Are you feeling overwhelmed by your current loan terms and seeking a way to lighten the financial burden? A loan modification offer can provide the relief you need, allowing you to adjust your monthly payments and potentially lower your interest rate. With the right guidance and understanding of the process, navigating a loan modification can be a straightforward solution to regain financial stability. Curious to learn more about how to effectively approach this opportunity?

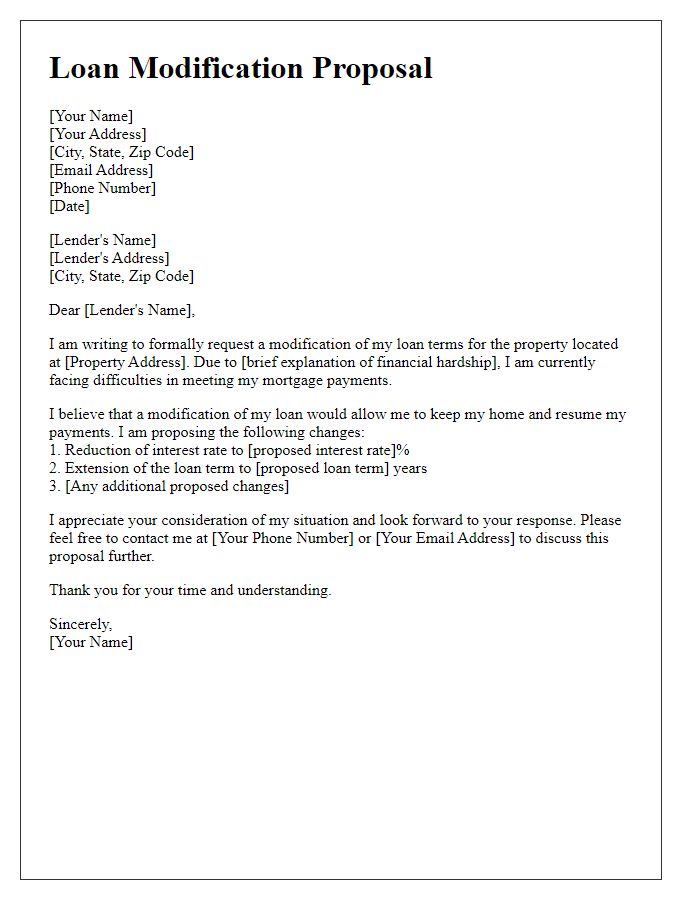

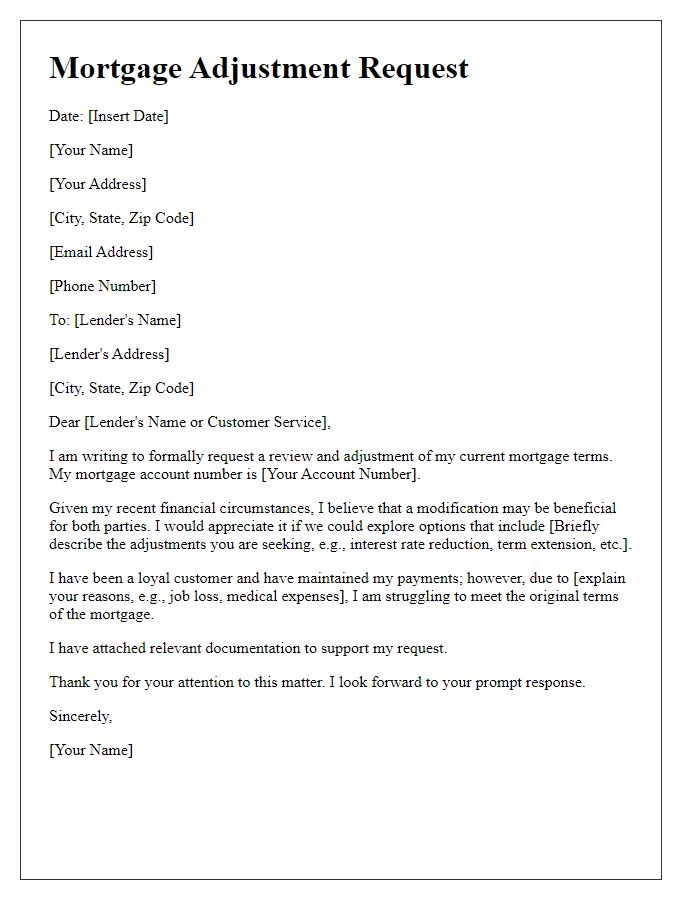

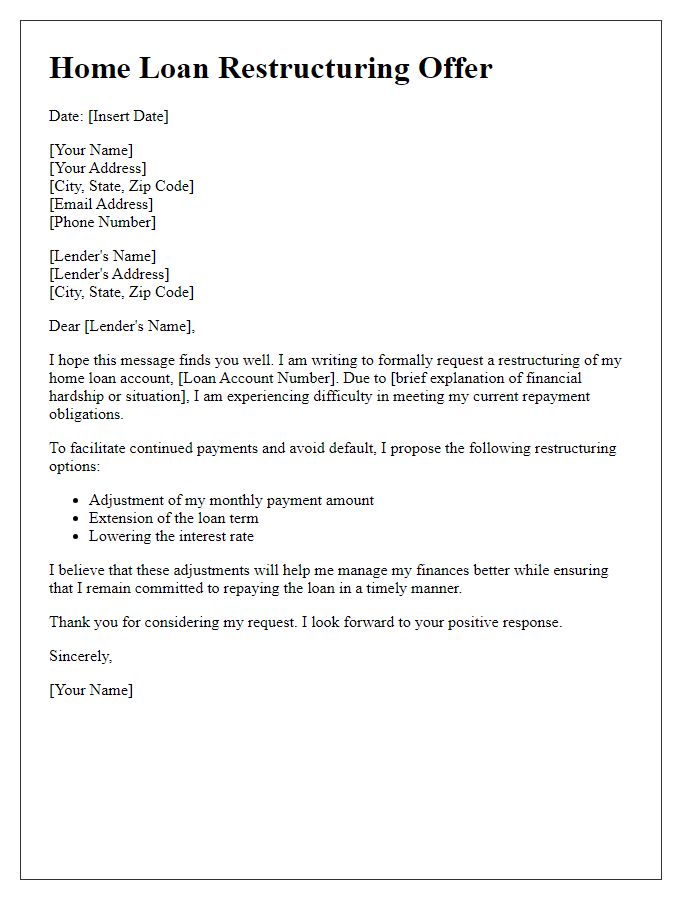

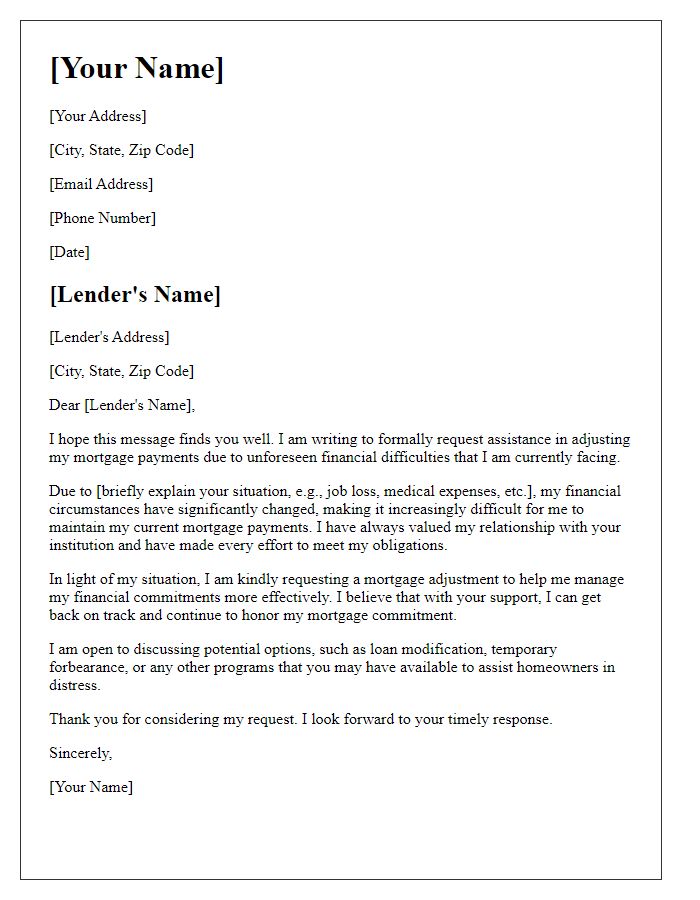

Loan Details

Loan modifications can significantly impact borrowers facing financial hardship. A loan modification is a change to the original terms of a mortgage, adjusting aspects