Are you considering a reallocation of your assets account? It can feel overwhelming, but it's a crucial step in optimizing your financial health and aligning your investments with your goals. With the right approach, you can ensure that your portfolio is well-balanced and set to grow. Keep reading to discover our helpful letter template that will guide you through this process!

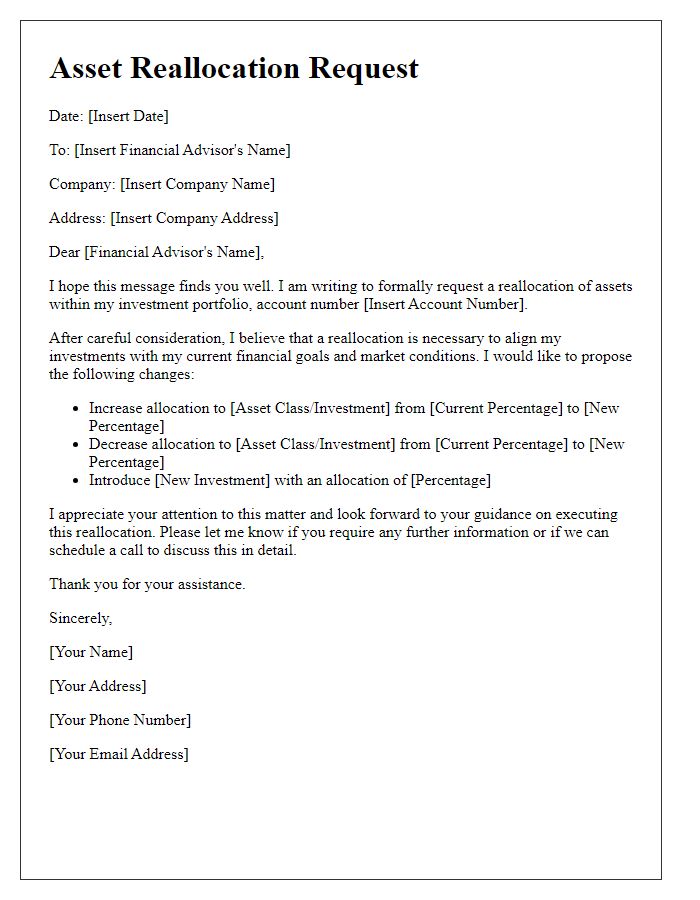

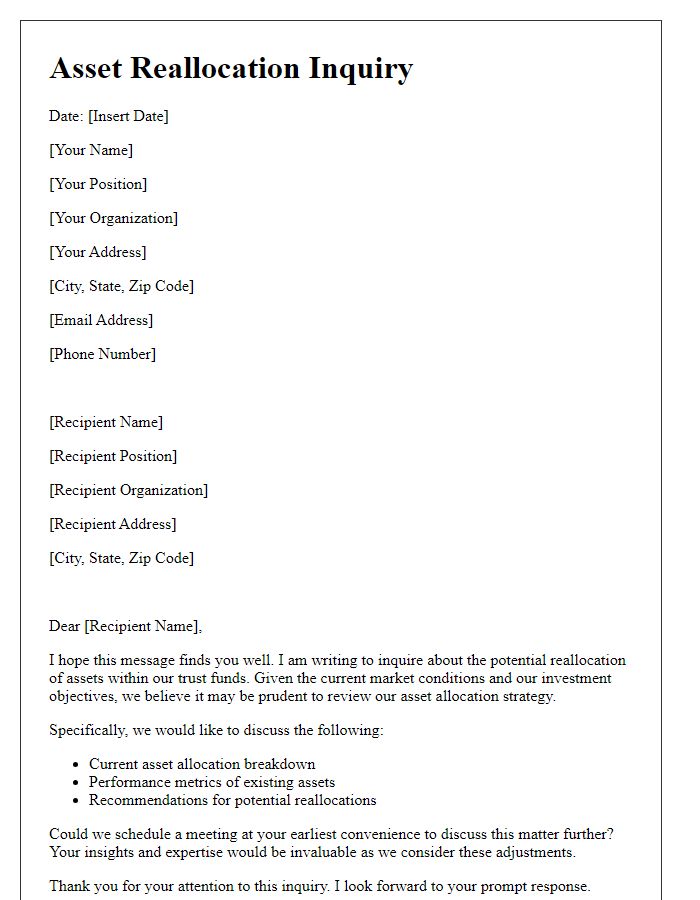

Subject Line: Clear and specific description of the reallocation request.

