Hey there! If you're navigating the world of home financing, you've probably heard about rate lock agreements. These contracts safeguard your interest rate, but what happens when they near expiration? Understanding your options can make all the difference in securing the best deal possible. So, sit back and let's dive into the essentials of what you need to know about rate lock expiration â you won't want to miss this!

Personalized Details: Borrower's name, account number

A rate lock expiration notice informs borrowers about the impending end date of their fixed mortgage interest rate agreement. The notice includes vital details such as the borrower's name (John Doe) and account number (123456789), allowing for clear identification. This communication typically emphasizes the importance of taking action before the rate lock's expiration date, which could lead to a potential increase in monthly payments if rates rise. This essential notice may also provide guidance on options available after the expiration, including extending the rate lock or opting for a different loan product, to support borrowers in making informed decisions regarding their mortgage financing.

Lock Expiration Date: Specific date of rate lock expiration

Rate lock expiration notices are critical for mortgage borrowers, especially those with fixed-rate mortgages secured at favorable terms. The lock expiration date, often noted as a specific date in the loan agreement, signals when the borrower must close the deal to retain the agreed-upon interest rate amidst fluctuating market conditions. Missing this date can result in increased monthly payments due to market rate adjustments, often influenced by economic indicators like the Federal Reserve's interest rate changes. Borrowers should closely monitor communication from lenders, ensuring all necessary documentation is prepared well before the lock expiration date to avoid last-minute delays or penalties.

Current Interest Rate: Detailed explanation of terms

A rate lock expiration notice is crucial for mortgage borrowers to understand their current interest rate, which is typically determined by market conditions at the time of the loan application. This rate, often expressed as a percentage (e.g., 3.5% for a fixed-rate mortgage), is guaranteed for a specific period, usually ranging from 30 to 90 days depending on the lender's policy. The terms may include prepayment penalties, points, or fees associated with securing the rate lock, impacting the overall cost of the loan. Once the rate lock period expires, borrowers risk losing the secured interest rate, which could result in a higher monthly payment if the market rates rise. Timely action is essential, advising borrowers to complete their loan processes before the expiration date to avoid potential financial implications.

Options Post-Expiration: Renewal and market rate implications

Expiration of a rate lock can significantly impact home financing, particularly concerning mortgage interest rates. Borrowers typically secure rate locks for a specific duration, often ranging from 30 to 90 days, to protect against rising rates. Post-expiration, options include renewing the rate lock, often at current market rates, which may be higher than the original locked rate. In some cases, lenders might offer a grace period or a one-time extension to mitigate financial strain. Homebuyers in fluctuating markets, like the housing market in California, should closely monitor interest rate trends and consider the financial implications of renewing versus accepting the market rate, especially when rates are volatile, averaging 7% as of late 2023. Understanding these factors is crucial for making informed decisions in the financing process.

Contact Information: Issuer's representative, phone, email

A rate lock expiration notice serves as an important communication regarding the mortgage interest rate agreement. Typically issued by a mortgage lender, this notice outlines critical details surrounding the expiration of the agreed interest rate, which may impact the borrower's loan conditions. This vital notification often includes specific contact information for the issuer's representative, detailing the representative's name, phone number, and email address for immediate correspondence. Borrowers must pay attention to the expiration date, as failure to act before this date may lead to adjustments in the interest rate, significantly affecting the overall cost of the mortgage loan over its term. Clear communication ensures borrowers are aware of their remaining options as the deadline approaches.

