Are you wondering how interest rate adjustments can impact your finances? Whether you're a homeowner, a business owner, or simply someone trying to make the best financial decisions, understanding these changes is crucial. In this article, we will explore the reasons behind interest rate fluctuations and how they can affect your loans, savings, and overall financial health. So, let's dive in and uncover the insights that can help you navigate your financial landscape more effectively!

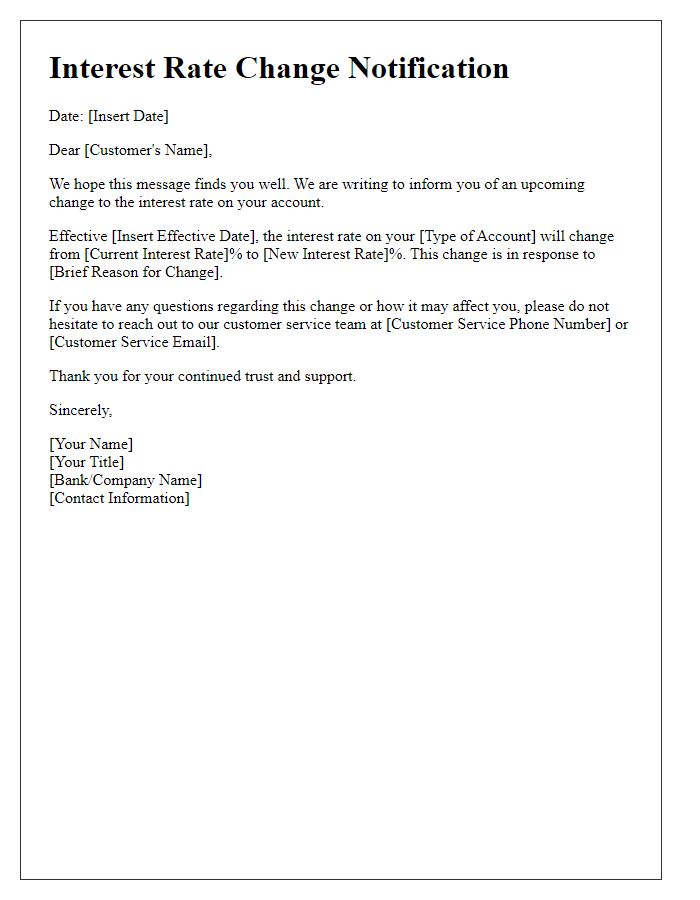

Clear Subject Line

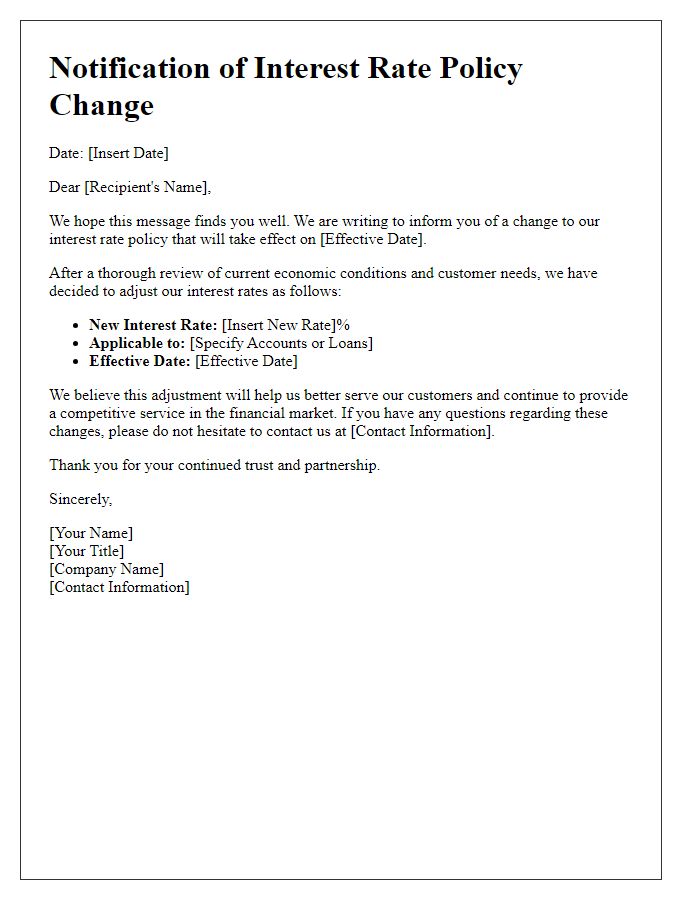

Interest rate adjustment announcements can significantly impact borrowers and investors. For example, when central banks such as the Federal Reserve in the United States increase interest rates by 0.25%, it can lead to higher monthly mortgage payments for homeowners and increased loan costs for businesses seeking financing. Fluctuations in rates influence market dynamics, affecting everything from stock prices to consumer spending. Investors must also monitor changes in bond yields, as a rise in interest rates often leads to a decline in bond prices, impacting portfolios across various sectors. Understanding these implications is crucial for making informed financial decisions.

Current Interest Rate Summary

Current interest rate adjustments significantly influence borrowing costs in finance. For instance, the Federal Reserve (commonly referred to as the Fed) sets baseline rates that directly impact mortgage loans, credit cards, and other financial products. As of October 2023, the federal funds rate stands at a range of 5.25% to 5.50%, reflective of various macroeconomic factors such as inflation, employment rates, and consumer spending in the United States. According to recent reports, a sharp increase in inflation (notably 6.4% year-over-year as of September 2023) has prompted regular adjustments in interest rates to stabilize the economy. Banks and financial institutions subsequently adjust their prime rates, which directly affect borrowers nationwide, potentially slowing economic growth if rates remain elevated.

