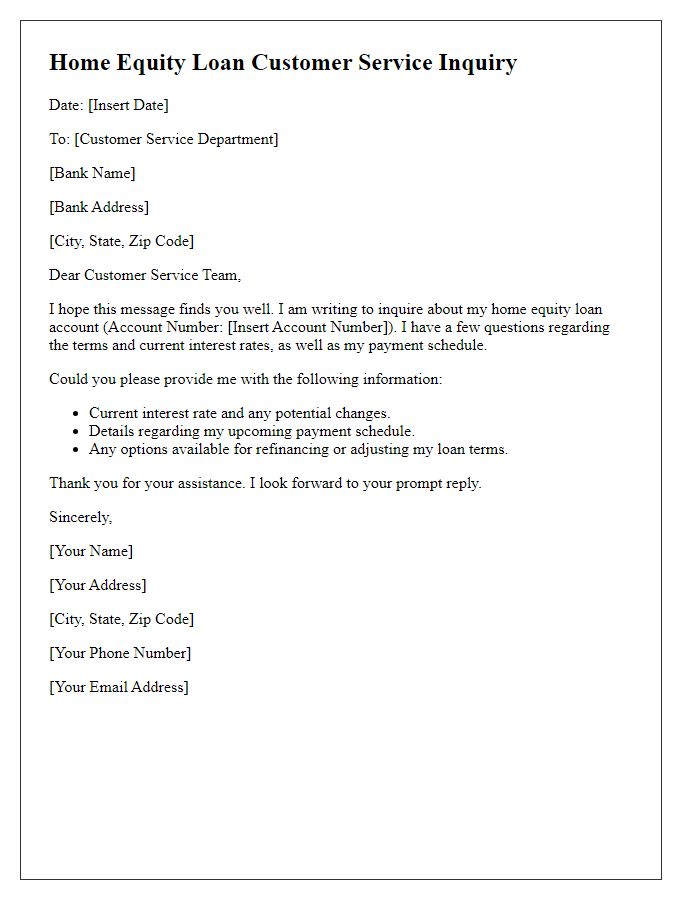

Are you considering tapping into your home's equity? Understanding the ins and outs of a home equity loan can empower you to make informed financial decisions. From favorable interest rates to flexible repayment options, there's a lot to discover that could benefit you. Join us as we dive deeper into the essential details of home equity loans and how they might be the perfect solution for your needs!

Borrower's personal and financial information

A home equity loan allows homeowners to borrow against the value of their property, leveraging accumulated equity. Borrowers typically provide personal information such as full name, date of birth, Social Security number, and contact details to ensure accurate identity verification. Financial information includes annual income (often exceeding $50,000 for many applicants), existing mortgage balance (commonly around 80% of the home's appraised value), and current debts, which help lenders assess creditworthiness. Documentation may also encompass credit scores (usually required to be above 620 for favorable rates) and proof of employment (often a recent pay stub or W-2 form), revealing the borrower's ability to repay the loan. Understanding these details is essential for navigating the loan application process efficiently.

Property details and valuation

The home equity loan process involves a comprehensive analysis of the property in question, including its specific valuation. Residential properties, typically identified by unique addresses, undergo formal appraisals to determine current market value. Appraisers consider various factors, such as square footage, year of construction, and local real estate market trends. For example, homes in suburban areas of California might face different valuation metrics compared to those in urban centers like New York City. Additional attributes, such as the number of bedrooms and bathrooms, landscape features, and recent renovations significantly influence property value assessments. Furthermore, the loan-to-value (LTV) ratio, which compares the loan amount to the home's appraised value, is critical in establishing the maximum lending limit while mitigating the lender's risk.

Loan amount, interest rate, and terms

Home equity loans provide homeowners access to their property's value, allowing them to secure funds for various needs. A typical loan amount can range from $20,000 to $500,000, depending on the home's appraisal value and existing mortgage balance. Interest rates generally vary, averaging between 3% to 8%, often influenced by the borrower's credit score and market trends. Loan terms typically span from 5 to 30 years, with options for fixed or adjustable rates, impacting monthly payments and total repayment amount. Home equity loans help finance significant expenses, including home renovations, debt consolidation, or educational costs, making them a valuable financial resource.

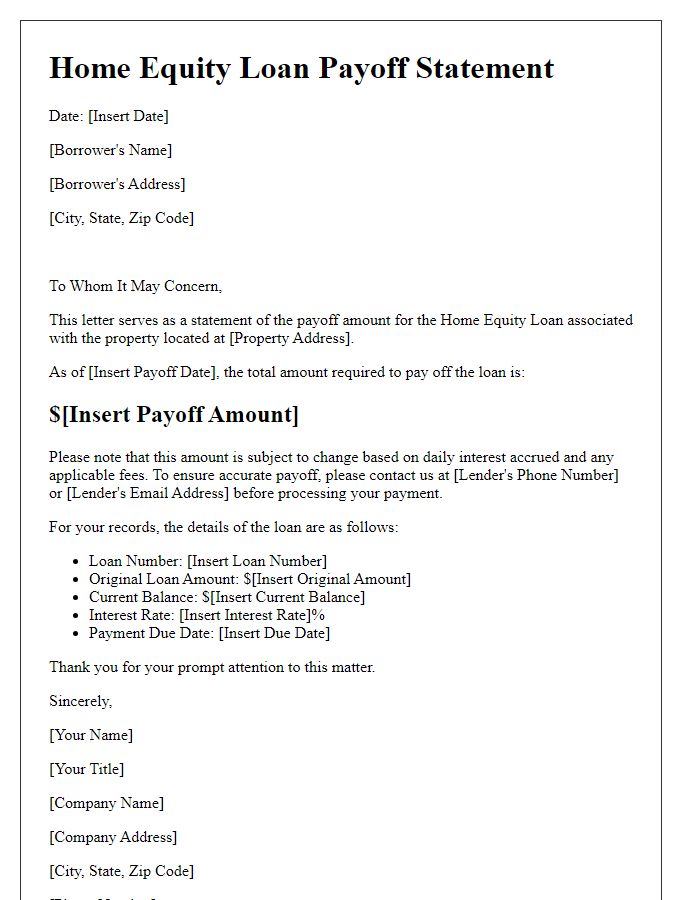

Repayment plan and schedule

A home equity loan represents a second mortgage that allows homeowners to borrow against the equity they've built in their property. Typically, repayment plans involve structured monthly payments, usually spanning 5 to 15 years, depending on the lender's terms. For example, a homeowner borrowing $50,000 at an interest rate of 6% may face monthly payments of approximately $400, ensuring they pay off the loan fully over a 10-year period. Understanding the amortization schedule is crucial; it outlines how each payment reduces the loan principal versus interest. Late payments can result in additional fees, adversely affecting credit scores. Homeowners should be aware of potential fluctuations in interest rates if the loan is variable, impacting total repayment amounts.

Required documentation and submission guidelines

When applying for a home equity loan, financial institutions typically require specific documentation to assess eligibility and confirm details. Essential documents include recent pay stubs (preferably within the last 30 days) to verify income, W-2 forms from the last two years for employment stability, and tax returns for comprehensive financial evaluation. Homeowners must also provide a mortgage statement to detail outstanding balances and property taxes paid in the previous year to indicate financial responsibility. Additionally, an appraisal report may be necessary to assess current market value of the property. Submission guidelines emphasize the necessity for organized documentation, either in physical or digital formats, to streamline the review process and enhance approval likelihood. Each lender may have unique requirements, so carefully reviewing those guidelines is crucial for a smooth application experience.

Comments