like interest rates or monthly payments to ensure affordability. For homeowners in trouble, this process may offer a lifeline, allowing continued residence in their properties, perhaps located in areas such as Los Angeles, California, where median home prices are high, often exceeding $800,000. Key figures to consider include the outstanding loan balance, which could be around $300,000, and current monthly payments that might be burdening the borrower by reaching $2,000. Engaging with lenders to discuss options for modification can be crucial in preventing foreclosure, especially when financial stability has been impacted by significant events like job loss or medical emergencies. Understanding these details can aid borrowers in advocating for better loan terms tailored to their current financial situation.

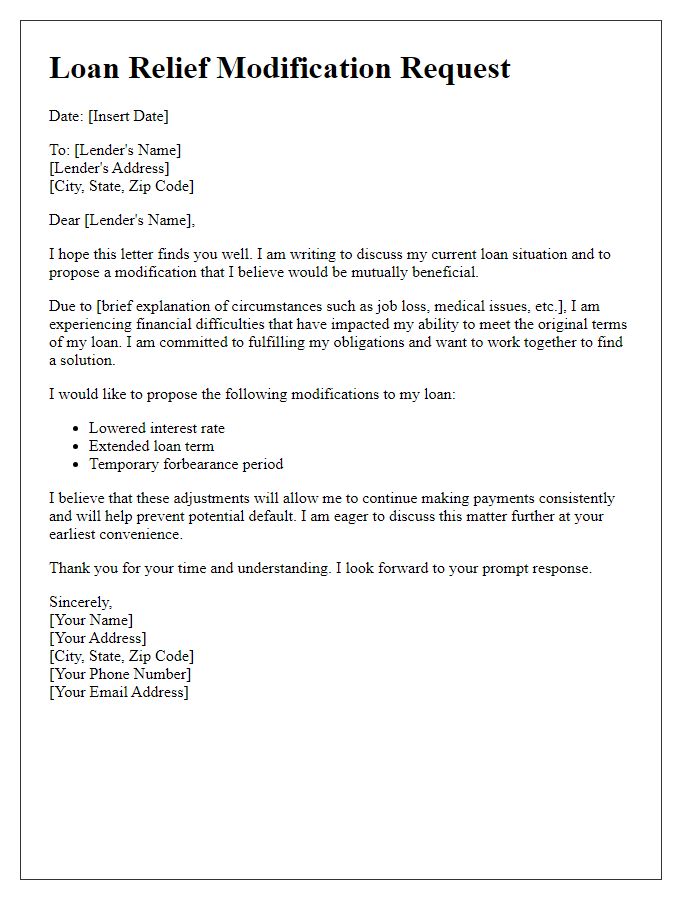

Borrower's Financial Hardship

Financial hardship in borrowers often results from various circumstances such as job loss, medical emergencies, or unexpected expenses. For homeowners facing difficulties, submitting a loan modification request is crucial. Affected individuals must provide detailed documentation, including income statements and recent bank statements, to substantiate their claims. Lenders, particularly those compliant with governmental programs like the Home Affordable Modification Program (HAMP), evaluate these requests to potentially reduce monthly payments or adjust interest rates, typically through a formal process. Accurate representation of financial status enhances the chances of approval, facilitating a path to retaining homeownership during challenging times.

