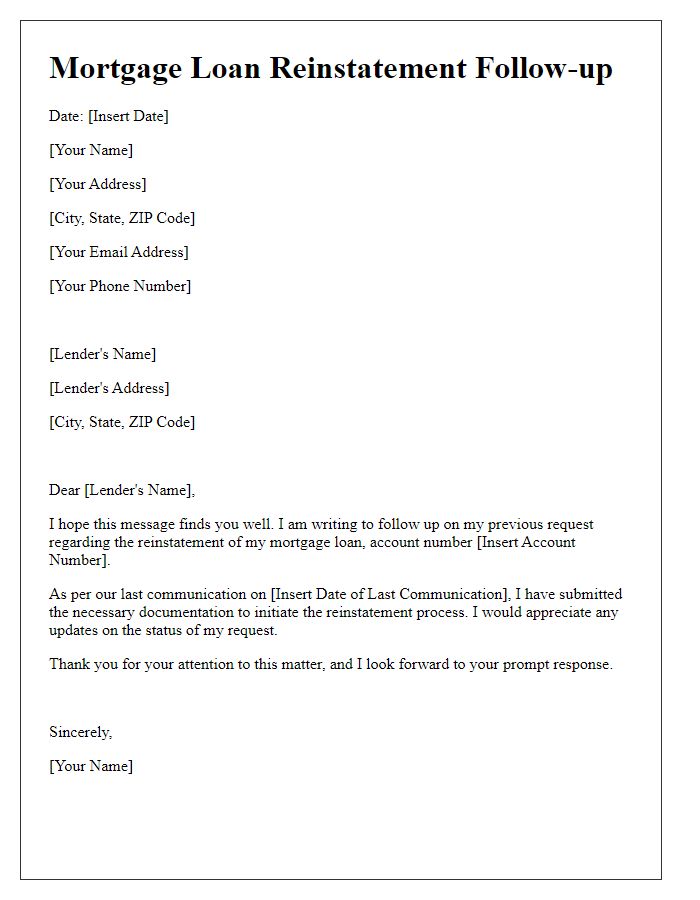

Payment Instructions and Due Date

A mortgage loan reinstatement process involves specific payment instructions and due dates that borrowers must adhere to in order to restore their mortgage status. Typically, borrowers are required to pay the total past due amount, including missed payments, late fees, and any applicable legal fees, to bring the loan current. Such reinstatement payments must often be submitted by a specified date, which is usually set by the lender, and failure to meet this deadline may result in further legal action or foreclosure proceedings. Payments are generally directed to the mortgage lender's designated address--such as the loan servicing department in Dallas, Texas--through certified check or electronic transfer to ensure prompt processing. Therefore, maintaining clear communication with the lender and timely responses to any correspondence are crucial steps in successfully navigating the reinstatement of a mortgage loan.

Contact Information for Assistance

Mortgage loan reinstatement is a critical process for homeowners facing financial distress. By contacting customer service departments of lending institutions, borrowers can explore options for reinstating their loans after delinquency. Assistance numbers typically vary by institution but often include dedicated hotline services operational during business hours. For example, major lenders like Bank of America or Wells Fargo provide specific representatives specializing in loan reinstatement, helping with paperwork and terms adjustments. Additionally, associations such as the Mortgage Bankers Association offer resources and guidelines for consumers needing further support in communicating with their lenders.

Comments