Reallocation of Assets Account Request: Transfer of Funds from Investment A to Investment B. The request involves the strategic realignment of investment portfolios, specifically transferring $50,000 from the high-risk assets in Investment A (Technology Sector Fund) to the more stable Investment B (Municipal Bond Fund). This decision responds to the current market volatility observed since March 2023, with notable fluctuations in tech stocks that have introduced uncertainty. The objective of this reallocation aims to enhance overall portfolio stability and improve yield stability, considering the anticipated interest rate hikes by the Federal Reserve in upcoming quarters. Prompt attention to this request will enable timely adjustment before the next quarterly evaluation period on December 15, 2023, ensuring optimal positioning against market shifts.

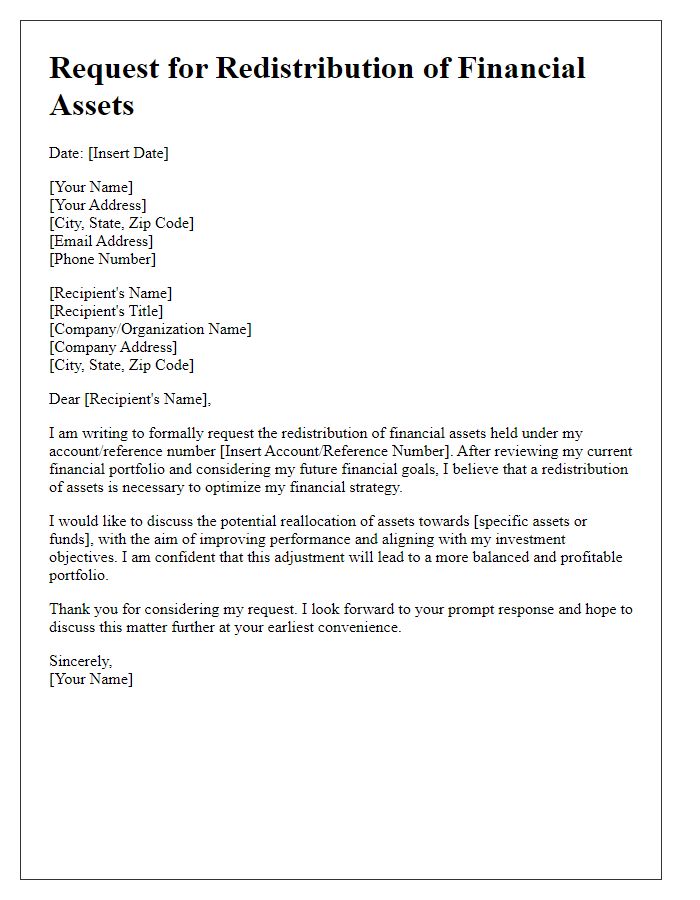

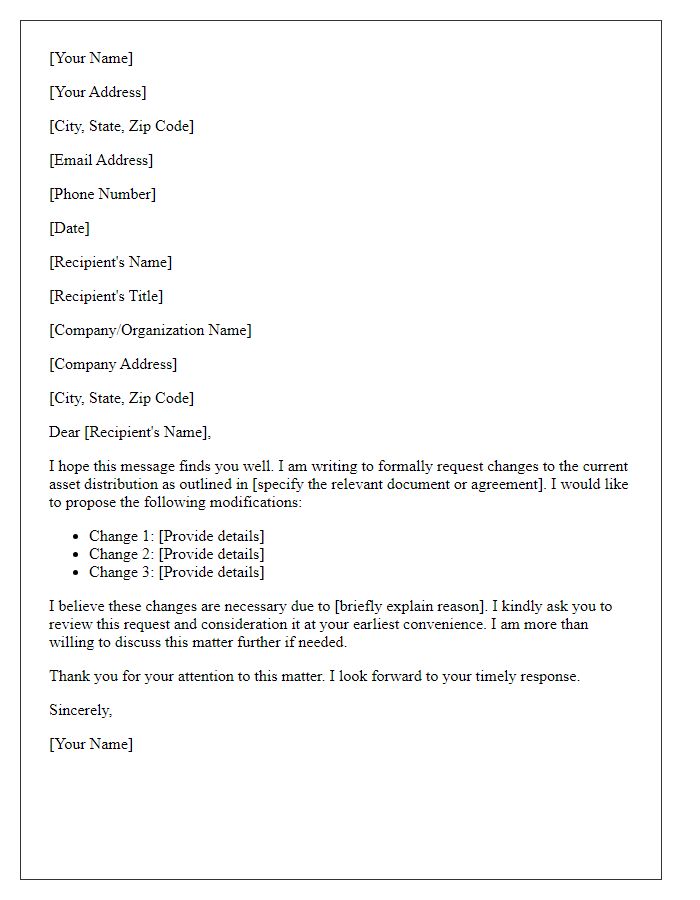

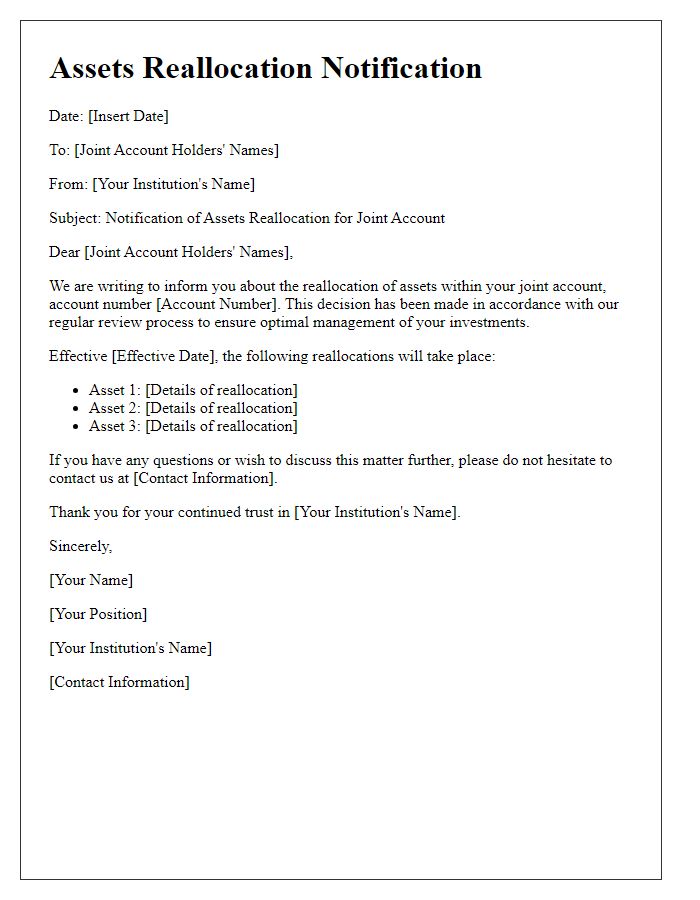

Greeting: Personalized greeting addressing the recipient appropriately.