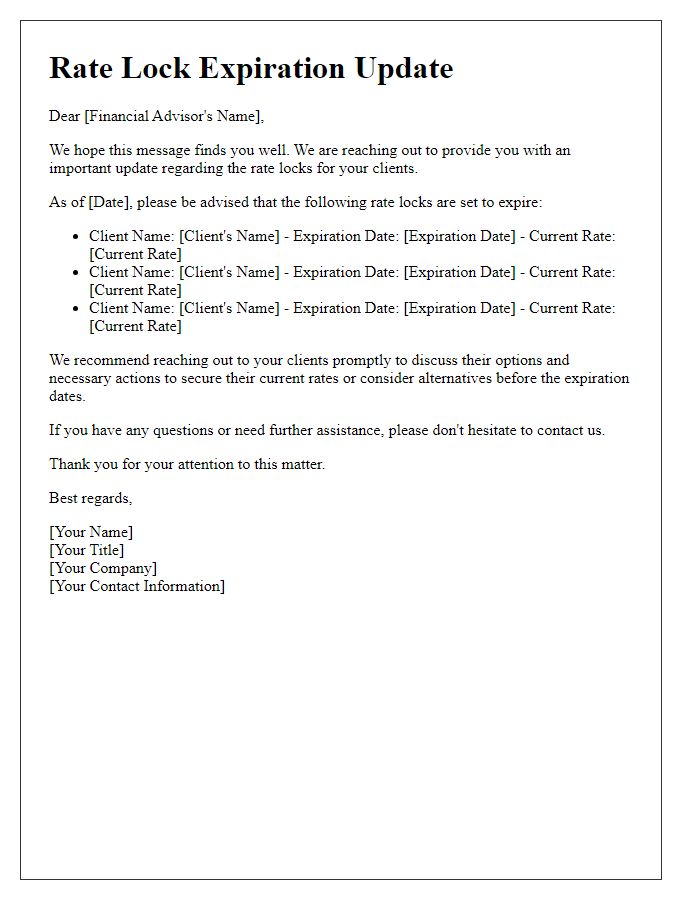

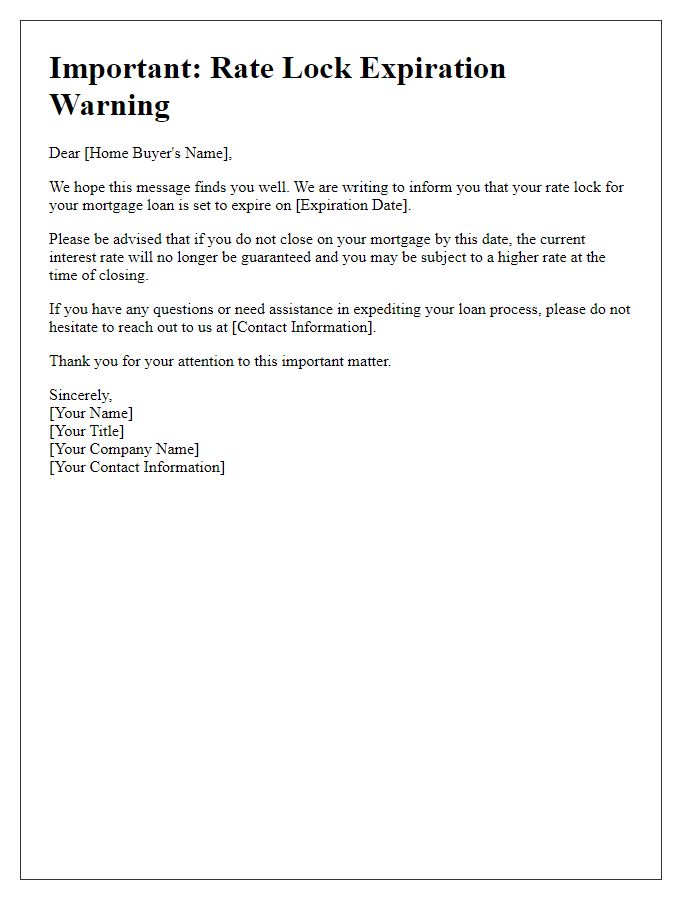

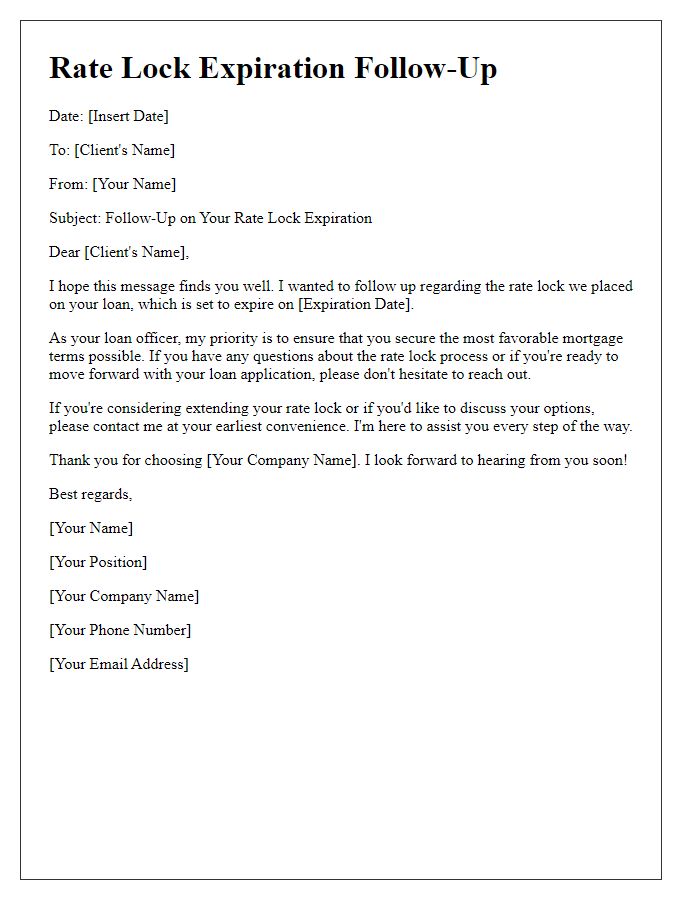

Letter Template For Rate Lock Expiration Notice Samples

