Are you feeling puzzled after receiving a letter explaining your loan rejection? It's a common situation that can leave many scratching their heads, wondering where things went wrong. Understanding the reasons behind such decisions is crucial, as it can guide you in improving your financial profile for future applications. Dive into the details with us to learn more about how to overcome these hurdles and enhance your chances of success!

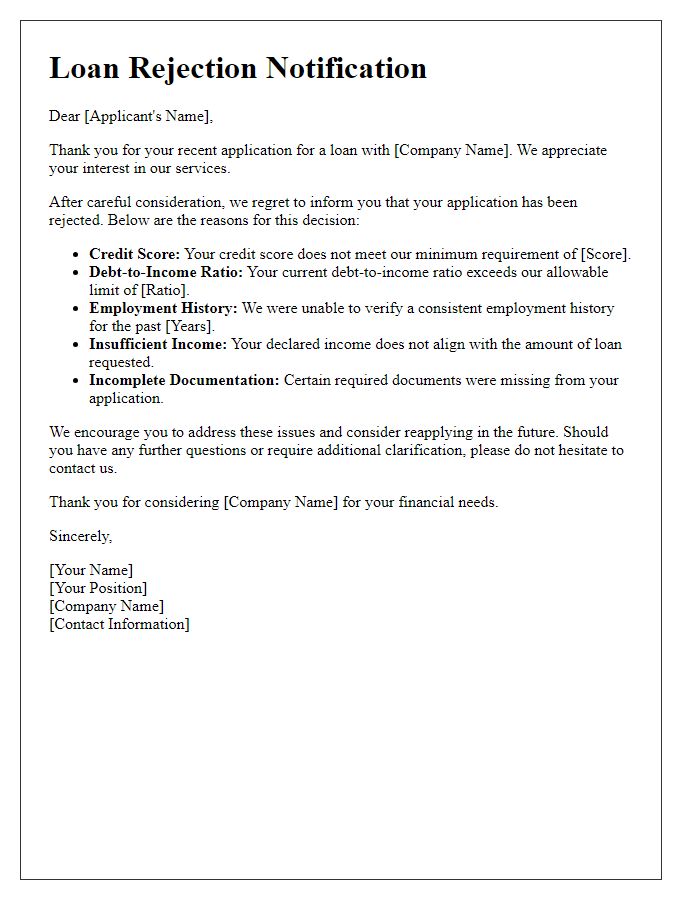

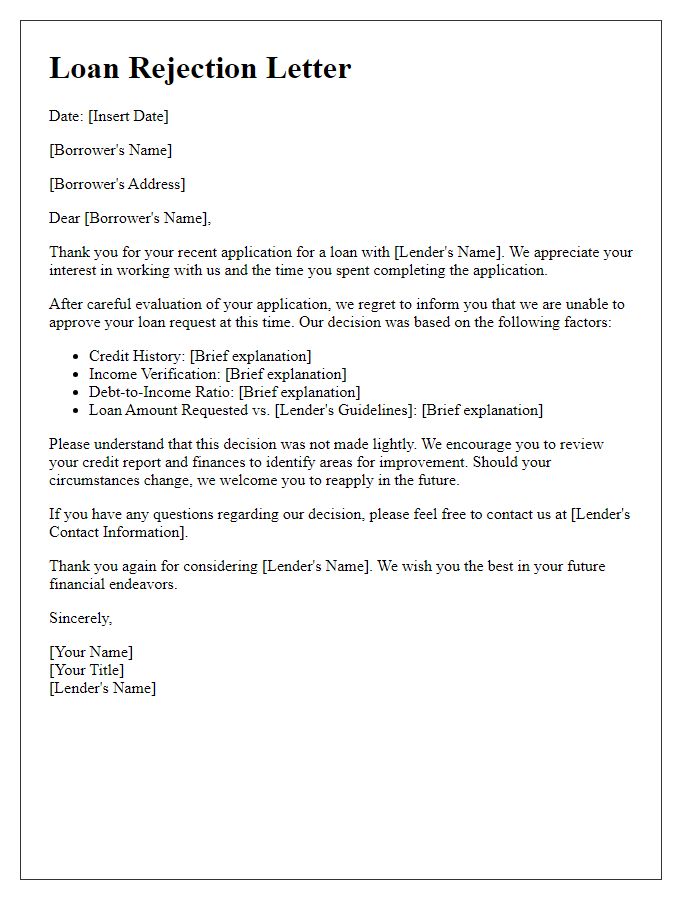

Clear Explanation of Rejection Reasons

Loan applications often face rejection due to specific factors such as credit score (below 620 considered poor), debt-to-income ratio (exceeding 43% may be unfavorable), or insufficient income documentation. Additionally, lack of collateral can hinder approval for secured loans. Financial institutions also assess job stability; frequent job changes within two years can raise concerns. Poor repayment history on previous debts, especially within the last five years, may further impact decisions. Legal issues such as bankruptcy (recently discharged within the last two years) can also complicate approval processes. Understanding these parameters can provide clarity on potential rejection reasons.

Compliance with Legal and Regulatory Requirements

