Are you feeling overwhelmed by a credit reporting error that's affecting your financial health? You're not aloneâmany people encounter inaccuracies on their credit reports that can lead to unnecessary stress and confusion. In this article, we'll guide you through crafting the perfect letter template for disputing those errors, ensuring you take control of your credit score. Ready to learn how to tackle this issue effectively? Keep reading!

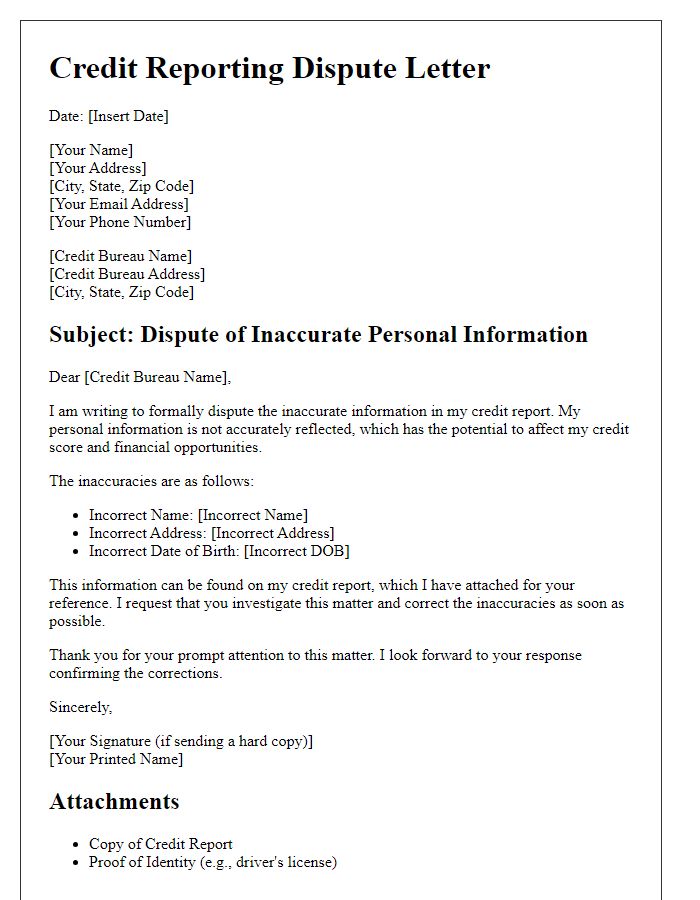

Accurate Personal Information

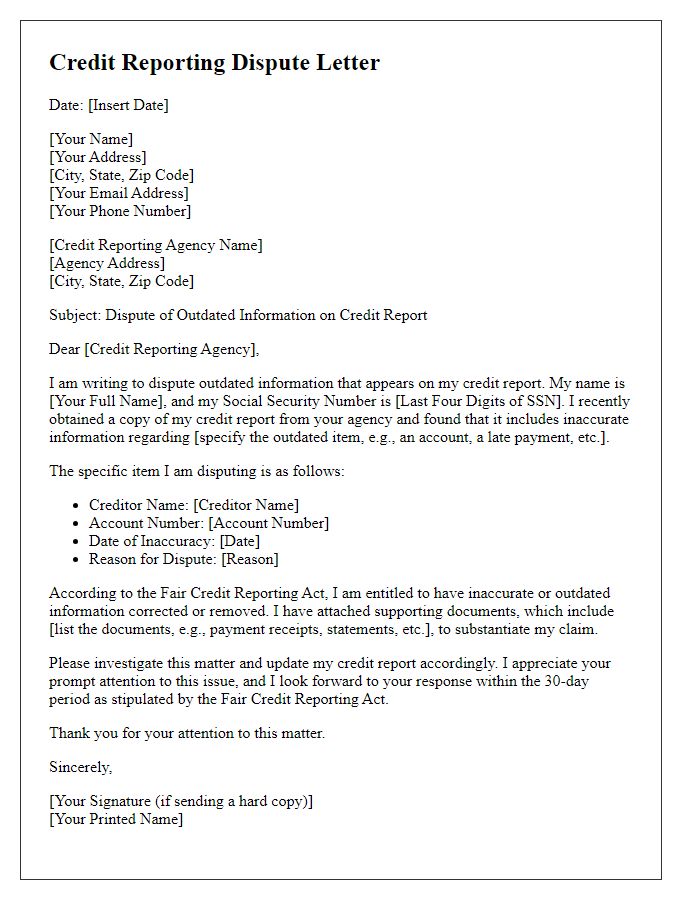

A credit reporting dispute involving accurate personal information can significantly influence an individual's credit score and borrowing capabilities. Discrepancies in personal details, such as names, addresses, and Social Security numbers, can lead to potential issues with lenders and affect loan approval probabilities. For instance, erroneous entries in a credit report, maintained by agencies like Experian, Equifax, or TransUnion, can result in incorrect assessments of creditworthiness. Timely resolution, typically within a 30-day investigation period, is essential to rectify inaccuracies and regain trust with financial institutions. Engaging with consumer protection laws, such as the Fair Credit Reporting Act (FCRA), can empower individuals to ensure their credit reports reflect true and accurate personal information.