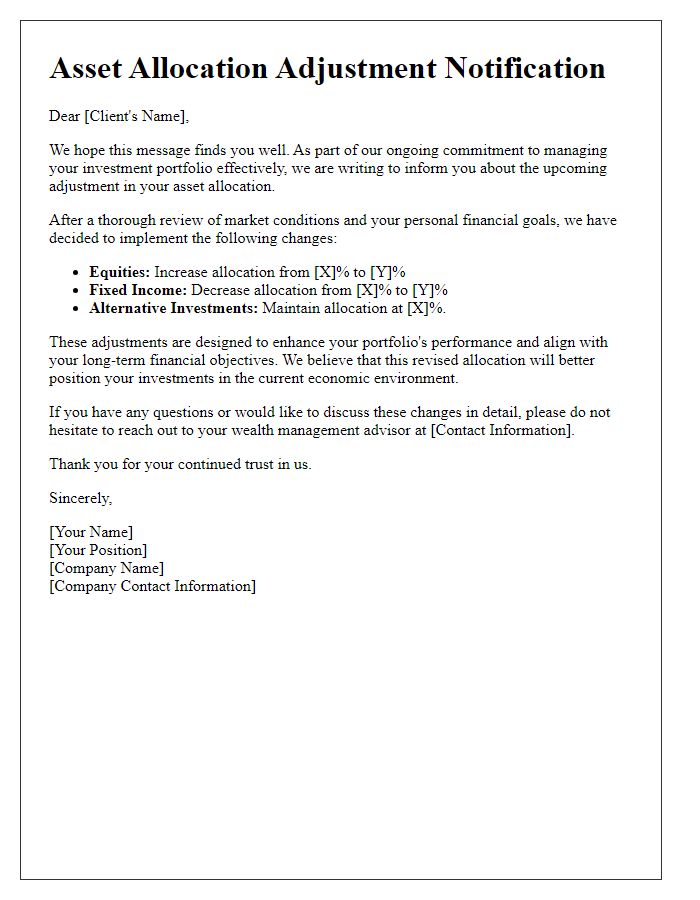

In the 2023 financial landscape, asset reallocation plays a crucial role in optimizing portfolio performance. Effective management of assets, including equities, fixed-income securities, and alternative investments, can enhance returns while mitigating risks. The strategic redistribution of assets, guided by ongoing market analysis and individual financial goals, ensures alignment with changing economic conditions. For instance, adjusting exposure to sectors such as technology or healthcare, which have shown significant growth, can capitalize on emerging trends. Analyzing historical performance data alongside potential future outcomes is essential for informed decision-making regarding asset classes.