Loan applications undergo rigorous assessment to ensure compliance with various legal and regulatory requirements, including the Fair Lending Act and the Equal Credit Opportunity Act. Each financial institution is mandated to evaluate creditworthiness through factors such as credit scores, income verification, and debt-to-income ratios. In some cases, applicants, like those seeking personal loans from FDIC-insured banks, may not meet specific thresholds, resulting in rejection. Moreover, documentation must adhere to standards set forth by local and federal regulations, ensuring ethical lending practices. Institutions must observe guidelines to mitigate risks associated with loan defaults and maintain financial stability, which informs decisions on applications.

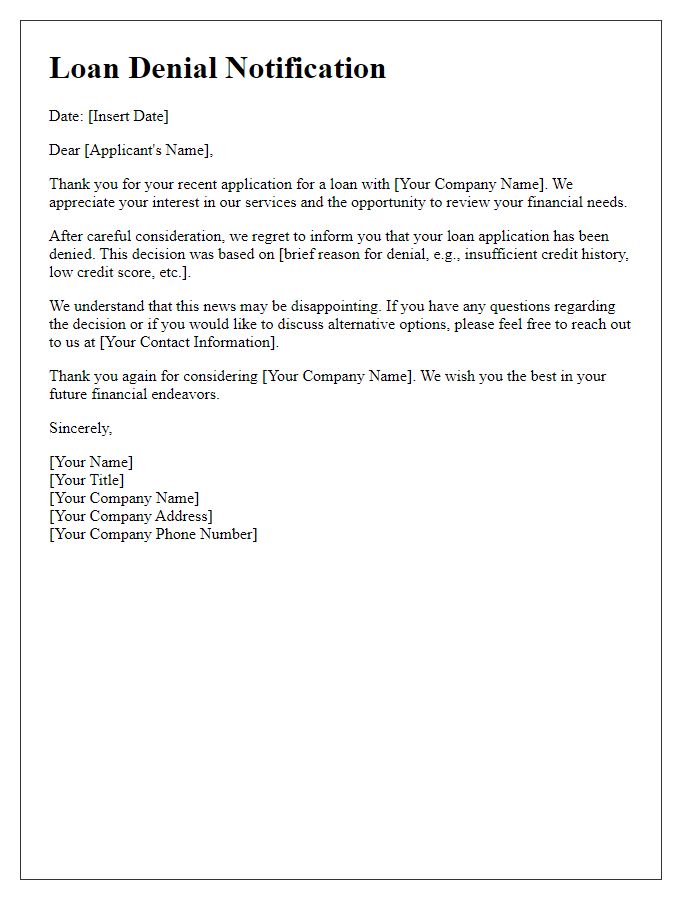

Professional and Respectful Tone

A loan rejection can be a difficult decision for applicants, impacting their financial plans and aspirations. Lenders evaluate several factors during this process, including credit scores, income levels, and debt-to-income ratios. A typical threshold for a satisfactory credit score generally falls above 620, while ideal income should cover monthly obligations, ideally below 36% of total income. If applicants seek personal loans exceeding $50,000, lenders may require verified income documentation, credit histories, and other financial records. Poor credit history, irregular income, and high existing debts typically increase the likelihood of denial. A detailed explanation of these criteria can help applicants understand the rationale behind rejection and guide them in future applications.