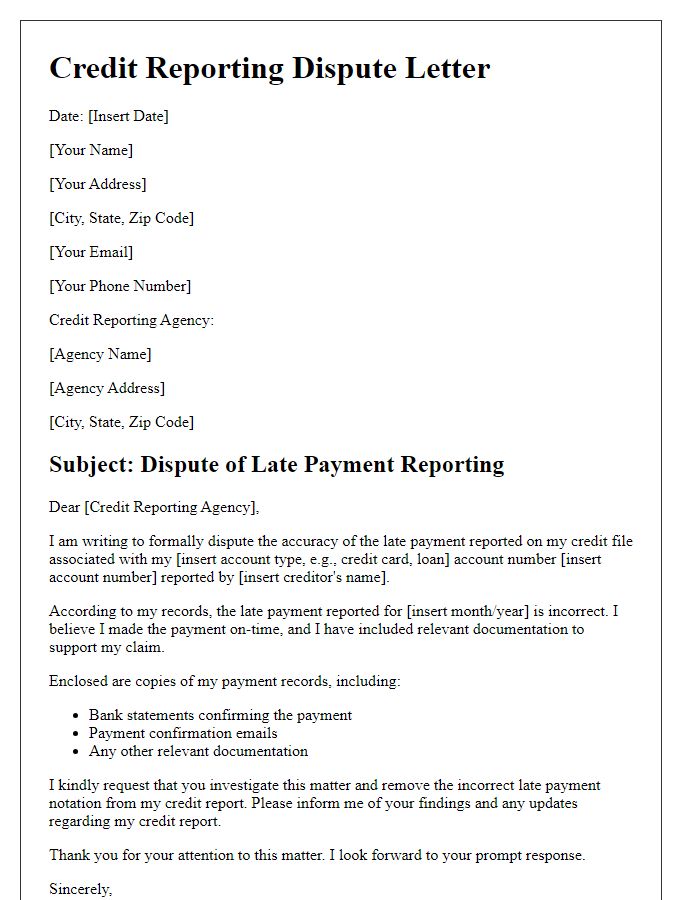

Explicit Dispute Description

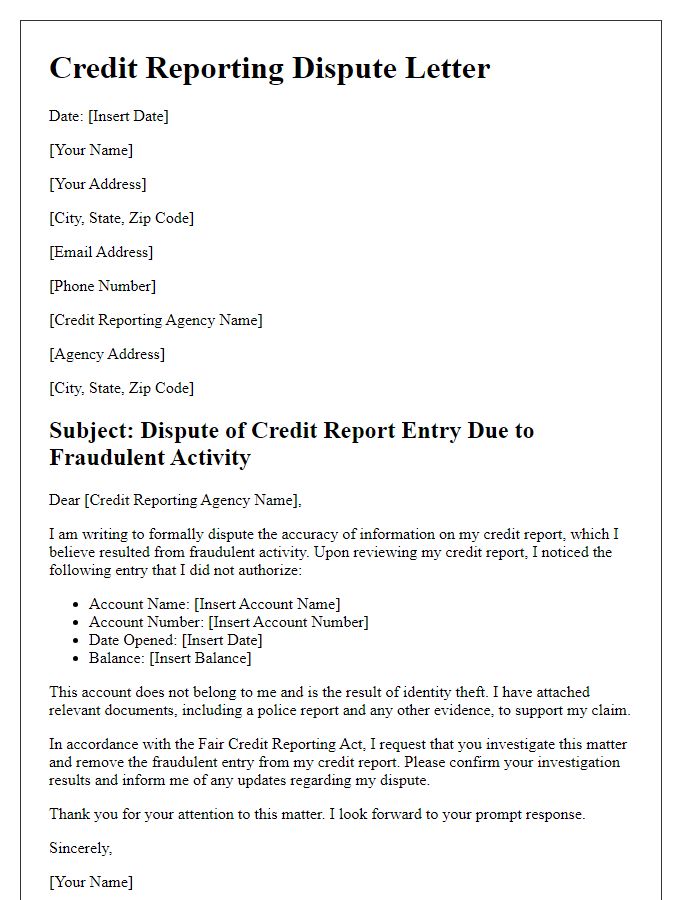

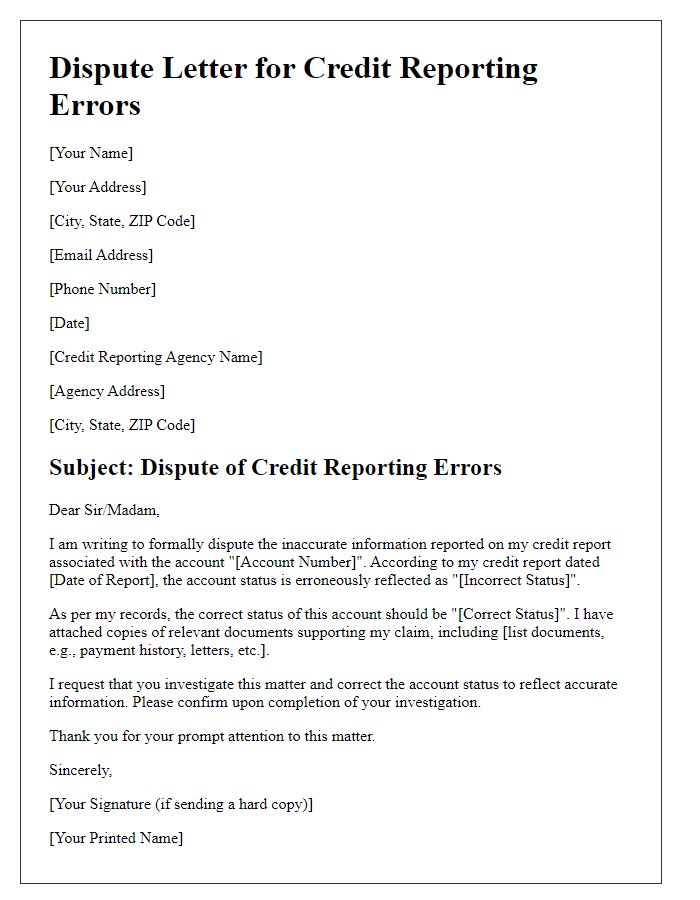

A credit reporting dispute may arise when individuals identify inaccuracies in their credit reports from agencies such as Equifax, Experian, or TransUnion. For instance, errors like incorrect account balances, outdated payment histories, or fraudulent inquiries can significantly impact credit scores. An explicit dispute must include clear identification of the specific inaccuracies, such as a late payment inaccurately reported on a mortgage account from Wells Fargo, including the date, amount, and account number. Providing documentation, such as bank statements or payment confirmations, helps substantiate claims. Timely resolution is crucial, as these inaccuracies can affect loan approvals and interest rates. Each credit bureau typically has a designated process, often available online, enabling consumers to submit disputes efficiently.

