Are you navigating the complexities of school tax exemption notices? Understanding the ins and outs of these documents can feel overwhelming, but it doesn't have to be! This article aims to break down the essential components of the school tax exemption notice, so you can feel empowered and informed. Dive in and discover everything you need to know to ensure you get the relief you deserve!

Subject Line Optimization

Subject lines play a critical role in ensuring that school tax exemption notices capture the attention of recipients effectively. For example, "Important Notification: School Tax Exemption Approval Details" clearly conveys the content and urgency of the message. Another option, "Action Required: Verify Your School Tax Exemption Status", prompts recipients to engage immediately. A straightforward subject line like "School Tax Exemption Benefits for 2023" highlights the relevant year, making the information timely. Additionally, using phrases like "Maximize Your Savings: School Tax Exemption Insights" can motivate recipients to explore the advantages provided by the exemption. Properly optimized subject lines enhance open rates and improve communication efficiency regarding essential financial matters related to school taxes.

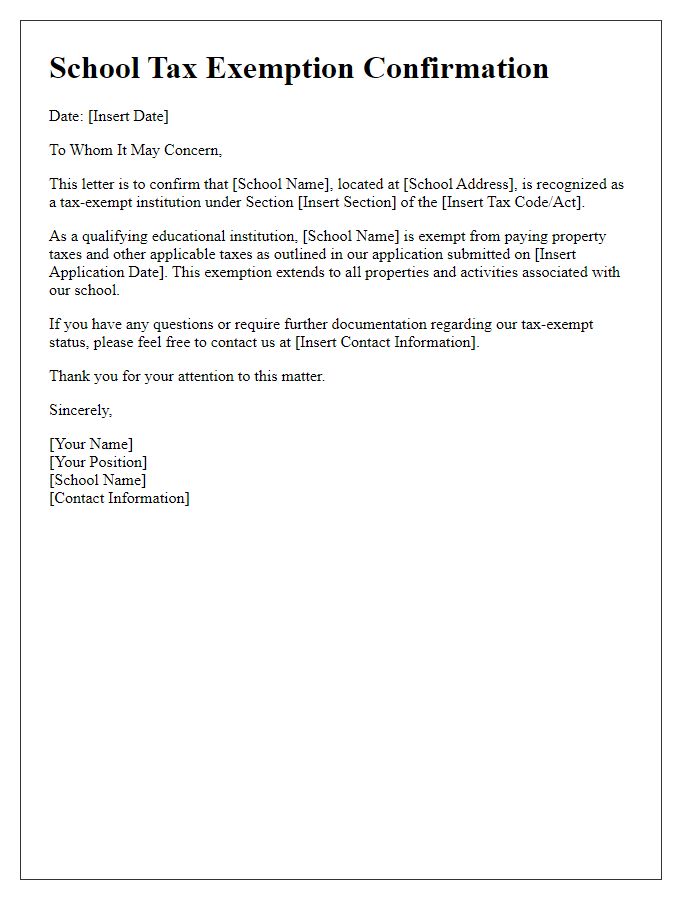

Personalization and Salutation

The school tax exemption notice serves as an essential document that informs eligible individuals about their exemption from local education-related taxation. This process typically involves personalized communication to ensure clarity and relevance. Key information includes the recipient's name, address, and specific details regarding their eligibility status. Formal salutations, such as "Dear [Recipient's Name]," establish a respectful tone. It may also mention pertinent regulations, for instance, state tax code numbers or references to local school district policies, ensuring recipients are well-informed about the criteria and benefits of their tax-exempt status.

Clear Explanation of Exemption Criteria

A school tax exemption notice provides crucial information about eligibility criteria, including specific income thresholds, age requirements, and residency stipulations. Eligible applicants typically include veterans, disabled individuals, and seniors aged 65 and older residing within the school district boundaries, such as those in Oakwood School District, which serves approximately 10,000 students. In many jurisdictions, applicants must submit proof of income not exceeding $30,000 annually to qualify, and the application process often requires documentation like tax returns and proof of residency. Additionally, participating in educational programs or community service initiatives may lead to further exemption benefits, ensuring that qualified families can reduce their financial burden for education-related expenses. The deadline for submissions usually falls on March 15th, providing families ample time to gather necessary paperwork before the evaluation period commences.