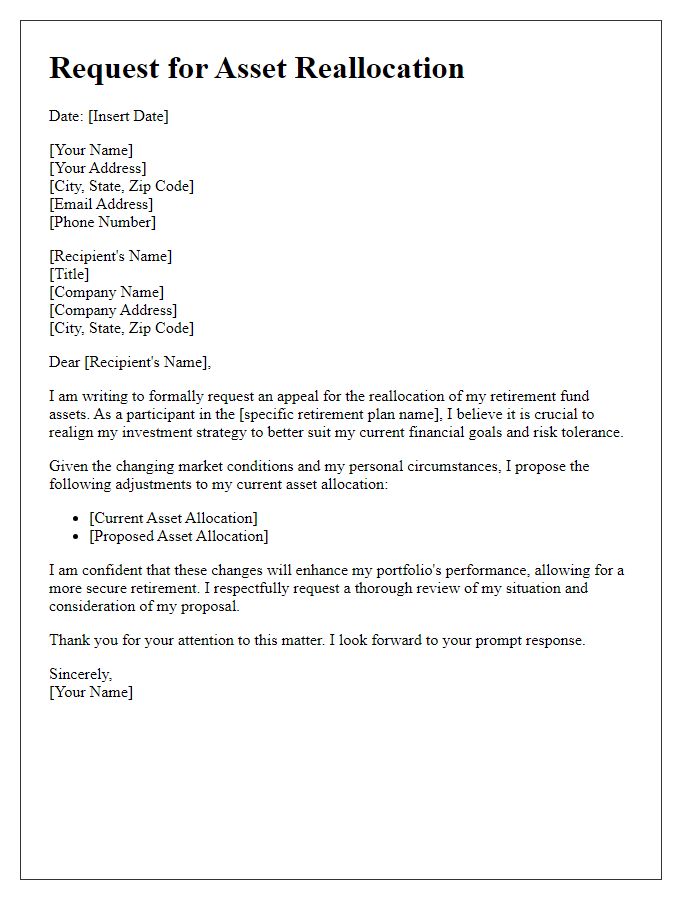

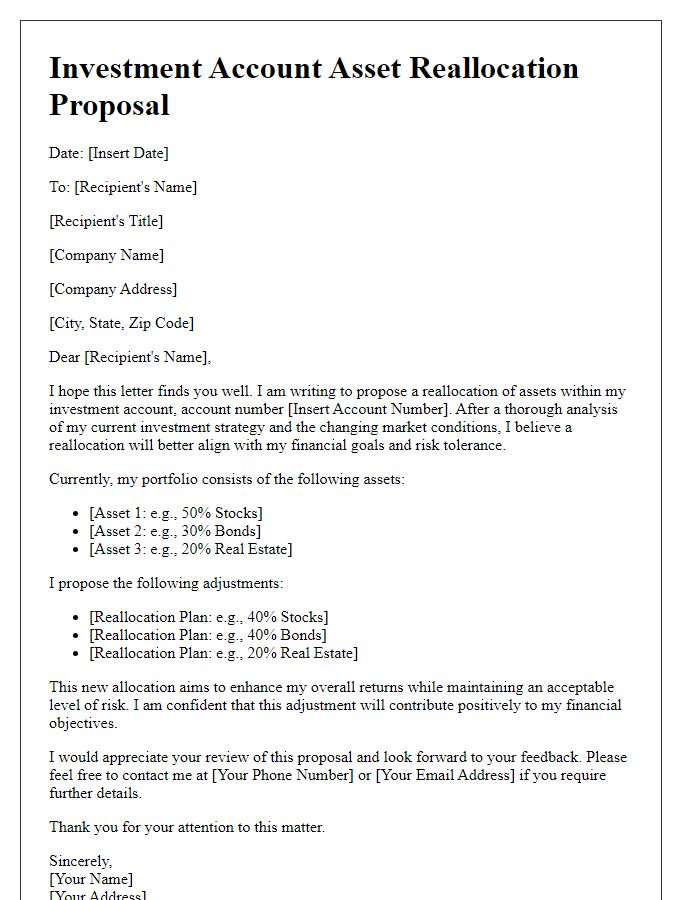

Purpose: Clear statement of intent and reason for reallocation.

Reallocation of assets account involves the redistribution of financial resources to enhance investment performance or align with changing strategic goals. This process is commonly executed during quarterly reviews, where performance metrics are analyzed. For example, reallocating funds from underperforming assets, such as high-risk stocks, to more stable securities like government bonds can stabilize returns. Institutional investors often engage in this practice to mitigate risks associated with market fluctuations. Additionally, asset allocation strategies may adapt in response to significant economic events, like inflation spikes or changes in interest rates, ensuring that investment portfolios remain resilient and aligned with long-term objectives.