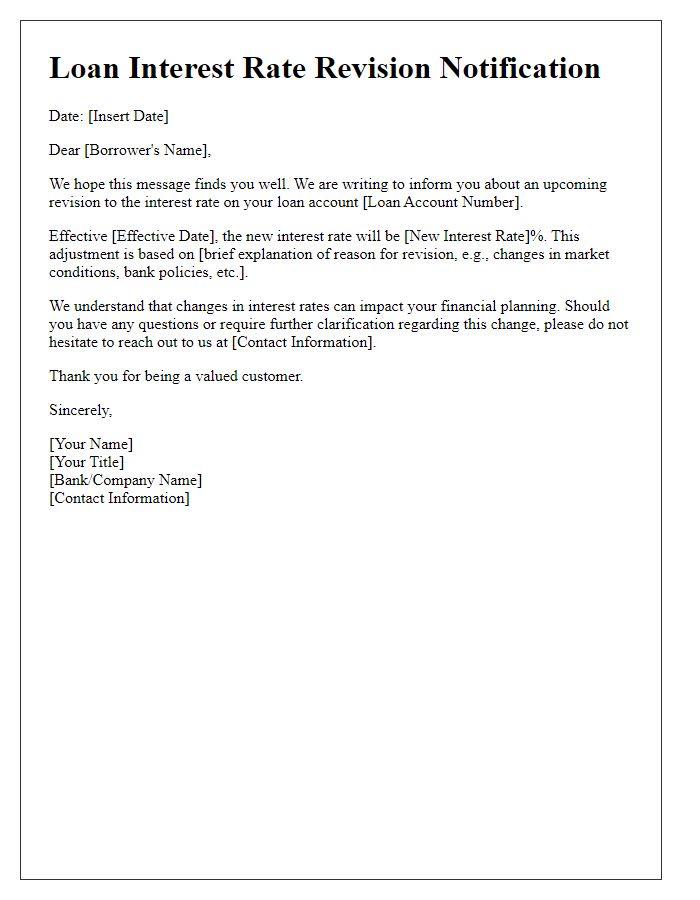

Explanation of Adjustment Reasons

Interest rate adjustments can significantly impact consumers and businesses, reflecting broader economic conditions. The Federal Reserve's monetary policy decisions play a crucial role in these changes, particularly the adjustments made to the federal funds rate, which influences banking rates. Recent inflation rates have surged to 8.6% in June 2022, prompting the central bank to increase rates to stabilize the economy and control rising prices. Additionally, global events such as supply chain disruptions from the COVID-19 pandemic and geopolitical tensions can exacerbate economic volatility, necessitating adjustments. Local circumstances, including unemployment rates and housing market trends, also contribute to the rationale behind interest rate modifications.