New Proposed Terms

The loan modification offer outlines new proposed terms aimed at improving the borrower's financial situation and enhancing repayment capability. Key modifications include a reduced interest rate of 3.5% (down from 5.2%), a potential extension of the loan term to 30 years, and a principal forbearance of $15,000. Additionally, the monthly payment is recalibrated to $1,100 (previously $1,500), promoting affordability. These changes aim to prevent foreclosure and create a sustainable repayment plan, ensuring a more manageable financial future for the borrower. Nonprofit assistance agencies and credit counseling can provide additional support during this transition.

Justification for Modification

Loan modification offers arise when borrowers face financial hardship, necessitating a change in loan terms to improve repayment feasibility. Common justifications include significant income loss, such as job layoffs affecting employment stability, rising living costs due to inflation impacting monthly budgets, or unforeseen medical expenses leading to reduced disposable income. Borrowers may provide documentation, such as pay stubs or medical bills, demonstrating their financial difficulties. Additionally, a strong justification could involve recent changes in family circumstances, such as divorce or the birth of a child, which create additional financial responsibilities. Modifying loan terms can lead to lower monthly payments or extended repayment periods, aiding borrowers in avoiding default and maintaining homeownership.

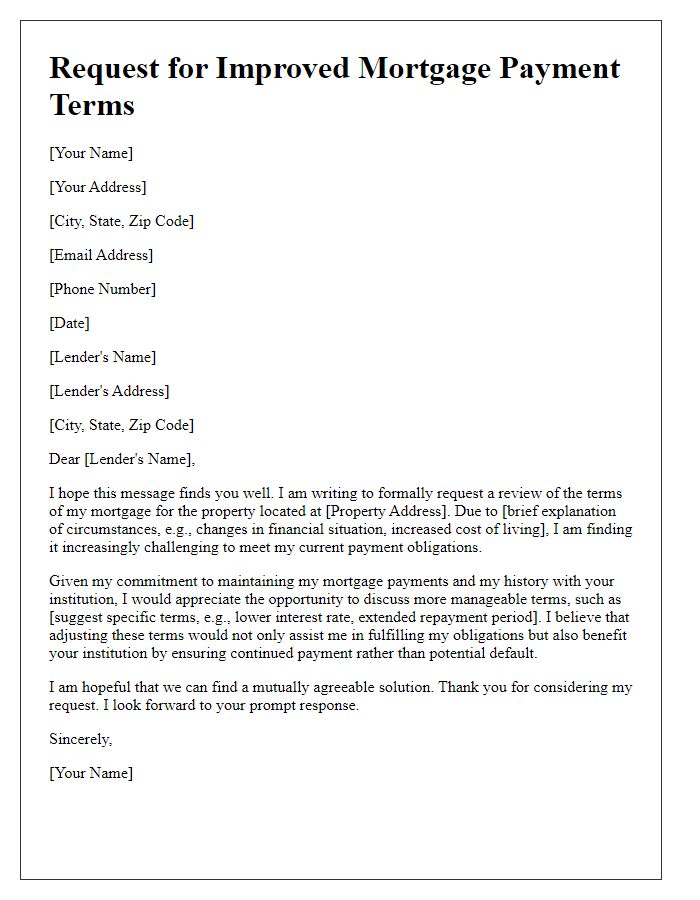

Contact Information

A loan modification offer typically includes crucial contact information for both the borrower and the lender. The borrower's details generally encompass full name, physical address including city and zip code, email address, and phone number. The lender's details should feature the name of the financial institution, a specific department for loan modifications, physical address, customer service phone number, and fax number if applicable. Including reference numbers, such as the loan account number, can streamline communications and ensure accurate processing of the loan modification request, enhancing the efficiency of the review process.

Comments