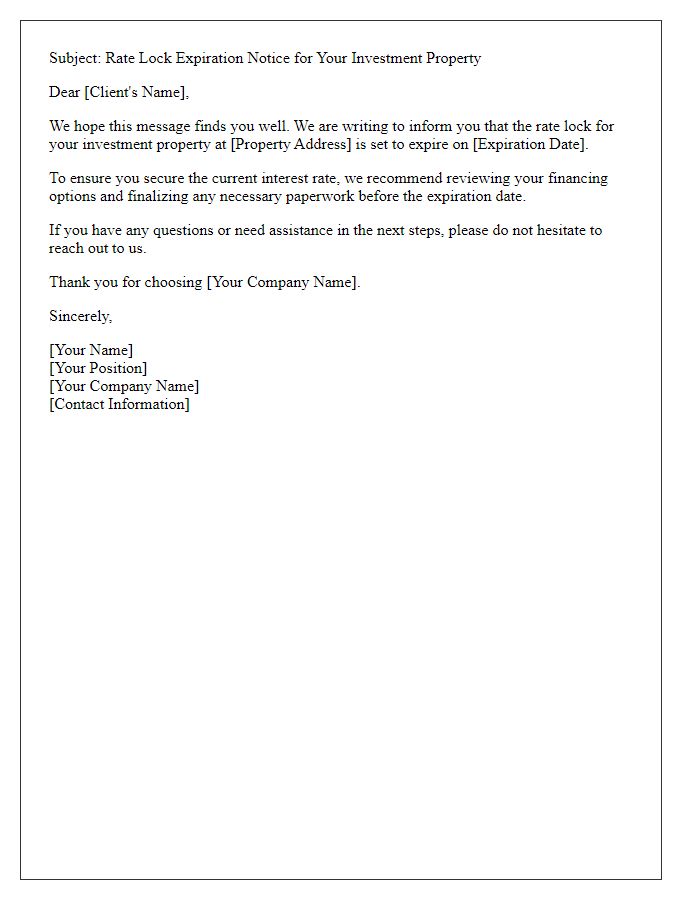

Letter template of rate lock expiration notification for investment properties

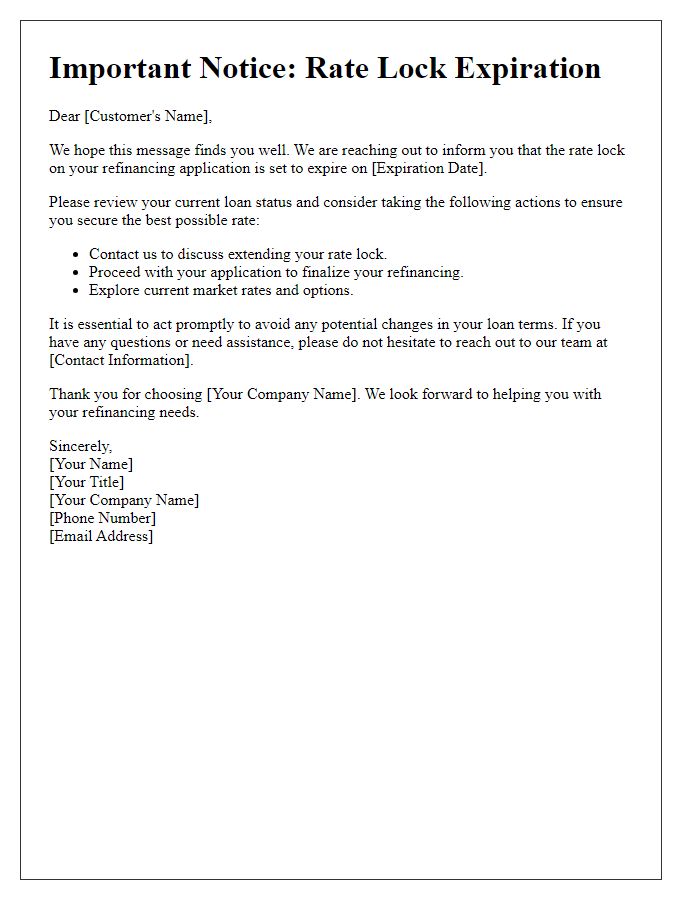