Supported Documentation

When addressing credit reporting disputes, it is essential to include supported documentation to enhance the validity of your case. Important documents may include a recent copy of your credit report, highlighting disputed items; a valid government-issued identification, such as a driver's license or passport; proof of residence (utility bills or lease agreements), confirming your current address; any correspondence with creditors or collection agencies regarding the disputed item; and payment records or bank statements, illustrating timely payments or debts not incurred. Including these documents strengthens your position, providing evidence for the inaccuracies claimed in your credit report.

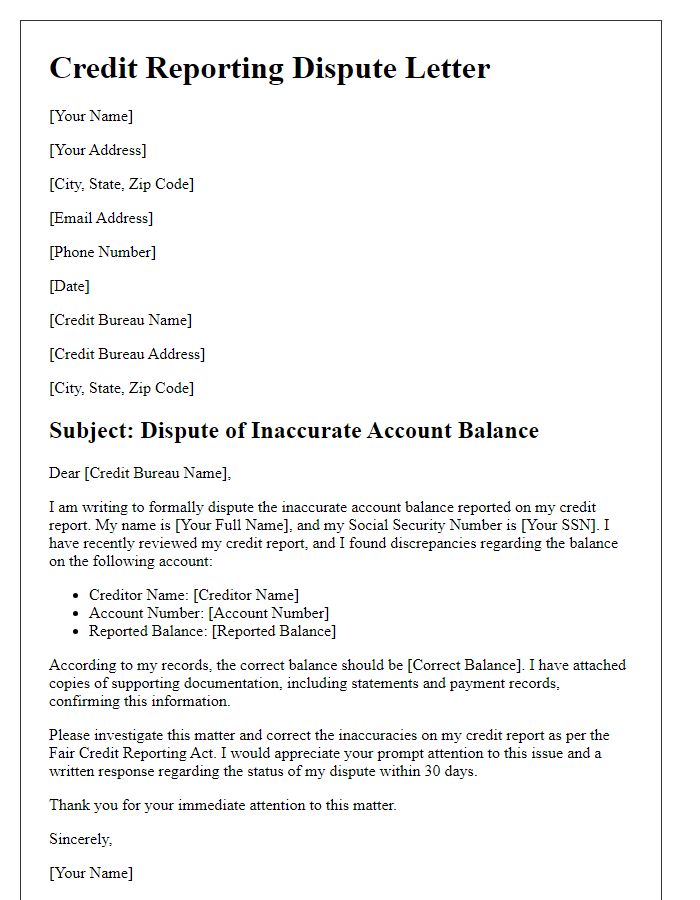

Requested Correction

Filing a credit reporting dispute involves submitting a request for correction to reporting agencies, such as Experian, TransUnion, or Equifax. Inaccuracies in credit reports, such as incorrect payment histories (accounts marked late when paid on time) or identity mistakes (e.g., credit lines belonging to someone else), can significantly impact credit scores (which range from 300 to 850). Documentation, like bank statements or payment confirmations, serves as evidence to support claims. Timely disputes are essential; the Fair Credit Reporting Act mandates a 30-day investigation period for agencies upon receiving a dispute. Effective communication, including clear identification of the inaccuracies and proper accompanying documentation, leads to a more efficient resolution process.

Contact Information for Follow-Up

Accurate and timely communication is crucial when resolving credit reporting disputes. An individual seeking to address inaccuracies in their credit report should ensure their contact information is clearly presented. Key details include full name, an address where correspondence can be received (preferably a permanent residence), a personal phone number for immediate follow-up, and an email address that is regularly monitored. Submission of all relevant documentation, such as copies of previous correspondence and evidence supporting the dispute (like payment records or account statements), can facilitate the investigation process conducted by credit reporting agencies, such as Experian or TransUnion.

