Are you feeling confused about the terms of your loan? It's not uncommon for borrowers to encounter discrepancies that leave them scratching their heads. Understanding the specifics of your agreement is crucial to avoid any unpleasant surprises down the line. Join us as we explore how to address these differences and ensure your financial future is secureâread on for tips and templates!

Accurate identification of borrower and lender details

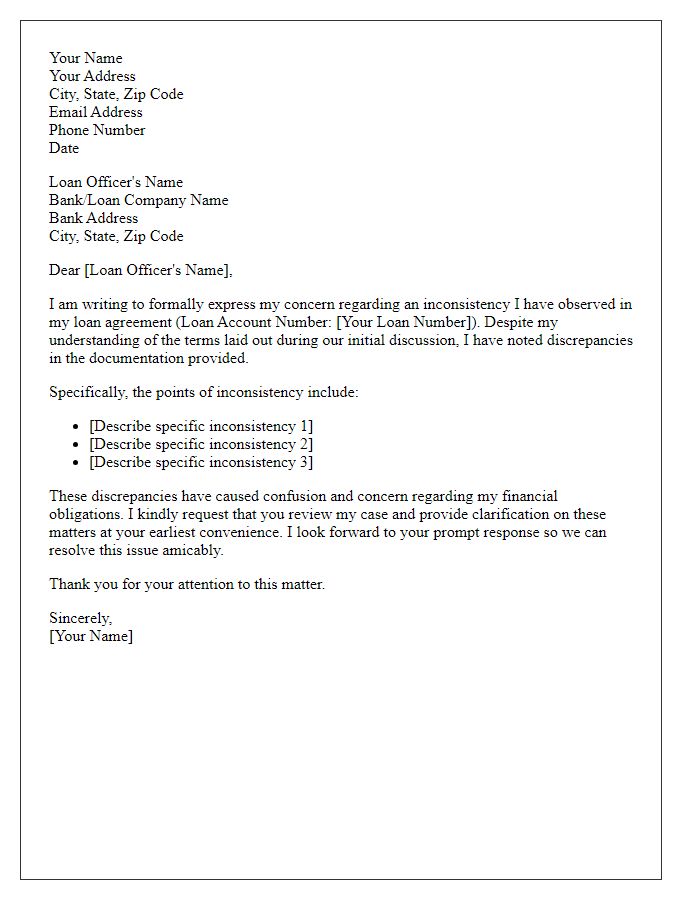

Discrepancies in loan terms can arise from inaccuracies in borrower and lender details, impacting the overall agreement. The borrower's information, including full name, address, and social security number, must match exactly with bank records. For lenders, the legal entity name and correct Federal Tax Identification Number are crucial for verification. Loan terms should align precisely with the signed documents, including interest rates, payment schedules, and collateral details. Any inconsistencies could lead to misunderstandings or legal complications, emphasizing the importance of accurate identification for both parties in the loan agreement process.

