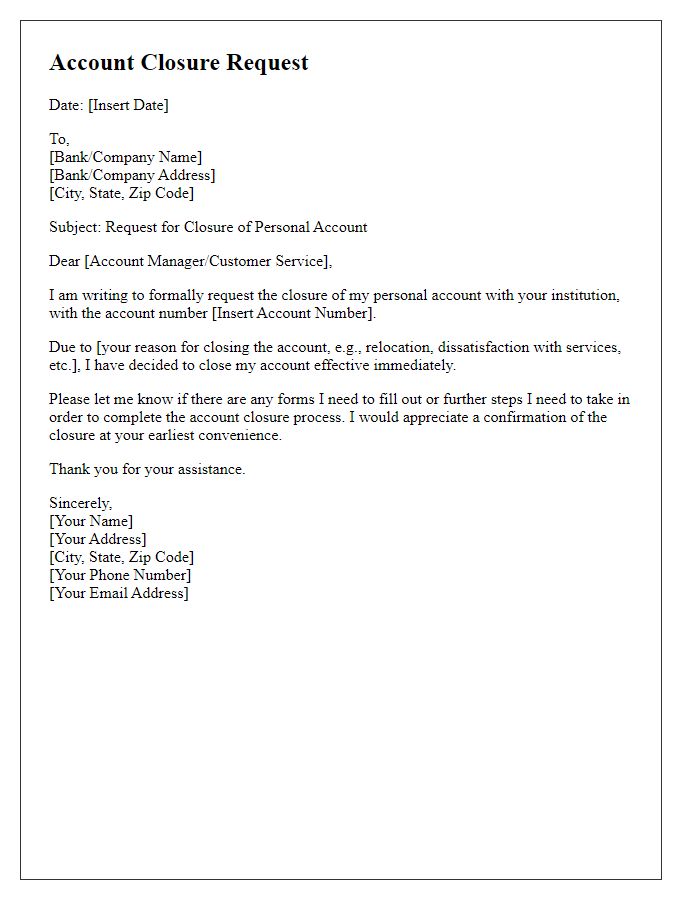

Are you looking to close an account and need a template for that? Writing a formal letter for statement of account closure can be straightforward and stress-free. Whether it's for a bank, utility service, or subscription, providing clear details will ensure a smooth process. Curious about what to include in your letter? Read on for a comprehensive guide!