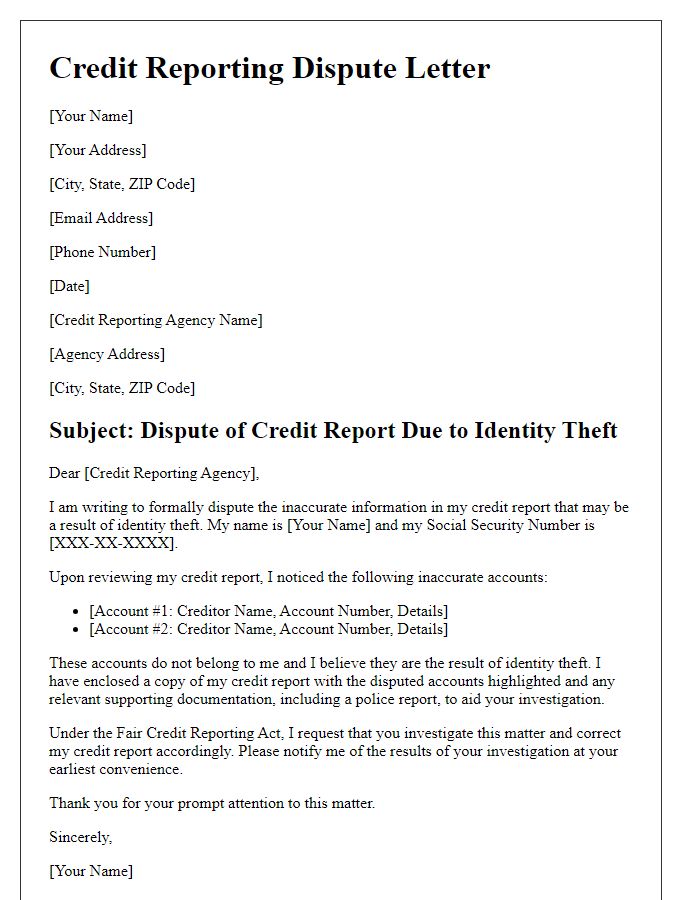

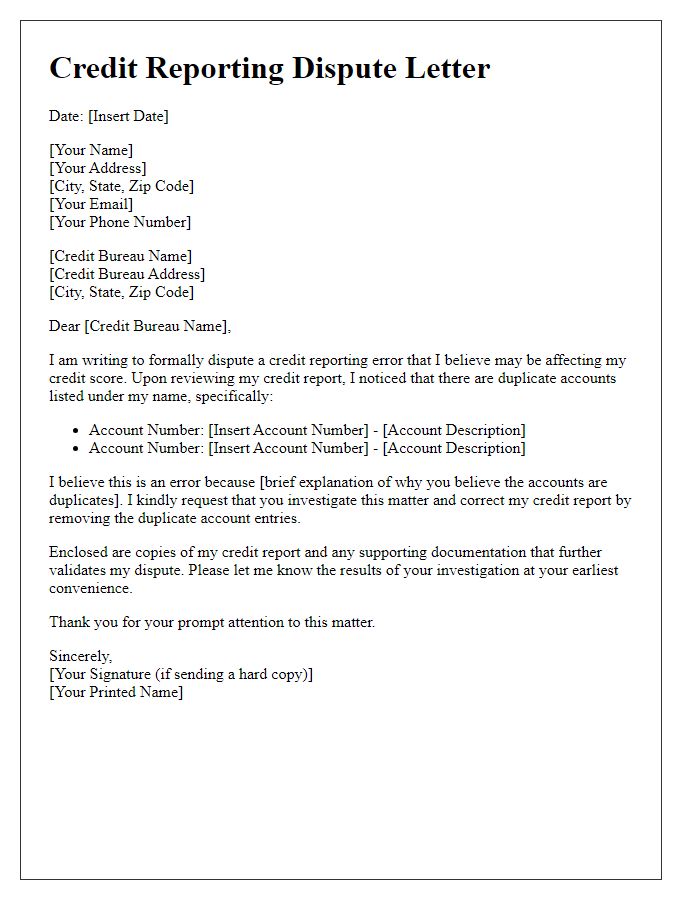

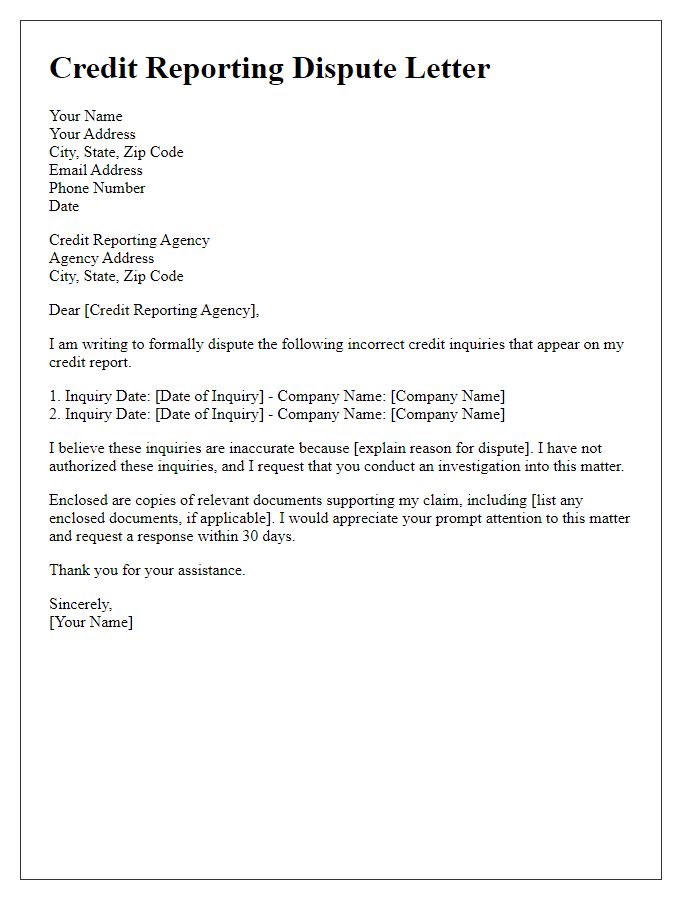

Letter Template For Credit Reporting Dispute Samples

Letter template of credit reporting dispute for inaccuracies in personal information