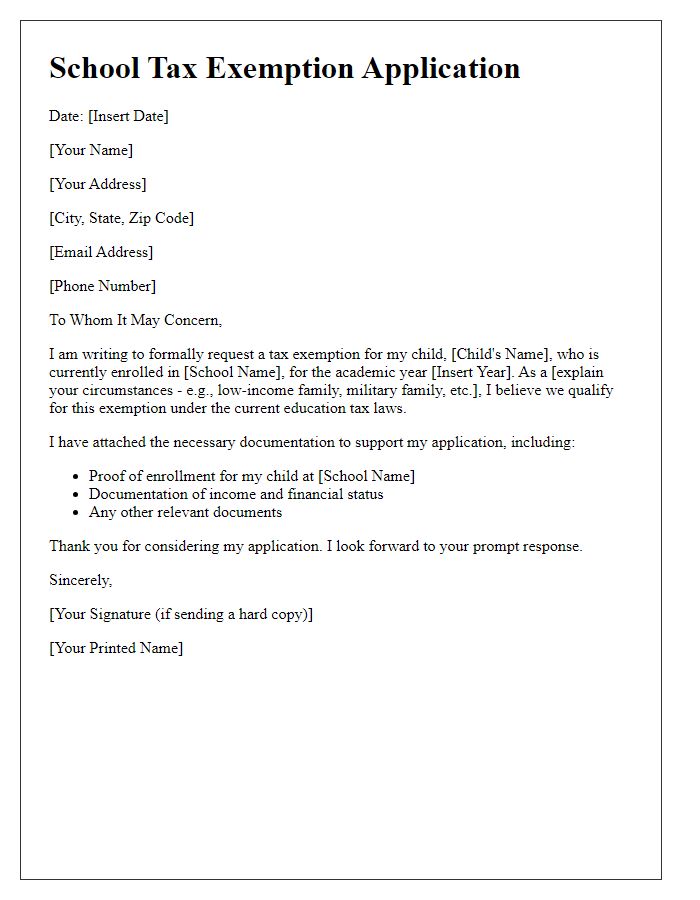

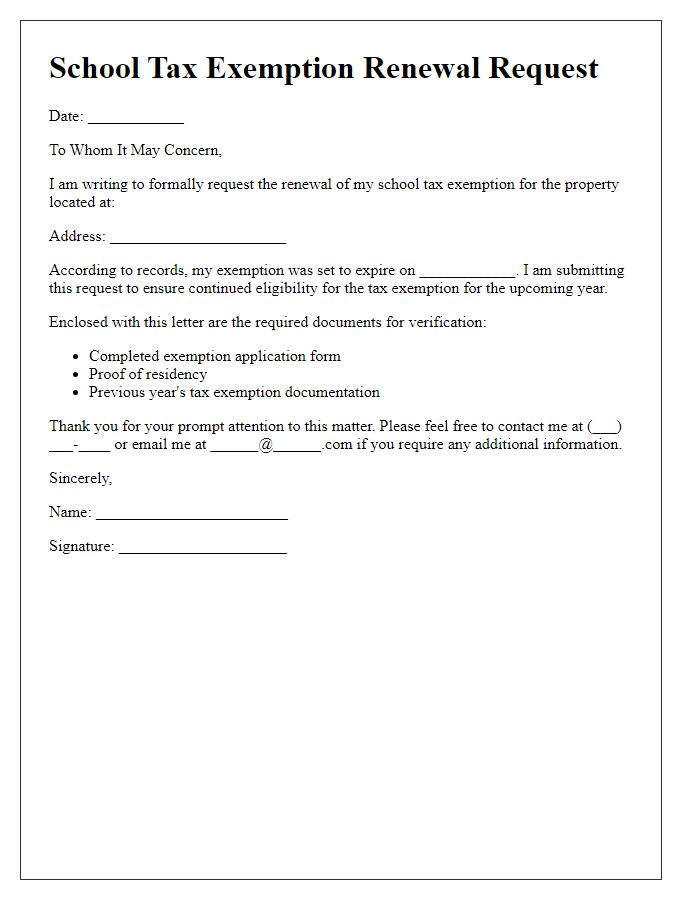

Required Documentation List

The school tax exemption notice requires specific documentation to verify eligibility for exemption. Essential documents include the completed application form, which outlines personal information of the applicant, along with proof of residency, such as utility bills showcasing the current address and state identification displaying the applicant's name and address. Income verification documents, including recent pay stubs or tax returns, may be necessary to establish financial standing. Additionally, providing evidence of enrollment in an accredited educational institution, such as current school transcripts or enrollment letters, can further support the application. Each of these papers is vital to ensure a thorough review by the tax authority to grant an exemption effectively.

Contact Information for Assistance

Inquiries regarding school tax exemption notices can be directed to the local education authority, typically found in municipal offices or school district websites. Contact information may include telephone numbers, often toll-free, and email addresses, ensuring efficient communication. Specific departments handling tax exemptions are crucial, such as the finance or tax assessment office. Local jurisdictions, including counties or cities, might have dedicated staff members available during business hours for assistance. Online resources may also provide reference materials or FAQs about the tax exemption process, enhancing understanding of eligibility criteria and application procedures.

Comments