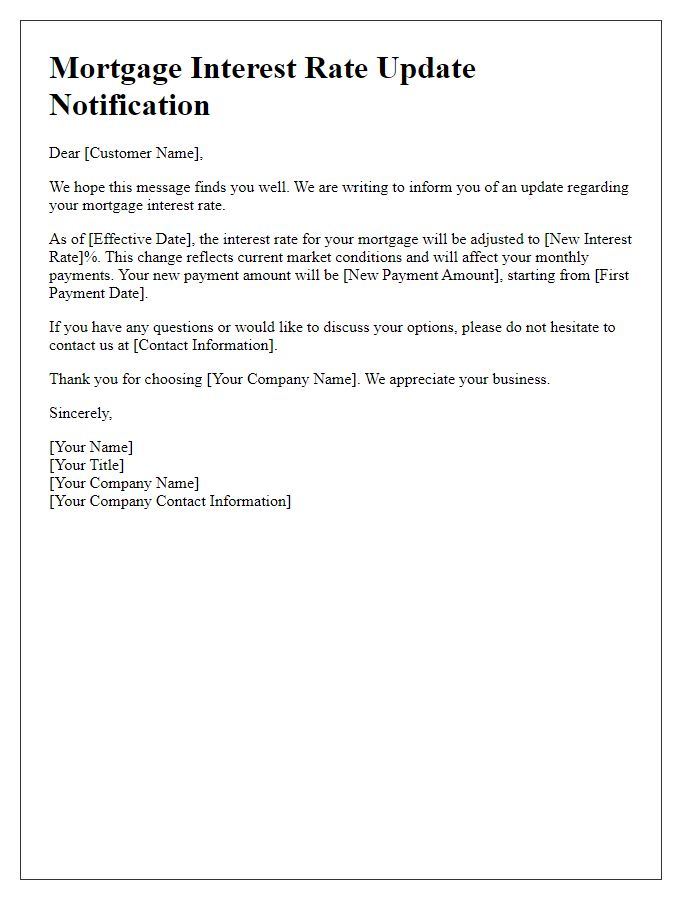

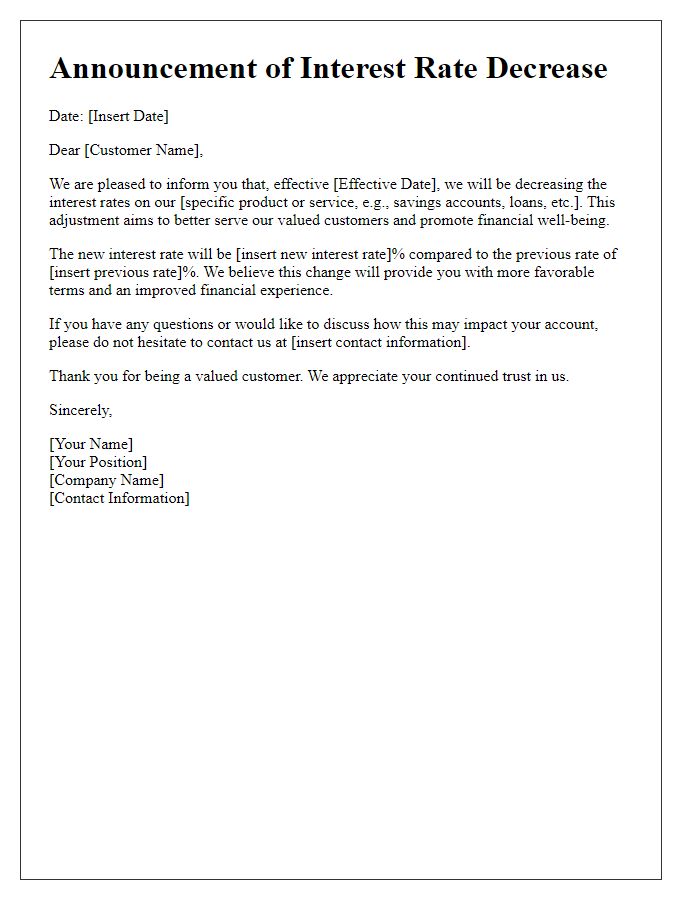

New Interest Rate Details

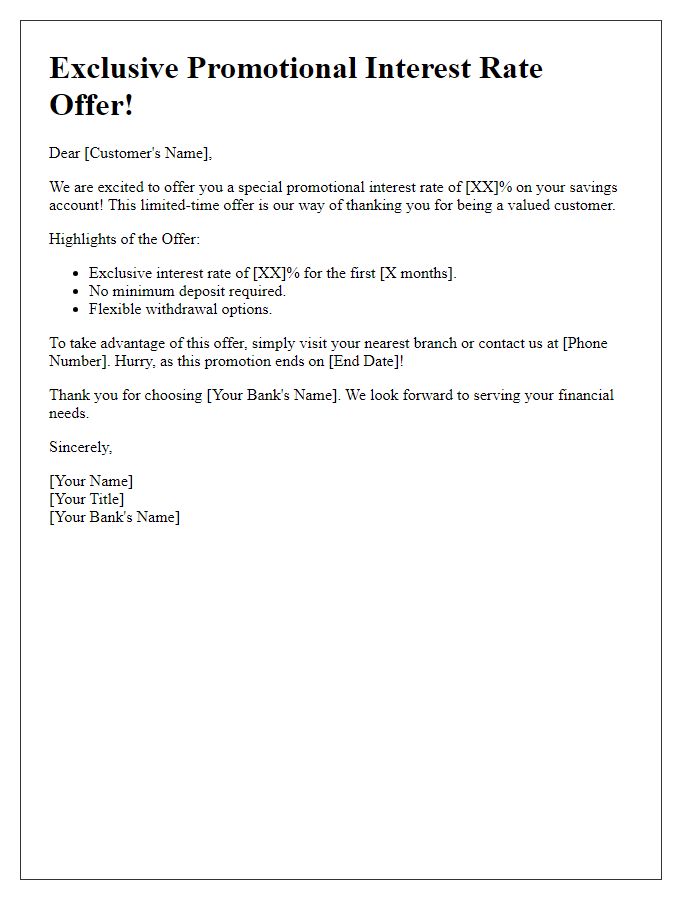

The recent adjustment of interest rates has significant implications for borrowers and financial institutions alike. As of October 2023, the Federal Reserve has increased the benchmark interest rate by 0.25%, bringing the new rate to a total of 5.25%. This change impacts loan products like mortgages and personal loans, resulting in higher monthly payments for consumers. Additionally, savers may see improved returns on savings accounts and certificates of deposit, with interest rates on these products potentially rising above 1.5%. Financial institutions must now adjust their lending and saving strategies in response to these changes, impacting their profit margins and consumer offerings in various regions across the United States.

Contact Information for Queries

Interest rate adjustments can significantly impact mortgage repayments and loan agreements. Financial institutions, such as banks and credit unions, frequently review market conditions, including the Federal Reserve's benchmark rate, to determine necessary changes. Potential borrowers should monitor rates, typically published by organizations like Freddie Mac or Bankrate, for transparency. For queries related to specific adjustments, customers should refer to the customer service department's contact details, often found on the institution's official website, to ensure timely and accurate information.

Comments