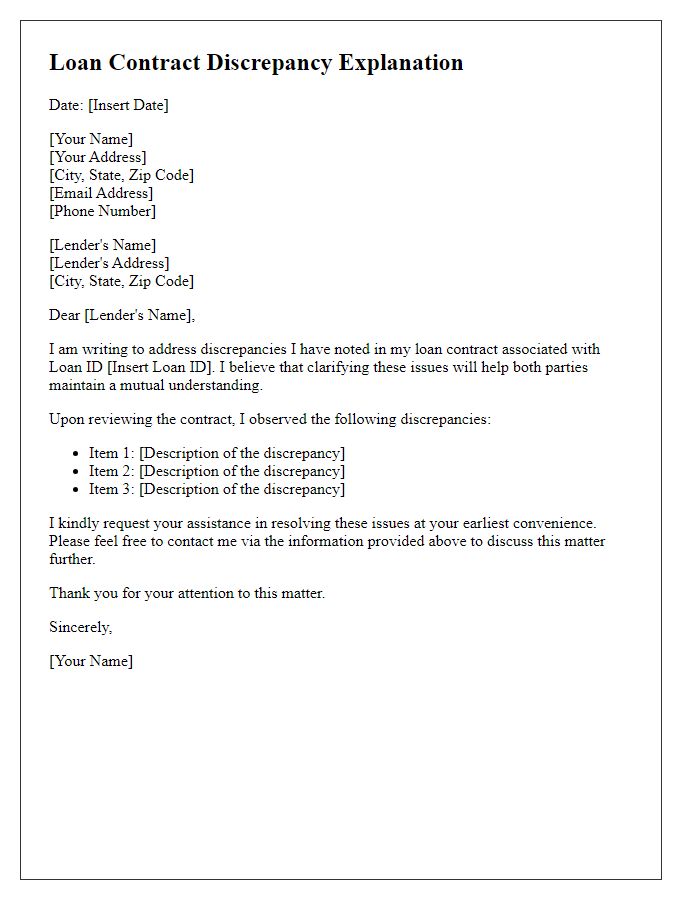

Clear description of the discrepancy found

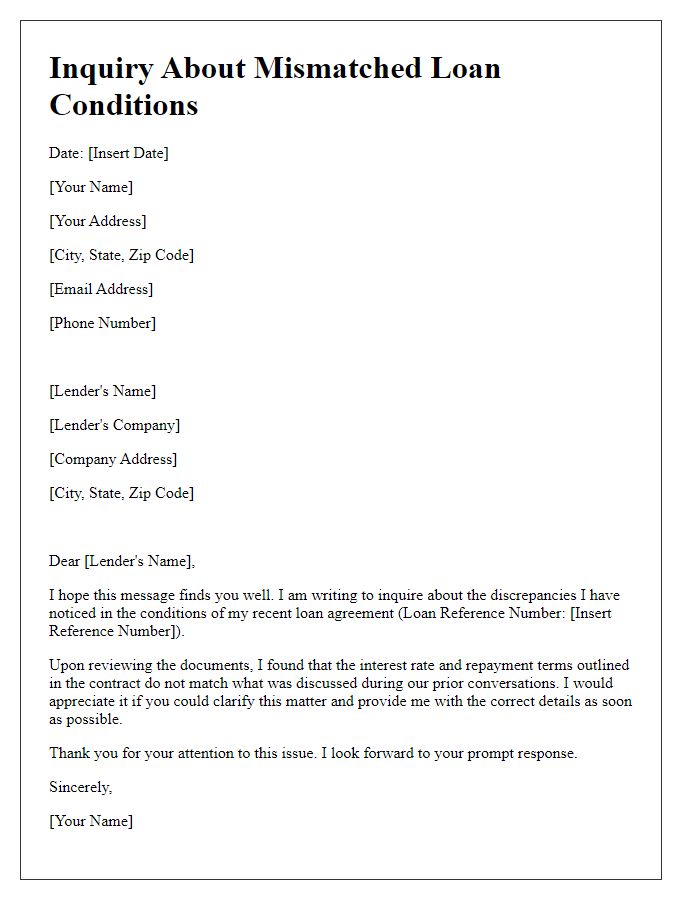

A discrepancy has been identified in the loan terms for the personal loan agreement issued by ABC Bank on April 15, 2023. The interest rate was stated as 3.5% adjustable, while the original documentation outlined it as a fixed rate of 3.5%. Loan documents, including the Truth in Lending Disclosure, clearly indicate a fixed interest rate, which conflicts with the recent statements received regarding rate adjustment. Additionally, the repayment schedule mentioned in the loan agreement specifies a monthly payment of $500 over five years, but the latest communication suggests a payment increase due to the adjustable rate feature. This discrepancy raises concerns regarding the accuracy of the provided terms and the potential financial impact on repayment obligations.