Letter template of rate lock expiration message for refinancing customers

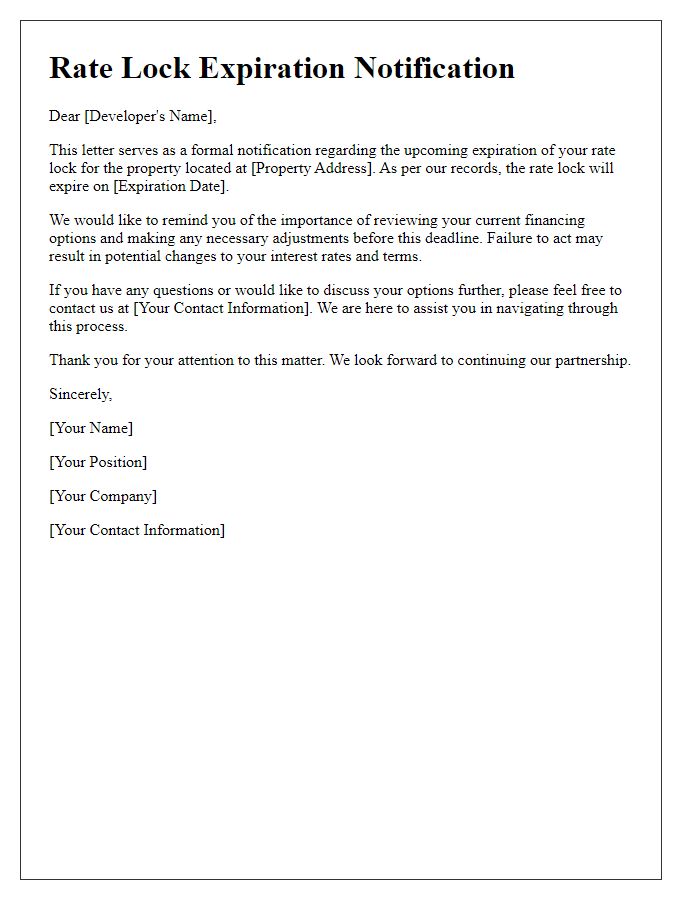

Letter template of rate lock expiration briefing for property developers

Comments