Letter template of credit reporting dispute for late payment discrepancies

Letter template of credit reporting dispute for incorrect account balances

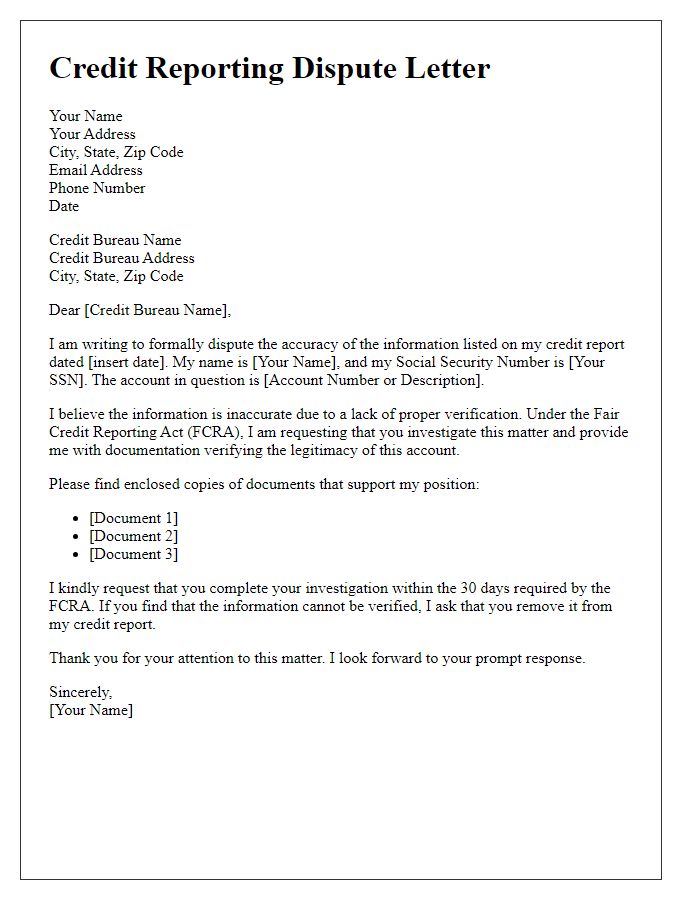

Letter template of credit reporting dispute for lack of credit verification

Comments