Reference to the specific loan agreement or contract

A loan agreement discrepancy often arises when terms outlined in the contract, such as interest rates, repayment schedules, and fees, do not align with the original expectations. For instance, the Loan Agreement dated September 1, 2023, specifies an interest rate of 4.5% annually; however, the documentation received indicates a rate of 5.0%, leading to significant financial implications over the loan's 15-year term. Additionally, the agreed-upon repayment schedule may differ, with potential monthly payment amounts being affected by misrepresented information. Ensuring accurate alignment between the loan documentation and the original contract is crucial to maintaining transparency and trust between the lender (XYZ Bank, established in 1995) and borrower.

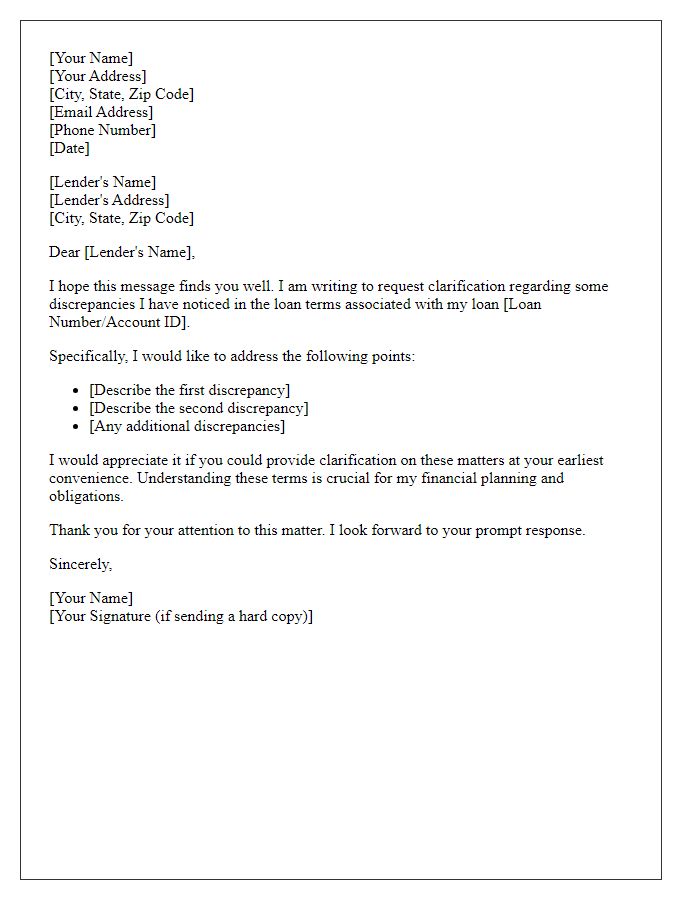

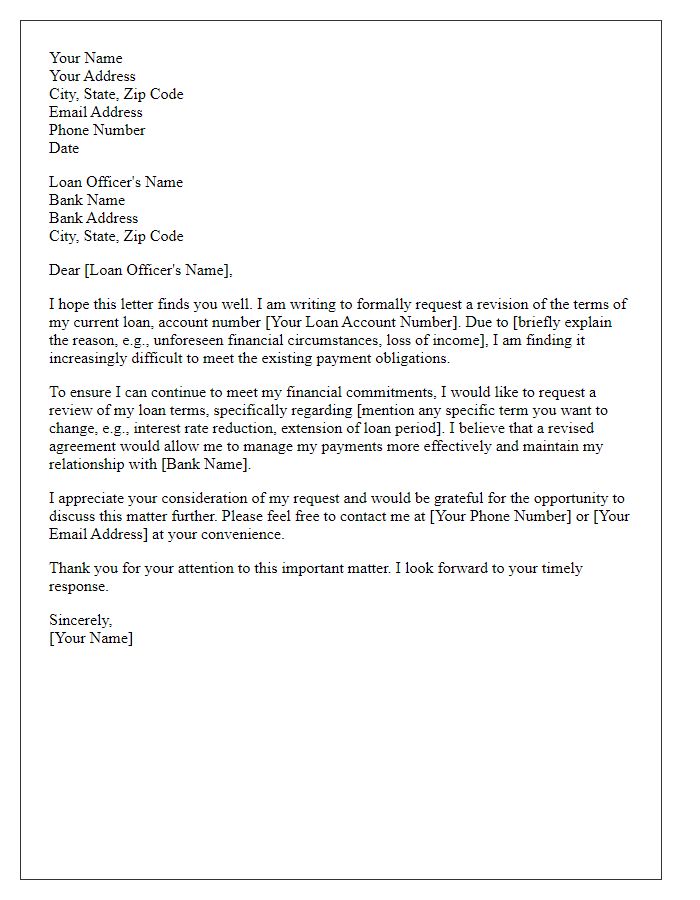

Proposed resolution or request for clarification

The recent loan agreement, dated August 15, 2023, outlines specific terms including interest rates, repayment schedules, and fees associated with the $250,000 mortgage to be taken from National Bank. However, upon reviewing the document, discrepancies concerning the interest rate and associated fees compared to our initial agreement dated July 10, 2023, have surfaced. The initial documents specified a competitive fixed interest rate of 