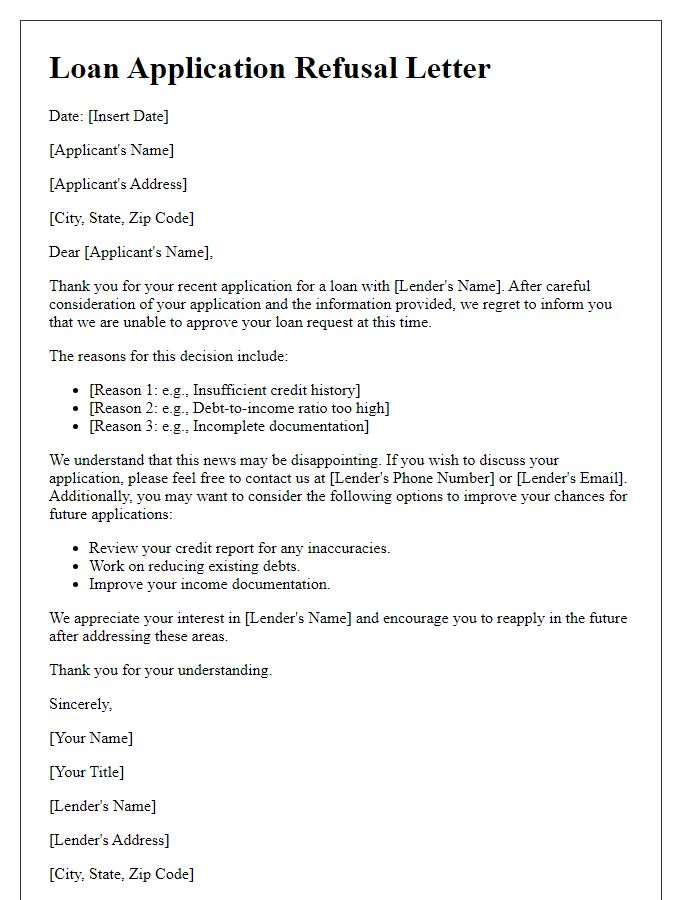

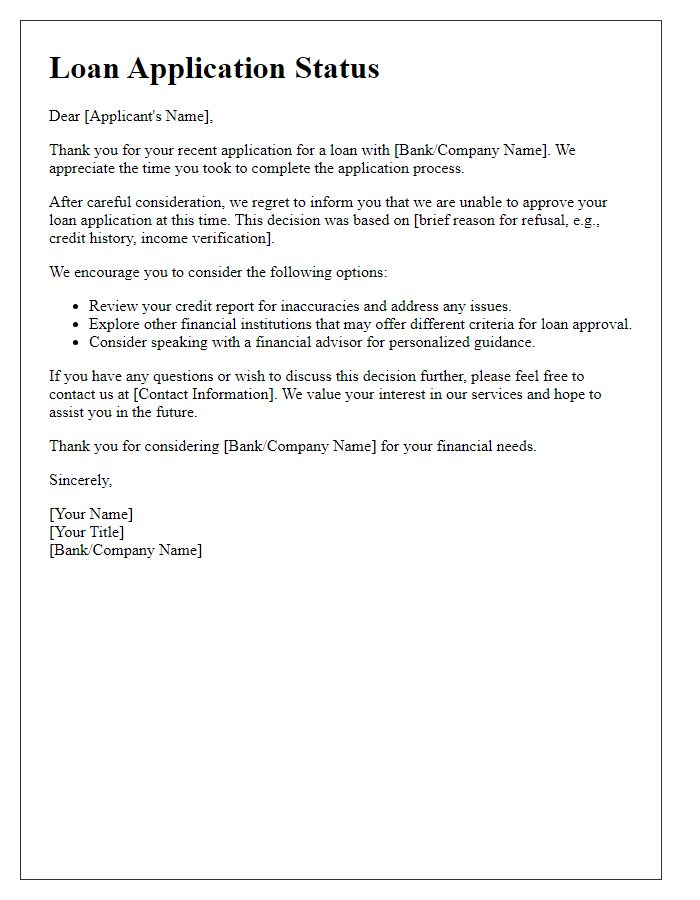

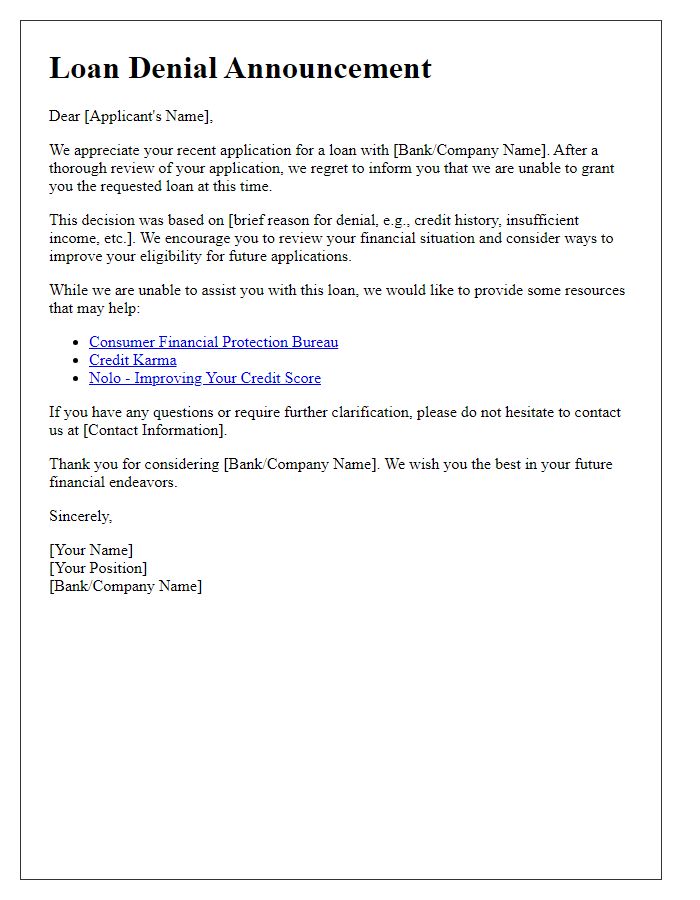

Offer Alternatives or Suggestions for Improvement

Loan rejection letters often explain the reasons behind the decision, helping applicants understand the situation better. Lenders may cite factors like credit score requirements (typically a score below 640), income verification issues (such as insufficient proof of earnings), or high debt-to-income ratios (exceeding 43% threshold). To offer constructive feedback, lenders can suggest practical alternatives like improving credit scores through timely bill payments, reducing outstanding debts, or securing a co-signer for future applications. Additionally, encouraging applicants to consider smaller loan amounts or different types of loans, such as secured loans with collateral, can provide pathways to eventual approval.

Contact Information for Further Inquiries

Loan rejection notices often leave applicants seeking clarity. Detailed communication, incorporating contact information for further inquiries, enhances transparency and facilitates understanding. The notice should include a direct phone number, such as a loan officer's line (e.g., (555) 123-4567), and an email address (e.g., info@lendingcompany.com) for applicants to reach out with questions. Additionally, specifying business hours, like Monday to Friday from 9 AM to 5 PM, establishes clear expectations. This accessibility empowers applicants to seek clarification about their specific financial situations or the reasons behind their loan rejection, fostering a more constructive dialogue between lenders and borrowers.

Comments