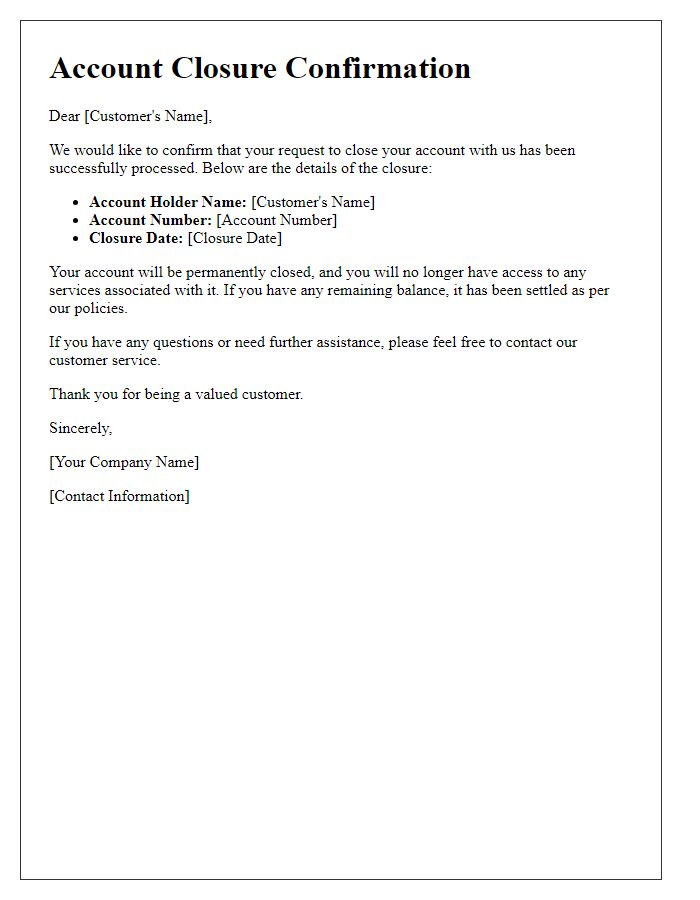

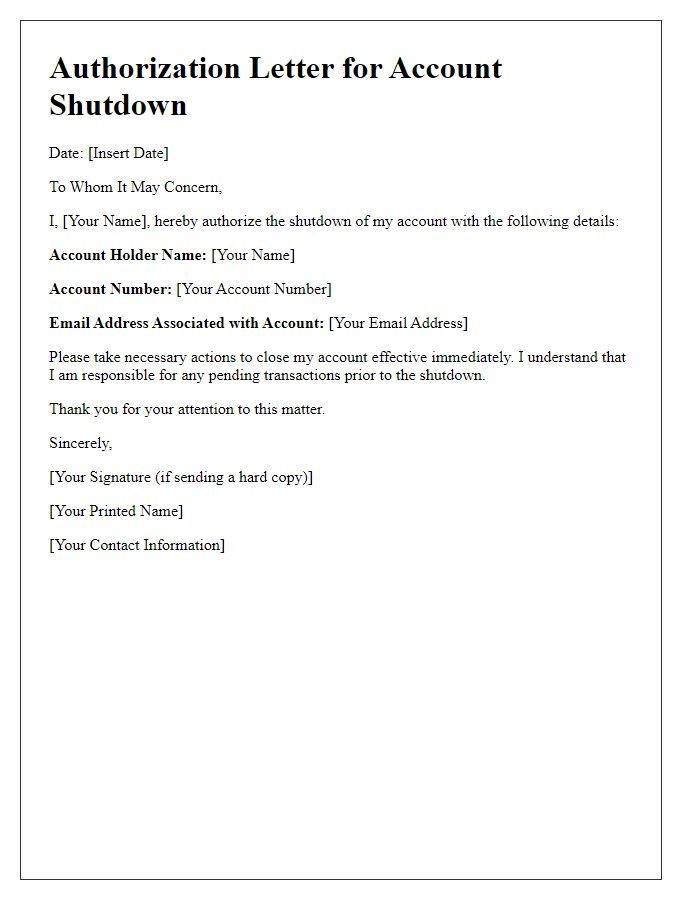

Account Holder Information

The closure of a financial account, such as a savings or checking account held at a banking institution like Wells Fargo, often requires formal communication from the account holder. This may include key details such as the account number (typically a unique series of digits), the account holder's full name (as registered with the bank), and the date of the request for closure (which is important for record-keeping). It's pivotal to specify a reason for account closure, like account inactivity (defined as no transactions for a predetermined period, usually six months). Additionally, instructions regarding the final balance (whether transferred to another account or issued as a check) must be clearly stated. Following up with contact details (email and phone number) ensures the bank can reach the account holder if necessary to address any outstanding issues before the closure is finalized.