3.5%, while the recently provided paperwork reflects an increase to 4%, significantly impacting overall repayment costs and monthly budgeting. Additionally, the change in the processing fee from $1,000 to $1,500 warrants clarification due to its influence on the total cost of the loan. A prompt resolution or further explanation would be appreciated to ensure alignment between expectations and the finalized agreement.

Contact information for further communication

Discrepancies in loan terms can lead to confusion and financial implications for borrowers. The loan agreement, often specifying interest rates (such as fixed or variable), repayment periods (ranging from 15 to 30 years), and collateral requirements, lacks clarity in some instances. As a result, borrowers may experience misunderstandings regarding their obligations. To address these issues effectively, provide contact information for further communication, ensuring that borrowers can reach a dedicated customer service representative or loan officer, typically available through phone numbers (e.g., 1-800-555-1234) or email addresses (such as support@loanprovider.com), enabling prompt resolution of concerns related to their loan terms.

Letter Template For Discrepancy In Loan Terms Samples

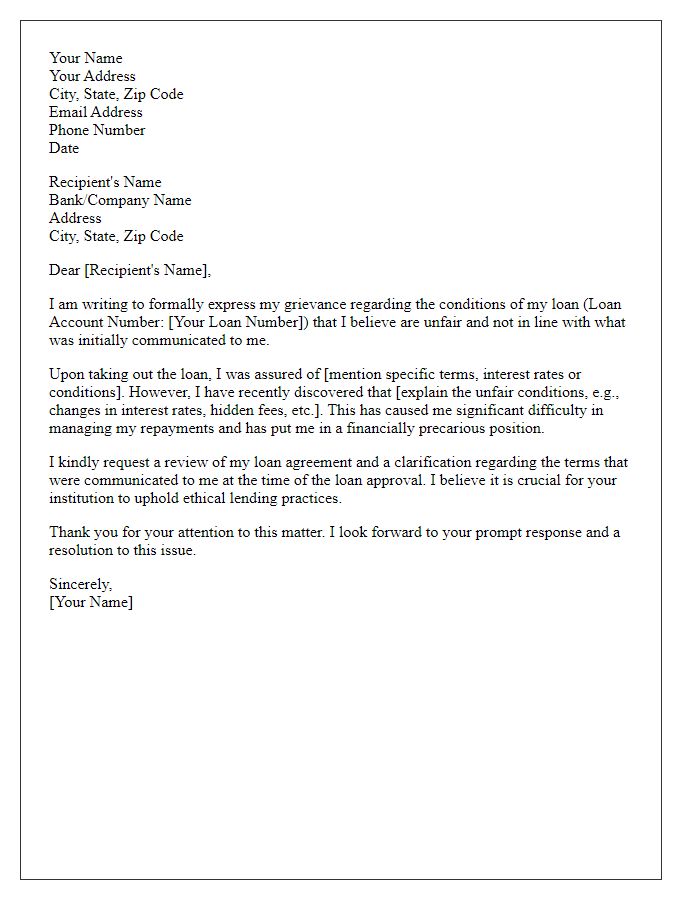

Letter template of formal complaint regarding loan agreement inconsistency

Comments