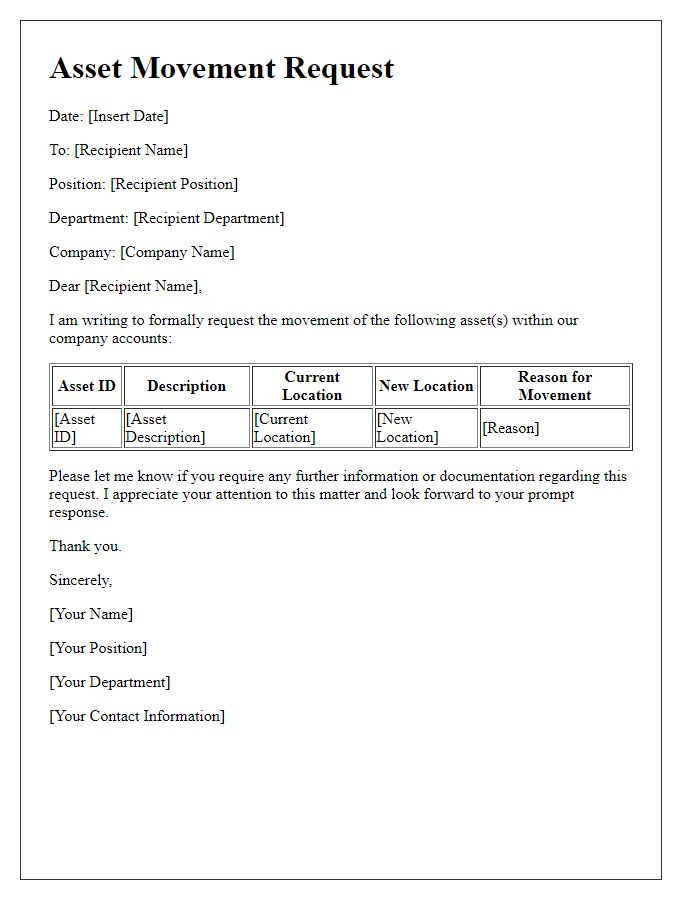

Asset Details: Detailed description of assets and reallocation specifics.

Reallocation of assets account involves strategic movement of financial resources and physical properties across different accounts or departments to optimize utilization. Asset details may include specific items such as real estate properties, which might involve commercial buildings located in urban areas or production equipment utilized in manufacturing facilities. Properties could include their appraised values, acquisition dates, and maintenance records. Reallocation specifics encompass processes like documentation of ownership transfer, account adjustments reflecting changes in asset value, and compliance with organizational policies on asset management. Documentation may also outline the timeline for reallocation, responsible parties involved, and implications for taxation and depreciation calculations. Efficient management of asset reallocation can lead to improved financial performance and resource allocation within a business framework.

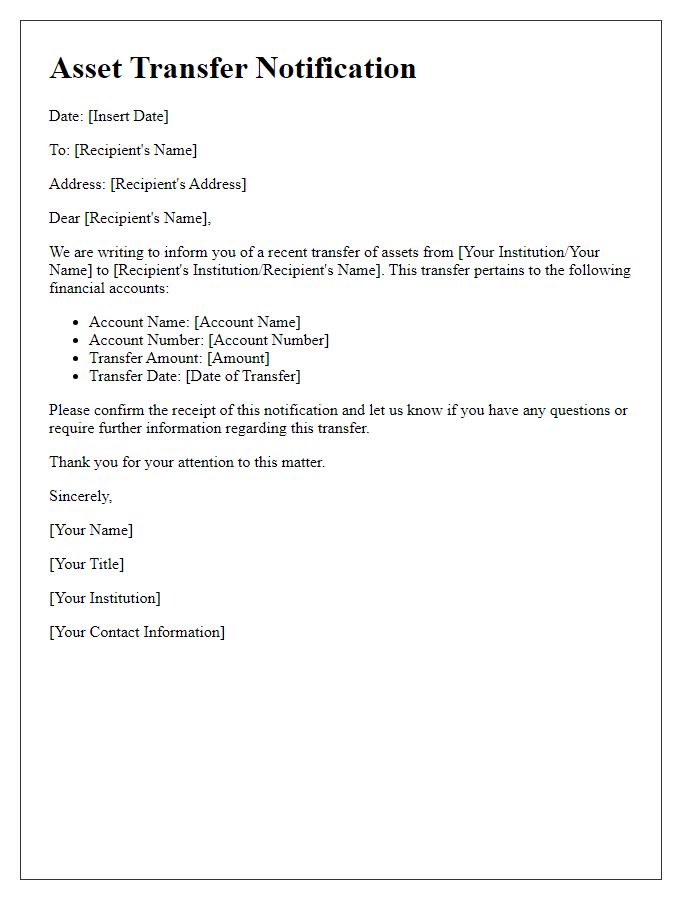

Contact Information: Accurate contact details for further communication.

Accurate contact details, including a valid email address, phone number, and physical address, are essential for efficient communication regarding the reallocation of asset accounts. Providing precise information, such as a direct line (e.g., +1-800-555-0199) and a secured email (e.g., name@domain.com), ensures prompt responses from financial advisors or account managers. Additionally, a physical address (e.g., 123 Finance St, Suite 400, New York, NY 10001) allows for the delivery of important documents or notices that may require a signature or further verification. Maintaining updated contact information mitigates the risk of miscommunication during the asset reallocation process.

Comments