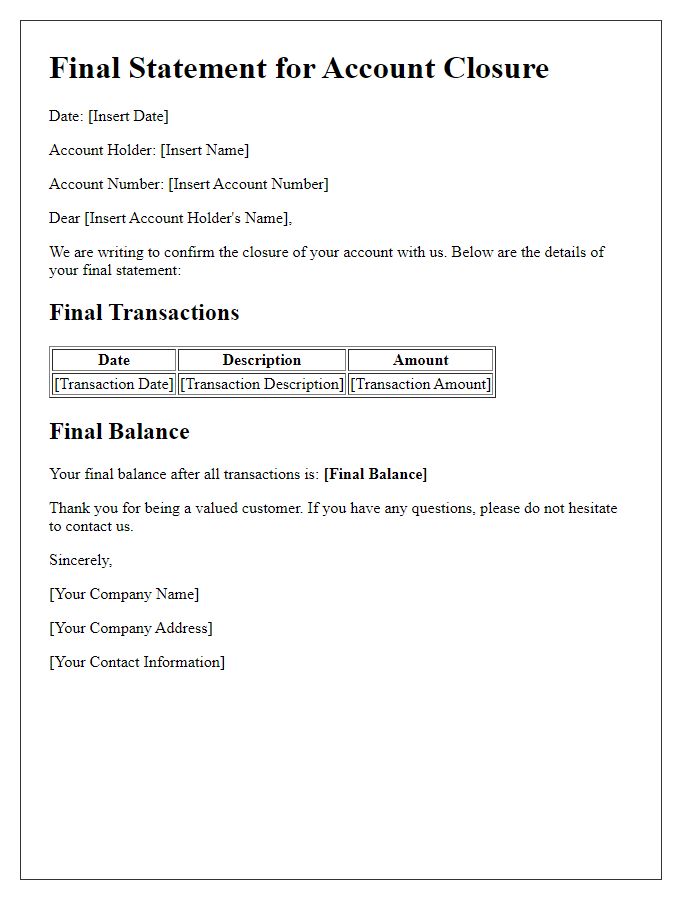

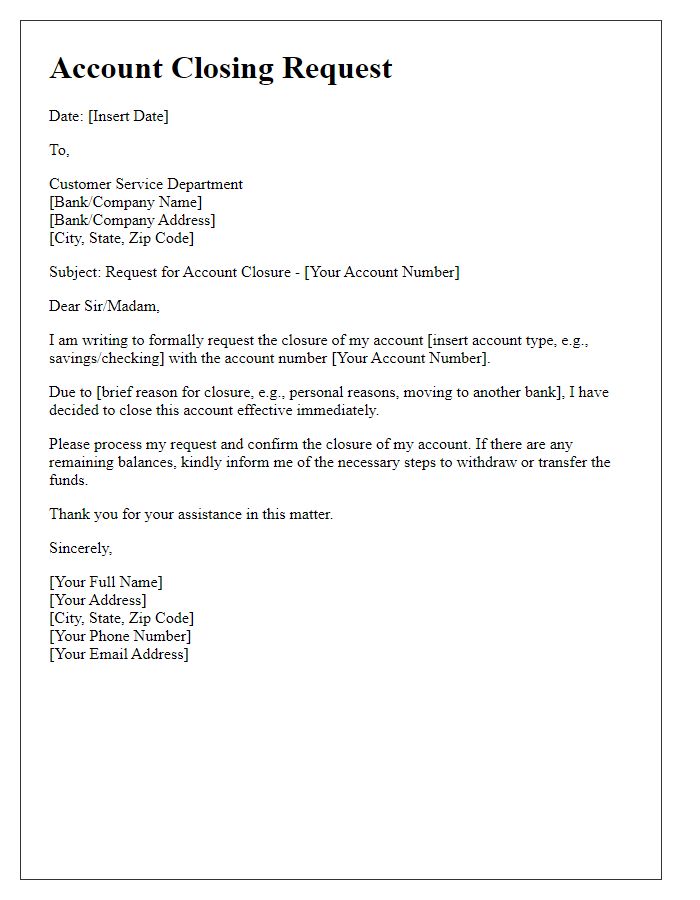

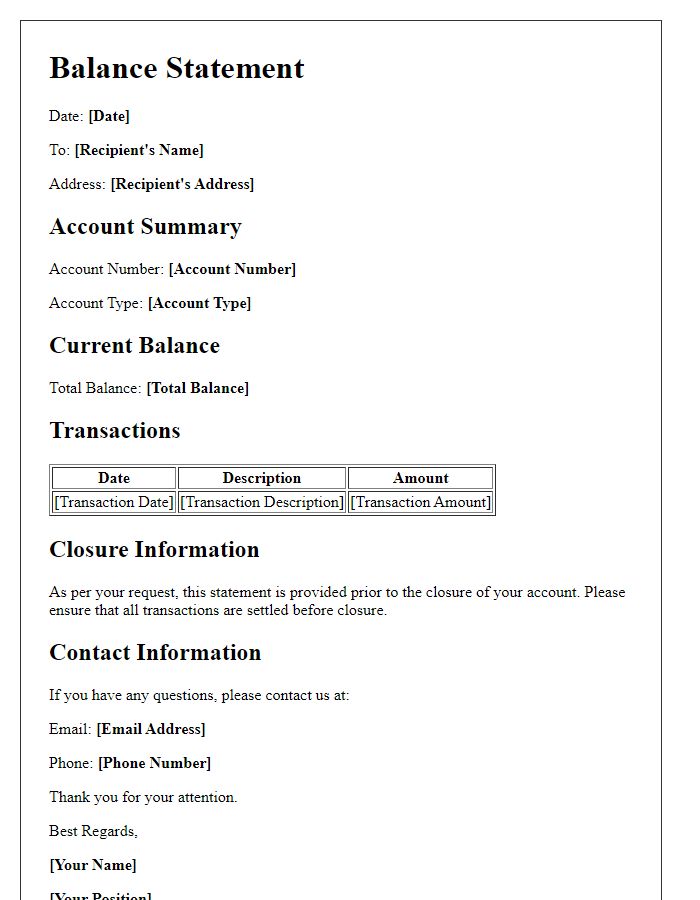

Account Details (Account Number and Type)

The recent closure of an account can involve critical financial implications and must be documented adequately. The account number, an essential 10 to 12 digit identifier unique to each account holder, must be clearly stated alongside the account type, which could be checking, savings, or investment. This detailed information ensures that financial institutions, such as banks like Bank of America or Chase, can accurately trace the account in their systems. Alongside this, customers should provide the date of closure, and any final transactions that occurred prior to the closure, such as last deposits or fees, to create a comprehensive record that reflects the account's final status.

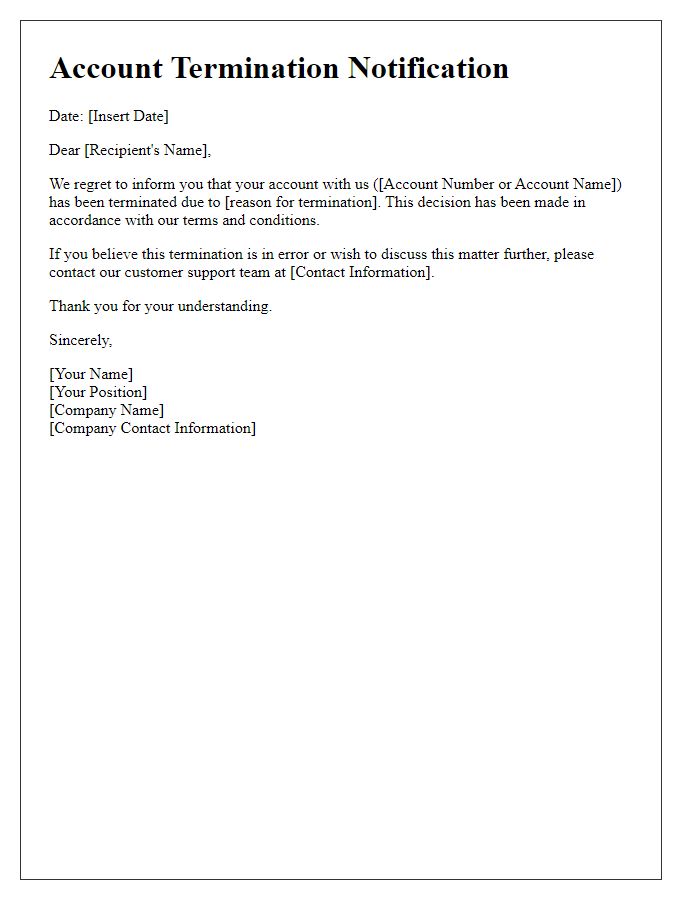

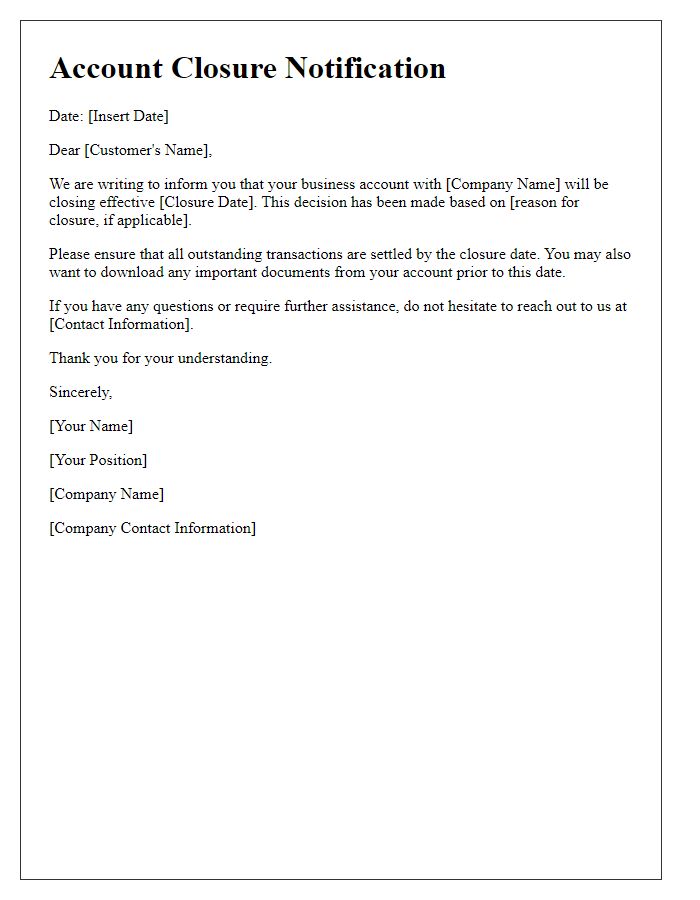

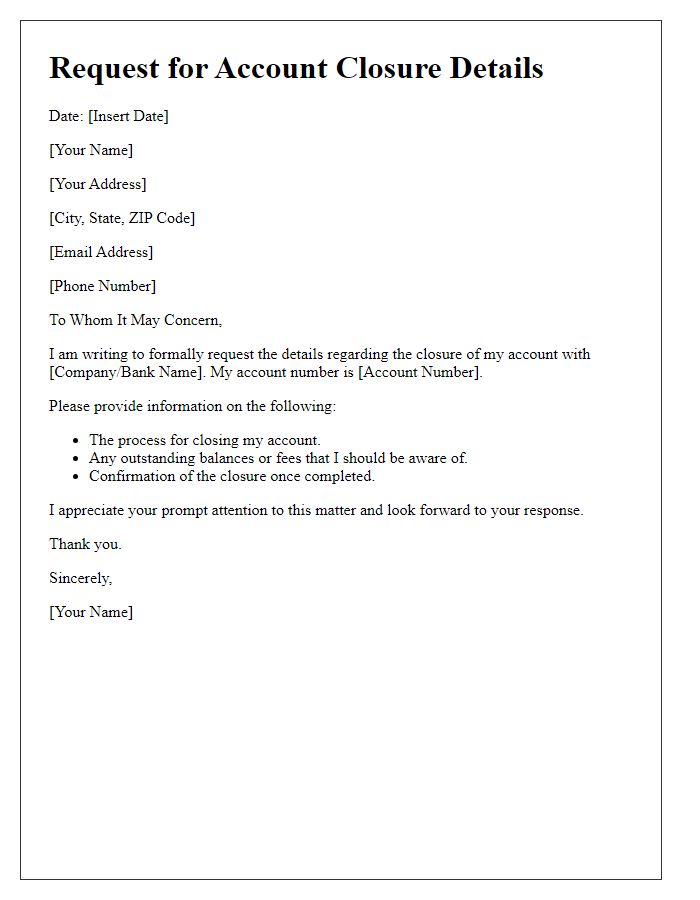

Effective Closure Date

A Statement of Account Closure details the termination of an account in financial institutions, such as banks. An effective closure date is the specific date when all transactions and account activities cease, typically noted at the end of the business day. Account holders must be informed in advance of the closure process to finalize any pending transactions. Additionally, remaining balances must be settled through checks or transfers to other accounts, ensuring compliance with regulations. Institutions provide this information for clarity in financial records, protecting both the institution and the client in case of future inquiries or disputes.

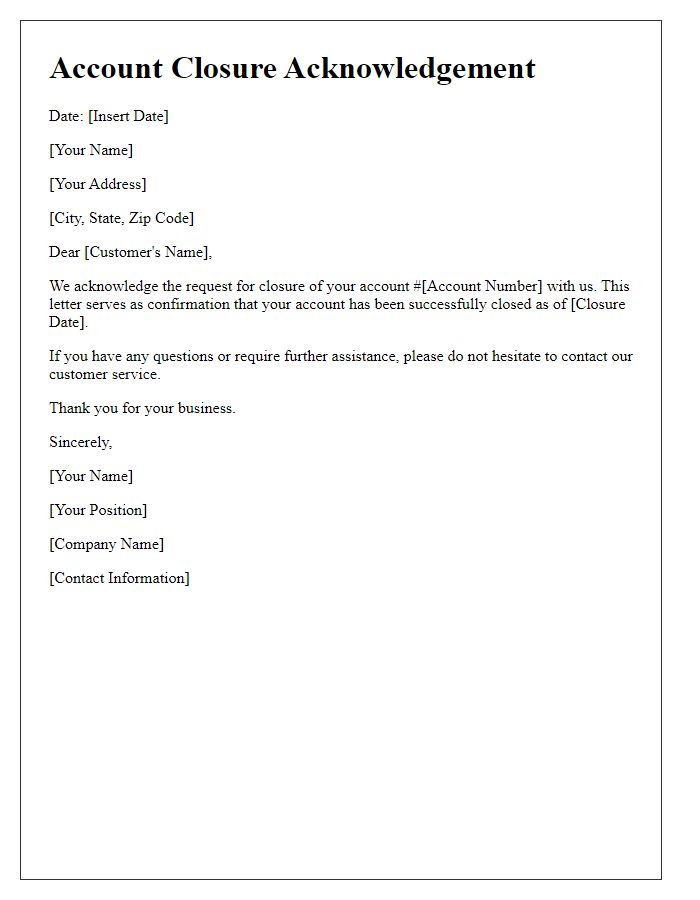

Summary of Transactions

The statement of account closure provides a comprehensive overview of transactions involving the financial account, typically at a banking institution like JPMorgan Chase or Bank of America. It includes key figures such as the final balance, which could indicate a surplus of $1,200 or a deficit of $300. Detailed entries of deposits, withdrawals, and fees outline transactions over a specified period, for instance, the last six months, reflecting financial activity during that timeframe. Each transaction date is critical, capturing significant events such as loan repayments or service charges, and it may specify transaction methods like electronic transfers or check deposits. This document serves as a formal record, important for future reference, tax documentation, or potential disputes regarding account activity.

Contact Information for Further Assistance

For individuals seeking assistance regarding account closure statements, it is essential to provide contact information that facilitates prompt communication. Contact your financial institution's customer service at 1-800-555-0199, available Monday through Friday from 8 AM to 6 PM EST. Additionally, email support can be reached at support@institution.com for inquiries regarding account balances, transaction histories, or specific account closure procedures. For immediate support, visiting the nearest branch located at 123 Finance Ave, Suite 100, can provide face-to-face assistance. Ensure to have personal identification and account details available for verification purposes.

Comments